- Satoshi is looking for Spike during Bitcoin’s Bull Runs, correlating with euphoria shop market.

- A drop of curiosity about Satoshi can indicate a calmness before Bitcoin’s next major movement.

Public interest in Bitcoin’s [BTC] Mysterious Creator, Satoshi Nakamoto, tends to worry in synchronization with Bitcoin’s Bull Runs, as a result of the excitement of retail investors, Media -Buzz and market euphoria.

As Bitcoin consolidates under the most important resistance levels, Interested in Satoshi has begun to fade. Historically, public curiosity about Satoshi has reflected the price movements of BTC.

This often offers a subtle signal for the next direction of the market.

Satoshi is looking for spans during Bitcoin Bull Runs

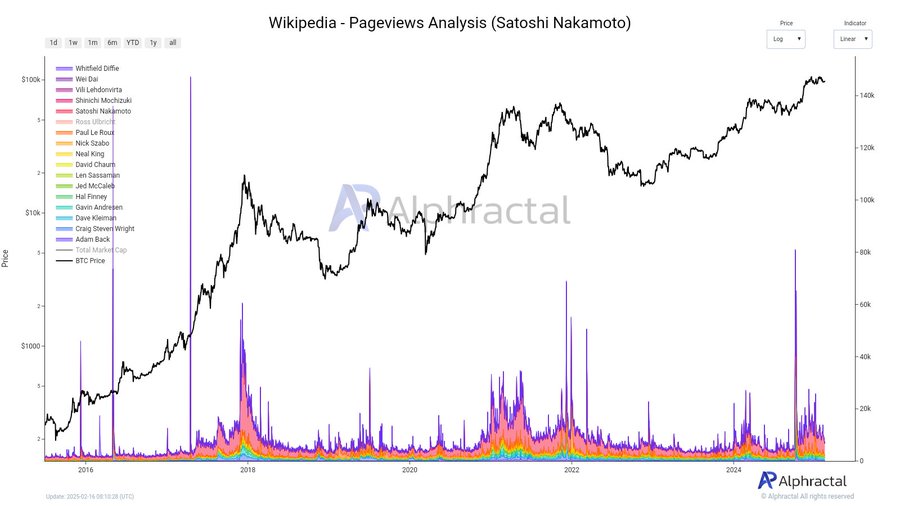

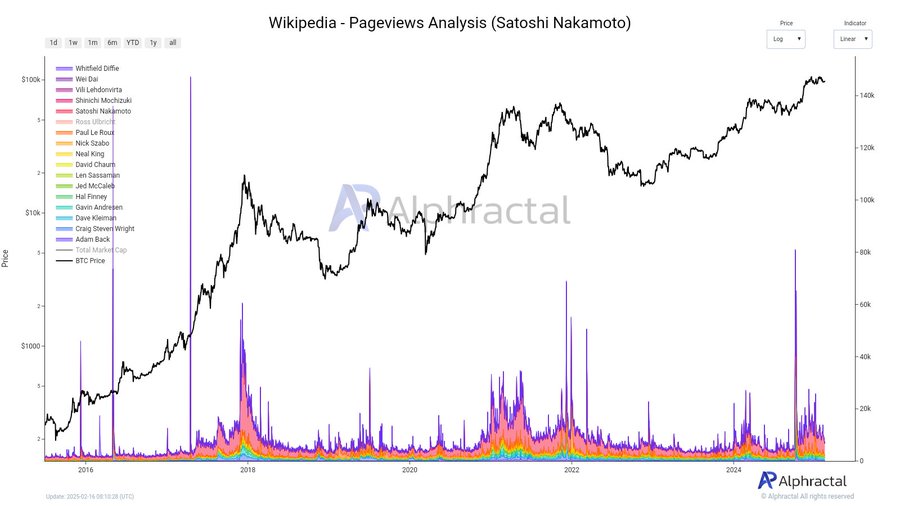

The public interest in Satoshi Nakamoto and other key figures such as HAL Finney, Nick Szabo and Gavin Andresen have risen historically during BTC Bull Runs.

Data peaks in Wikipedia are looking for these figures that are in accordance with the most important meetings of BTC in 2017 and 2021. During these periods, Markt Euphoria retail investors pulled deeper into the origin of Bitcoin, which feeds speculation and curiosity.

Any rise in the price of Bitcoin reflected increased public interest in his maker, which strengthens the connection between market sentiment and Satoshi-related searches.

Fading interest in the midst of Bitcoin’s consolidation

In recent months, interest in Satoshi Nakamoto has risen thanks to HBOs Money Electric: The Bitcoin MysterySpeculation around the release of Ross Ulbricht and growing discussions about Len Sassaman.

Source: Alfractaal

However, because BTC struggles under the most important resistance levels, this wave of curiosity has largely disappeared. We can reflect this in decreasing Wikipedia page views and Google search assignments.

This indicated that the interest of the retail trade can cool during the price consolidation of Bitcoin.

Retail versus institutional interest

Retail investors often chase stories, with speculation around Satoshi that acts as a hype indicator during price stabs. Institutional players focus on liquidity, macro -economic trends and clarity of the regulations.

Retail -controlled searches peak in bull markets, while institutional interest rates remain stable, giving the Fundamentals of BTC priority.

This divergence suggests that although the excitement of the retail trade can decrease, the institutional involvement continues to grow. Such a involvement could possibly stabilize the market during phases with a low insight.

What fading Satoshi interest means for BTC

Does this fading interest in Satoshi mean the complacency of the market, or can it be the calmness before the next major movement of BTC? Historically, periods of low retail enthusiasm are often followed by considerable price shifts – an outbreak or a decline.

As the speculation of the retail trade decreases, institutional involvement continues to grow, so that the market stabilizes during quieter periods.

Although it is uncertain which direction BTC will take, the current silence in Satoshi-related searches is perhaps a signal for something big on the horizon.