- Bitcoin’s Options OI saw a sharp decline, indicating reduced speculative activity and increased caution among traders.

- Low trading volumes and subdued price action pointed to a consolidation phase for the crypto market.

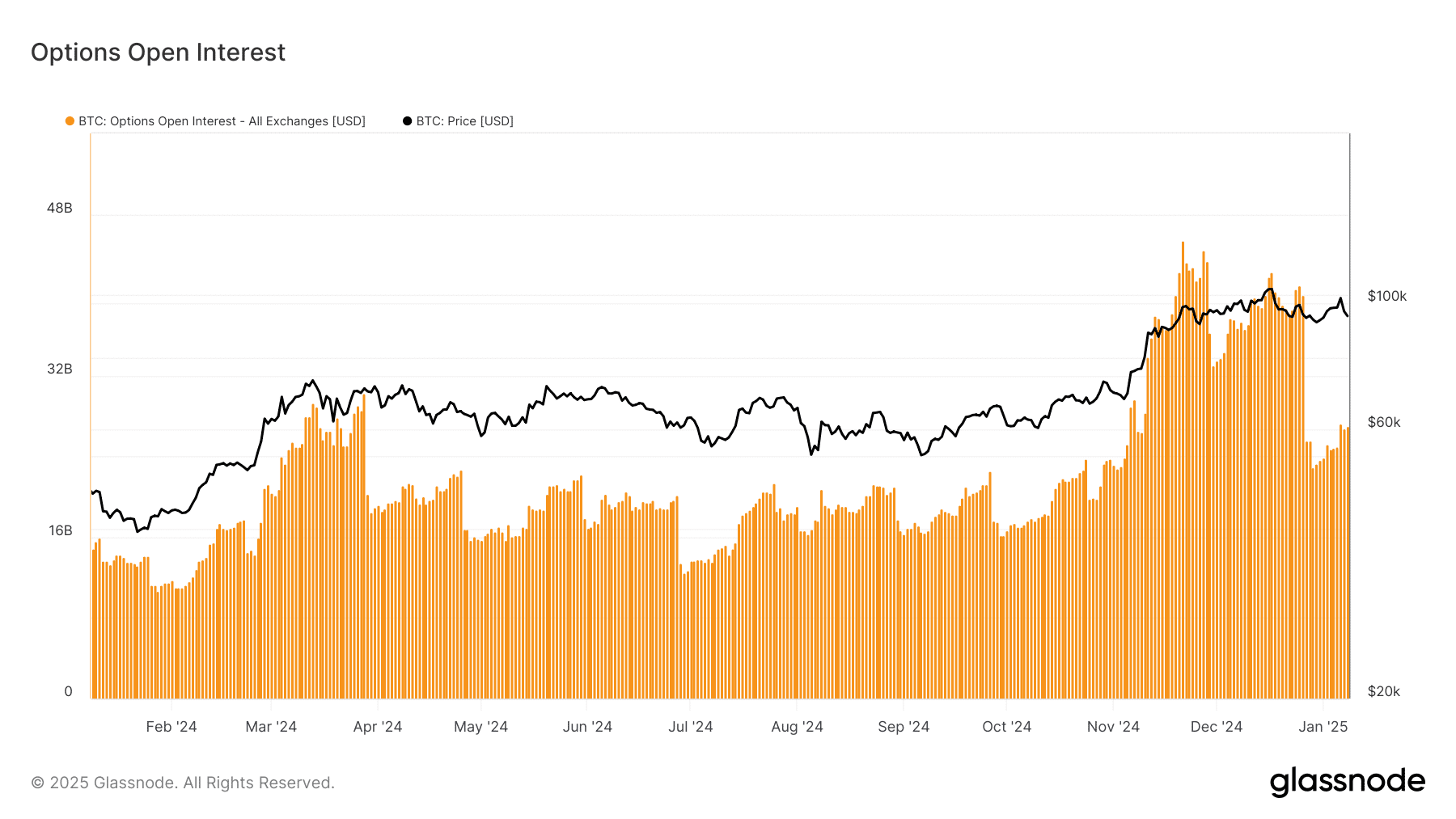

The cryptocurrency market witnessed a shift in sentiment as Bitcoin [BTC] Options Open Interest (OI) showed a historic decline.

This development reflected a broader market transition towards caution, driven by macroeconomic uncertainties and recent price volatility.

The attached price charts of Options OI and BTC highlighted this significant shift in market dynamics.

Historical decline in Bitcoin Options OI

The Options Open interest rate graph reveals a steep drop in OI, with numbers falling from their recent highs as traders take a more conservative approach.

Historically, OI has acted as a barometer of speculative activity and overall market confidence.

AMBCrypto’s analysis showed that OI fell from almost $40 billion to the current range of $27 billion.

The current decline underlines market participants’ withdrawal from leveraged positions, likely driven by global economic pressures and fears of continued interest rate hikes by the Federal Reserve.

Source: Glassnode

The decline also coincides with a broader contraction in trading volumes, indicating a lack of momentum to support speculative bets.

This shift could herald a consolidation phase for the market, with risk appetite remaining subdued and traders adopting a wait-and-see strategy.

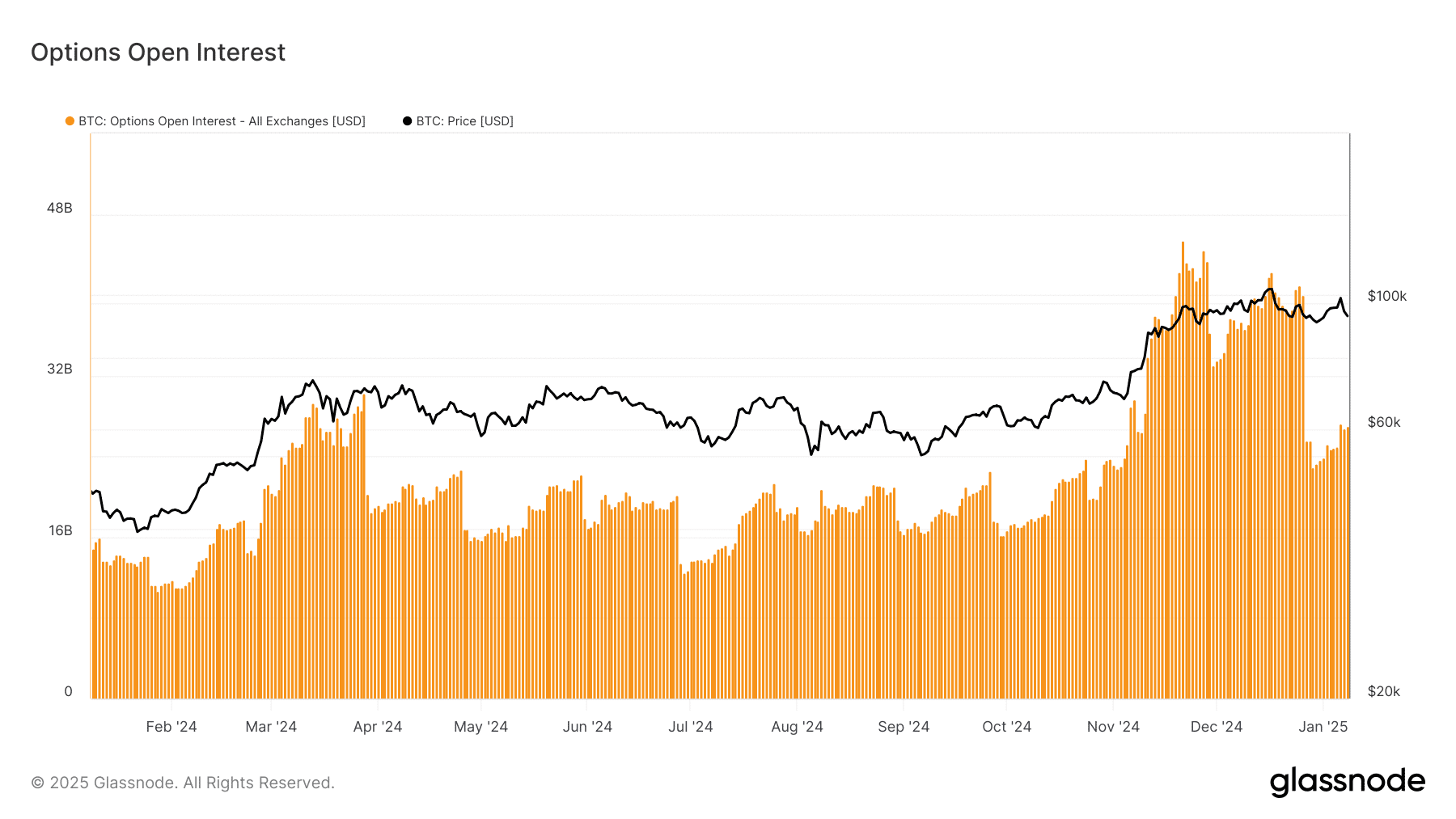

Bitcoin price reflects caution

Bitcoin’s price action reflects the cautious sentiment evident in the derivatives market.

Bitcoin was trading at $93,316 at the time of writing and has fallen below the 50-day moving average of $97,654, signaling a bearish turn in the short term.

Meanwhile, the 200-day moving average at $72,962 acted as a crucial long-term support level.

Source: TradingView

At 2.64K, volume levels remained relatively low, further highlighting the reduced trading activity and lack of directional conviction among market participants.

This low activity reflected hesitation in the face of external macroeconomic uncertainties, including strong labor market data and possible Federal Reserve tightening.

The Ichimoku Cloud analysis and moving averages suggested that Bitcoin could remain between $90,000 and $95,000 in the near term.

A breach of these levels could accelerate a further sell-off or trigger a recovery, depending on broader market sentiment.

Market implications and broader trends

The dip in Bitcoin Options OI signals a shift in market dynamics, with traders and investors becoming more cautious in their approach.

This trend is further reinforced by declining volumes and muted price movements, which together indicate a lack of strong catalysts for significant market movements.

Although caution prevails at the moment, this phase could pave the way for greater stability as a reduced debt burden minimizes the risk of extreme volatility.

However, the market remains highly sensitive to external factors, including macroeconomic data and regulatory developments, which could reignite speculative interest or deepen the consolidation phase.

A market in transition

The historic drop in Bitcoin Options Open Interest highlights the evolving sentiment in the crypto market.

Read Bitcoin’s [BTC] Price forecast 2025-26

As caution replaces speculative exuberance, traders are likely to focus on key support and resistance levels while keeping a close eye on global economic indicators.

Whether this transition leads to greater market stability or paves the way for renewed volatility remains to be seen.