- Bitcoin is trading at $67K, above the average price of Spot ETFs.

- BTC Open Interest was at its highest level since 2020.

Bitcoin [BTC] has risen above $67,000 again, drawing traders’ and institutions’ attention to key support levels that could play a crucial role in the ongoing bull rally.

One such level is the average cost of Bitcoin Spot ETFs, excluding Grayscale’s (GBTC). Throughout 2024, this price level has emerged as an important support, providing stability during volatile periods.

Despite small dips, Bitcoin has consistently recovered, underscoring the resilience of Spot ETF investors who have maintained their positions even during market corrections.

The $57,000 level, which represents the average cost of Bitcoin Spot ETFs, has proven to be a crucial support throughout the year.

Source: CryptoQuant

It has only been tested twice: during the sell-off on August 5 and the sharp correction on September 6. However, instead of panic selling, Spot ETF investors held firm, with only minor outflows.

This showed strong belief in Bitcoin’s long-term potential as investors showed no signs of capitulation despite temporary unrealized losses.

BTC Spot ETFs Inflows and OI

This resilience has helped solidify the $57K level as a base for the ongoing bull rally, with the rise of Bitcoin Spot ETFs providing a regulated entry point for institutional investors, boosting confidence in the market.

This integration of traditional financial products with Bitcoin has opened the door for wider adoption.

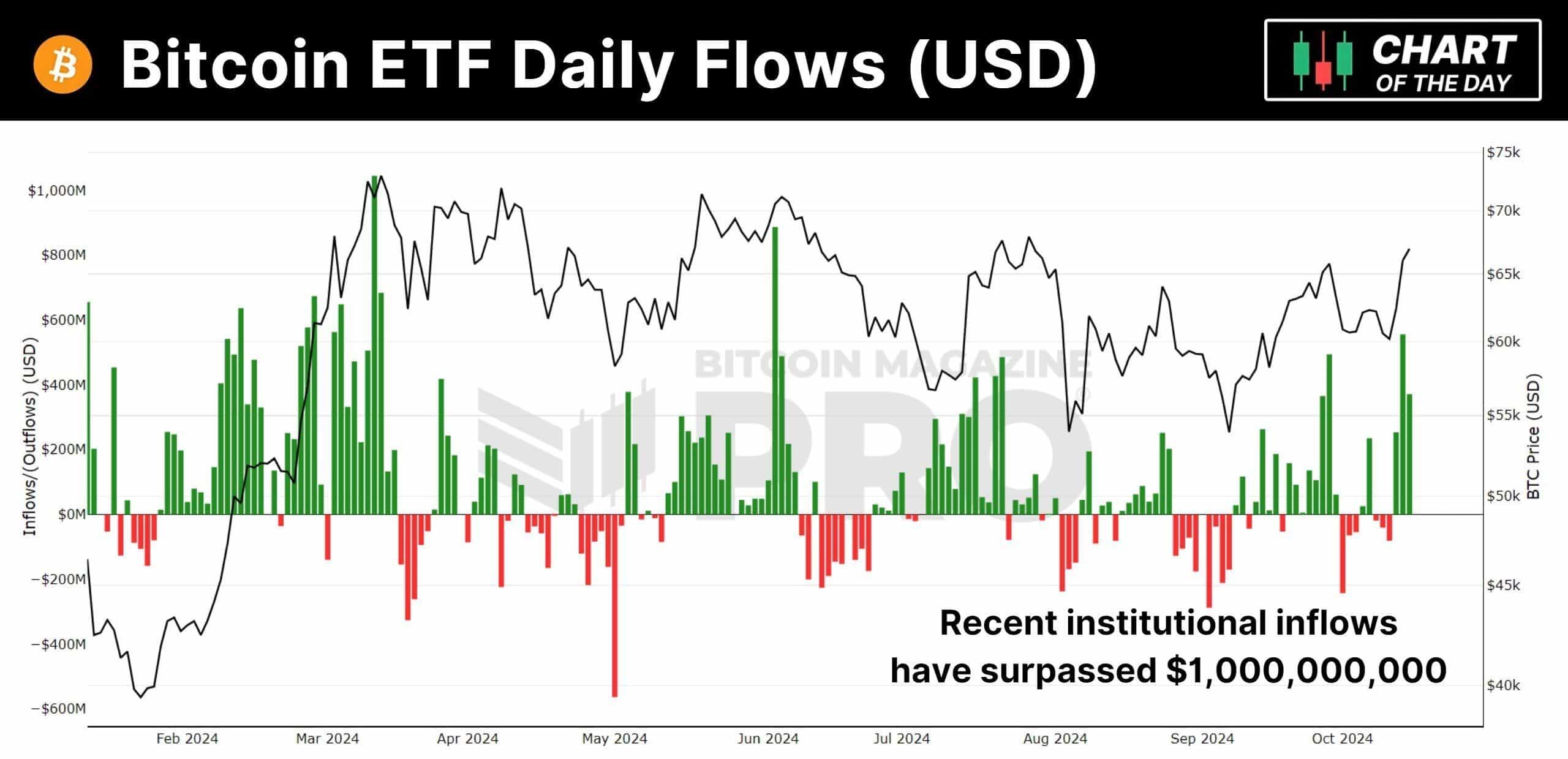

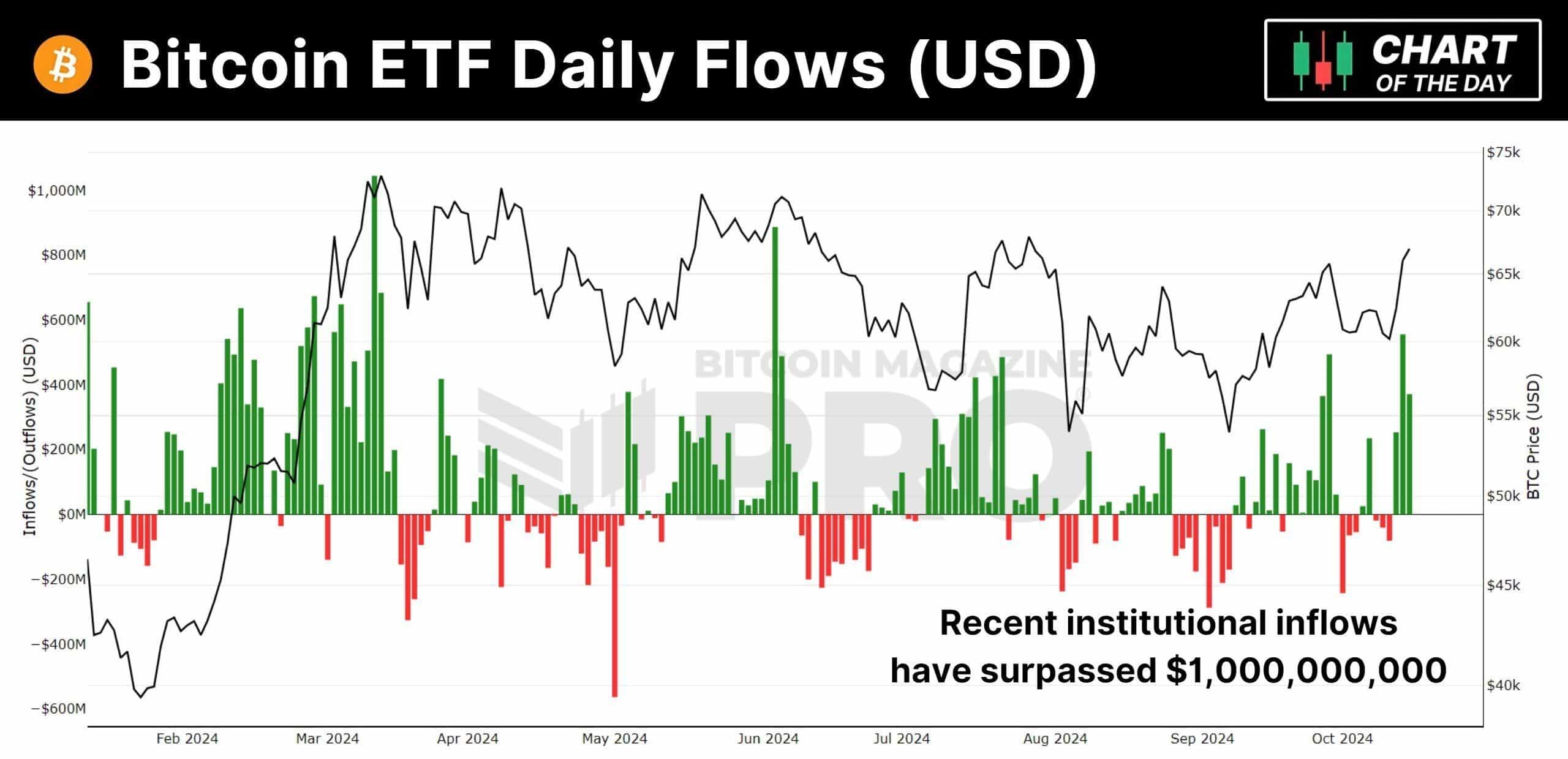

In the past three trading days alone, Bitcoin ETFs have seen inflows of over $1 billion, indicating that institutional investors are accumulating BTC at an unprecedented rate.

Source: Bitcoin Magazine PRO

In addition to the growing influence of Spot ETFs, Open Interest (OI) in Bitcoin Futures is reaching new heights, especially on Binance, where OI has soared to $40 billion.

This reflected continued bullish sentiment among traders, who continued to buy eagerly despite the price rise. This surge in demand could reduce available supply, sending BTC prices higher.

OI futures on other exchanges such as Bybit and OKX have also reached peak levels, further supporting the idea that Bitcoin is likely to remain above the $57K level during this bull run.

Source: IntoTheCryptoverse

Whale transactions

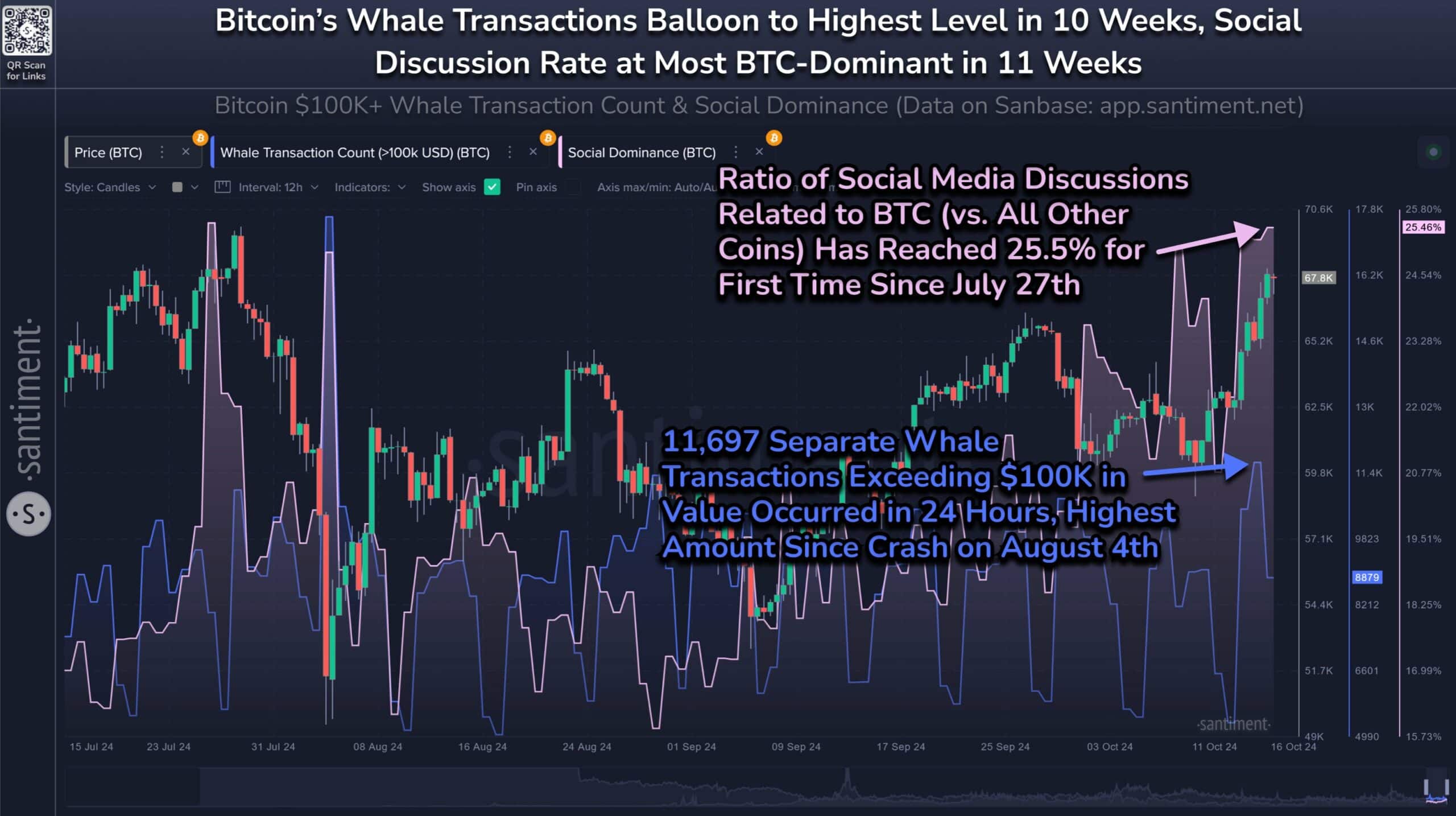

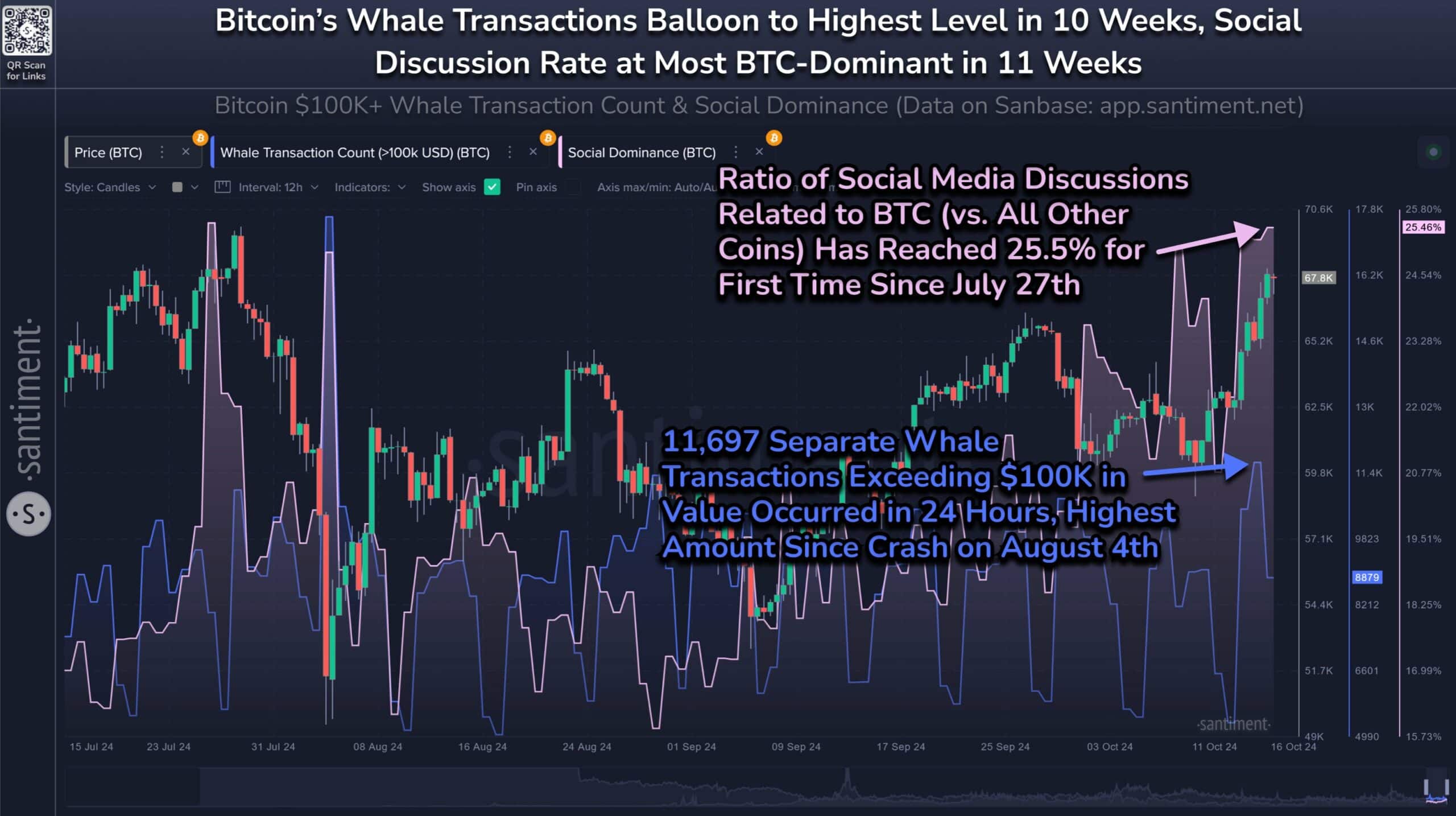

Another major factor supporting the $57,000 support level is the recent spike in whale trades. Over the past ten weeks, whale transfers of $100,000 or more have soared, with 11,697 such transactions recorded.

This increased activity suggests that large investors are actively accumulating Bitcoin, adding more confidence to the market’s upward trajectory.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Furthermore, Bitcoin has dominated social media discussions, accounting for more than a quarter of all crypto-related conversations.

Source: Santiment

While the price may undergo short-term corrections, the medium- and long-term figures remain bullish, increasing the likelihood that BTC will maintain its position above the $57,000 support level during the current rally.