- Bitcoin’s 90-day active offer drops and indicates a lower trading activity and demand in the short term.

- The decrease in active delivery may indicate a potential price consolidation or further dip.

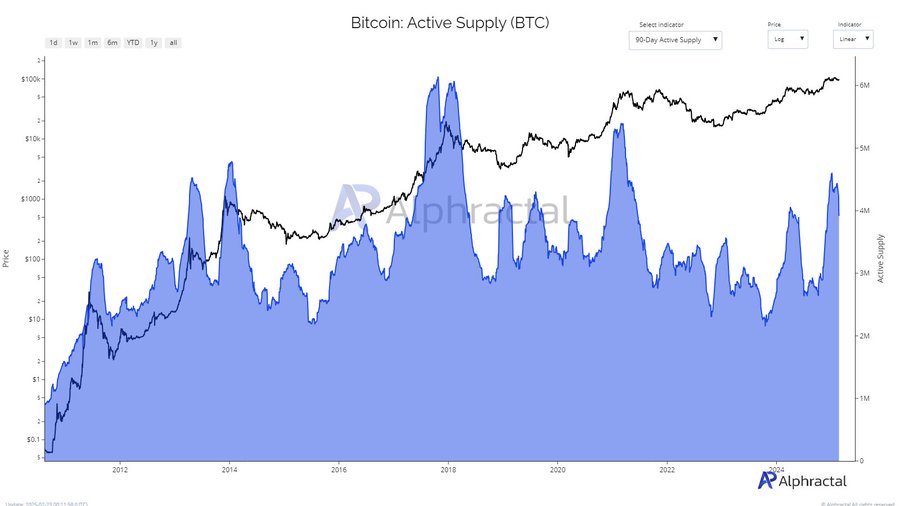

In recent weeks, Bitcoin’s [BTC] Active range of 90 days has been a noticeable decline and raises questions about the current state of market demand and investor sentiment.

This has long been used to assess both the level of new market interests and the general mood of traders.

As the statistics continue to fall, it is crucial to understand what this shift could mean for the price movement of Bitcoin and which trends investors should pay attention to in the coming months.

Active offer, market demand and sentiment

The 90-day active offer helps to read both the market demand and sentiment by following the Bitcoin that was handled at least once within a period of 90 days.

A high active offer usually indicates increased market participation, which is often a reflection of the rising demand from new or short -term traders.

Conversely, a decrease in active delivery may indicate reduced interest or a shift in sentiment, because in the long term holders are less likely to sell during periods of lower market activity.

Historically, considerable shifts in active delivery are correlated with changes in market mood, so that potential price fluctuations and trends are often indicated.

Factors behind the shift in market behavior

The recent decrease in the 90-day active stock of Bitcoin pointed out A reduction in commercial activity in the short termSignal less interest from new market participants.

If this trend continues, this suggests that the price of Bitcoin can consolidate sideways for a longer period or experience a slight dip.

Various factors contribute to this shift.

After the rise of Bitcoin beyond $ 100,000 after President Donald Trump’s election, the market had to deal with increased volatility, driven by policy security and inflation problems.

This has led to more cautious trading behavior.

Moreover, the decision of the SEC to drop his case against Coinbase has created a more favorable regulatory environment, causing the long -term retaining to active trade.

As the institutional interest rate grows, market participants seem to use a wait -and -see approach that can further influence active delivery statistics.

Historical trends and patterns in the active range of Bitcoin

An assessment of historical Bitcoin Cycli shows that the active supply tends to rise during the peaks of the bull market and to contract in early phase rallies or post-recalcation consolidation periods.

The graph indicates earlier peaks in active delivery during the most important price increases of Bitcoin in 2013, 2017 and 2021, followed by steep decreases during corrective phases.

Source: Alfractaal

In particular, the recent decline in active offer reflects trends that are observed before large outbreak, which suggests that current market participants hold their assets while awaiting a higher price bone.

If this pattern applies, Bitcoin can be in a consolidation phase before a new upward movement.

Has this influenced BTC’s price?

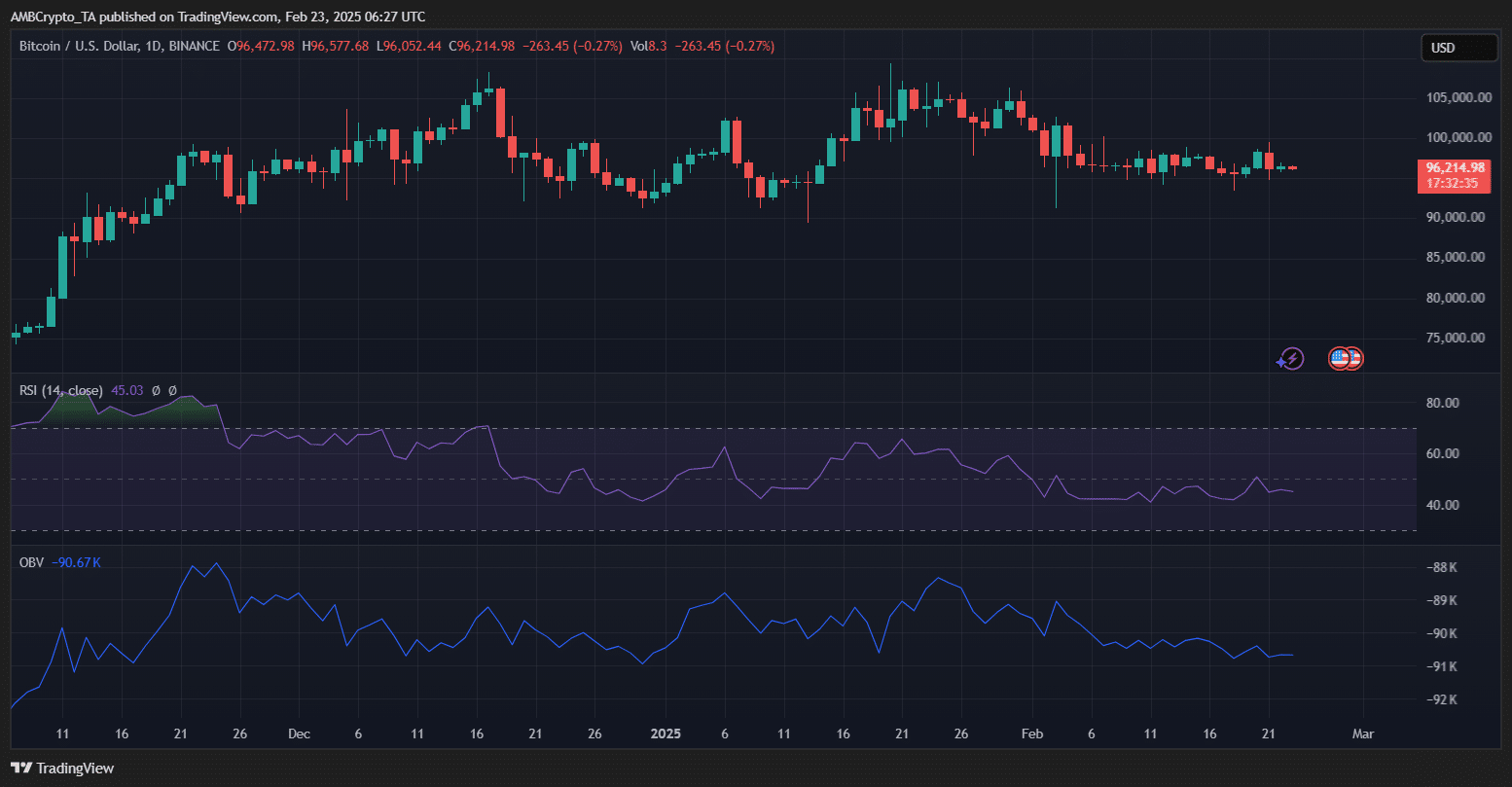

Bitcoin traded at $ 96.214 at the time of the press, which showed a decrease of 0.27% in the last 24 hours. The RSI at 45.03 indicated that BTC is located on neutral territory, neither sold nor overbough.

The OBV was trending down, which points to weakening purchasing pressure, which worked in line with the decline in active diet of 90 days.

Source: TradingView

BTC marked $ 100,000 after not determining a clear outbreak.

The decreasing trading activity in the short term indicates that investors are careful and probably wait for stronger catalysts. If BTC fails to win back Momentum, a withdrawal to $ 90,000 remains possible.

However, if the question arises, BTC could try a new push to psychological resistance at $ 100,000.