- The absence of significant catalysts has made the crypto market susceptible to US macro data prints.

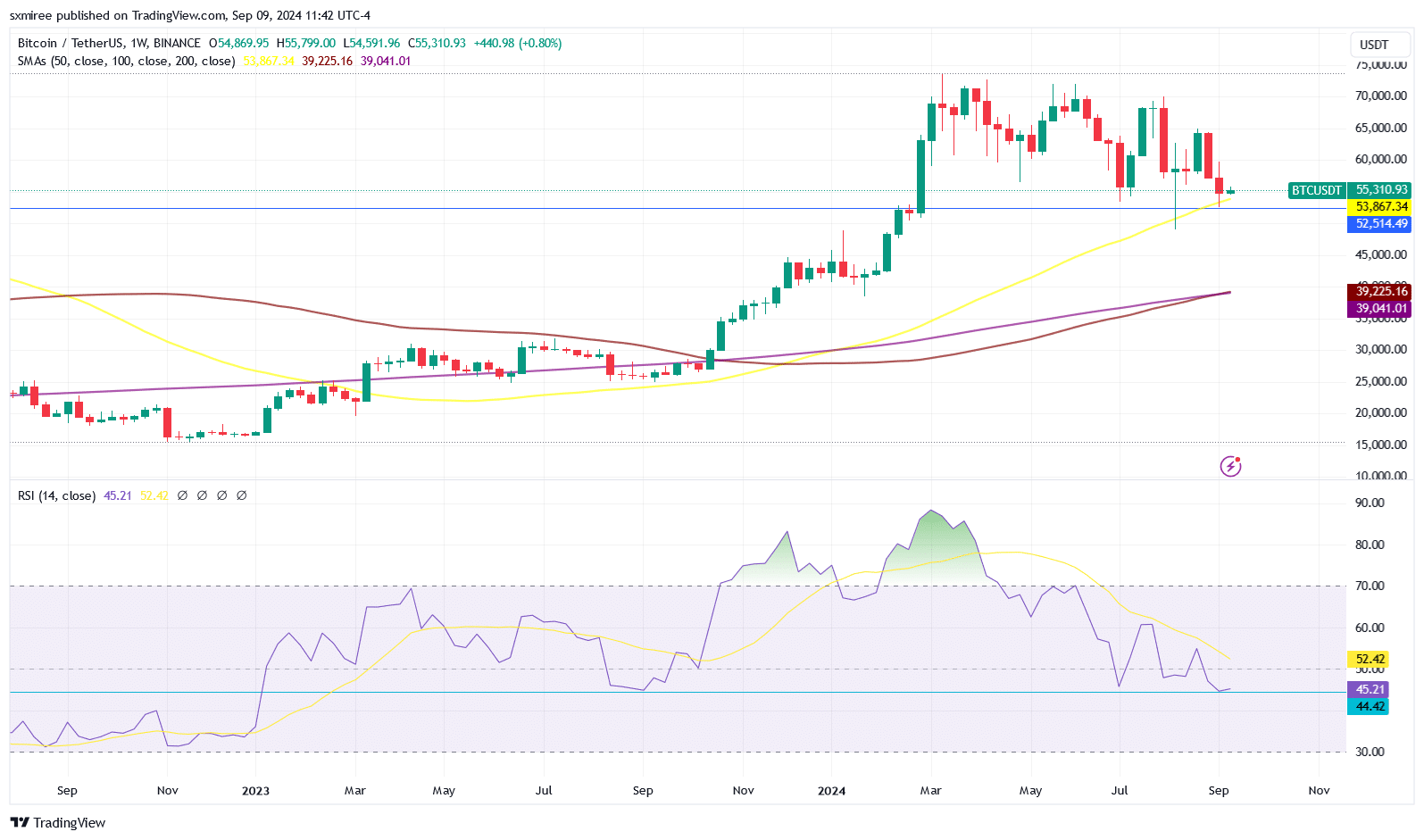

- Bitcoin’s weekly Relative Strength Index value closed at its lowest level since January 2023.

Bitcoin [BTC] briefly climbed above $55,500 on September 9 after mild losses heading into the weekend, leaving a negative 4.26% return for the week just ended.

While not as deep as the previous week’s 11% decline, the somewhat disappointing close marked consecutive weekly losses for the crypto asset since June 10, when it trailed declines for four consecutive weeks.

Observers attributed last week’s dip to US nonfarm payrolls data and negative flows from Bitcoin ETFs. The latest U.S. jobs report shows the economy added 142,000 nonfarm payroll jobs in August, below expectations of 160,000.

Meanwhile, data from SoSo showed Value Bitcoin spot ETFs are in an eight-day streak of outflows.

Last week of inflation data before the FOMC meeting

This week, market participants welcome more U.S. economic data that could impact the Fed’s September 18 interest rate decision and the overall direction of the market.

The Bureau of Labor Statistics will release the August U.S. Consumer Price Index report on Wednesday, September 11, followed by Producer Price Index data on Thursday.

The publications come after Tuesday’s American presidential debate between candidates Kamala Harris and Donald Trump. Ahead of the debate, analysts at Bernstein pointed out that the current market does not take into account the outcome of the election and the nature of the regulatory environment.

The analysts led by Gautam Chhugani prediction that Bitcoin could fall to the $30,000 to $40,000 range if Democratic candidate and Vice President Harris is elected president.

In contrast, a Trump victory in the November election could push Bitcoin above $80,000 in the fourth quarter.

Further drop below $50,000 on the cards

In his final analysis Regarding Bayesian probabilities, chart trader Peter Brandt noted that technical indicators are increasingly leaning in favor of his initial low $30,000 projection.

He said,

“Currently, my Bayesian probability for sub-$40,000 is at 65% with a yet-to-be-reached top of $80,000 at 20% and an advance through this halving cycle to $130,000 in September 2025 at 15%.”

Brandt’s analysis builds on his initial price predictions. In April he has observed that the BTC price had reached a market top after hitting an all-time high of $73,835, and in May he said projected a continuation of the then bull trend.

Brandt is not alone in this bearish assessment. 10x Research founder Markus Thielen as well thought that Bitcoin reached a cycle top in April, drawing attention to reduced Bitcoin network activity after the first quarter.

Thielen also identified steady outflows from Bitcoin ETFs and a weak US economy as other bearish factors that could push BTC further down.

The halving thesis is still in play

Bitcoin hit a new all-time high before the halving this year and has been trading sluggishly since the event. Yet some analysts argue that Bitcoin is poised for further gains based on price action in previous half-years.

Bitcoin consistently tracked gains in October, November and December 2016 and 2020.

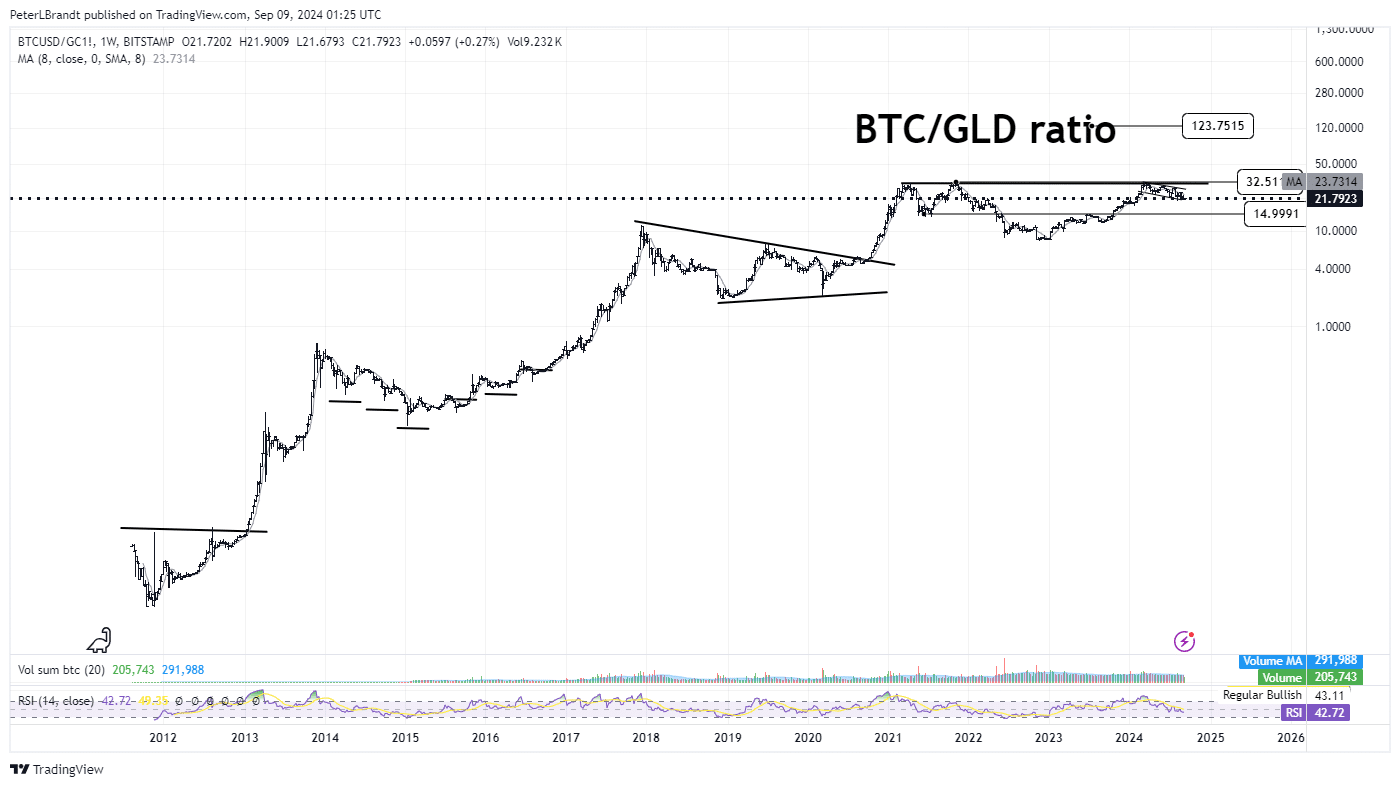

It is worth noting that the price of Bitcoin against gold has reached lower highs this year, despite a boost from the debut of Bitcoin ETFs on the scene and the halving in March. Brandt believes this continued price weakness could push the BTC/Gold ratio to 15 to 1.

Read Bitcoin’s [BTC] Price forecast 2024–2025

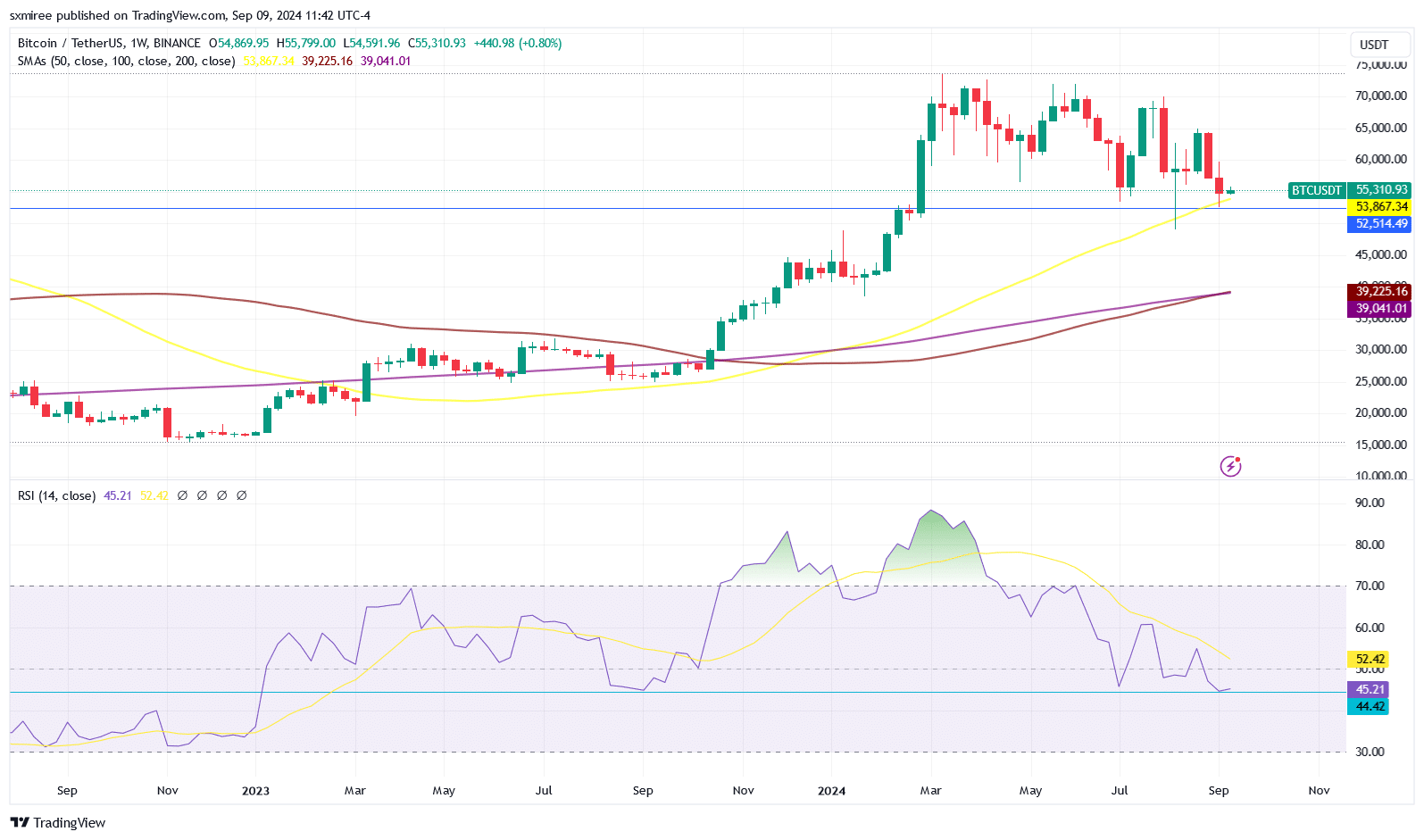

Possible recovery of BTC/USDT

Bitcoin is trading around $55,400 at the time of writing, following its lowest weekly close since late February. BTC’s weekly RSI similarly closed at its lowest level since early 2023.

Source: TradingView

Interestingly, Bitcoin order books indicate a possible bullish stance on the horizon, just like the Bitcoin CME futures chart. Bitcoin futures opened higher than last weekand returns to a falling wedge pattern after briefly breaking below it.