- The bearish sentiment surrounding BTC was dominant in the market.

- Selling pressure on the currency was high.

Bitcoins [BTC] The price action remained disappointing, as the price did not rise above $64,000 in recent days. In the meantime, a key BTC metric entered an area of indecisive direction.

Does this mean investors will have to wait longer for BTC to rise again?

What’s going on with Bitcoin?

CoinMarketCaps facts revealed that BTC has fallen by more than 2% in the past seven days.

This pushed the price of BTC below $64,000, while at the time of writing it was trading at $63,843.66 with a market cap of over $1.26 trillion.

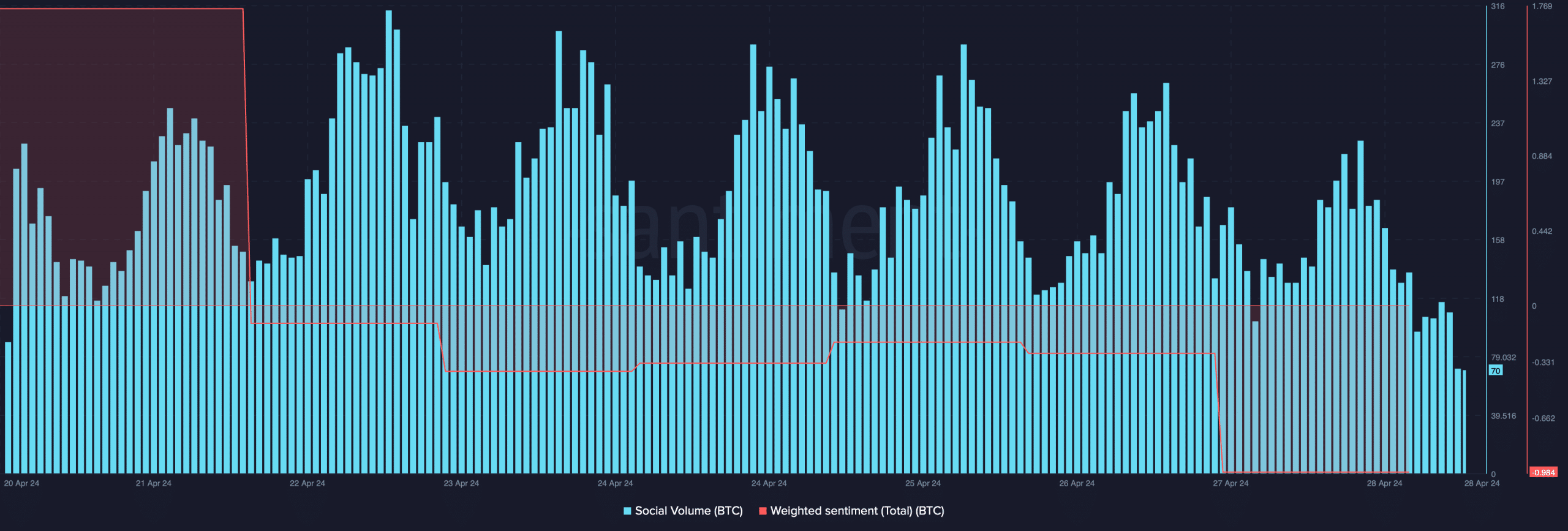

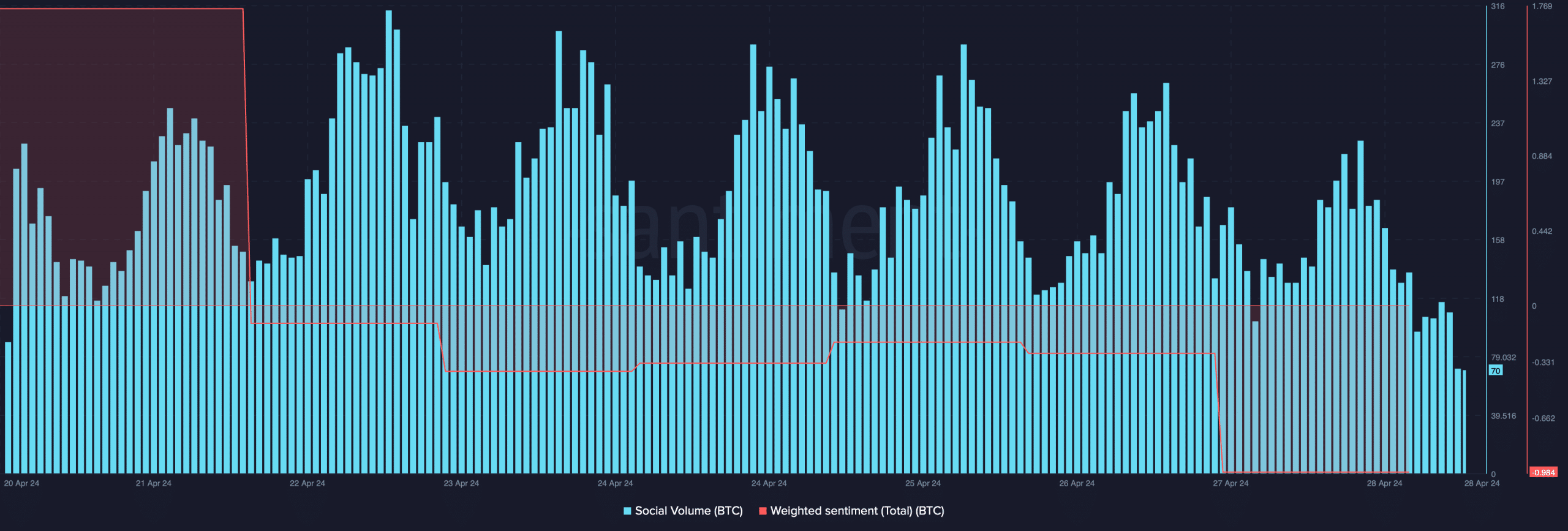

Due to the negative price action, the weighted sentiment around the king of the cryptos turned bearish on April 27.

Social volume also fell slightly last week, reflecting a decline in BTC’s popularity in the crypto space.

Source: Santiment

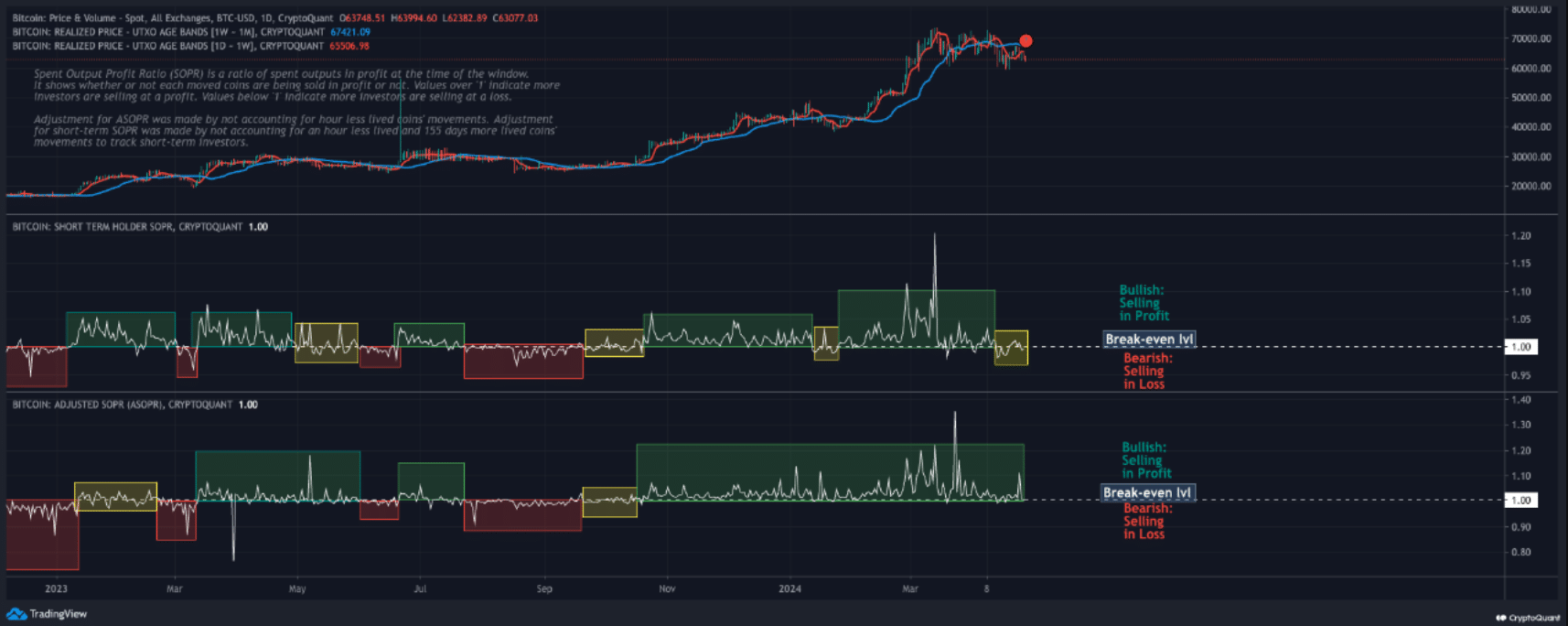

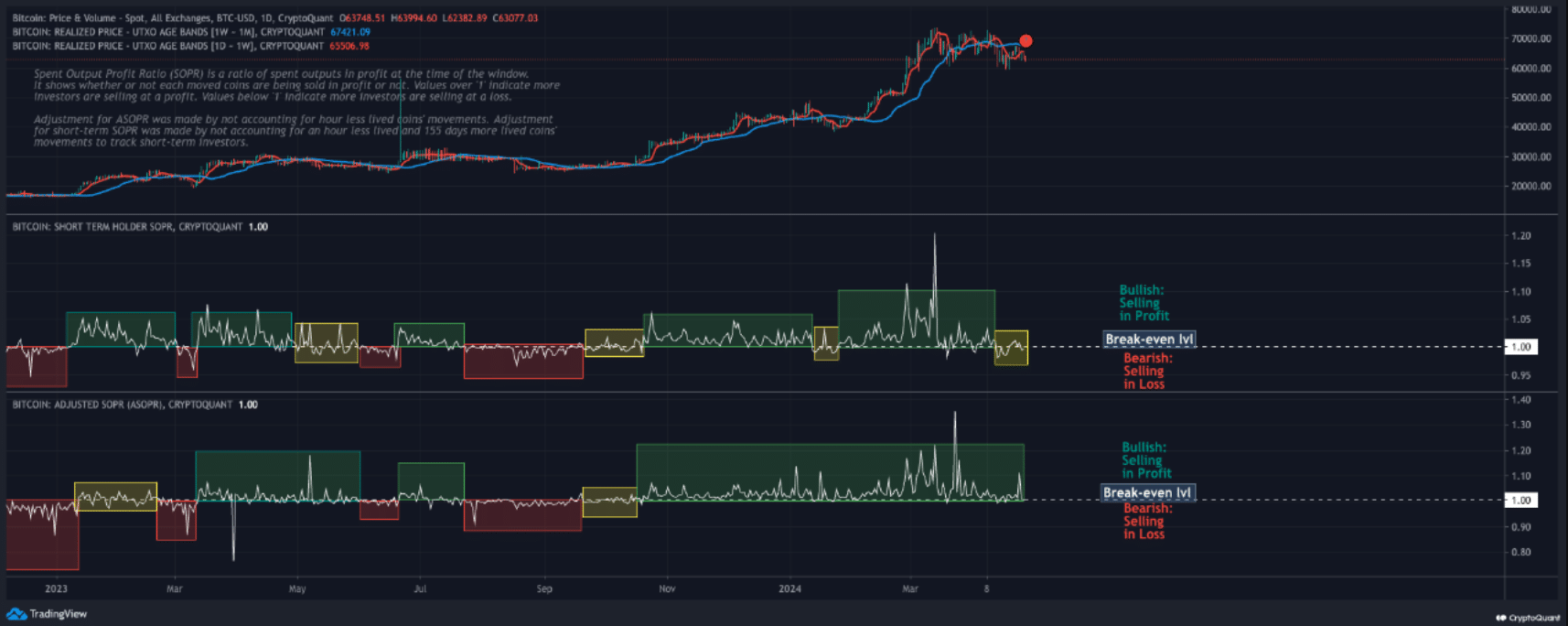

Meanwhile, Phi Deltalytics, an author and analyst at CryptoQuant, posted a analysis using a key BTC metric.

According to the analysis, Bitcoin’s adjusted Spent Output Profit Ratio (SOPR) continued to move in a bullish direction, while the SOPR has entered a zone of uncertainty in the near term.

This discrepancy highlighted a complex environment in which short-term investors faced losses.

Source: CryptoQuant

The said analysis,

“While fluctuations of this nature are not uncommon, especially during periods of price exploration towards new record highs, increased vigilance is warranted.”

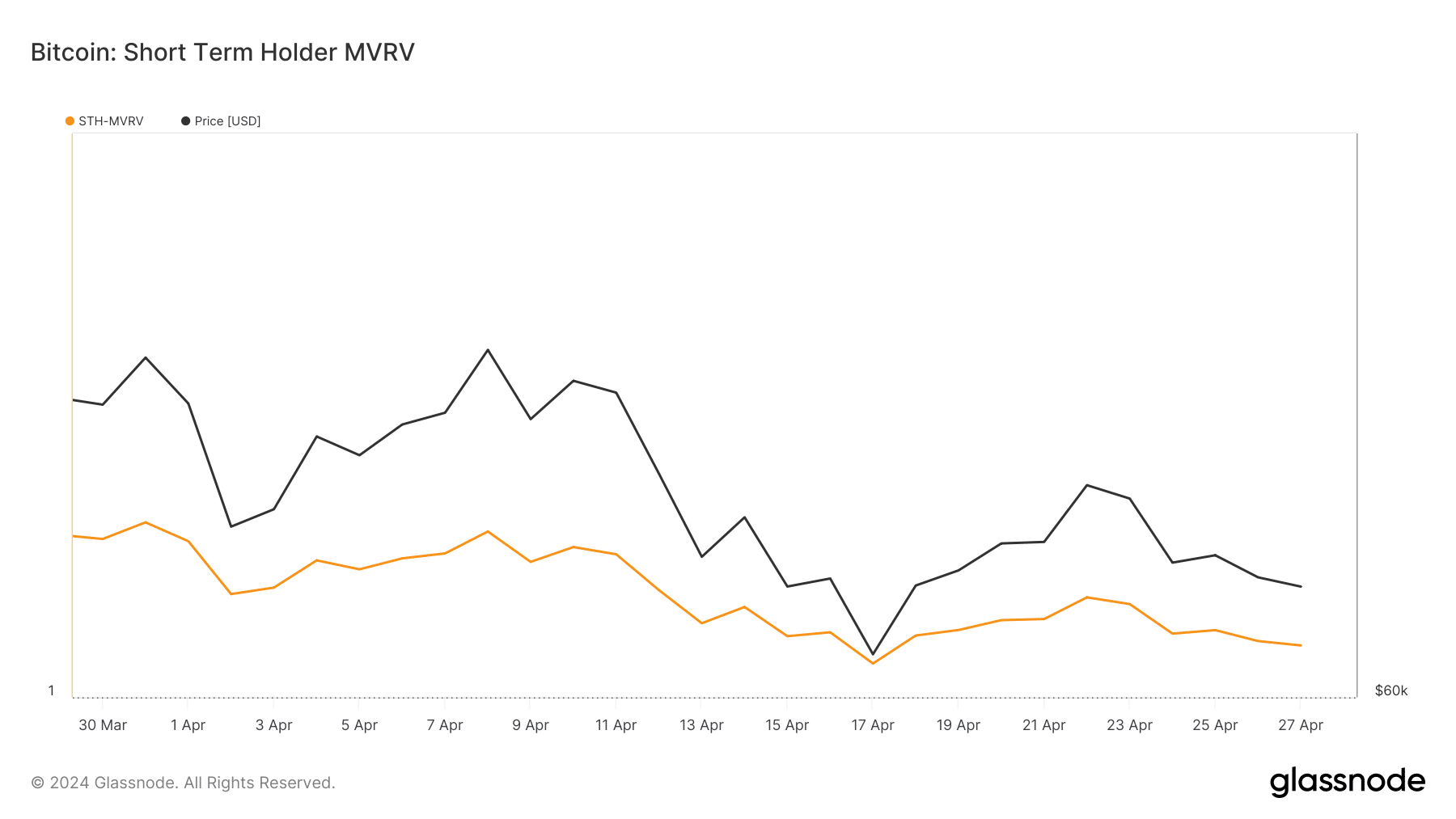

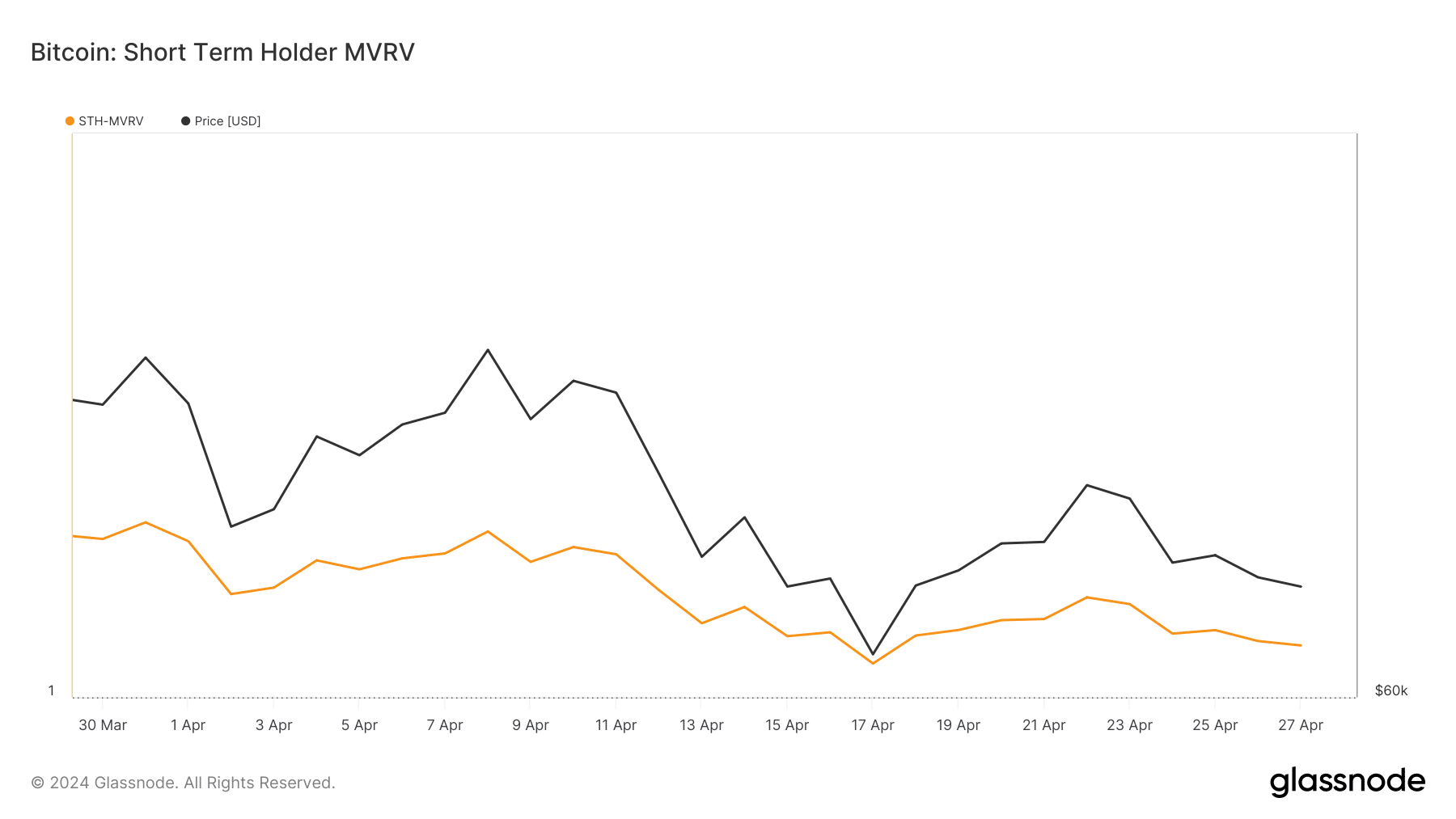

AMBCrypto’s analysis of Glassnode’s data also pointed to an interesting development regarding short-term holders. We found that BTC’s STH MVRV has fallen in recent weeks.

For the uninitiated, a low MVRV suggests that Bitcoin’s current price is relatively lower compared to the last transaction prices.

Source: Glassnode

Does this indicate a price increase?

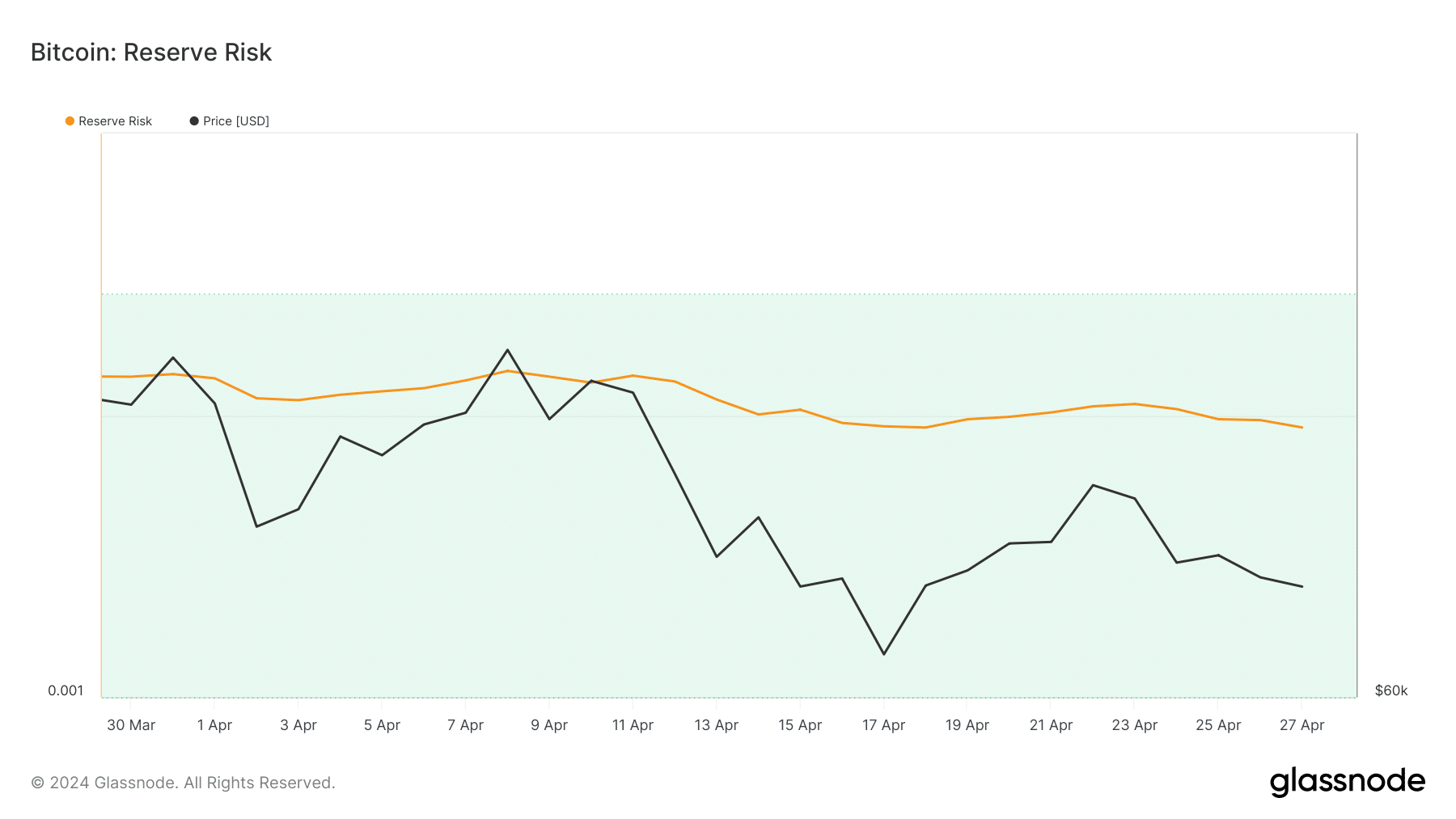

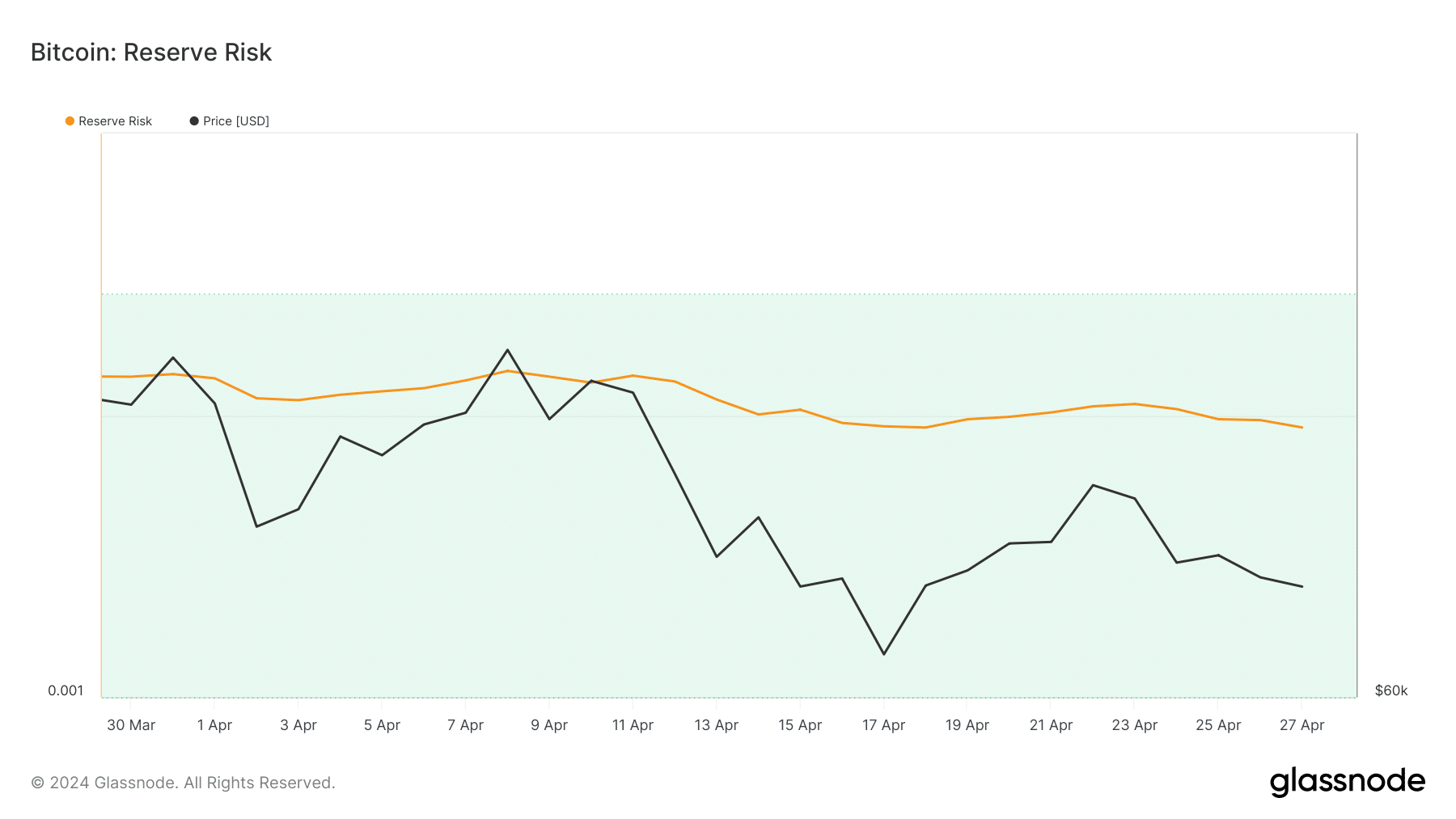

Since BTC appeared to be undervalued, AMBCrypto took a closer look at its condition to better understand whether a price increase was looming. According to our analysis, BTC’s reserve risk was low.

This measure indicated that confidence in BTC was high. However, the price was low at the time of writing, which could be interpreted as a bullish signal.

Source: Glassnode

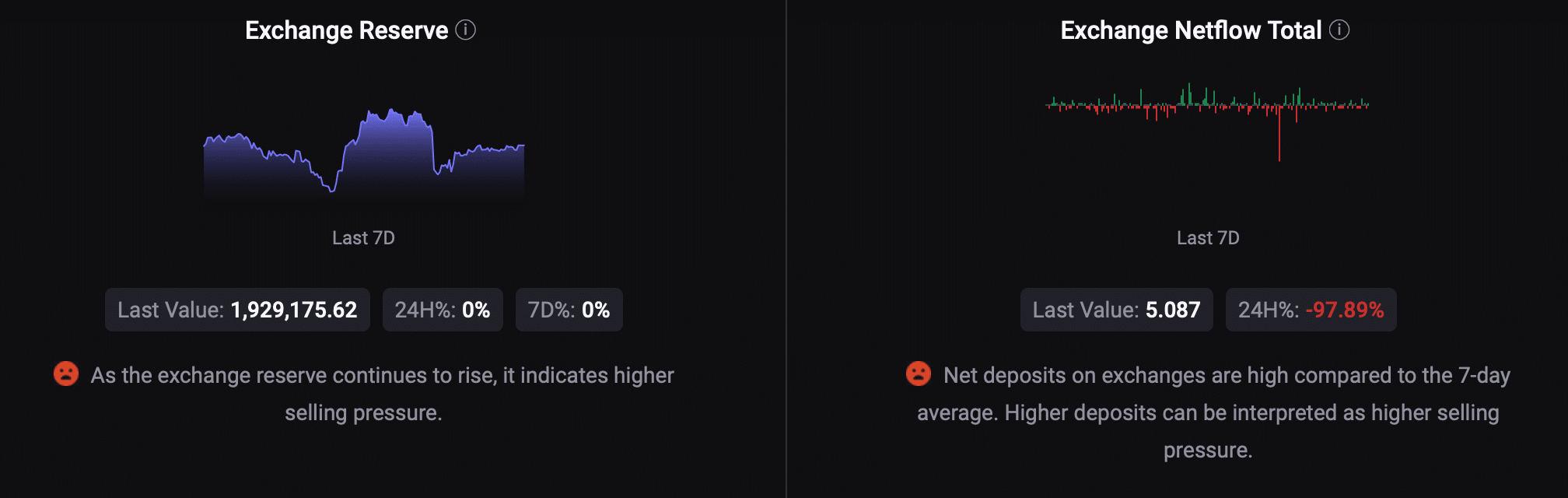

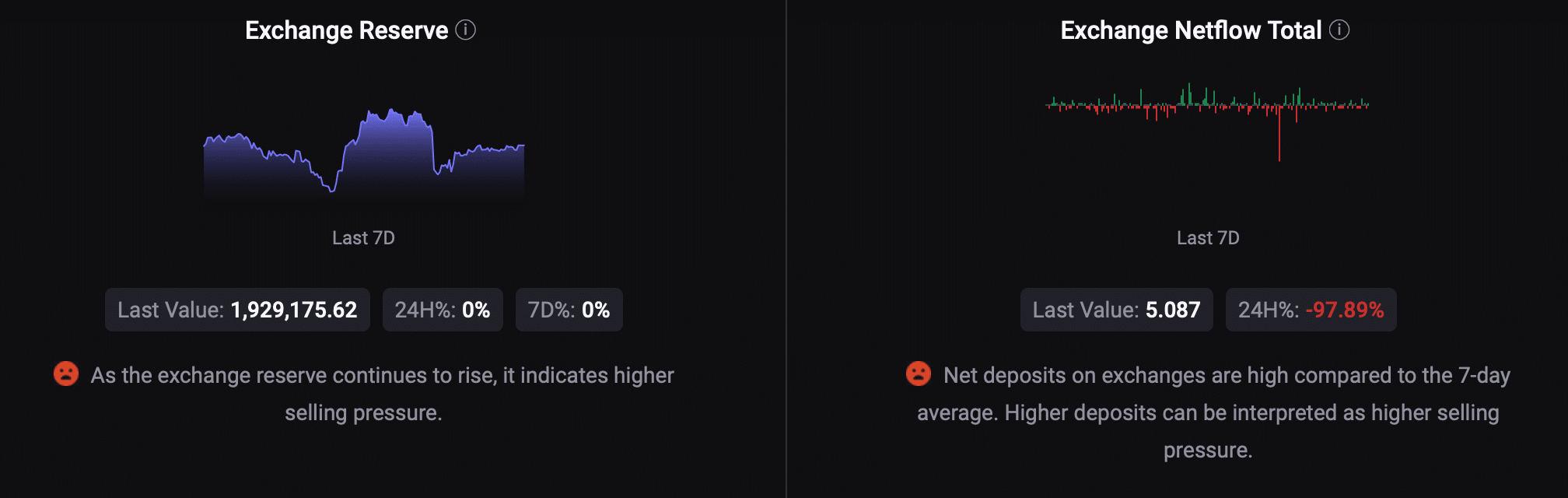

Not everything looked optimistic for BTC. AMBCrypto’s look at CryptoQuant, for example facts revealed that selling pressure on BTC was high as the exchange reserve increased.

Net deposits on the exchanges were also high compared to the average of the last seven days.

Source: CryptoQuant

Read Bitcoins [BTC] Price prediction 2024-2025

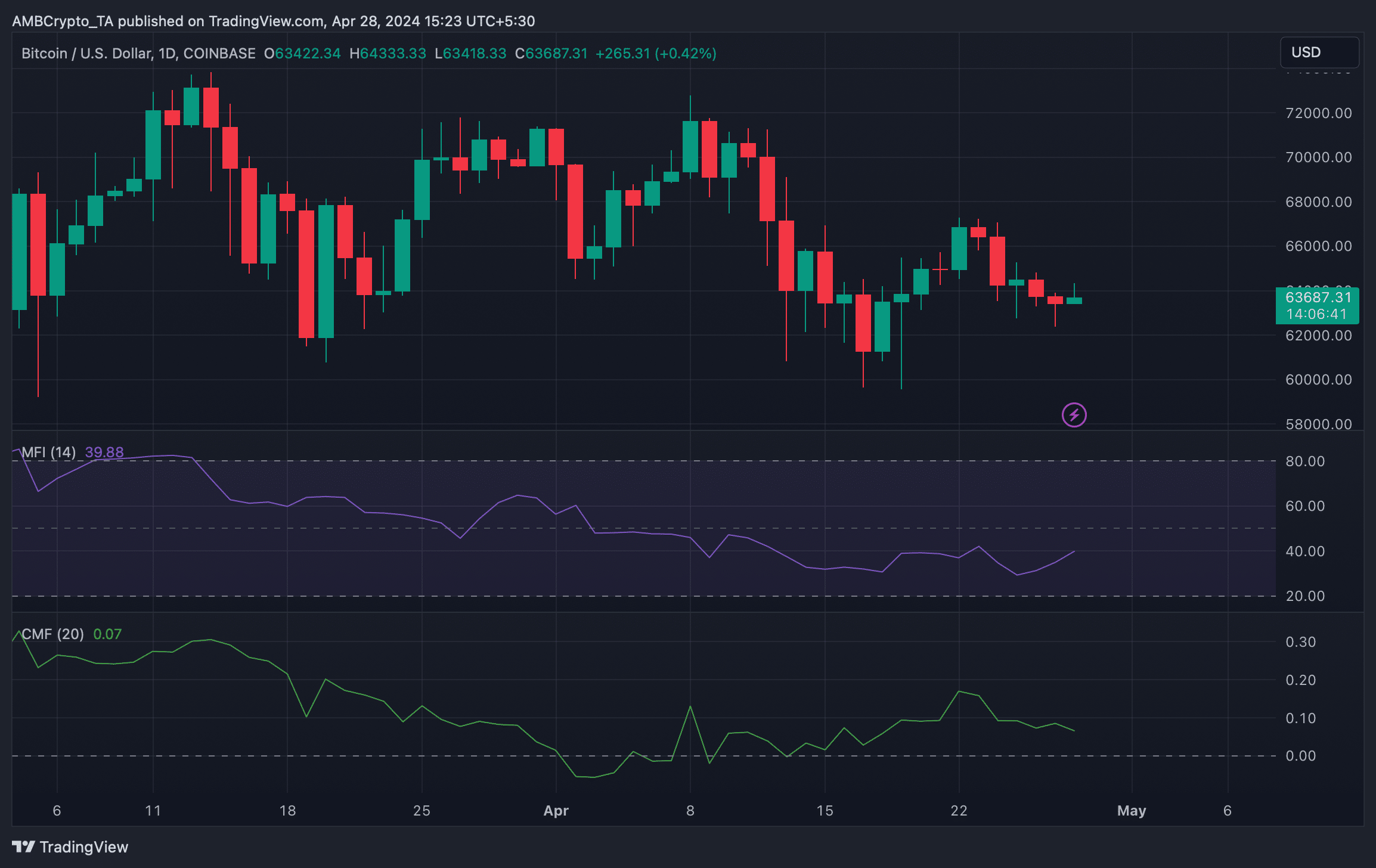

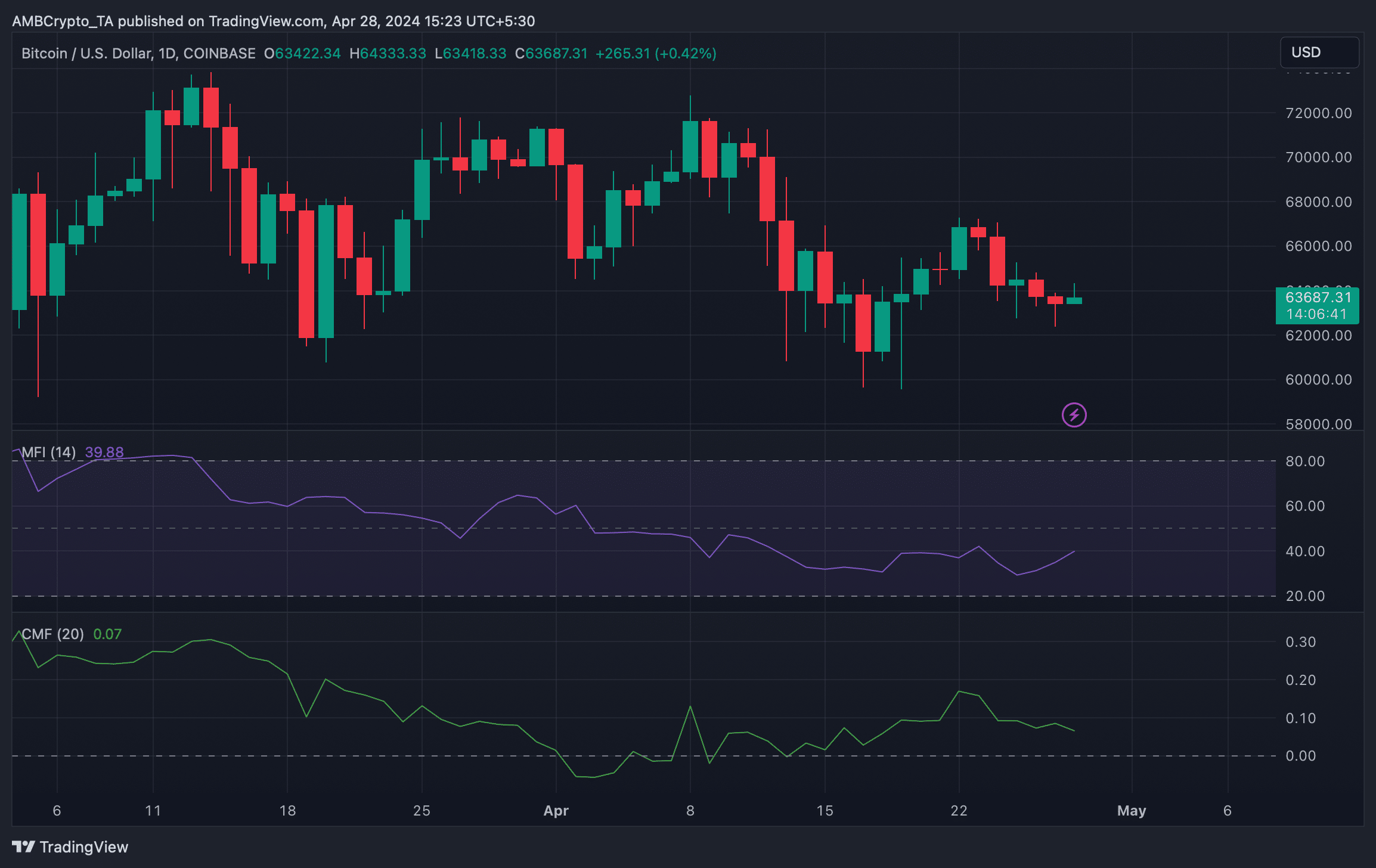

We then looked at BTC’s daily chart to see what market indicators had to offer regarding BTC’s upcoming price movement.

According to our analysis, the Money Flow Index (MFI) indicated an increase in prices as it moved up. However, the Chaikin Money Flow (CMF) remained bearish.

Source: TradingView