- Bitcoin’s block interval dropped significantly as its hash rate increased.

- The number of unconfirmed transactions in Mempool’s queue was low.

Transaction costs on the Bitcoin [BTC] network have dropped to their lowest level since March, potentially causing more problems for miners. According to a tweet from on-chain analytics firm IntoTheBlock, total fees collected on July 14 were $3.6 million, up 37.7% from the previous day.

#Bitcoin rates fell to their lowest level since March, despite the recovery in transaction activity pic.twitter.com/xT9VMYoXOP

— IntoTheBlock (@intotheblock) July 14, 2023

Is your wallet green? Check out the Bitcoin Profit Calculator

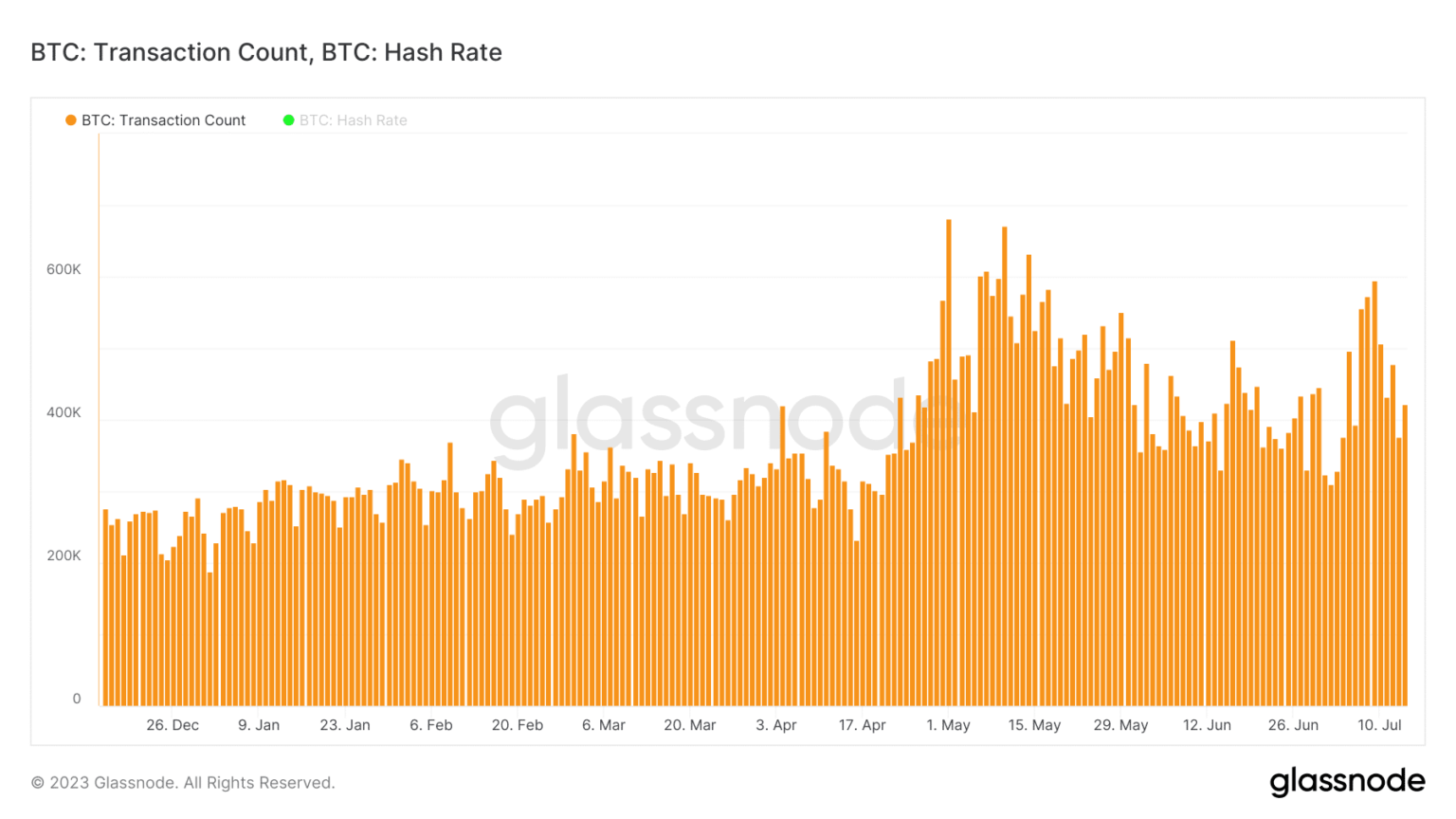

Interestingly, the drop in fees came despite a sharp uptick in on-chain trading activity. According to the Glassnode chart below, transaction numbers recovered strongly in July after weeks of downtrend.

Source: Glassnode

In fact, the number of transactions hit the highest level since May’s BRC-20 euphoria last weekend. So what could explain the drop in fees?

Block intervals decrease

The period when the number of transactions increased also saw a sharp increase in the network’s hash rate. A growing hash rate is a positive development in the sense that the network is becoming more decentralized and secure.

However, a growing hash rate also reduces the rate at which new blocks are mined and added to the chain. As pictured below, the block interval decreased significantly as the hash rate increased. This meant that transactions could be processed quickly without people having to increase their costs to go the extra mile.

Source: Glassnode

According to Mempool data, the number of unconfirmed transactions in the queue at the time of writing was 259,652, a significant decrease from the 465,000 in early May. A $0.3 fee was charged, which precluded prioritization of transactions.

Source: Mempool

The miners’ misery continues

Low transaction fees through blockchain networks work to the advantage of users, especially with low value transactions. This bodes well for Bitcoin’s widespread adoption by retail users.

On the contrary, reduced fees negatively affect miners’ economy. Miners should be incentivized to validate transactions and secure the Bitcoin network. They rely on these incentives to cover their hardware and electricity costs.

Read Bitcoin [BTC] Price Forecast 2023-24

Bitcoin miners fought the punitive bear market of 2022 with tenacity, expecting to recoup their losses in 2023. However, after reaching annual peaks in May, their revenues have dried up significantly.

Source: Glassnode