This article is available in Spanish.

Many analysts are mulling over the next major milestone as Bitcoin’s remarkable price rise has captured the market’s attention. A research firm, 10x Research, predicts thatthe alpha coin could reach $122,000 by February. While this may seem like an ambitious goal, it is consistent with the optimistic perspective of numerous experts who have observed Bitcoin’s ability to surpass critical price thresholds since the adoption of Bitcoin ETFs.

Related reading

Bitcoin: Robust Momentum

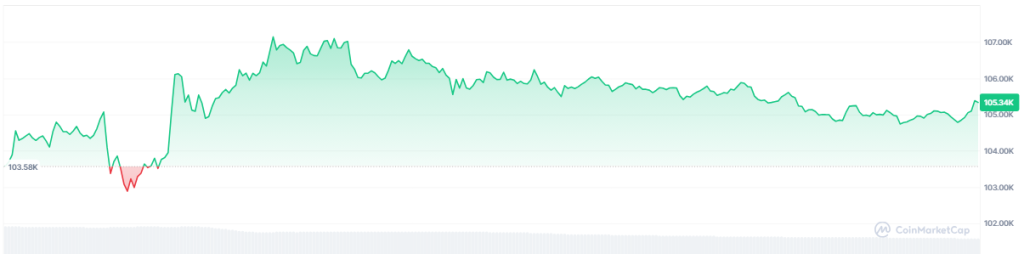

Bitcoin’s momentum is undeniable. In recent months, the price has fluctuated consistently, with periodic increases typically occurring between $16,000 and $18,000.

Markus Thielen of 10x Research believes that these consistent gains indicate a continuation of the upward movement, implying that $122,000 is achievable in the near future. Thielen underlines that crypto asset market behavior may experience a lull in achieving this target, despite the optimistic outlook.

Thielen believes Bitcoin’s breakout offers a “low-risk, high-reward entry opportunity,” with Bitcoin trading at $105,727. He noted that BTC tested the resistance at $101,000 after Donald Trump’s inauguration, making it an opportune time to buy with stop-losses around $98,000.

Thielen also pointed out that Bitcoin has risen in increments of $16,000-$18,000 since the launch of spot Bitcoin ETFs in the US, suggesting it could reach $122,000 in February before entering a new consolidation phase.

Expectation of consolidation after the wave

A period of consolidation may follow Bitcoin’s expected rise to $122,000. This phase, in which the price stabilizes prior to another breakout, has been a recurring trend throughout history. Investors should anticipate this period of sideways price action, which could provide new opportunities for those expecting a more favorable entry point.

Power in relation to the stock market

The optimistic forecast also aligns with Bitcoin’s relative strength compared to traditional markets. Despite the challenges equities have faced, the sector has shown remarkable resilience.

With the increasing number of institutional investors investing in Bitcoin, the price of this digital asset is becoming less correlated with the broader financial market. This pattern has the potential to intensify the upward trajectory towards $12,000.

Meanwhile, according to current price predictions, the price of Bitcoin is predicted to rise by 24% Reaching $130k by February 21, 2025. According to CoinCodex, technical indicators show that current sentiment is bullish, while the Fear & Greed Index reads 84 (Extreme Greed).

Related reading

When?

While Bitcoin’s historical success does not guarantee future results, current conditions are favorable for more growth. The cornerstone for any price increase is Bitcoin’s ability to benefit from positive news, such as ETF approvals, along with institutional support. The question is not whether Bitcoin will reach $122,000; rather, when.

Featured image from Getty Images, chart from TradingView