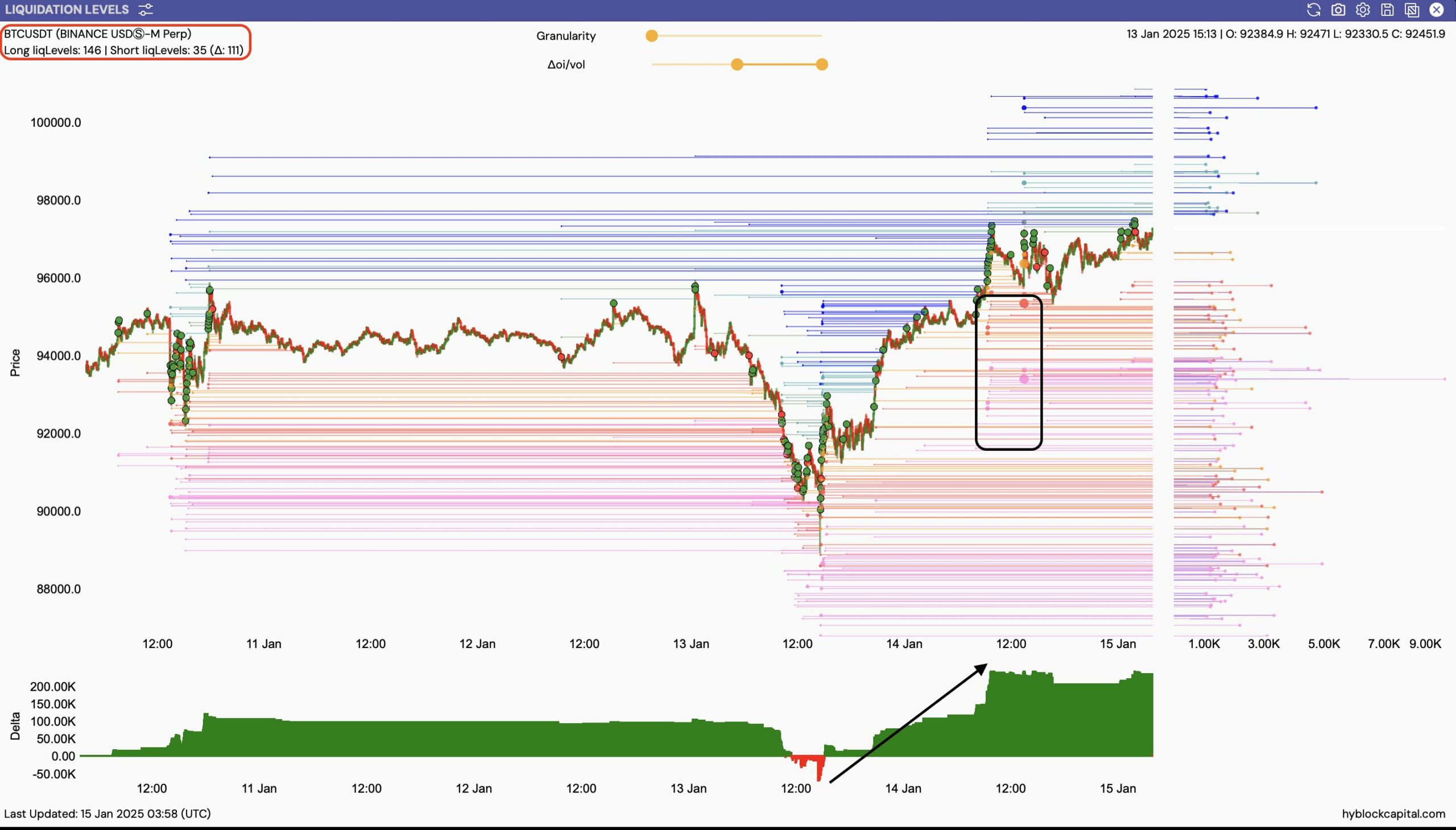

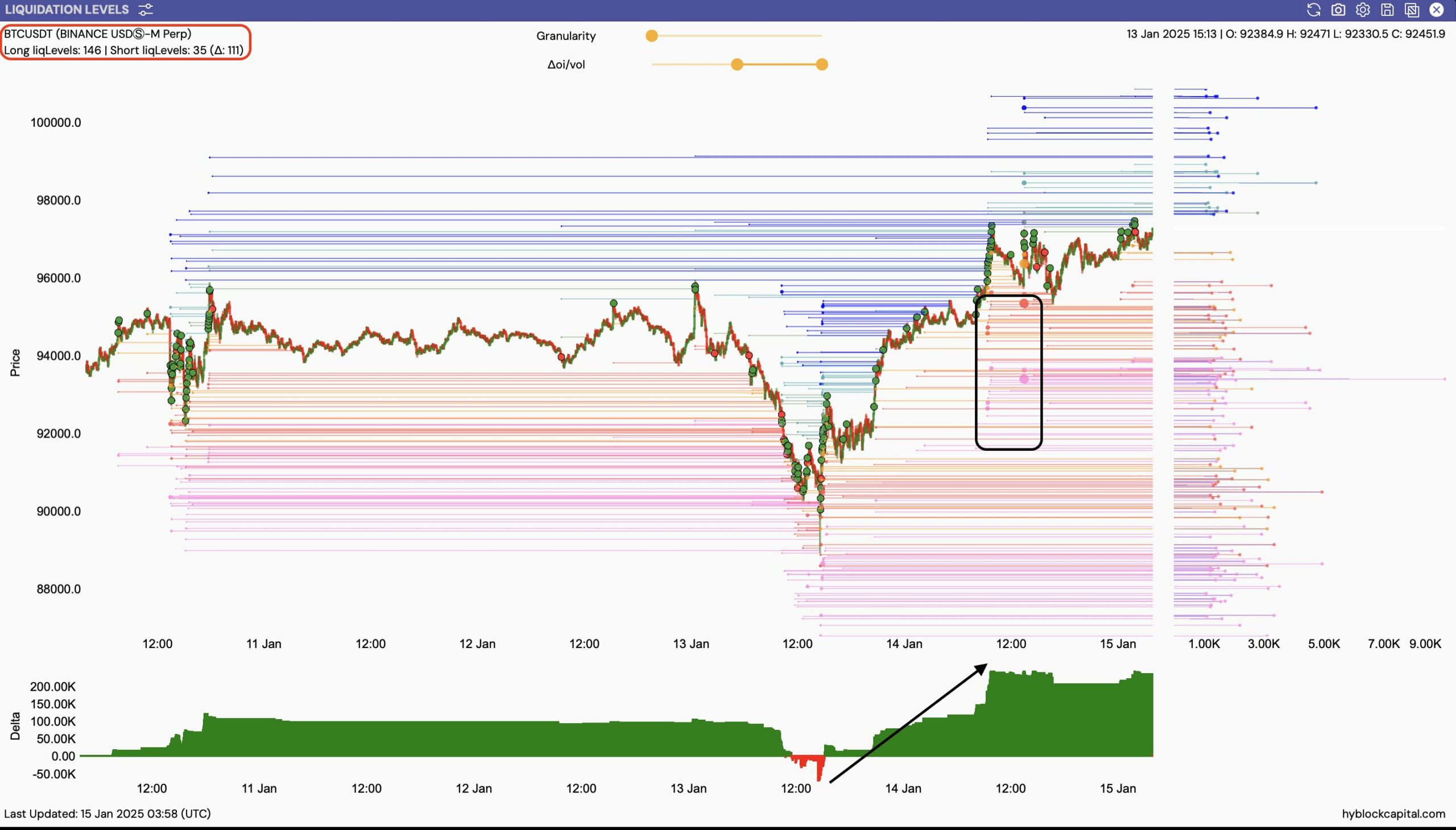

- Bitcoin has seen fewer short liquidity levels than long liquidity levels

- BTC’s annual high is one that the bulls need to break to attempt another ATH.

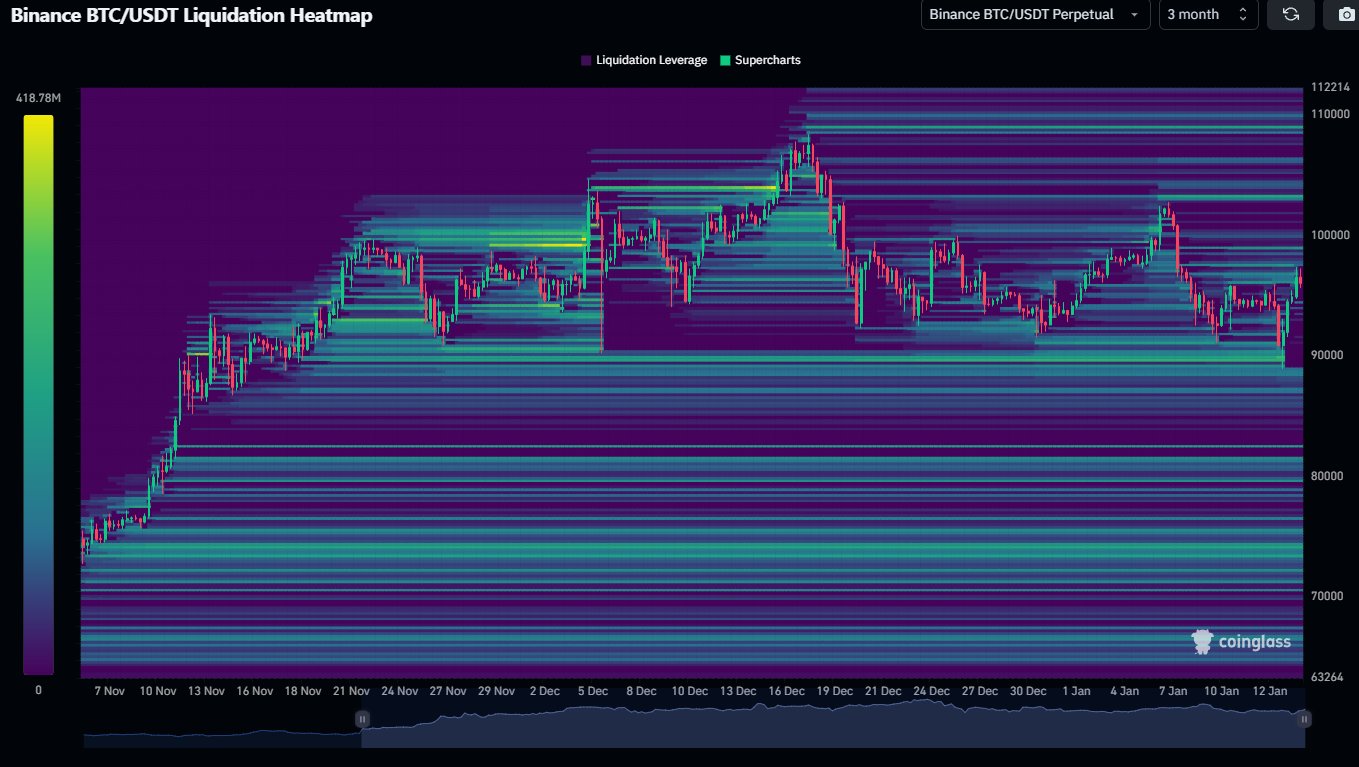

Following Bitcoin’s latest uptrend on the charts, analysis of the liquidation heatmap revealed a significant increase in long liquidity levels. In fact, this was especially evident around the $90,000 price zone. This shift resulted in the foundation of support levels up to $88,800, which went unexploited, reinforcing a strong buy-in area for traders.

Conversely, short liquidity levels were less prevalent – a sign of a lack of bearish conviction among traders, suggesting the potential for a decline may be limited.

Source: Hyblock Capital

This imbalance between long and short positions could imply a bullish outlook for BTC in the near term. If this holds, Bitcoin could challenge its higher resistance levels, giving bullish traders even more power.

Significant long positions underline market confidence, potentially driving the price towards higher benchmarks. Meanwhile, fewer short positions reduce the likelihood of significant price declines, creating a favorable environment for further price gains.

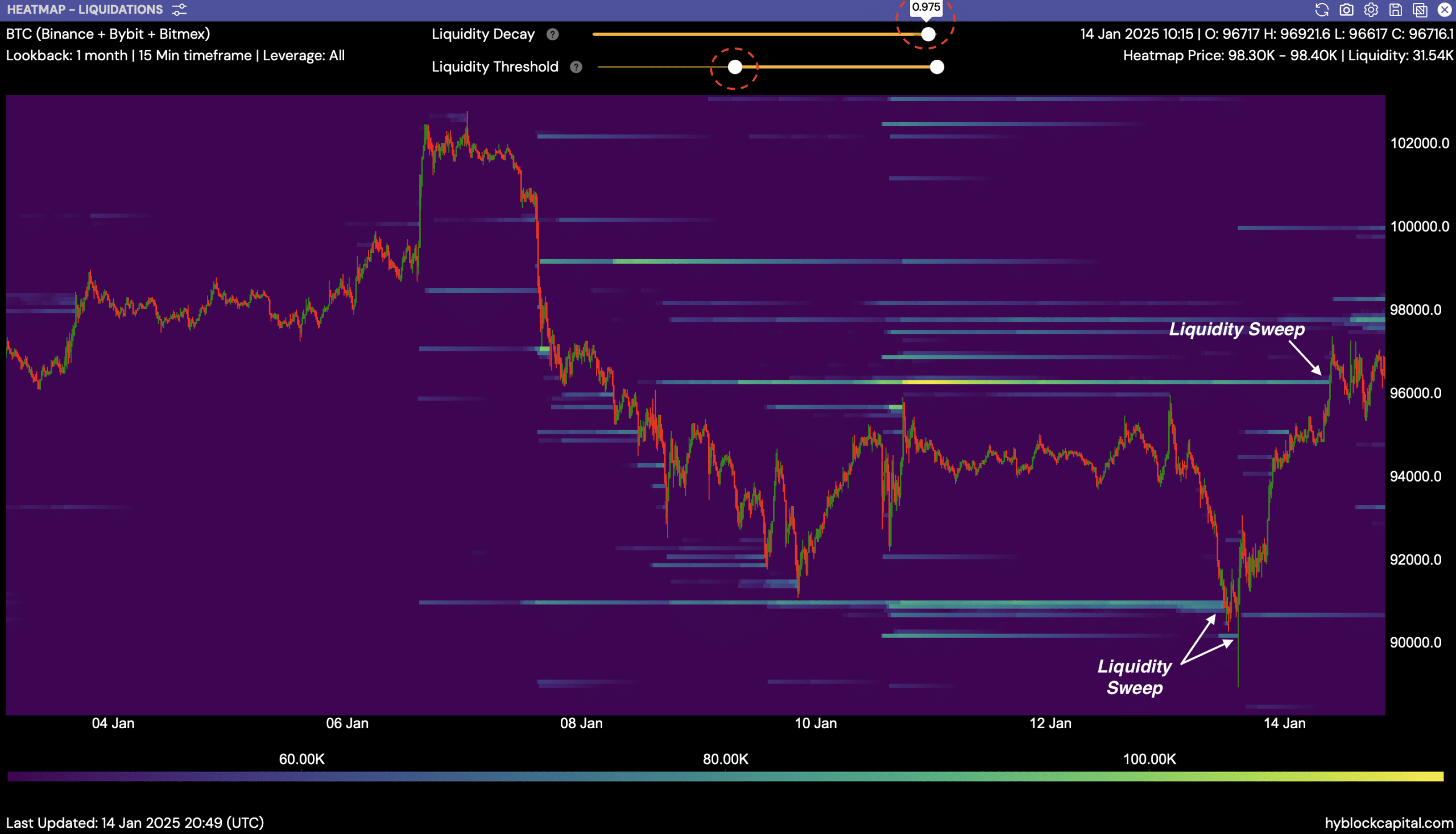

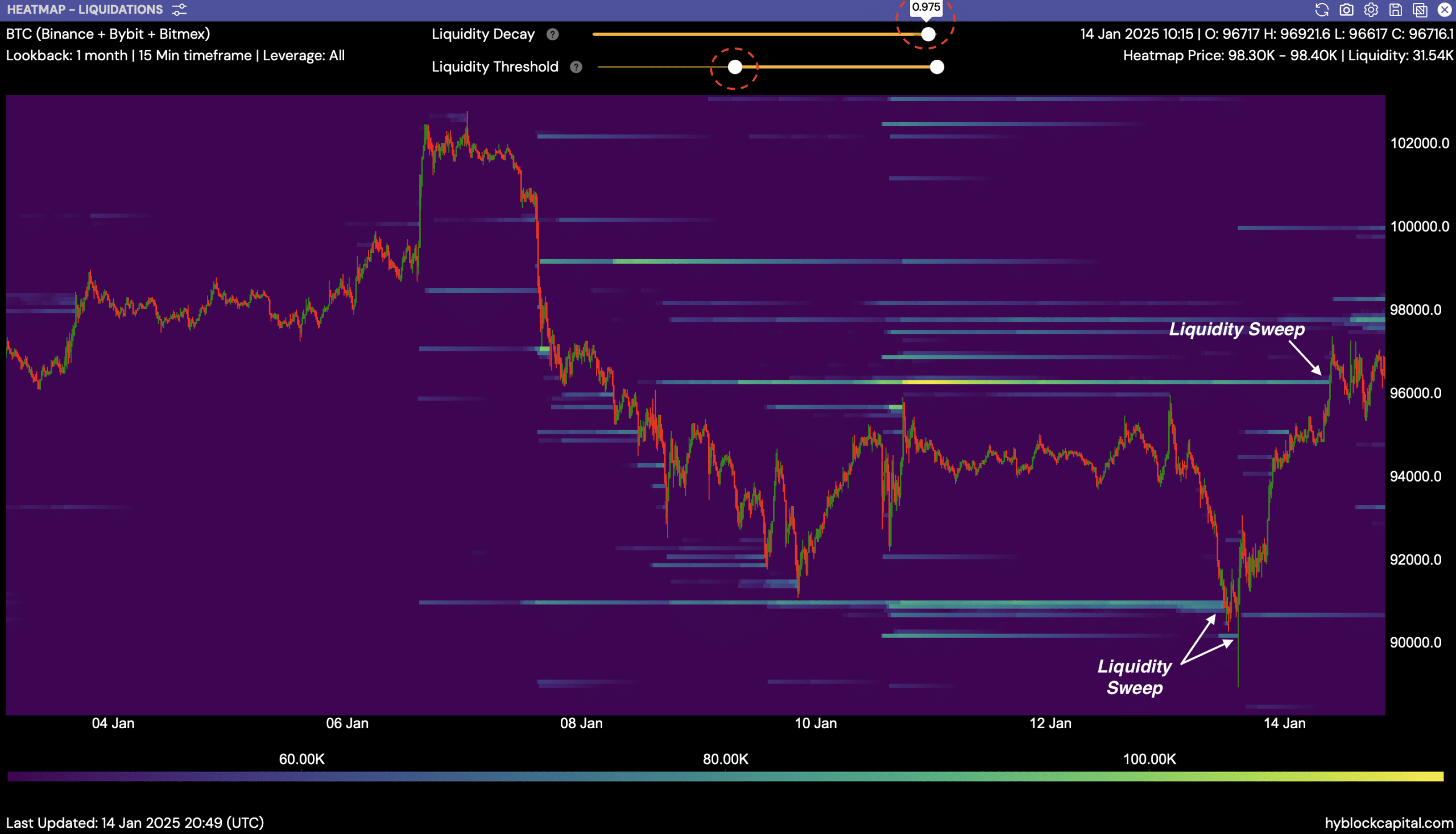

Liquidity moves on both sides

Looking at the price behavior, BTC seemed to capture liquidity clusters on both sides of around $90,000, where significant buying took place, leading to a rapid rise to current levels. Notable price levels were around $98,300 and $96,700, as evidenced by multiple liquidity moves visible in these zones.

The recent rise to just below $98,400, followed by a pullback, underscored the crucial role these clusters play in determining short-term price movements.

Source: Hyblock Capital

The interactions around these price points, especially the one around $90,000, illustrated how traders capitalize on sudden price drops to accumulate positions – and then stage a recovery.

This pattern indicated a potential for continued volatility as traders respond to liquidity thresholds, which affects the market’s price sensitivity. At this point, the approach is cautious, with the possibility of further testing of liquidity margins.

What does BTC need for a new ATH?

The liquidity move at the $90,000 level was critical to short- and medium-term price movements. The strong upward movement immediately following this liquidity event confirmed that this was a strategic point for price recovery.

The $90,000 level in particular also often proved a target for both whale manipulation and retail hunting, reinforcing the price’s role as a crucial market zone. The level has been critical to Bitcoin’s current price. Especially since it approaches the psychological level of $100,000.

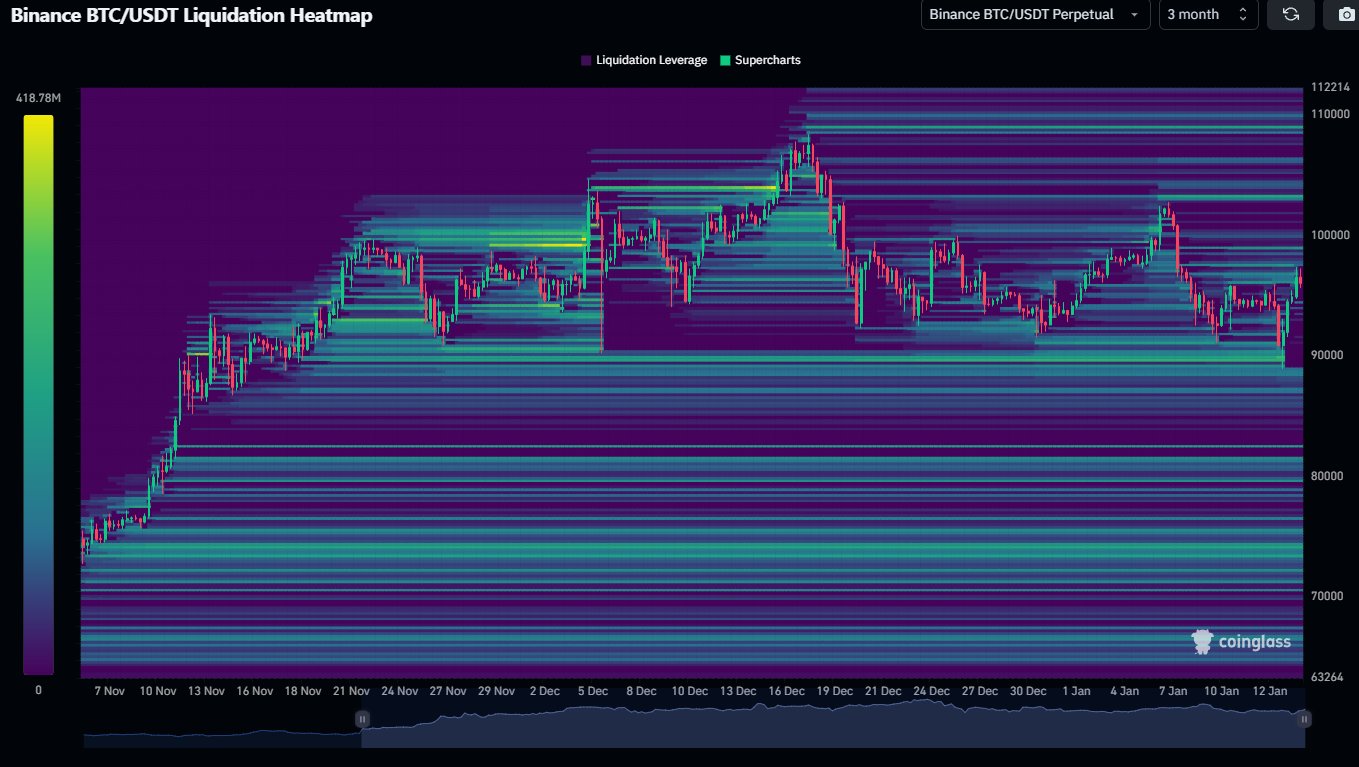

Source: Coinglass

Notably, the annual high of almost $103,000 remains a formidable barrier. A break above this level could trigger a surge to a new all-time high. Traders should take these liquidity zones into account when planning their market entries and exits.