- Bitcoin’s inflow into a binance decrease considerably, indicating a reduced sales pressure and a cautious market mood

- Short-term holders show a reduced activity, which suggests a shift to a neutral or hold-oriented attitude

Bitcoin’s [BTC] in the short term Traders seem to settle.

A significant decrease in BTC inflow to Binance, together with reduced activity of holders of 1-3 months, suggests a change in market sentiment. Short -term traders, who have previously driven the sales pressure, are now holding their coins.

While the influx of Binance is decreasing, other exchanges witnessed increased activity, which indicates a shift in taking risks to cautious restraint.

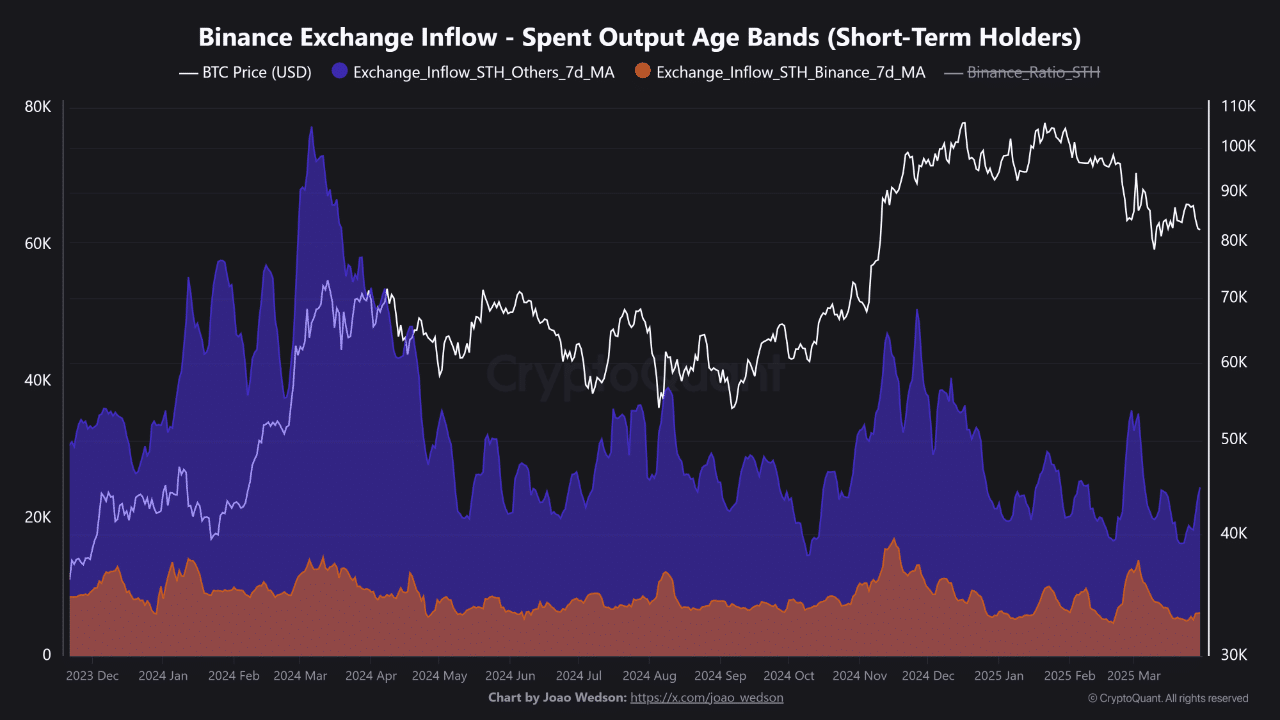

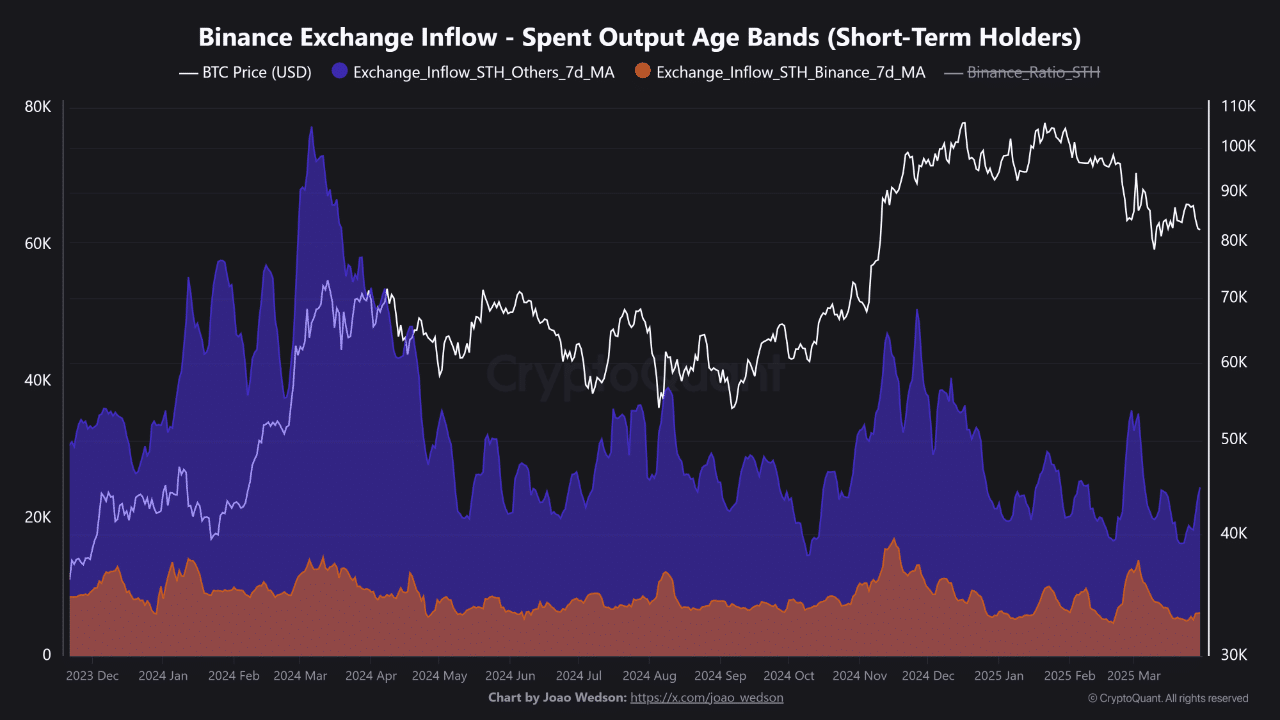

Reduced Bitcoin current to Binance

A remarkable change in BTC entry into Binance often reflects shifts in investor sentiment or strategic movements within the cryptomarkt.

Recent data unveiling a sharp decrease in Bitcoin transfers from short-term holders (STHS) to Binance, which drops to only 6,300 BTC. For comparison: on average 24,700 BTC has been sent to other stock markets.

This decline indicates a possible reduction in sales pressure on Binance, where traders adopt a more cautious or neutral position.

Source: Cryptuquant

If this trend continues, this can affect Binance’s liquidity and trade volume, which may influence Bitcoin’s price stability. In the meantime, the increase in BTC inflow to other stock exchanges on the shifting of trade preferences within the crypto community.

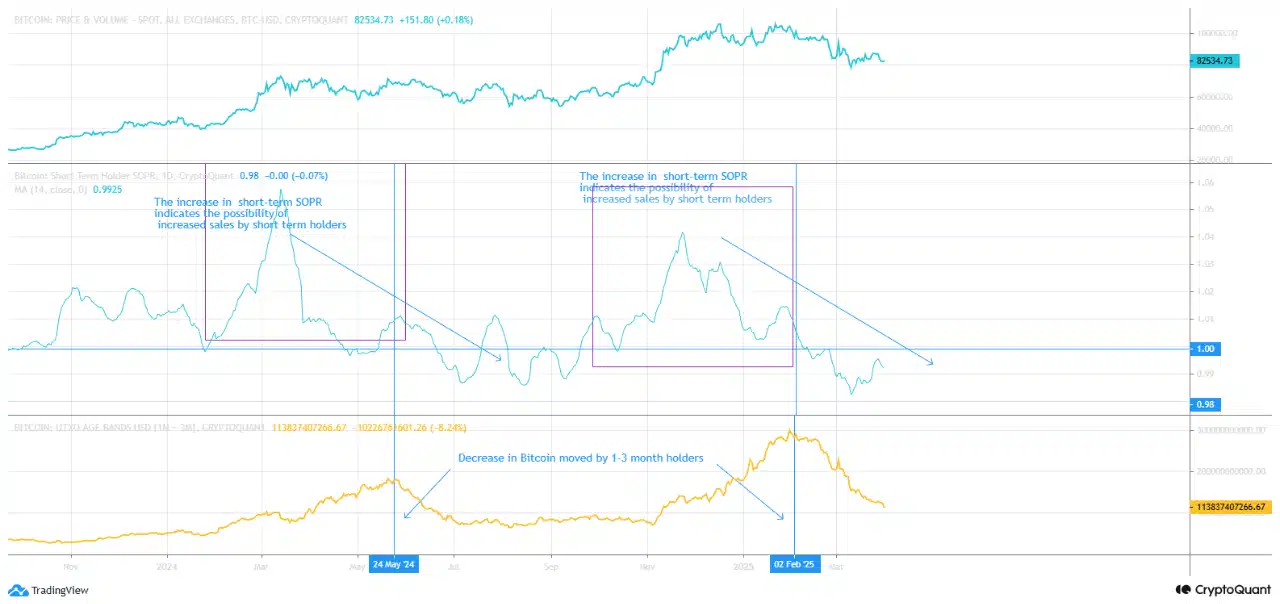

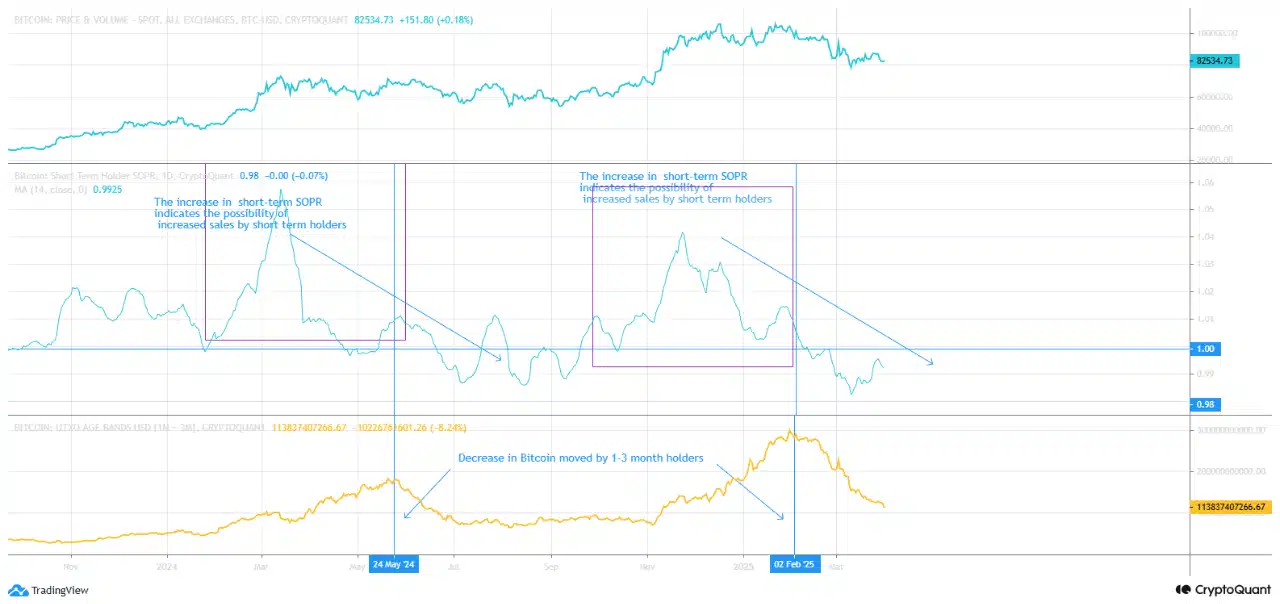

Shift in StH activity

Bitcoin holders in the short term play a crucial role in stimulating market sentiment and influencing sales pressure.

Their behavior often reflects the profitable or loss -saving decisions in the short term, making them important indicators of market momentum.

Source: Cryptuquant

Recent data emphasizes a significant purchase of the BTC activity of short-term holders. Both the short-term statistics of SOPR and Utxo age tape show a reduced movement, which indicates increased hesitation for selling.

After taking a profit from recent transactions, these holders seem to have started a more careful, hold-oriented phase.

This shift indicates a possible reduction in sales pressure and points to a more balanced or neutral market front views in the short term.

Bitcoin -Price views

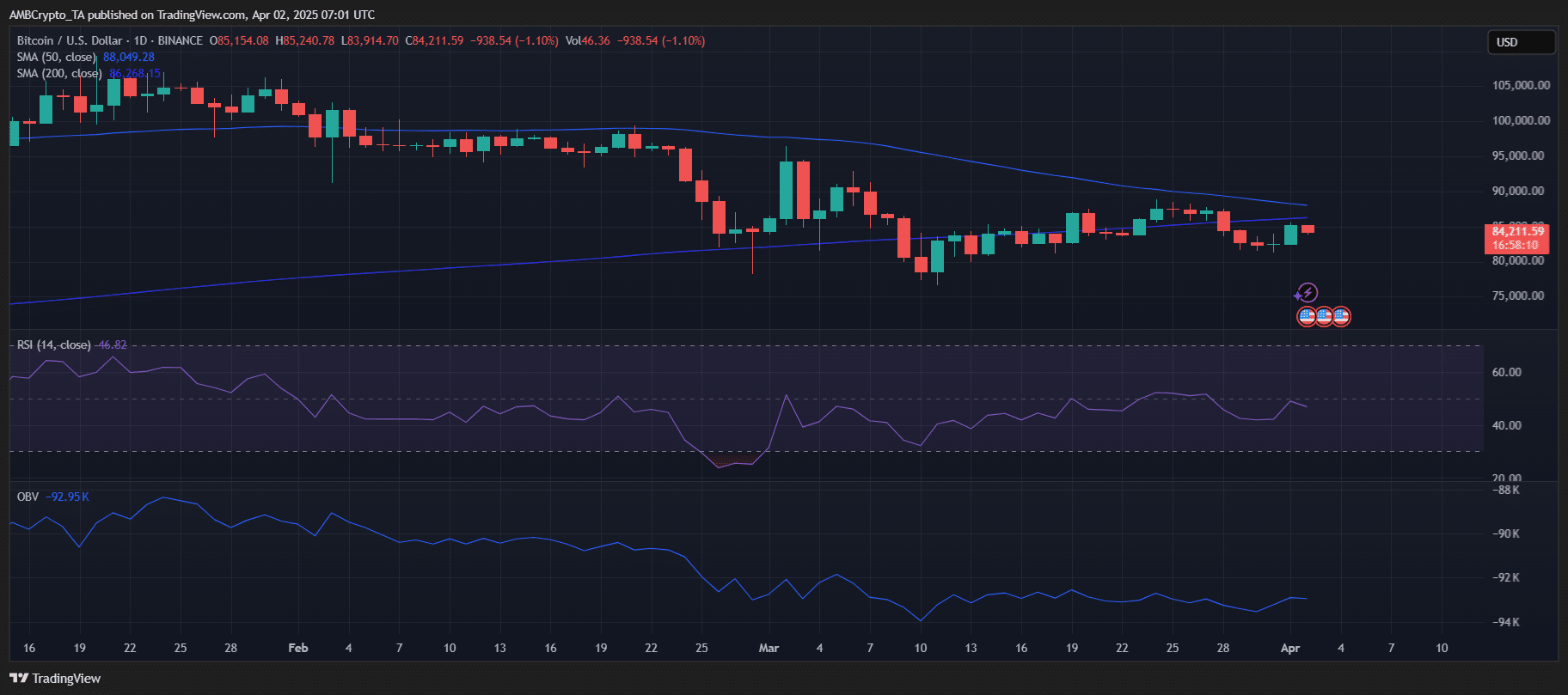

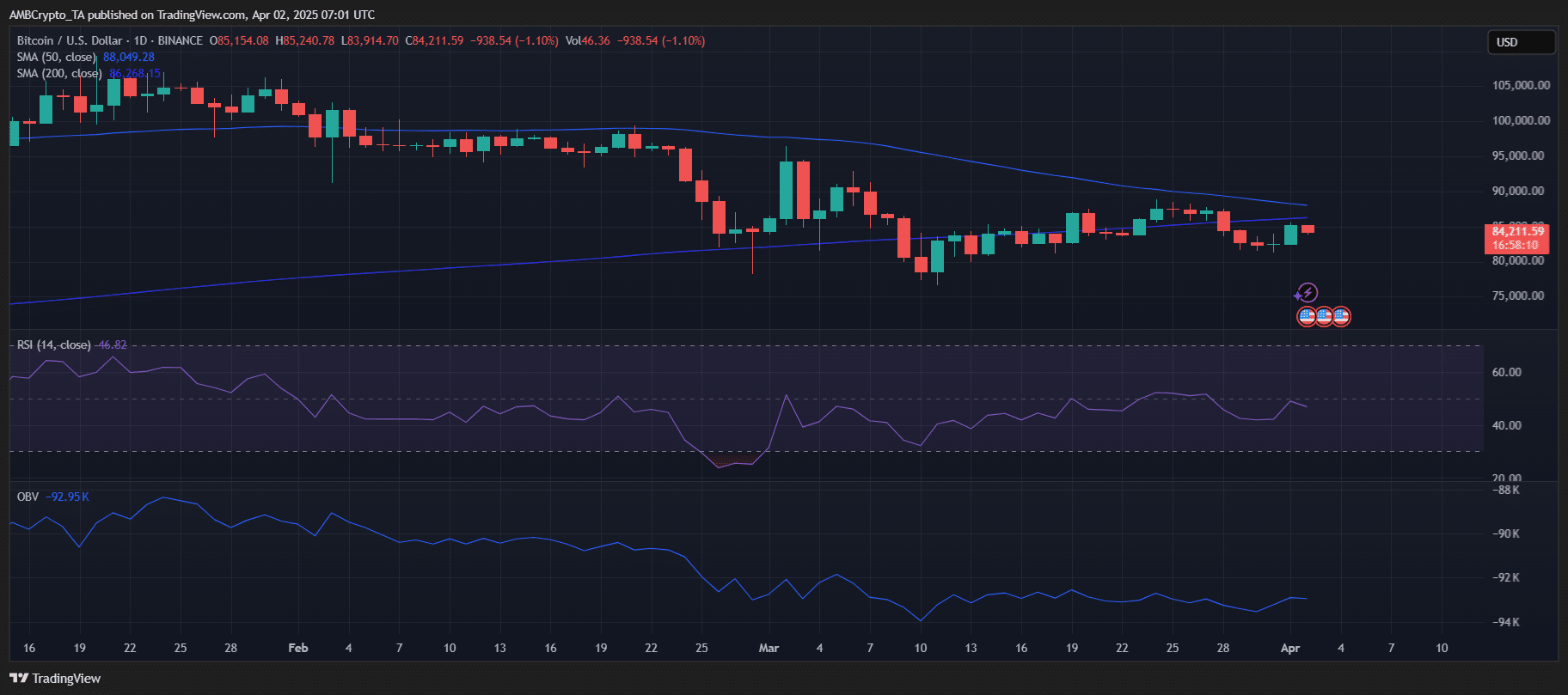

Source: TradingView

Bitcoin’s recent attempt to break over 50d SMA at $ 86,268 confronted with resistance, reducing the price to $ 84,211.

At the time of the press, the RSI indicated at 46.82 that the market was in a neutral to somewhat bearish zone, suggesting that buying momentum remains weak.

Moreover, the BBV was at -92.95 K, hinting on a low trade volume and reduced purchasing pressure. If BTC does not return the 50-day SMA, support could recover near the 200-day SMA at $ 88,049. Conversely, a successful breakout can form the basis for recovery.