- The price of BTC fell more than 5%, powered by legal uncertainty, institutional repositioning and safety problems in the crypto space.

- Accumulation patterns showed that investors were still fascinating, with new demand zones forming between $ 84k and $ 92k.

Bitcoin [BTC]The world’s largest cryptocurrency due to market value, has experienced a significant decrease and more than 5% dropped to a low of three and a half months.

From 28 February, Bitcoin traded under $ 80,000 for the first time since November 11, 2024.

This decline is influenced by uncertainties around the approaching rates and crypto policy of US President Donald Trump. This was accompanied by a reduced trust of investors after a considerable hack of $ 1.5 billion with Ethereum [ETH].

Factors that contribute to the Bitcoin -Dia

Various important factors have contributed to the recent Bitcoin slide:

Policy uncertainty: The announcement of President Trump of a rate of 25% on the import from Canada and Mexico, which starts on March 4, has introduced considerable uncertainty in the world markets.

This policy movement has expressed concern about possible inflation and its impact on economic growth. It has led investors to re -assess their positions in risk -sensitive assets, including cryptocurrencies such as Bitcoin.

Security: The confidence of the cryptocurrency market was further shaken by a massive infringement of security, where hackers stole for about $ 1.5 billion in ETH from the Bybit exchange.

This incident, described as the largest crypto robbery so far, has increased the fear with regard to the security of digital assets and the platforms that support them.

Investment service: The initial optimism after President Trump’s election, fed by expectations of a crypto-friendly regulatory environment, has decreased.

The absence of concrete policy developments, such as the expected establishment of a strategic bitcoin reserve, has led to a cooling of the market euphoria that rather raised prices.

Insights into investor behavior

Despite the recent slides, Data on chains Unveiled remarkable accumulation trends at Bitcoin -Investors:

September to October 2024: During this period considerable accumulation occurred within the price range from $ 60,000 to $ 67,000.

Addresses with cost bases in this bracket have retained their participations, indicating a strong belief in the long -term value of Bitcoin.

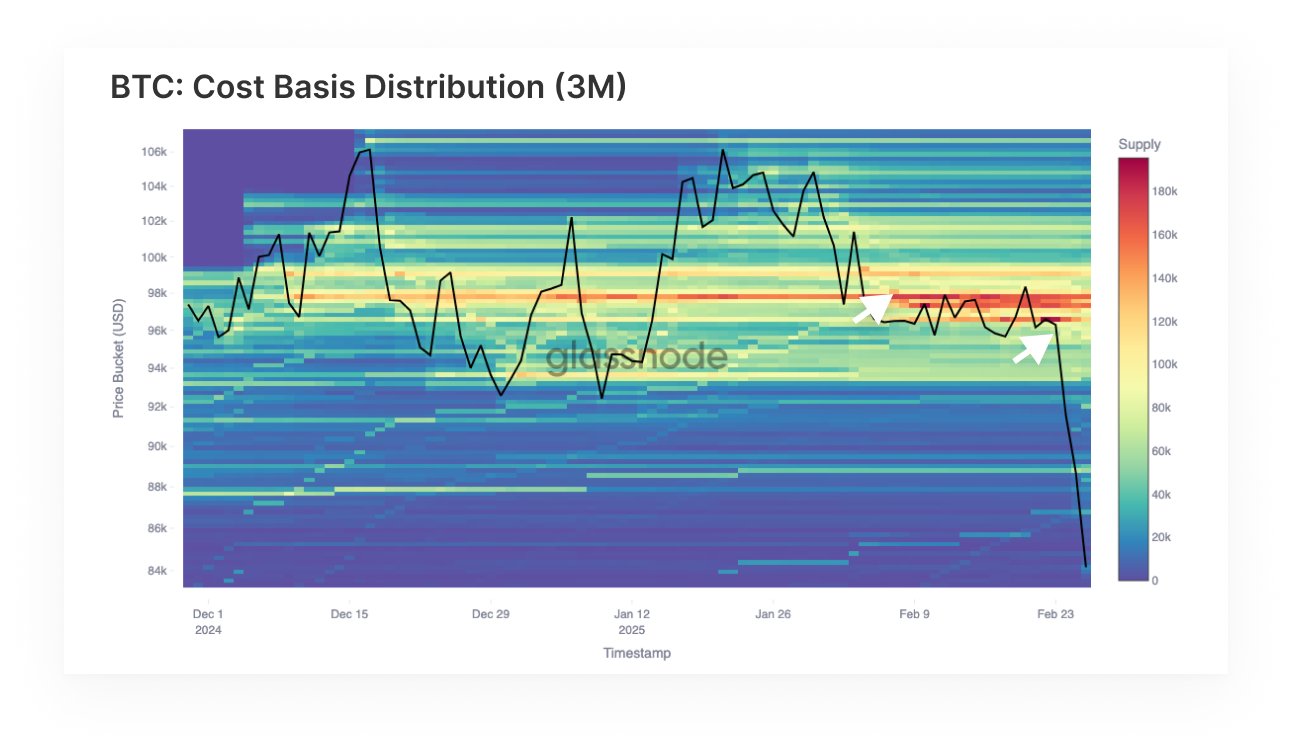

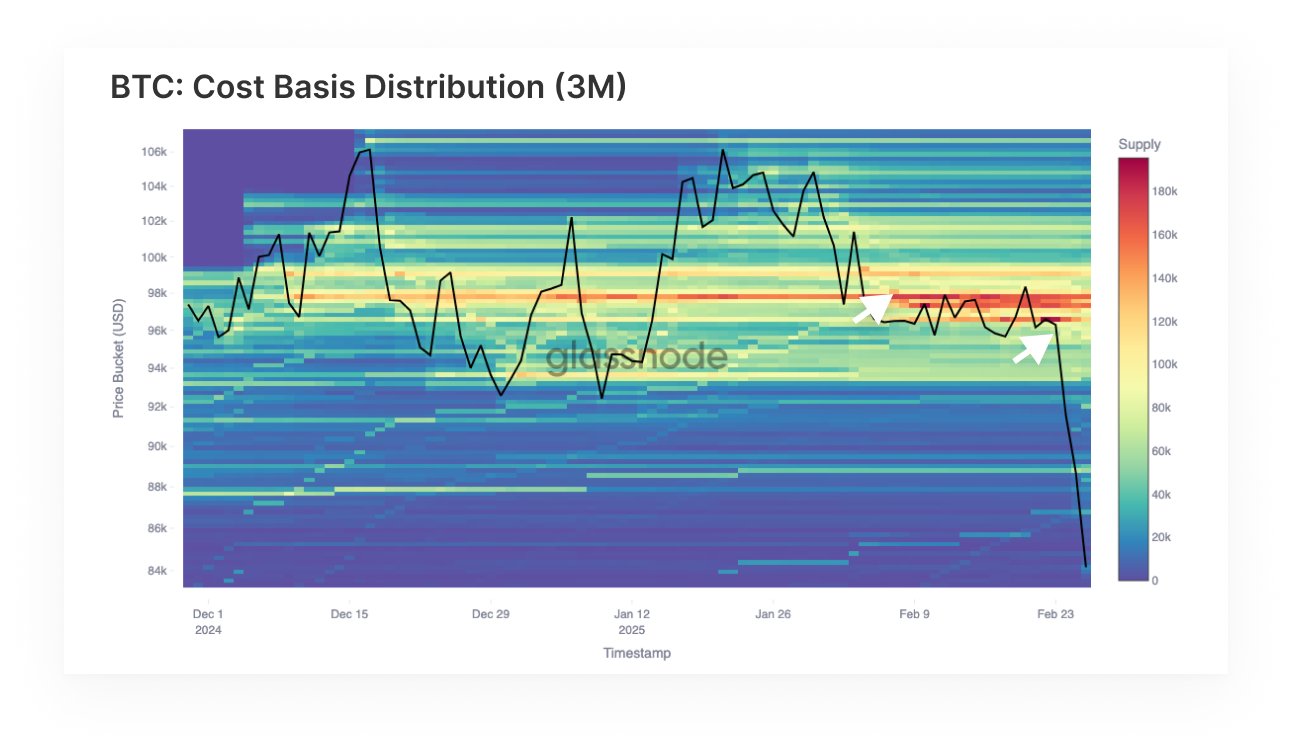

Source: Glassnode

December 2024 to February 2025: A new battery zone was created between $ 96,000 and $ 98,000.

Although some investors in this reach have started redistributing their participations, the density of this supply cluster suggests that it could act as a formidable resistance level if the prices visit this territory again.

Short -term analyzes also emphasize emerging demand clusters between $ 84,000 and $ 92,000. The critical question remains whether this new question is sufficient to compensate for the prevailing pressure-side pressure.

Analysis of institutional involvement

Institutional participation in the Bitcoin market has been an important engine of its price dynamics:

The aggressive acquisition of the strategy: Previously known as micro strategy, the company has expanded its Bitcoin Holdings by nearly $ 2 billion, bringing its total reserves around 499,096 Bitcoins.

This aggressive accumulation strategy underlines a strong institutional belief in the future appreciation of Bitcoin.

Market volatility problems: Despite such notes, the wider institutional sentiment remains careful. Factors such as policy security, safety issues and market volatility contribute to a hesitant approach to potential institutional investors.

Bitcoin’s future prospects

The Cryptocurrency market is at an intersection, influenced by various policy decisions, safety reasons and investor sentiment:

Regular developments: The market keeps a close eye on the coming policy of the Trump administration on digital assets. Clear and supporting regulations can rejuvenate the trust of investors and possibly reverse the current downward trend.

Market sentiment: Although short -term volatility yields challenges, the underlying accumulation patterns suggest that a segment of investors remains optimistic about Bitcoin’s long -term perspectives.

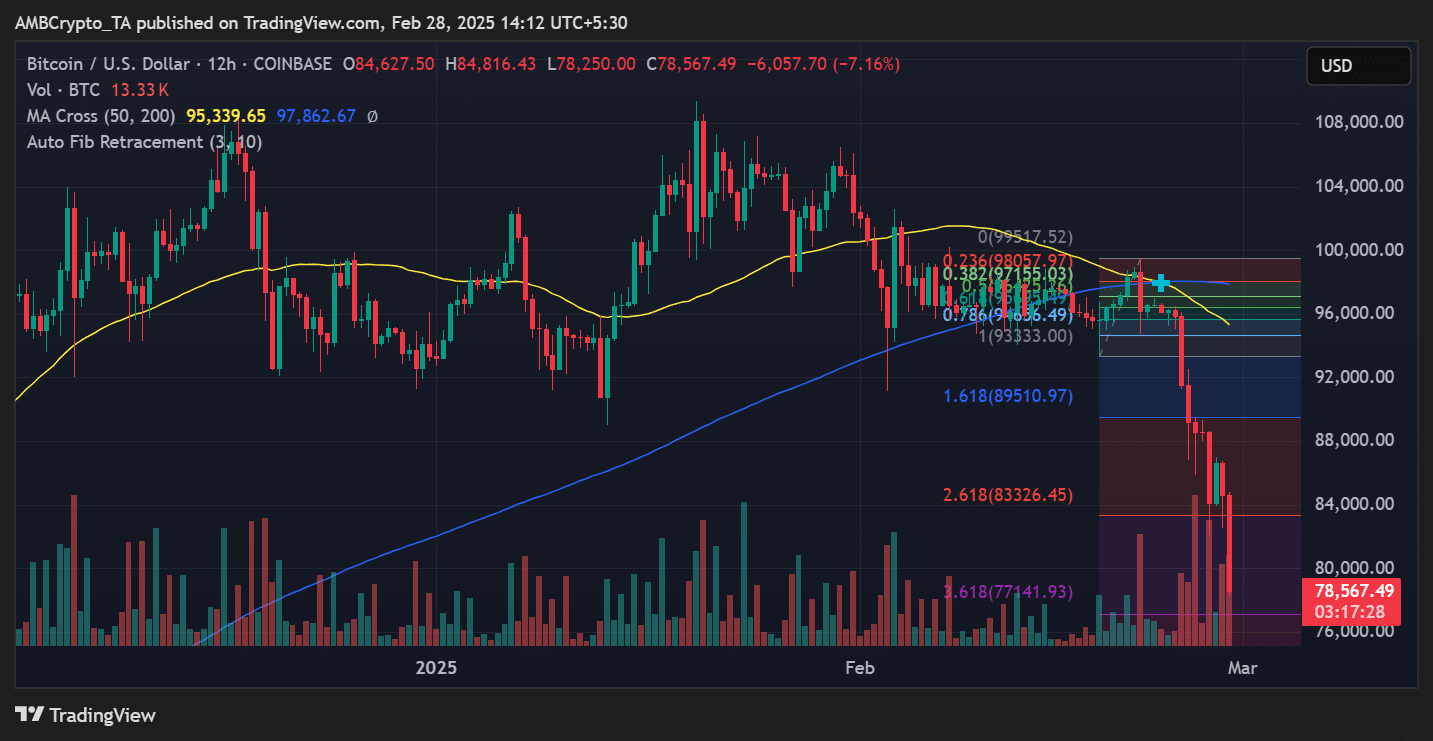

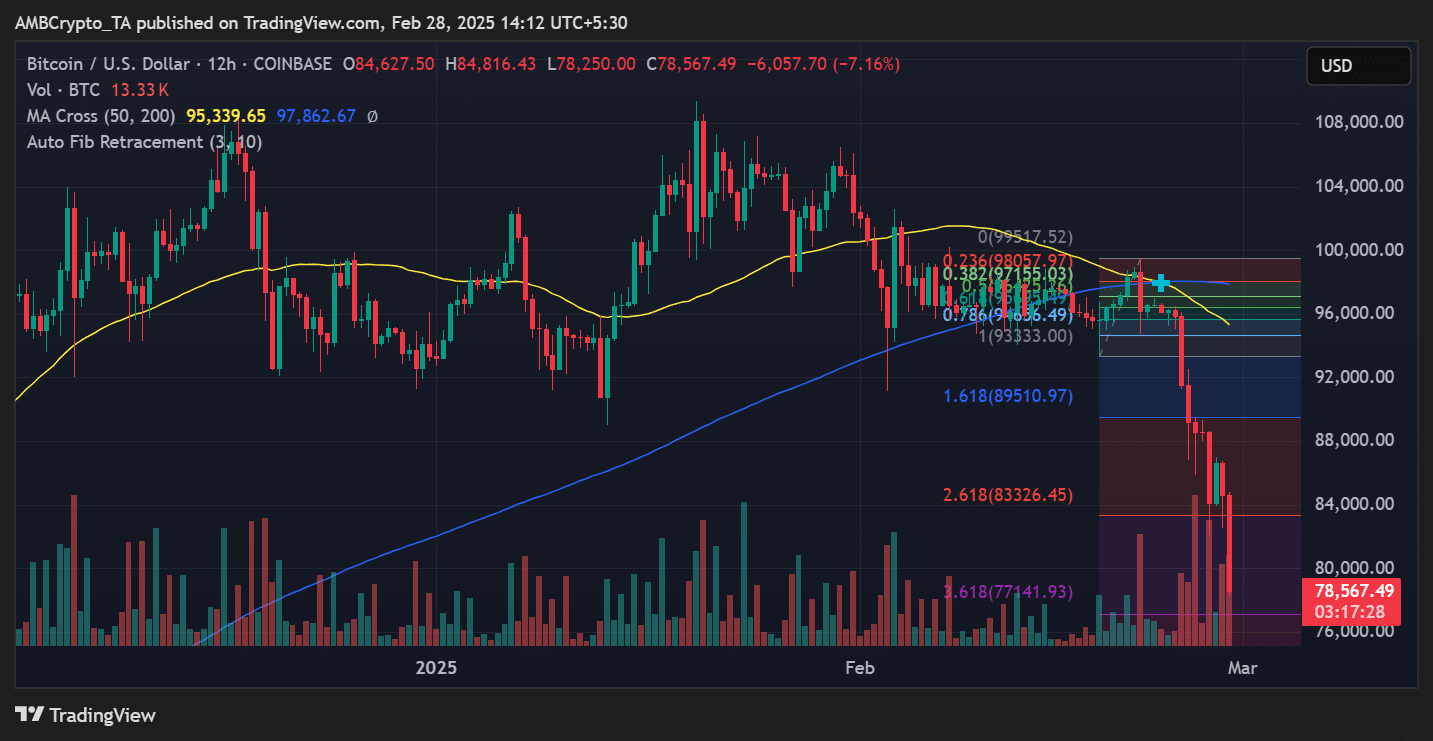

The interplay between emerging demand zones and existing resistance levels will be crucial in the coming months in determining Bitcoin’s price process.

Source: TradingView

In conclusion, the recent Bitcoin slide reflects a complex interplay of uncertainties, safety problems and changing investors sentiments under the $ 80,000 threshold.

While the market navigates these challenges, the actions of both institutional and individual investors will play a crucial role in shaping the future landscape of the cryptocurrency sector.