- Low reserve risk implied prices were low and HODLer confidence was high.

- Long-term holders store nearly 75% of all Bitcoins in circulation.

Crypto circles are awash with speculation about Bitcoins [BTC] next moves of the ongoing range-bound price movement. For context, after ripping to yearly highs during the June market rally, the king coin has bored market participants, snaking in a narrow zone between $29,000-$31,000.

Is your wallet green? Check out the Bitcoin Profit Calculator

Many expert analyzes have attributed the lull to investors’ growing propensity for HODL coins rather than liquidating them for profit. However, it begs the question: will the increased hoarding mentality eventually lead to an increase in Bitcoin’s economic value?

Bitcoin in early bull market?

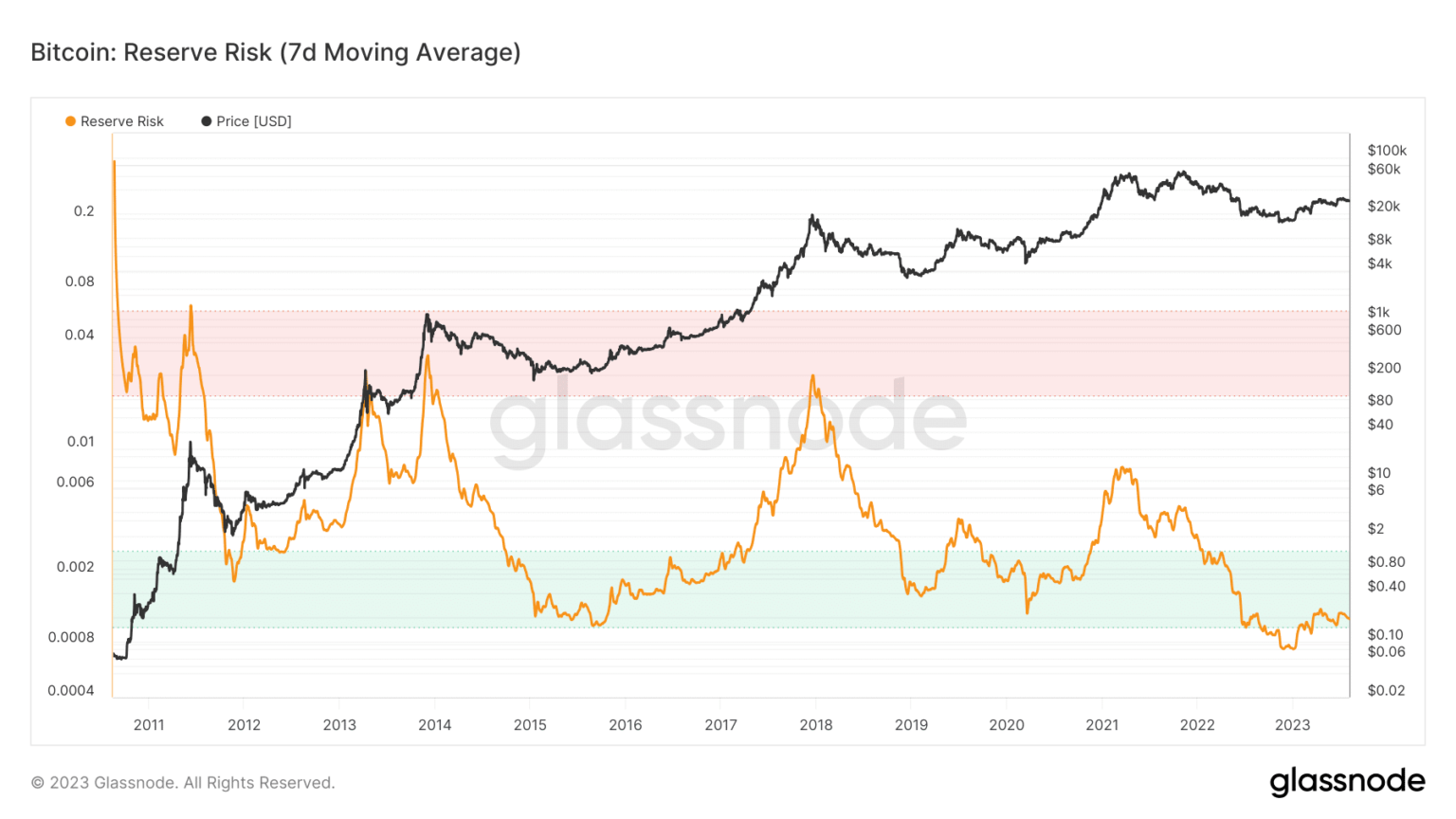

According to an on-chain analytics tool Glasnode, the 7-day average of the Bitcoin reserve risk indicator fell to a one-month low. Reserve Risk is a lesser-used but reliable metric and comes in handy when gauging Bitcoin’s long-term growth potential.

Source: Glassnode

The choice to purchase a Bitcoin was supported by the trust of the existing and future participants. The more existing participants postpone spending their coins, the stronger their belief in Bitcoin’s future prospects.

Glassnode defines Reserve Risk as basically the risk/reward ratio to the confidence of long-term shareholders.

As prices skyrocket, so does the temptation to sell and lock in profits. While weaker hands capitulate, the seasoned hands resist the urge. Reserve risk was the relationship between the incentive to sell and the strength of the HODLers.

Low reserve risk means prices are low and HODLer confidence is high. A potential investor sees this as a positive signal to enter the market and purchase Bitcoins. Hence, the current situation indicated that a bull rally could be imminent.

Also historically, as can be seen in the chart above, the dip to the green bands has been followed by major price moves. This reinforced the perception that BTC was in the early stages of a bull market.

Read Bitcoin [BTC] Price Forecast 2023-24

Bitcoin’s strengths drive HODLing

Long-term holders have gained momentum over the past two years, holding nearly 75% of all Bitcoins in circulation at the time of writing. As a result, the supply left for active traders, or short-term holders, has declined sharply.

BTC’s resilience shown during both crypto and TradFi crises, coupled with regulatory approvals, has paved the way for future investment and growth. As a result, investors are increasingly looking at it as a store of value.

Source: Glassnode