- The TD sequentially that is perfect Bitcoin at the top on January 21, a purchase signal now flashes on the daily graph.

- After BTC had swept the liquidity below $ 95k, it is on its way to liquidity in levels above $ 98k while whale buys at $ 97k.

Analysis of Bitcoin [BTC] The use of the TD sequential indicator signaled a market at the top on January 21, 2025, at $ 103,000. After this peak, the price of Bitcoin saw a remarkable decrease, so that the predictive reliability of the TD was seized.

TD Sequential recently issued a purchase signal on the daily period of time, with the price of Bitcoin around $ 96,214.

This suggested the potential for a market base, which indicates a suitable moment for investors to consider entering the market.

The presence of a purchase signal after a decline indicates that the sales pressure can be tiring and that a reversal can be imminent.

Source: Ali/X

If the purchase signal does not lead to continuing purchasing pressure, BTC can test lower support levels, possibly around the recent lows of $ 94,400.

Such a drop would connect to the pattern of TD sequential of identifying crucial points, but instead of a rally it can precipitate.

Although the current buying signal presents a potential bullish scenario for Bitcoin, investors must therefore remain careful.

They must consider both the possibility of a rebound in the direction of higher levels, such as $ 100,000, or a constant downward trend if the signal does not manifest itself in a tangible buying momentum.

Sleeping whale buys when BTC focuses on the liquidity above

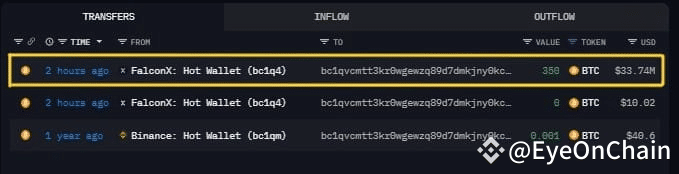

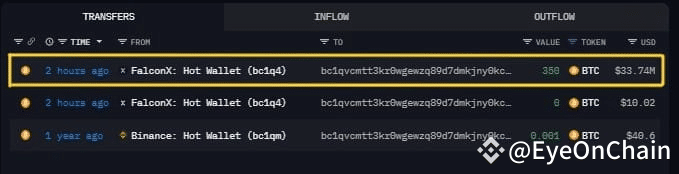

A sleeping Walvispallet “BC1QV …” withdrew 350 BTC, with a value of $ 33.97 million, from Falconx to $ 97,053 per BTC. The substantial purchase by a large player can indicate potential upward momentum.

However, if the market sentiment does not match the purchase strategy of the whale, this may push prices if others decide to pay out, for fear of a top.

Source: Eyeonchain/X

After a sweeping liquidity under $ 95k, BTC seems ready to test higher levels, in particular around $ 98k. This step supports a potential continuation if BTC support can retain above these critical liquidity thresholds.

Usually overcoming such zones can further catalyze the interest, so that the prices may push up. Conversely, if BTC cannot violate the $ 98k liquidity zone, this may indicate insufficient purchasing pressure, possibly lead to a different retracement.

Source: Coinglass

Finally, according to analyst Benjamin Cowen, the total on-chain risk indicator suggested that the peak of Bitcoin may not have been reached.

The metric is currently showing levels that are not typical of a market top. This implies a potential for a further meeting.

Read Bitcoin’s [BTC] Price forecast 2025–2026

Conversely, if the risk -indicator starts to show values associated with previous market picks, this can indicate that the current rally can approach the end.

This scenario would require close monitoring of any shifts in chain activity that can precede a price correction.