- Decline in fees signals a challenging period for network profitability

- Supply on the stock exchanges fell, while other developments supported a price increase

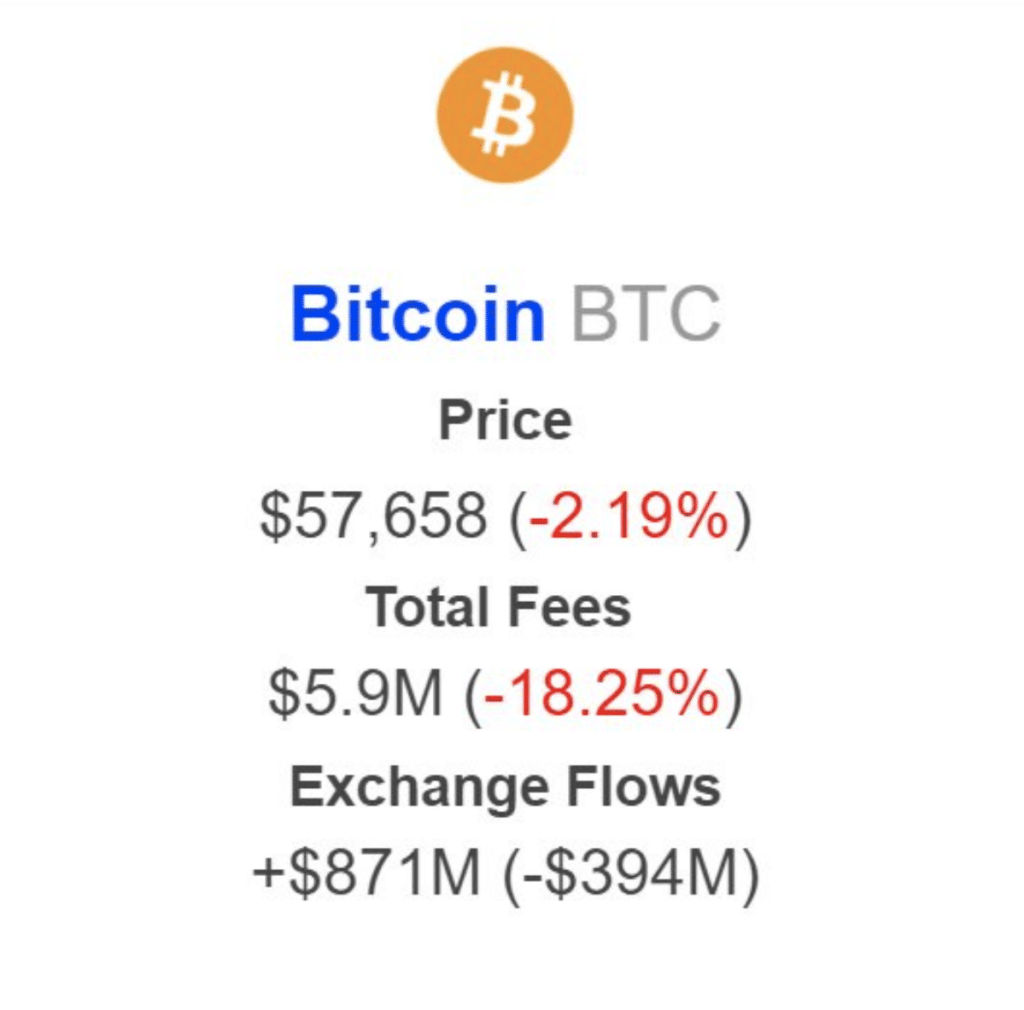

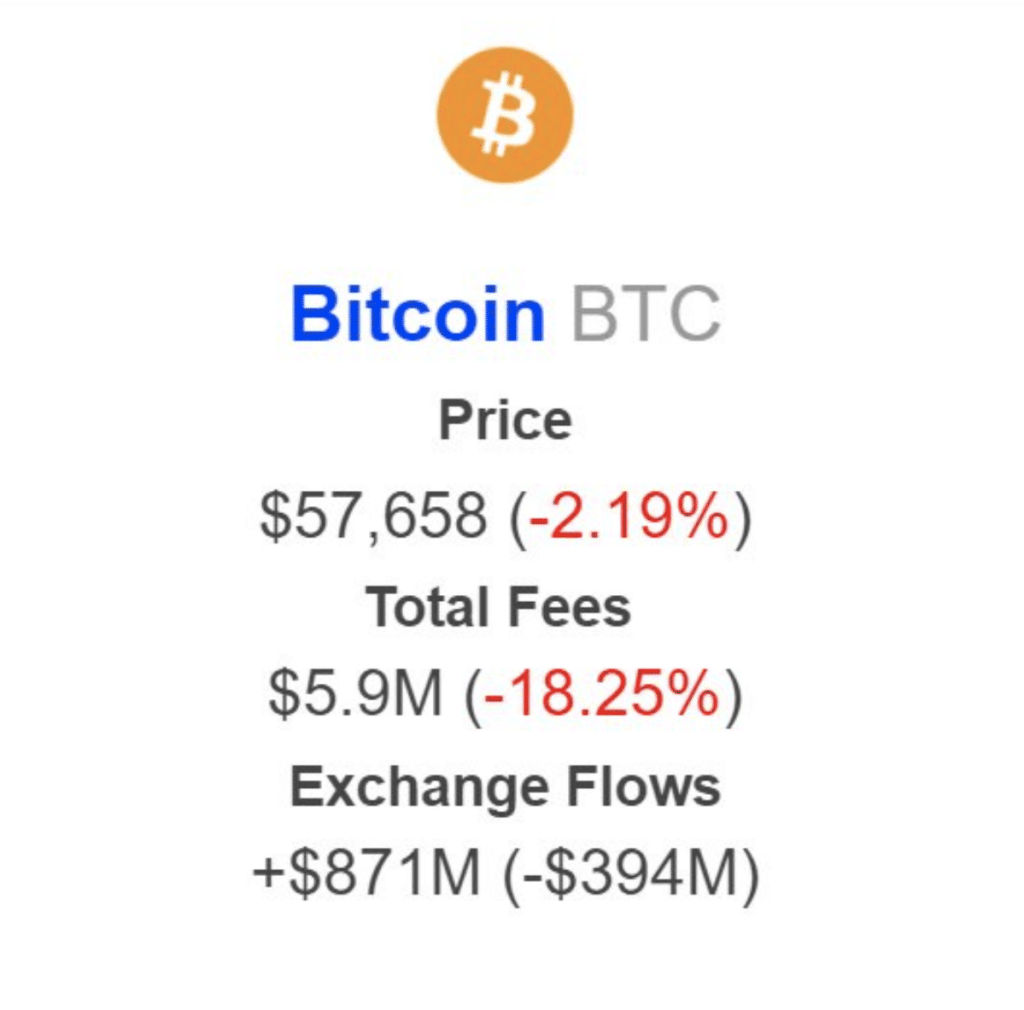

The total costs generated by the Bitcoin [BTC] network decreased by 18.25%, compared to last week’s value. According to IntoTheBlock, Bitcoin only made $5.90 million.

However, that was not the only thing. The drop also meant that the network had lost the lowest costs since November 2023.

Lower transactions equal lower fees

For those unfamiliar, Bitcoin trading volume usually determines how much fees the network earns. If the volume is high, it means that user demand for block space will increase.

Therefore, miners would be able to validate new blocks while making a profit. The last time something like this happened was during the halving, when the Runes Protocol came into play.

Source: IntoTheBlock

At the time, fees rose and miners’ profitability peaked. Unfortunately, that hasn’t been the case lately, with the price of BTC being one of the culprits.

At the time of writing, the price of Bitcoin was $58,135. Before the most recent surge, the coin was trading as high as $54,832 as it struggled with falling interest rates and low demand.

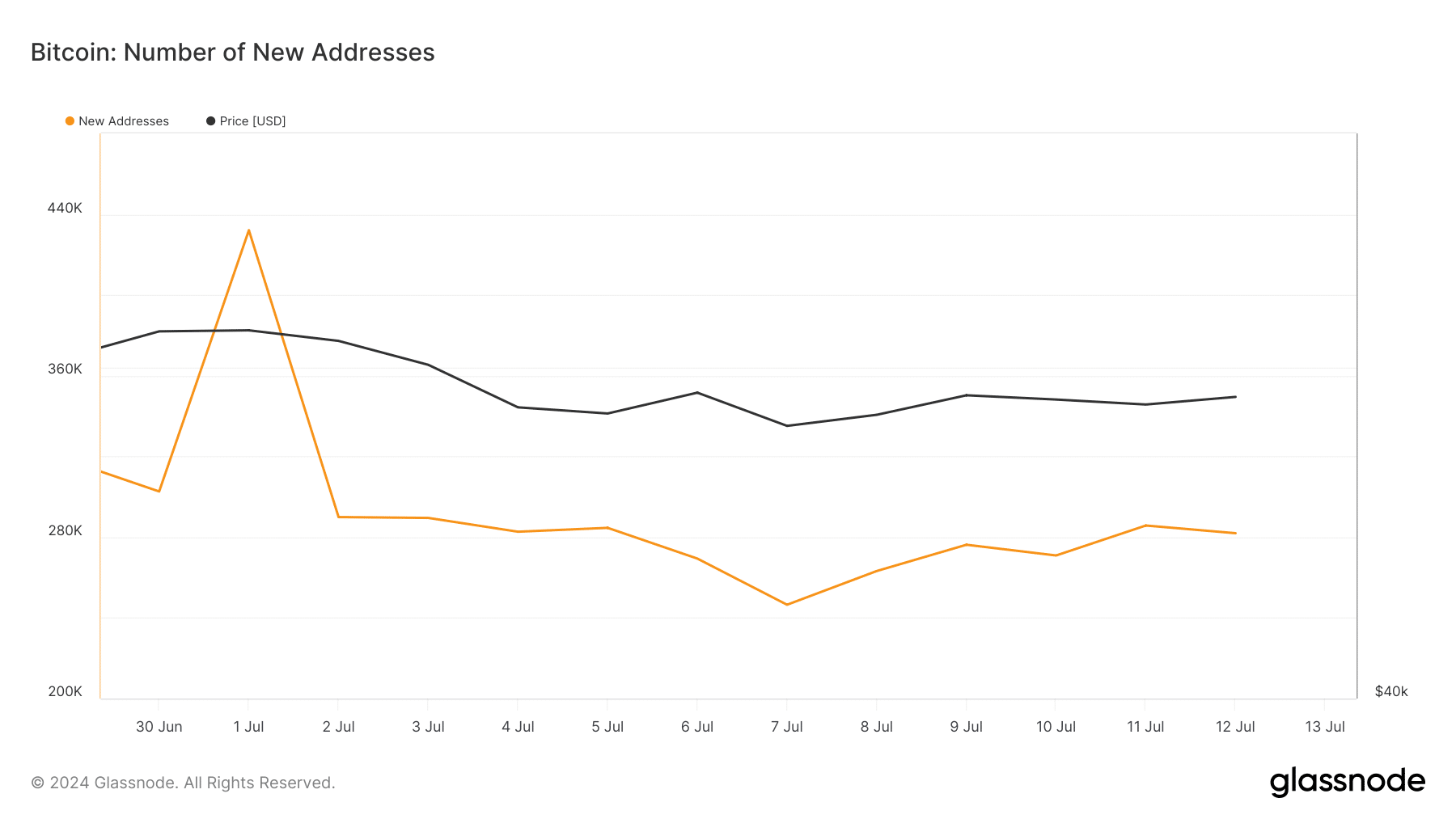

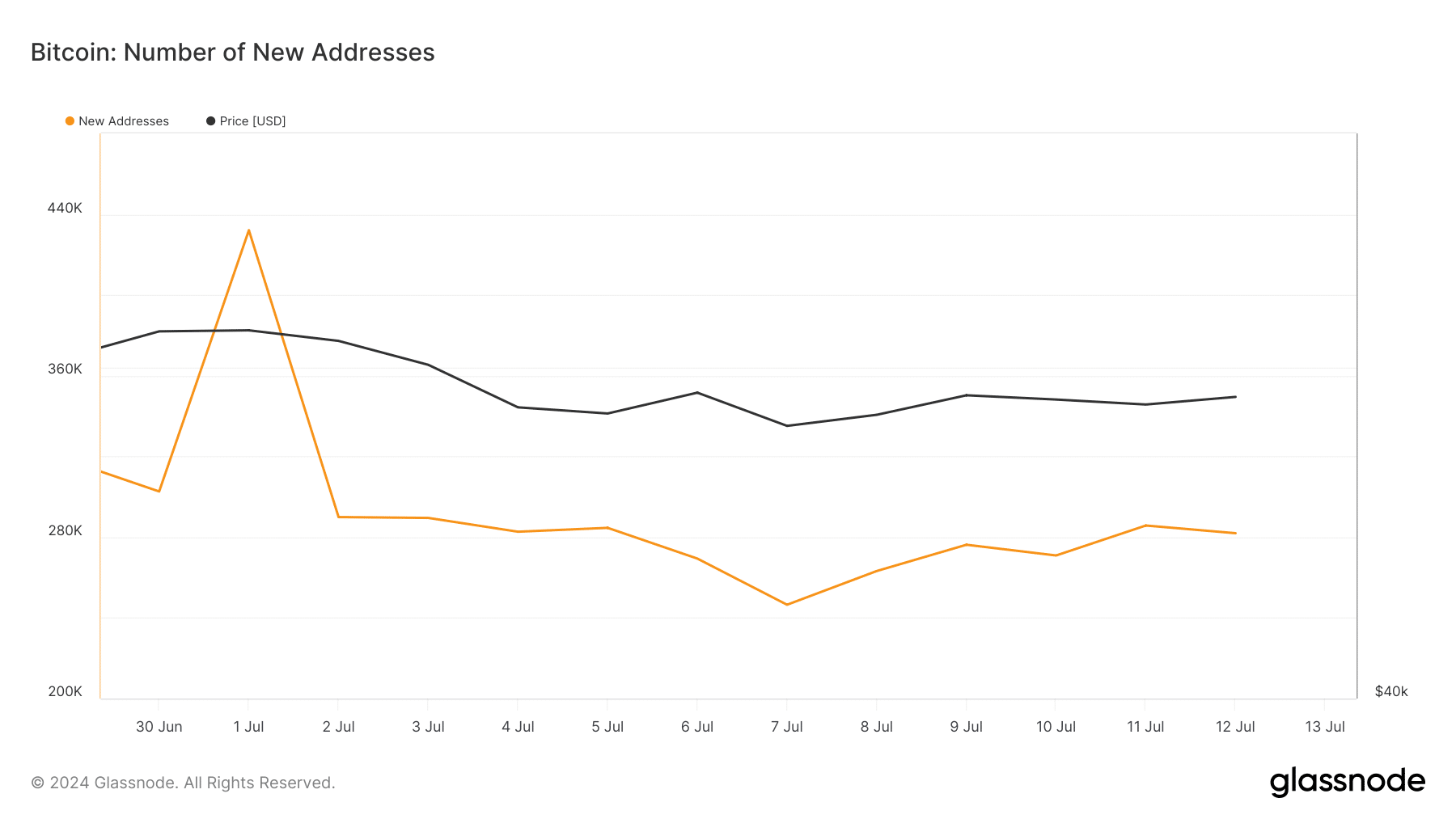

AMBCrypto found evidence of low demand by looking at the number of new addresses. According to Glassnode, the number of new Bitcoin addresses as of July 12 was only 289,915. However, by the beginning of the month, this same metric stood at 432,026.

This decrease implies that there is a decrease in the number of first transactions created by unique addresses on the network.

Source: Glassnode

BTC is ready to go up again

If this figure continues to decline, it would be inevitable not to register another drop in Bitcoin costs. However, if a jump happens in the coming weeks, the network could potentially generate more revenue and the price of BTC could also rise.

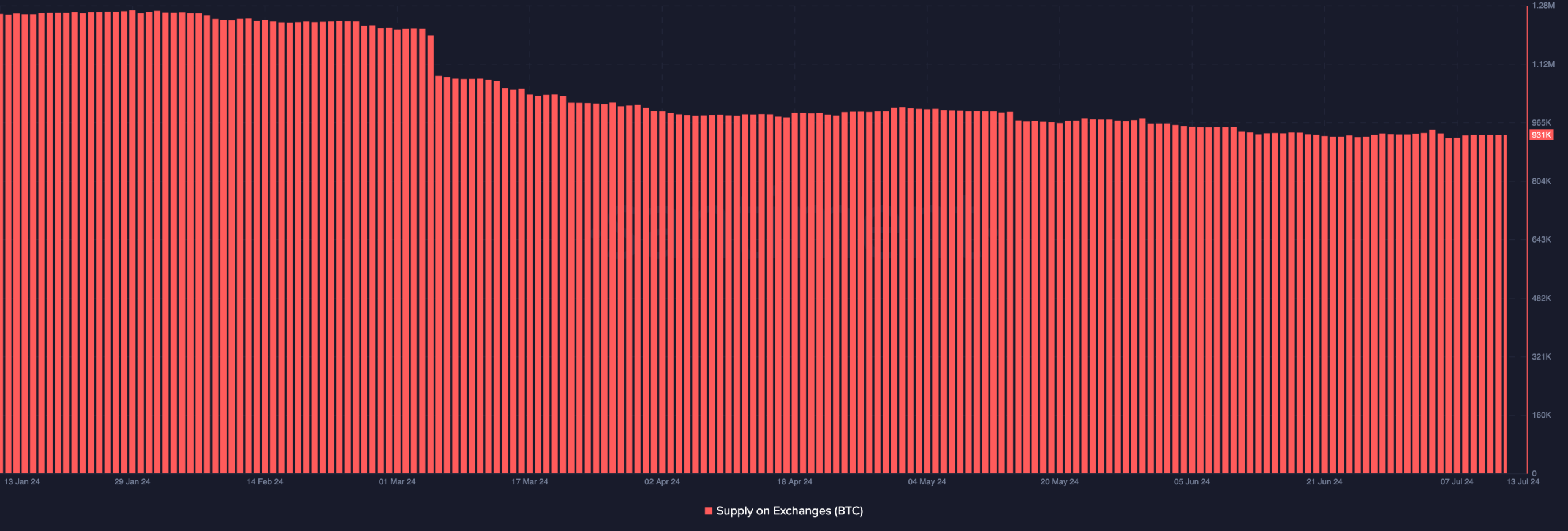

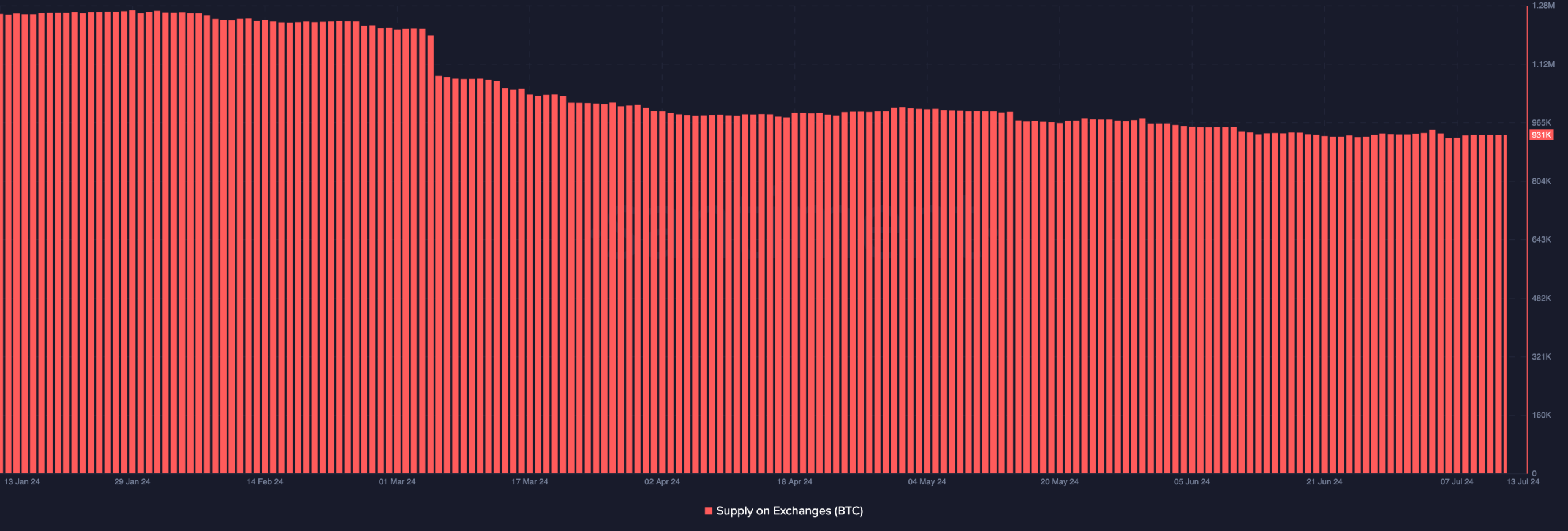

We also looked at the offerings at trade fairs. When supply increases on the exchanges, it means that holders will most likely want to sell. If this happens, Bitcoin’s price could drop down the charts.

At the time of writing, supply had fallen to 931,000. Should this remain the case over time, the cryptocurrency’s price will recover and potentially test $60,000 again in the near term.

Source: Santiment

It also seemed that Bitcoin was on its way to a perfect condition for a remarkable rise. For example, AMBCrypto reported how the Crypto Fear and Greed Index fell to extreme fear, indicating a buying opportunity.

In addition, the German government had a hand in pushing down the price as a result of the enormous sell-off. Finally, Bitcoin also recorded the highest ETF inflows of the month on July 12.

Read Bitcoin’s [BTC] Price forecast 2024-2025

If this condition persists, and if it is accompanied by buying pressure later, the price of BTC could rise to $63,000 or $65,000 within weeks.

However, this prediction could be debunked if another round of whale sell-offs occur. If that is the case, Bitcoin could fall back to $57,000.