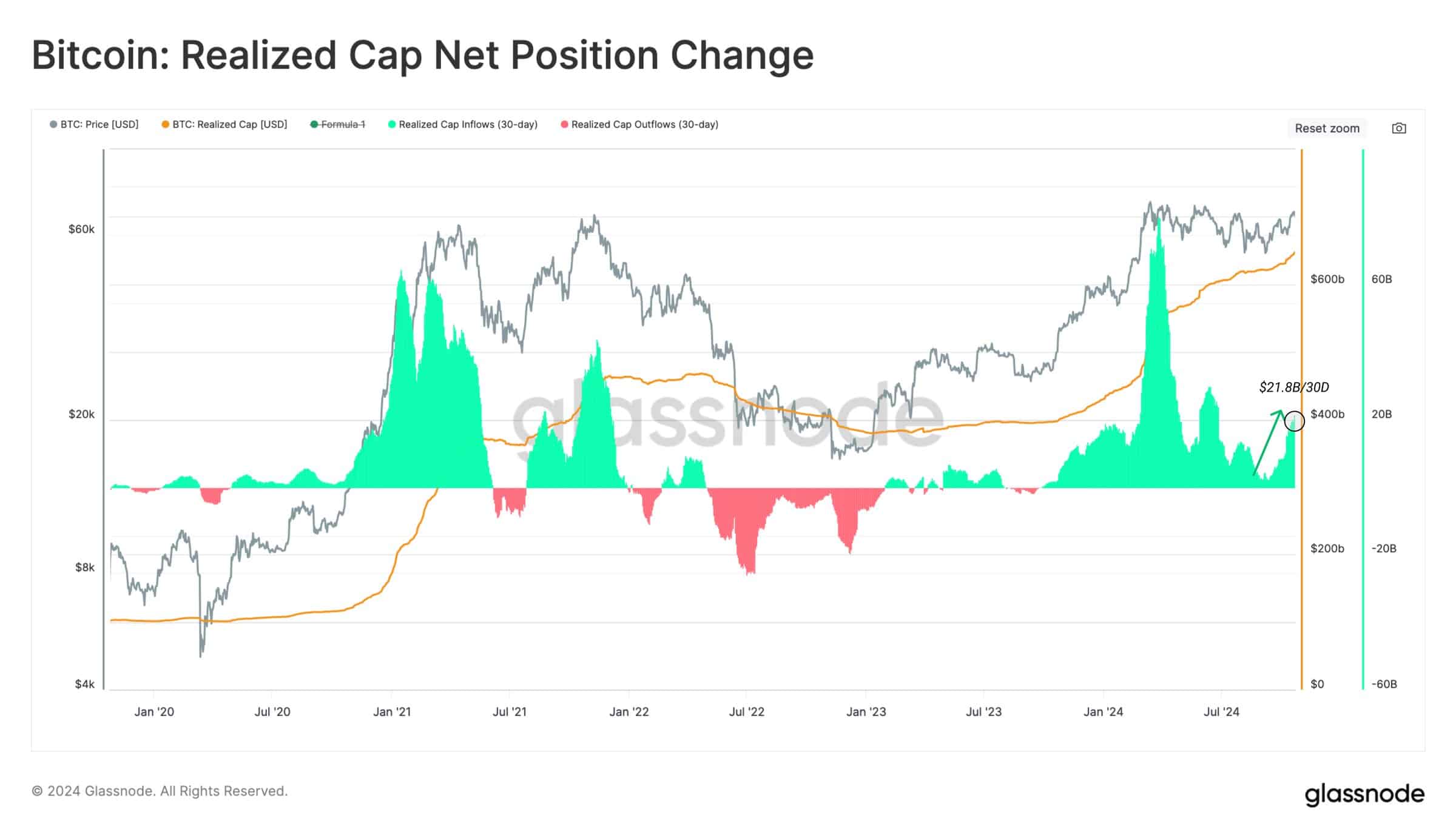

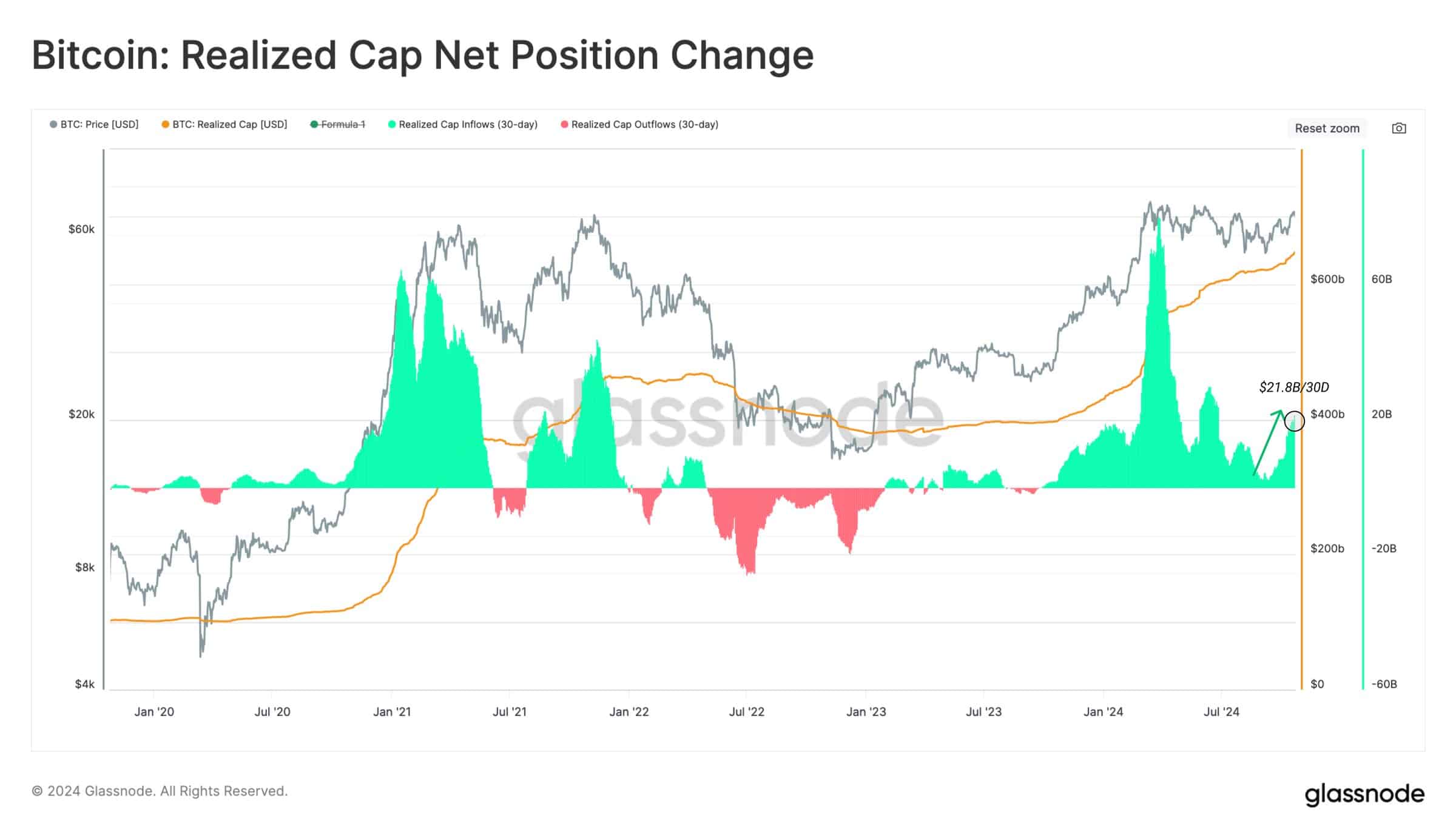

- Capital inflows into Bitcoin soared to new ATH.

- The departure from weaker hands may have strengthened BTC’s market base.

Bitcoin [BTC] price movements are being closely watched as recent data shows a notable increase in net capital inflows, pointing to potentially higher prices ahead.

Over the past 30 days, capital inflows into Bitcoin have increased by $21.8 billion, an increase of 3.3%, pushing Bitcoin’s realized cap to an all-time high of over $646 billion.

This growth suggests that liquidity within Bitcoin is increasing, and with more capital backing the asset, Bitcoin could be positioned for significant price appreciation.

Source: Glassnode

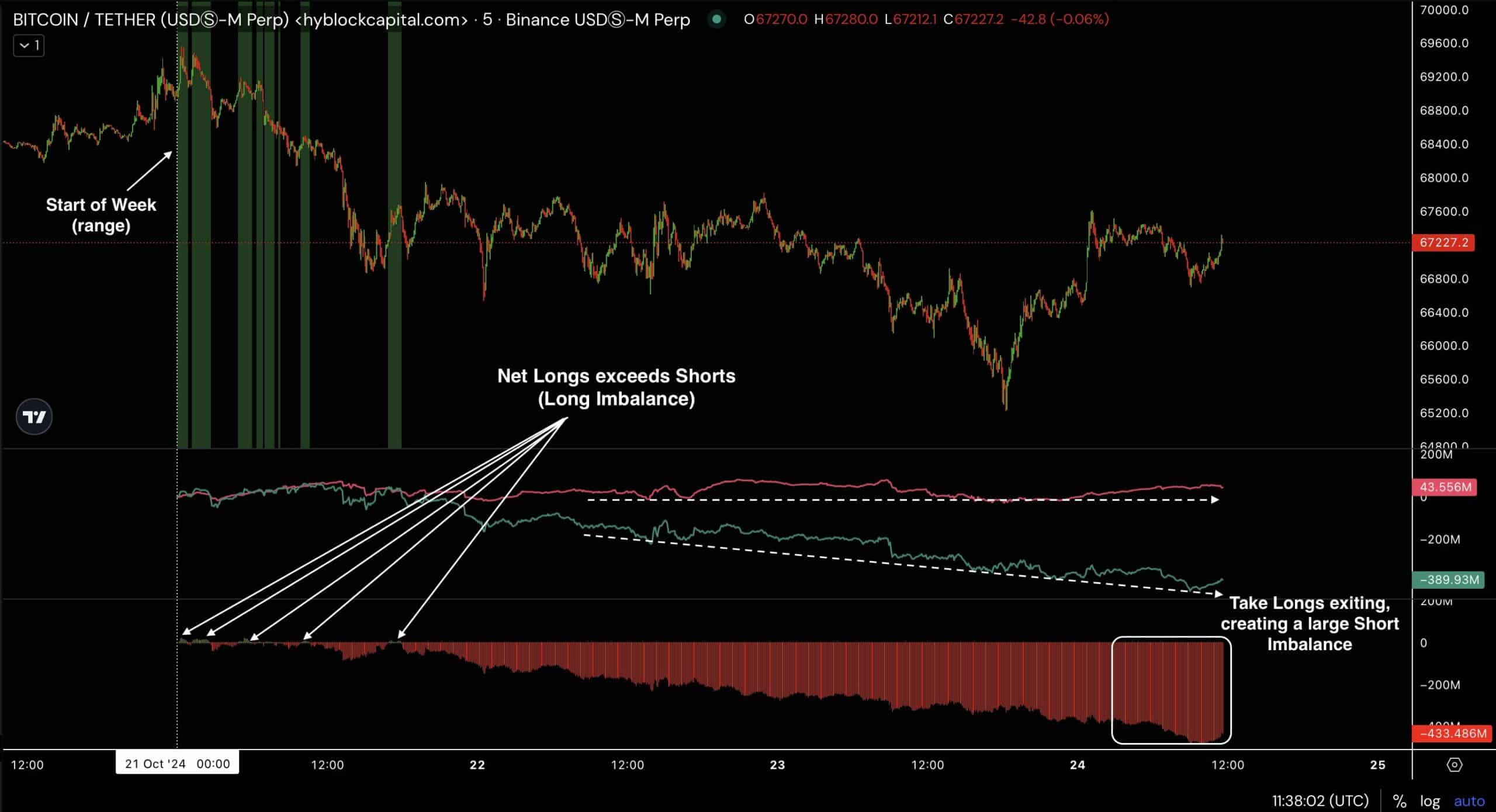

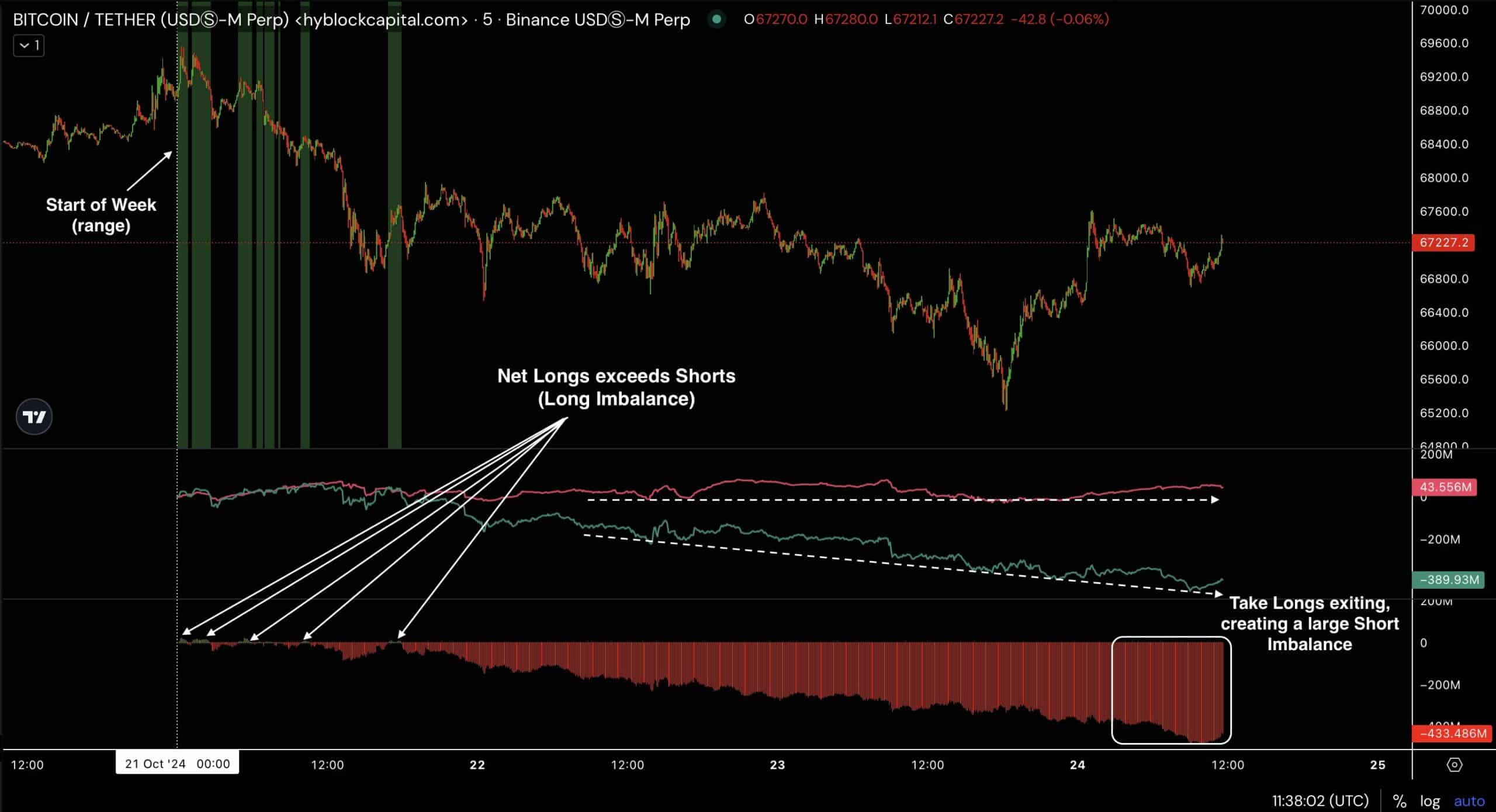

Weak breaks out as BTC retests breakout level

Bitcoin’s price dynamics this week indicate that weak hands may have exited the market, creating an environment for new capital to make the next big move.

At the start of the week, BTC saw a decline, causing some traders to pursue aggressive long positions in hopes of a recovery.

This created a scenario where BTC held onto some of these long positions, leading to further selling pressure.

However, after this shakeout, Bitcoin’s price quickly recovered, indicating that the departure of weaker hands may have strengthened the market’s fundamentals.

Source: Hyblock Capital

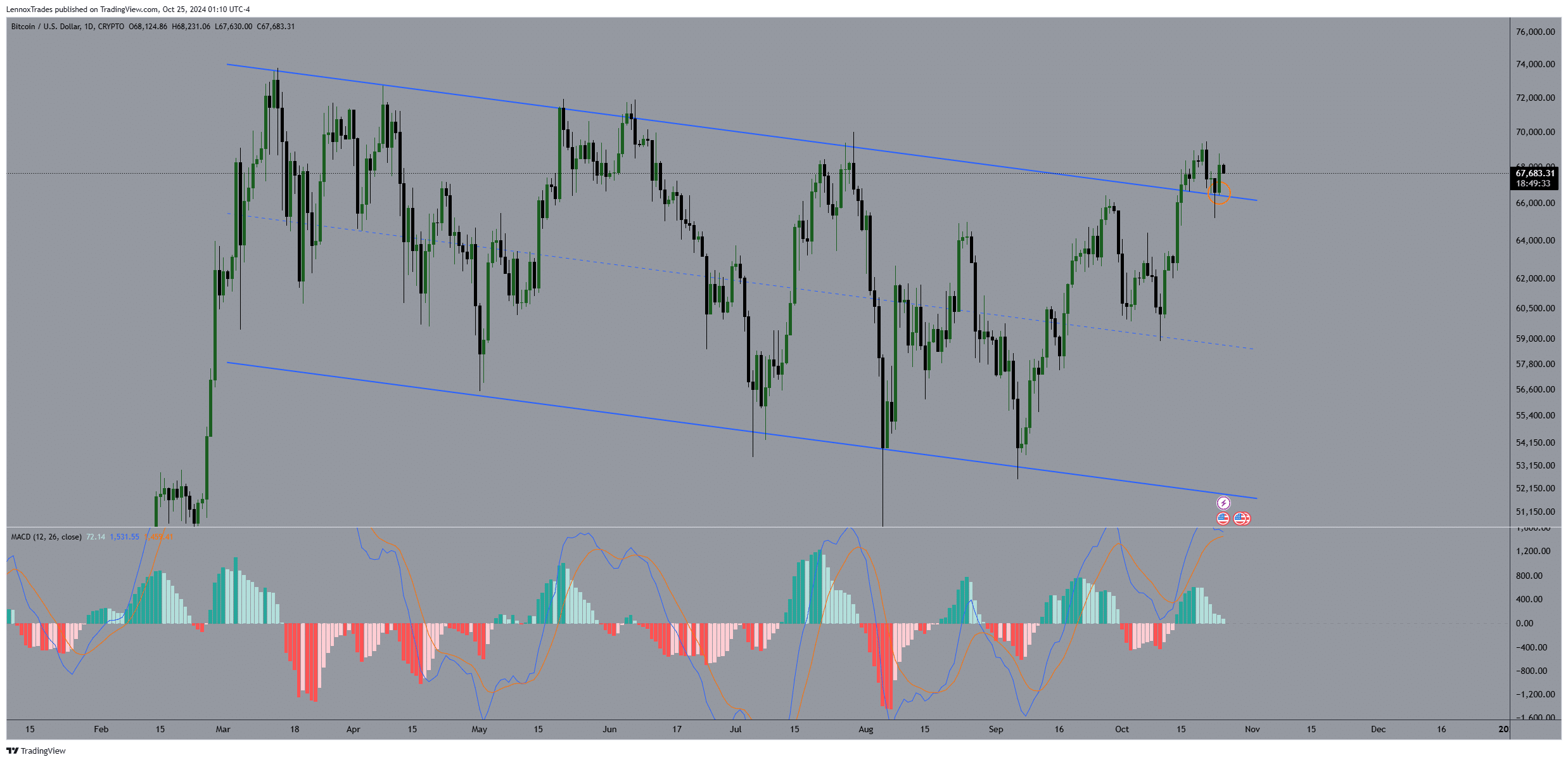

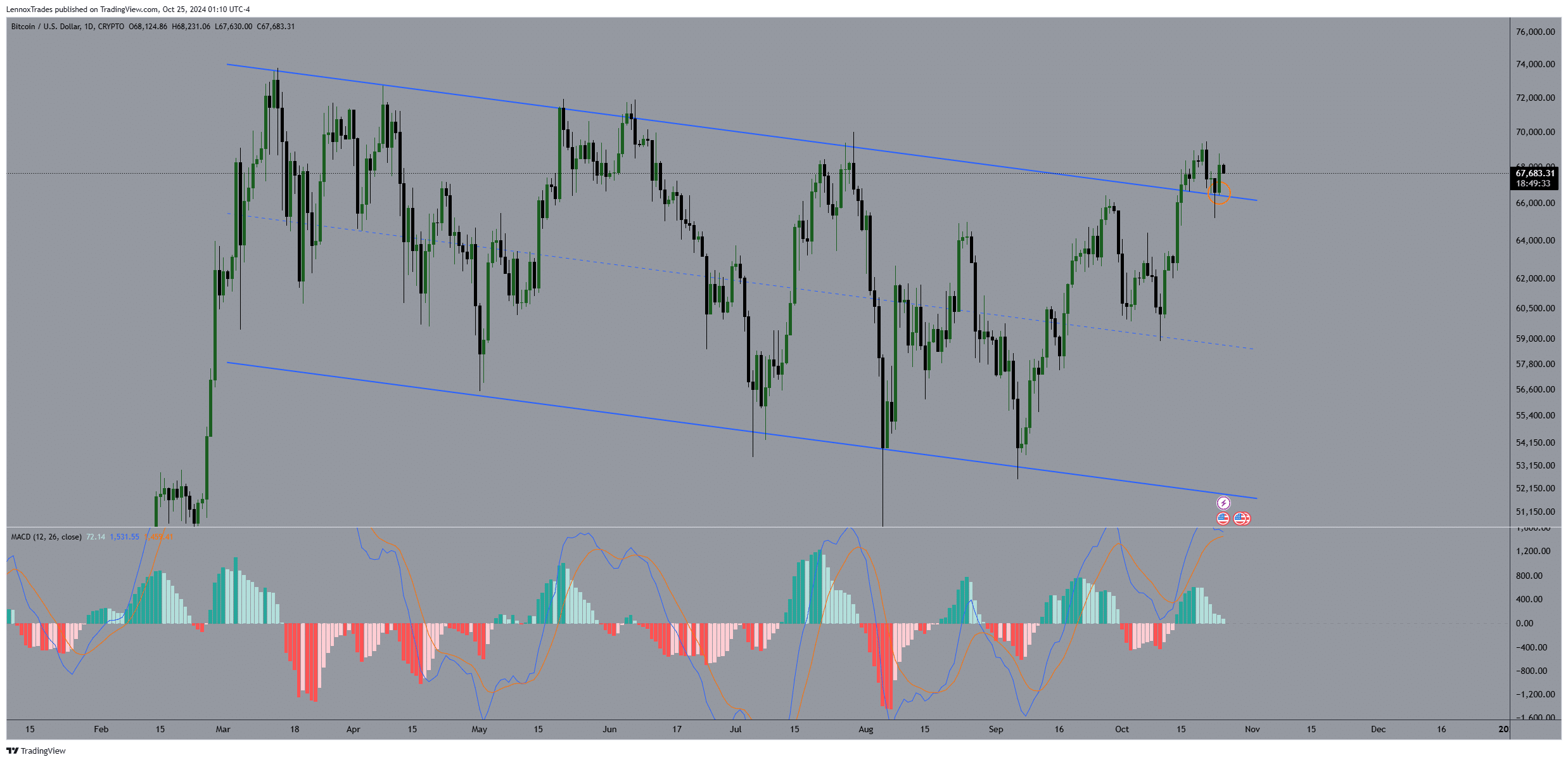

As for technical indicators, BTC recently retested its descending trend channel, which has been a crucial resistance for more than eight months.

A breakout from this channel with a successful retest suggests that Bitcoin could continue its upward trajectory.

BTC previously reached the upper limit of this trend channel and tested the $69.5K zone, but eventually retreated.

Source: TradingView

Despite this rejection, Bitcoin has since recovered strongly from the breakout level, with yesterday’s daily close, as at the time of writing, being bullish.

This move could be the confirmation traders have been looking for, potentially paving the way for a rally that could challenge previous highs.

New holders to determine the next move

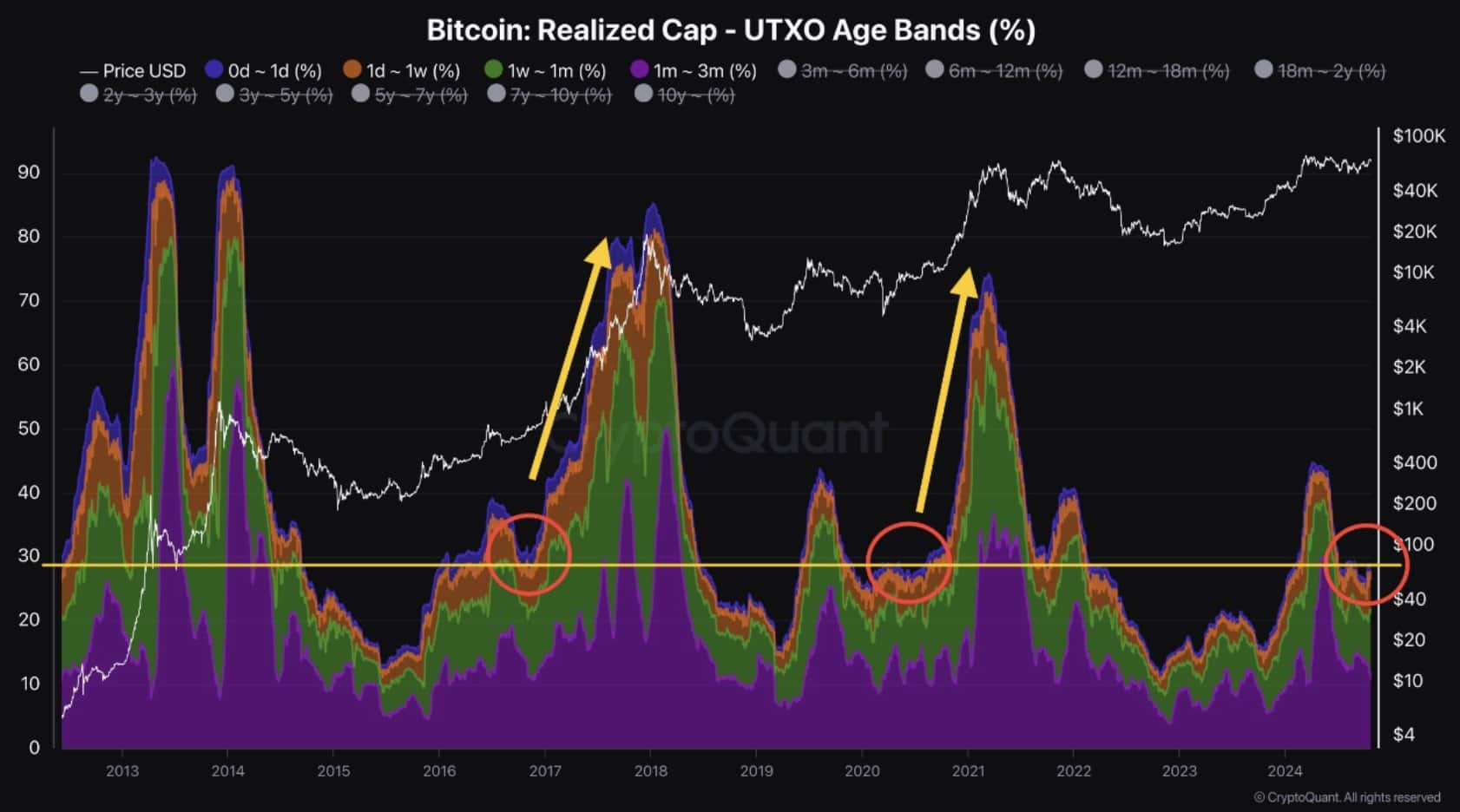

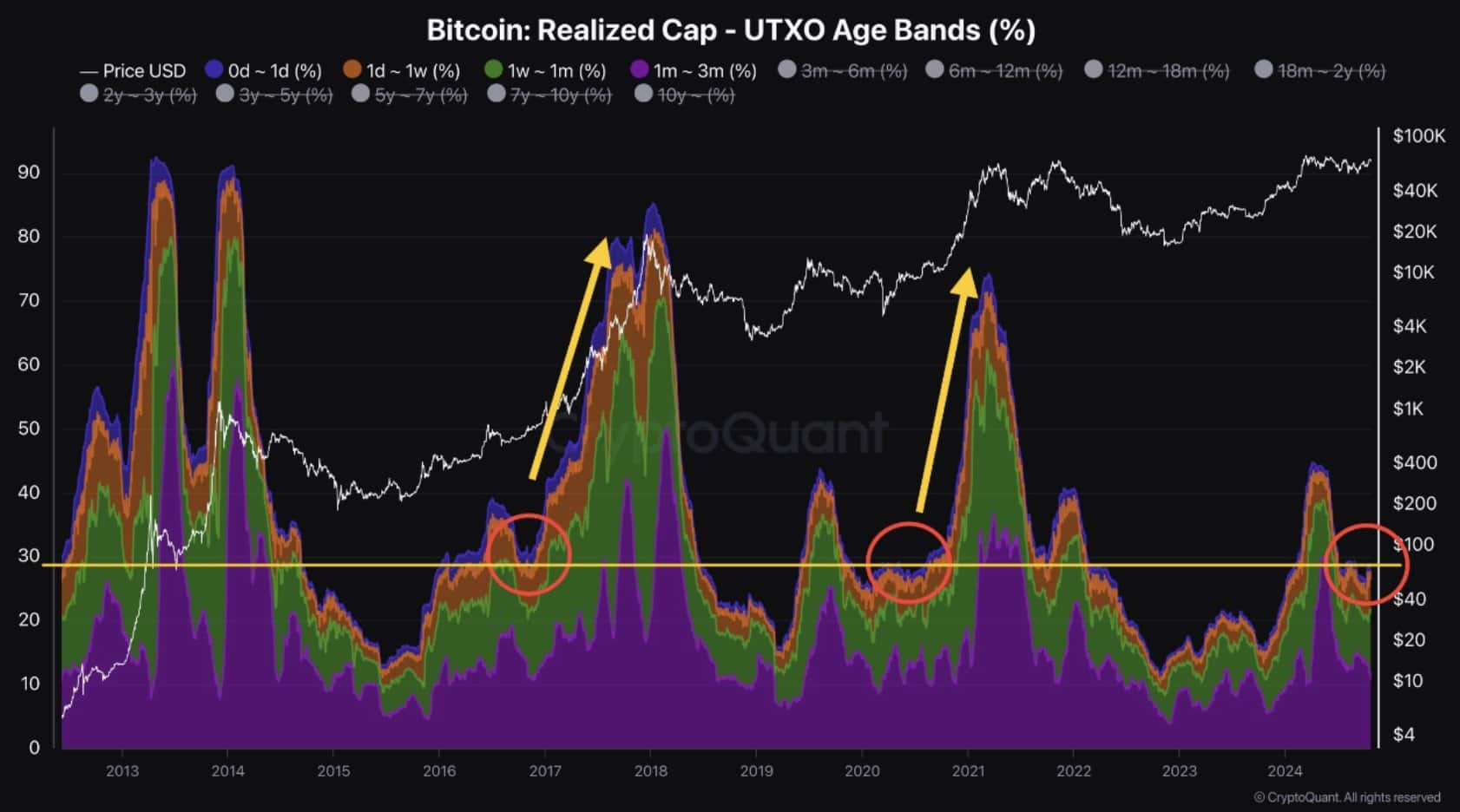

Finally, the actions of new investors appear to be crucial in determining Bitcoin’s next major price direction.

Historical data shows that when unspent transaction outputs (UTXOs) – a measure of Bitcoin held for less than six months – show a sharp increase after a lull, Bitcoin typically sees significant price growth.

Is your portfolio green? Check the Bitcoin Profit Calculator

Recent data shows a clear trend, indicating that BTC’s price may start to move upward. Record capital inflows and aligned technical indicators make a BTC breakout look increasingly likely.

Source: CryptoQuant

With Bitcoin’s liquidity and capital levels rising and weak hands largely out of hands, BTC could be poised for a further upward trajectory. The coming weeks will tell, and traders will be watching for signs that BTC is poised to reach new highs.