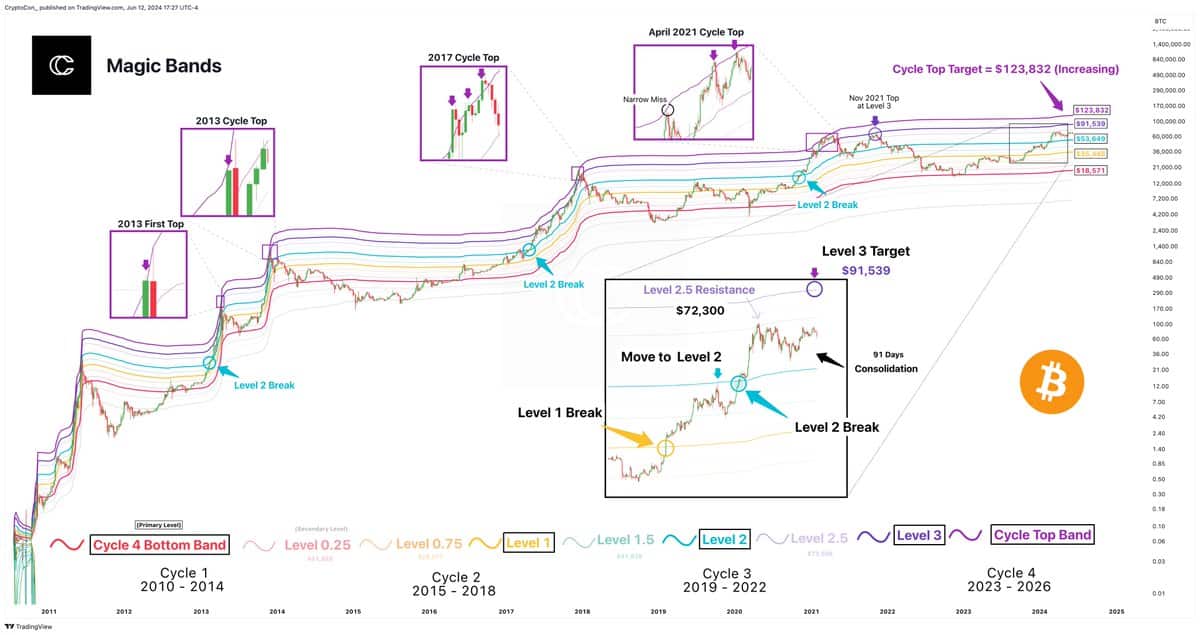

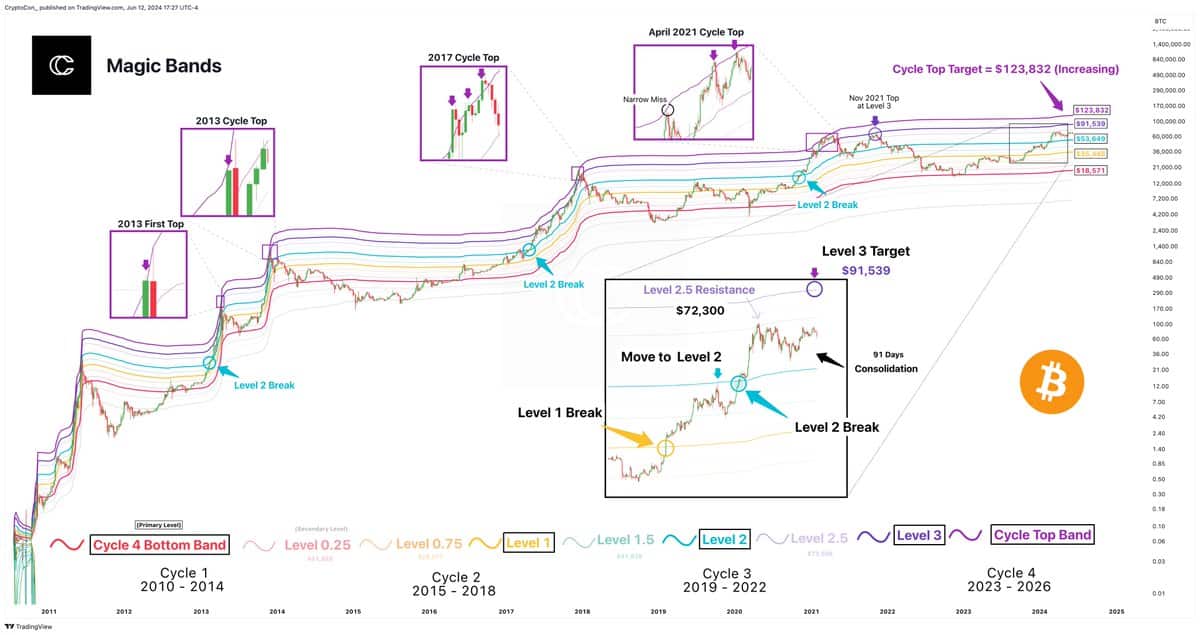

- Bitcoin’s expected target remains high at $91,539 under the “Magic Bands” model.

- Recent whale activity and increasing active addresses indicate strong market support for this bullish outlook.

Despite recent fluctuations in the crypto market, Bitcoin remains [BTC] continued to show signs of a possible upward movement.

After the latest US CPI report, which indicated a slowdown in inflation, Bitcoin briefly rose to $69,000.

At the time of writing, the price was hovering around $67,505, reflecting a small increase in the past 24 hours. This resilience came against the backdrop of broader market corrections, with assets down 4.7% this week.

Bitcoin: technical predictions

Amid these price dynamics, CryptoCon, a pseudonymous technical analyst, remained steadfast in their bullish outlook for Bitcoin. project a potential increase to $91,539 in the near future.

This target, according to CryptoCon’s post on social platform

The forecast uses the ‘Magic Bands’ model, which uses historical peak and trough patterns to predict future price levels.

The “Magic Bands” model suggested that Bitcoin, currently navigating ‘level 2.5’ of the cycle, was poised for a breakout that could push the price to $91,539.

Source: CryptoCon/X

This would represent a significant increase from the current valuation and potentially pave the way for it to reach what the model predicts as a ‘Cycle Top Target’ of $123,832.

Analyzing fundamental issues

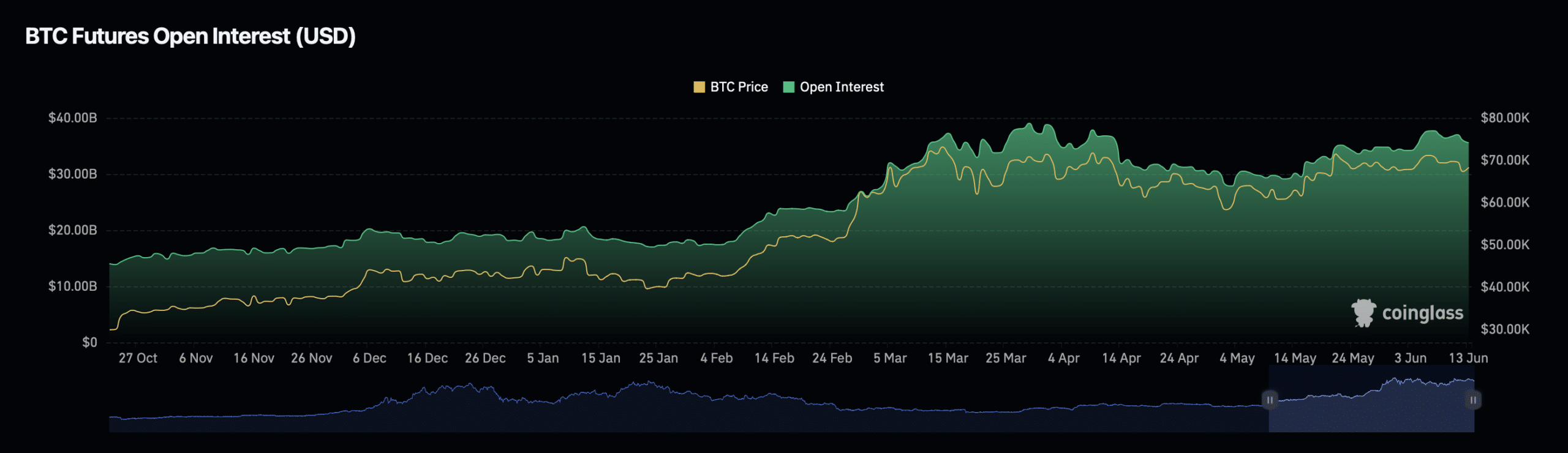

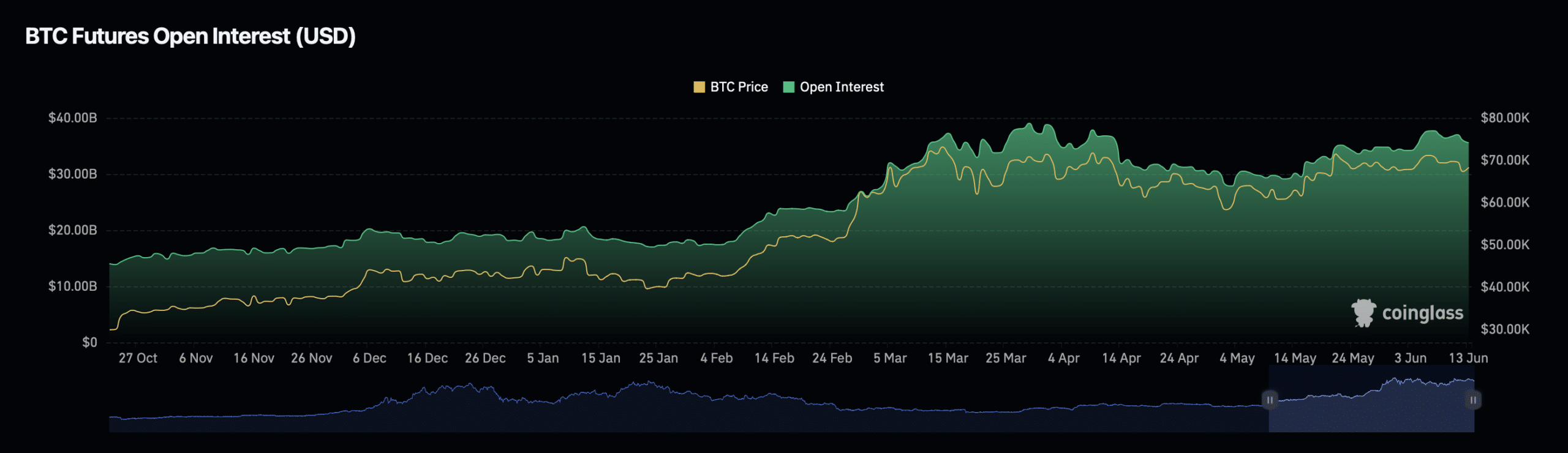

To gauge the feasibility of such a price jump, one can look at Bitcoin’s Open Interest and active addresses.

AMBCrypto’s analysis showed a mixed pattern in Open Interest, while total Open Interest fell by 3.11% over the past day.

The valuation rose significantly by 53.11% over the same period, indicating a tightening market that could lead to price volatility.

Source: Coinglass

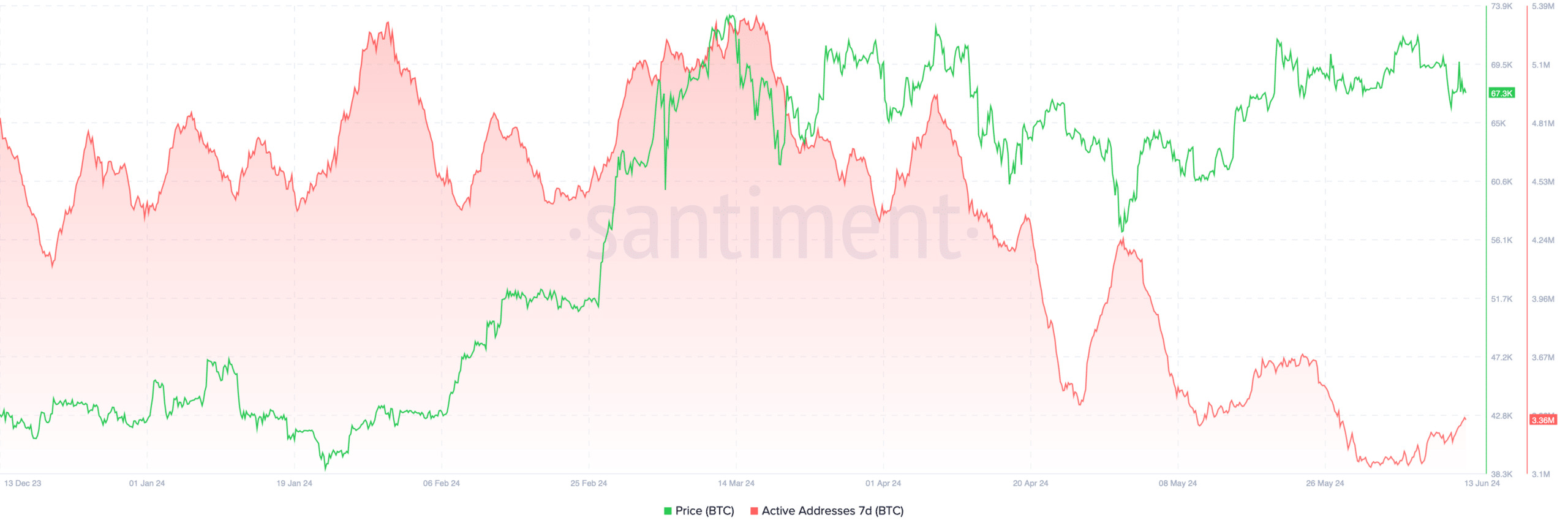

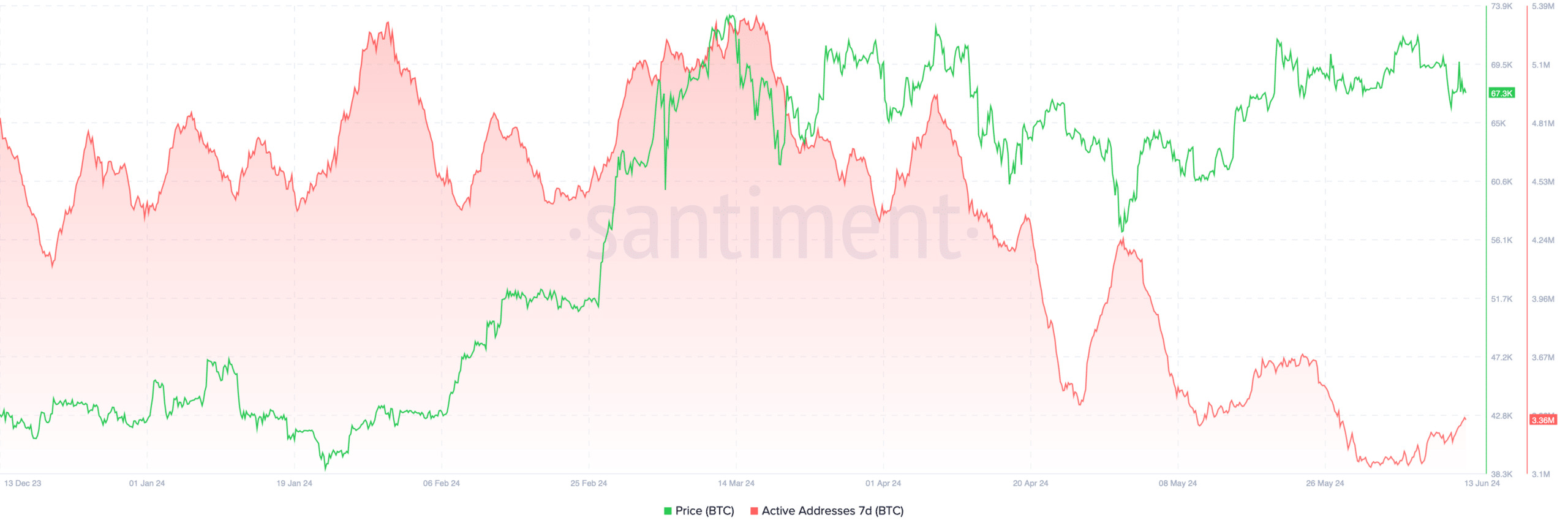

Moreover, the number of active Bitcoin addresses has increased from 3.14 million to 3.36 million in recent days.

Active addresses typically indicates a growing user base and can be a harbinger of higher transaction volumes, which could support higher price levels.

Source: Santiment

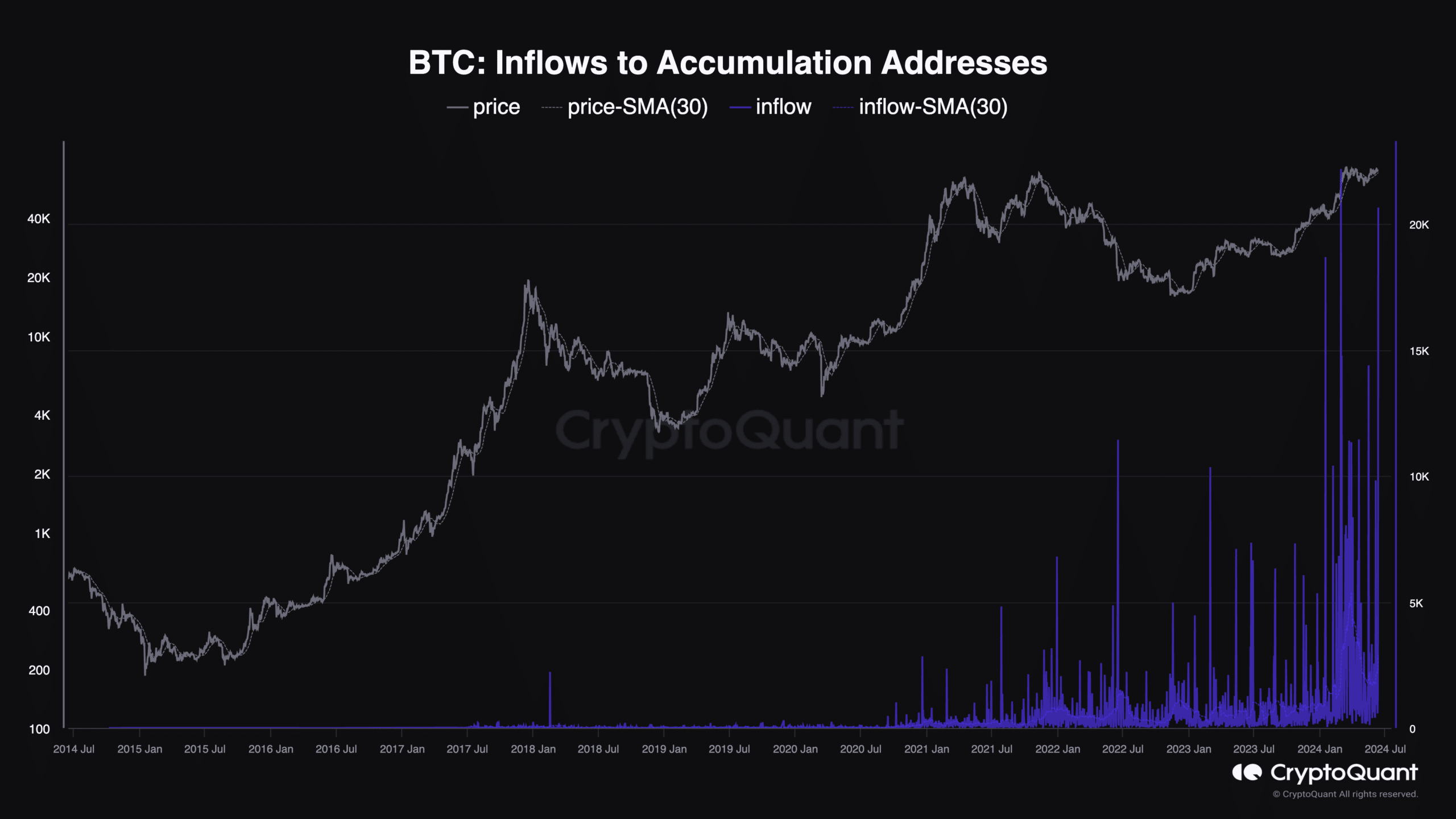

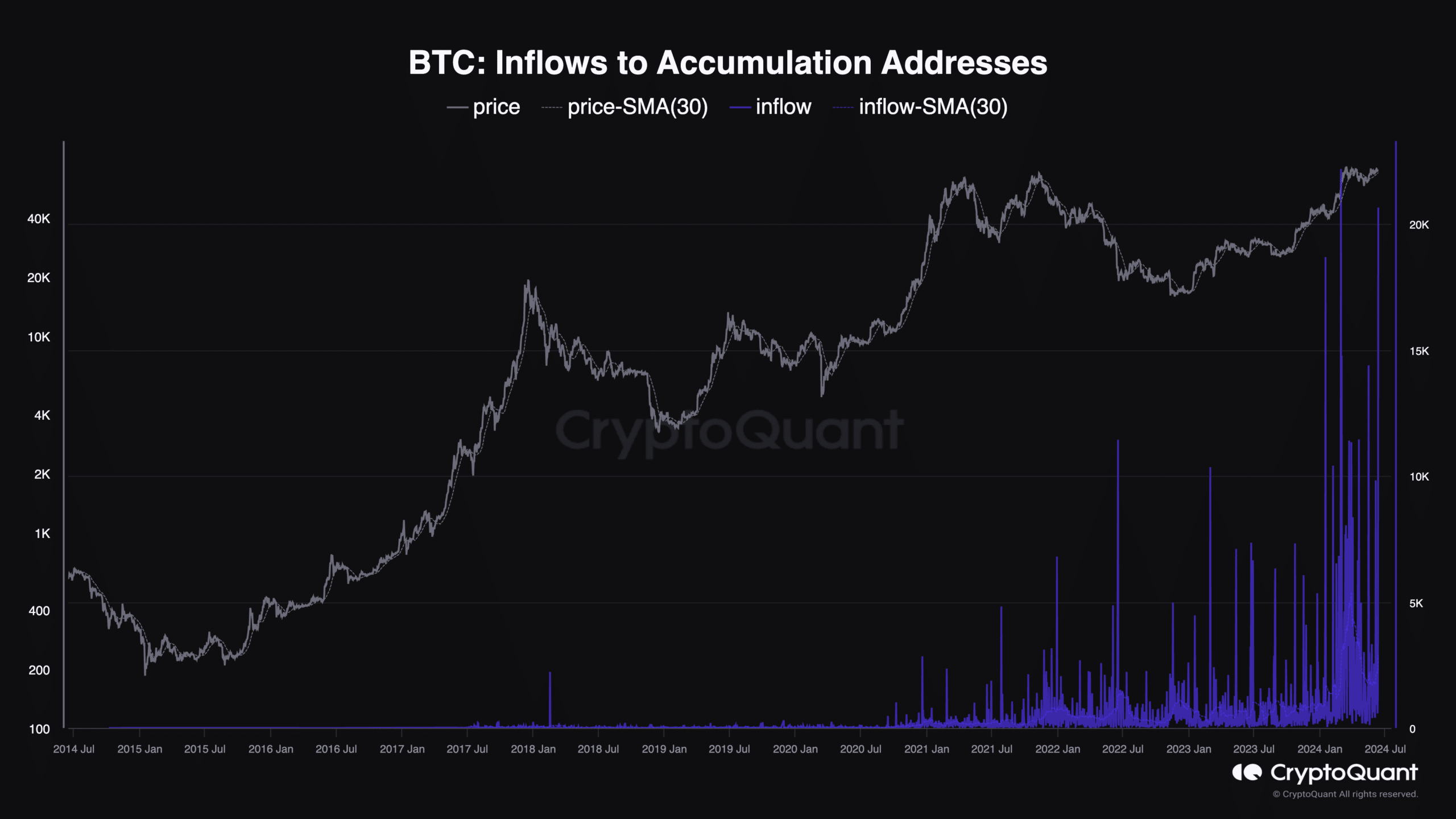

The behavior of Bitcoin whales also provided insight into market sentiment. On June 11, during a notable price drop, whales collected another 20,600 BTC, worth approximately $1.38 billion.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024-2025

This marked one of the most important purchases in one day by major investors since February, indicating that major players saw value at current prices and may have been positioning themselves for expected price increases.

Furthermore, AMBCrypto recently made a notable report revival previously dormant Bitcoin addresses.