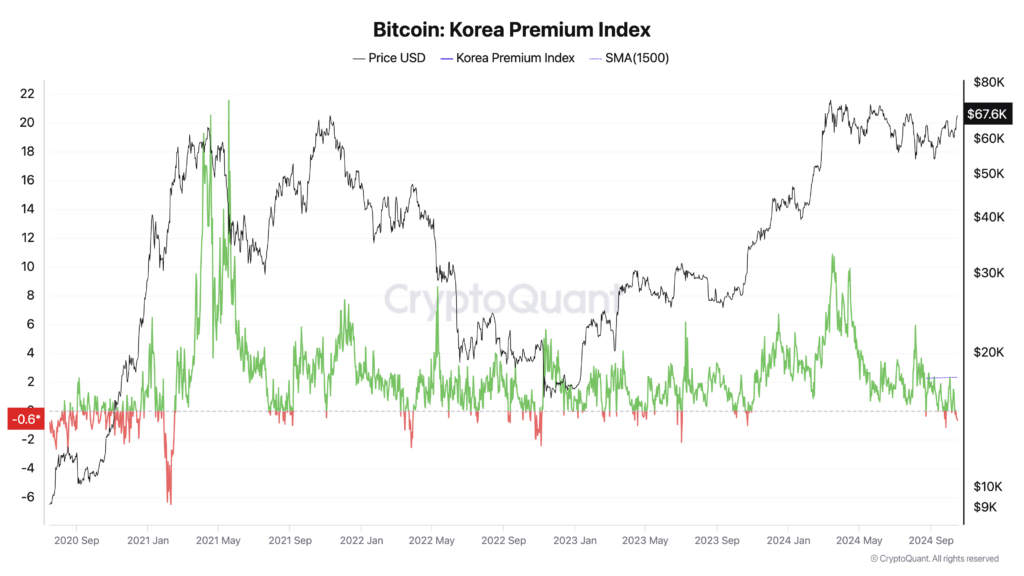

Bitcoin is trading at a discount on South Korean exchanges, reversing the traditional “kimchi premium” that has historically signaled bullish market sentiment.

Per The Korea Times, the cryptocurrency is priced about 700,000 won ($511.73) lower domestically than on global exchanges, resulting in a negative premium (discount) of -0.74% as of Thursday afternoon.

This shift seems to indicate a bearish view among South Korean investors. Typically, a higher kimchi premium indicates strong local demand and positive sentiment, which often leads to Bitcoin prices exceeding global rates. In contrast, a lower or negative premium reflects weakened enthusiasm and reduced buying pressure, potentially signaling a market correction or alignment with global valuations.

Analysts attribute this unusual discrepancy to subdued investor sentiment in South Korea and higher demand for virtual assets on foreign platforms. KP Jang, head of Xangle Research, told the Korea Times that restrictions are preventing foreign and institutional investors from accessing domestic stock exchanges, amplifying the impact of declining demand from retail investors.

A shift in traders’ preferences towards altcoins is also affecting the market. As Bitcoin boomed globally, Korean traders began accumulating undervalued alternative cryptocurrencies in anticipation of a solid rally in the fourth quarter. reported Through Business insider. These altcoins, including Tao, Sei Network, Aptos, Sui, NEAR Protocol and The Graph, are seen as having higher returns, potentially diverting attention from Bitcoin.

Declan Kim, a research analyst at DeSpread, also told the Korea Times that the altcoin market, which comprises a significant portion of domestic trading, continues to struggle amid transitional phases of new regulations. The implementation of the Virtual Asset User Protection Act affects market forces. Many altcoins are still unlisted on domestic exchanges compared to foreign ones, and the ban on market making makes securing liquidity a challenge.

The Kimchi bounty has traditionally been a hallmark of the South Korean crypto market. When Bitcoin crossed the 100 million won mark domestically in March, the premium briefly spiked to as much as 10%. A higher premium generally indicates strong local demand and bullish sentiment, often coinciding with or preceding Bitcoin price increases. Conversely, a lower or negative premium indicates bearish sentiment and reduced buying pressure.

Data indicates a notable decline in trading volume between Bitcoin and Korean Won (BTC/KRW) over the past 40 days, reflecting a shift in investor focus.

Analysts expect the reverse kimchi premium to be temporary. Jang expects the discrepancy to disappear soon, as such premiums have rarely held up for long periods. He said ongoing discussions on legislation allowing corporate investment in virtual assets could improve liquidity on domestic exchanges and gradually narrow the price gap with foreign markets.

Current trading conditions reflect a complex interplay of domestic regulations, investor behavior and global market trends, indicating significant shifts within South Korea’s crypto landscape. The negative kimchi premium, while unusual, could ultimately lead to a more balanced and mature market as it better aligns with global digital asset valuations.

The last time Kimchi Premium turned negative was in October 2023, right before Bitcoin’s ETF-driven bull run.