- STHs have registered $ 7 billion in realized losses, the most in this cycle

- The price of Bitcoin remains under important advanced averages, with the behavior of the short term that is crucial for the short -term trend direction

Short bitcoin [BTC] Holders feel the heat as non -realized losses set up, which marks a critical bending point in this market cycle. Despite all the structure of pressure, history suggests that this can be a natural cooling phase within a wider bull trend.

Bitcoin losing losses, but stay within historical reach

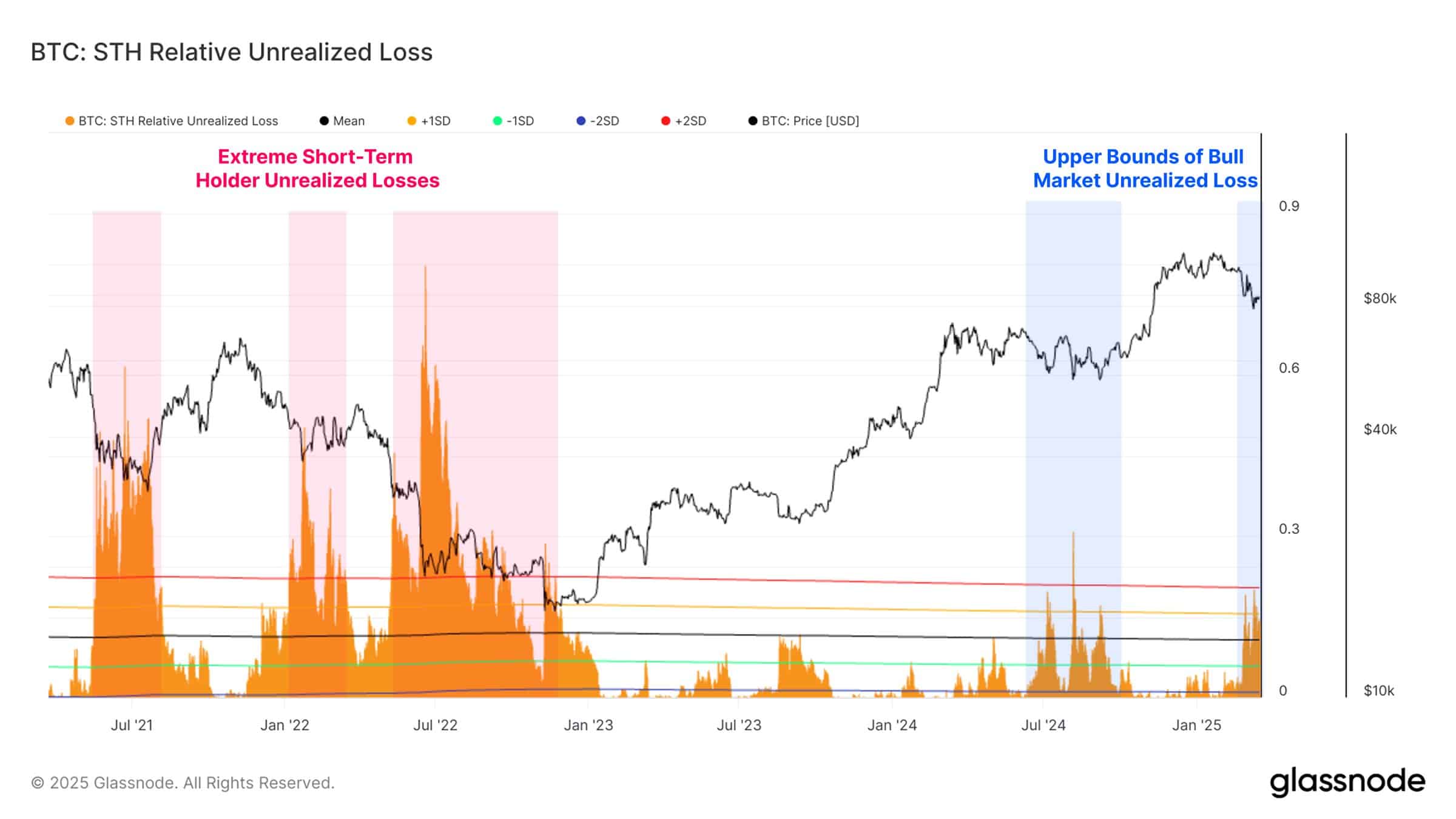

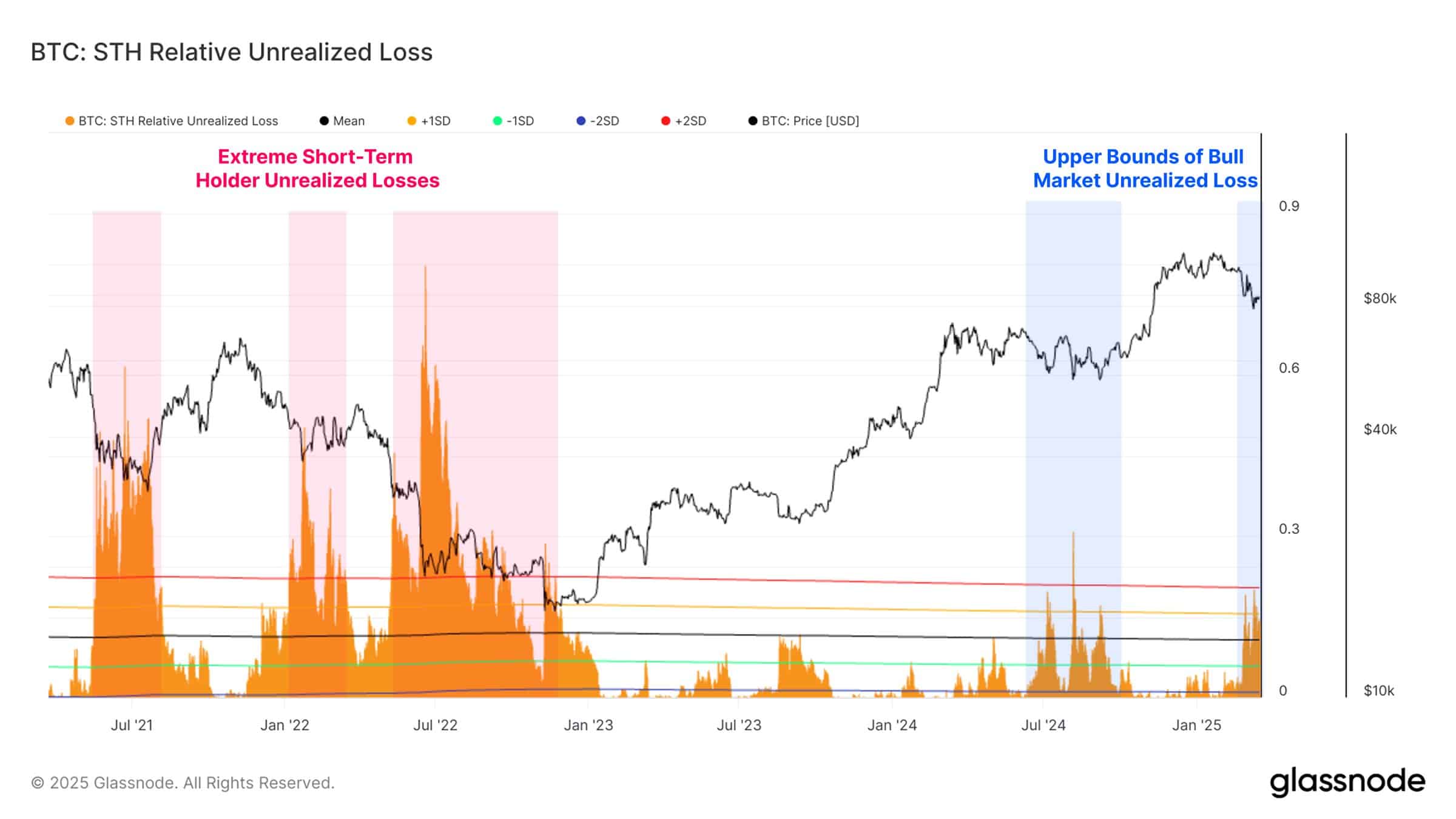

In fact data from Glass node revealed that the relative non-realized losses for holders in the short term [STHs] Can approach the +2 standard deviation level – a threshold that is historically associated with peak complaints.

And yet they remain within the upper borders that are typically seen during bull markets, which do not yet violate a capitulation area.

Source: Glassnode

The time level of StH pain also seemed to be remarkable, with more than $ 7 billion in realized losses that have been registered in the last 30 days.

Although this figure is the highest loss event of the current cycle, it is considerable under the astonishing $ 19.8 billion and $ 20.7 billion levels that are seen during the most important drawings of May 2021 and June 2022.

This means that although the losses have increased, many investors still leave before extreme capitulation begins. In other words, short-term holders can lock modest losses, instead of enduring deeper drawings-a sign of wider market strength.

Bitcoin’s price structure and risk zones

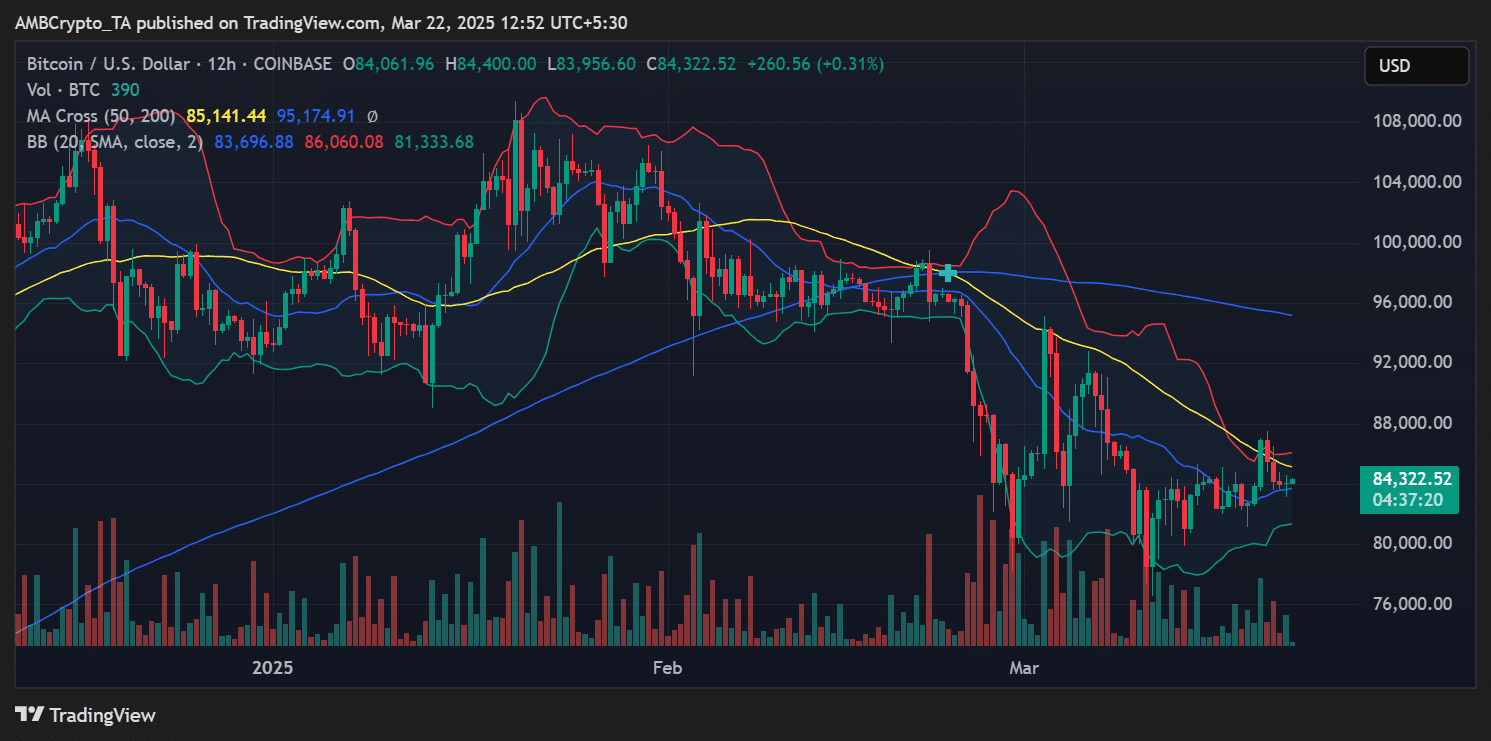

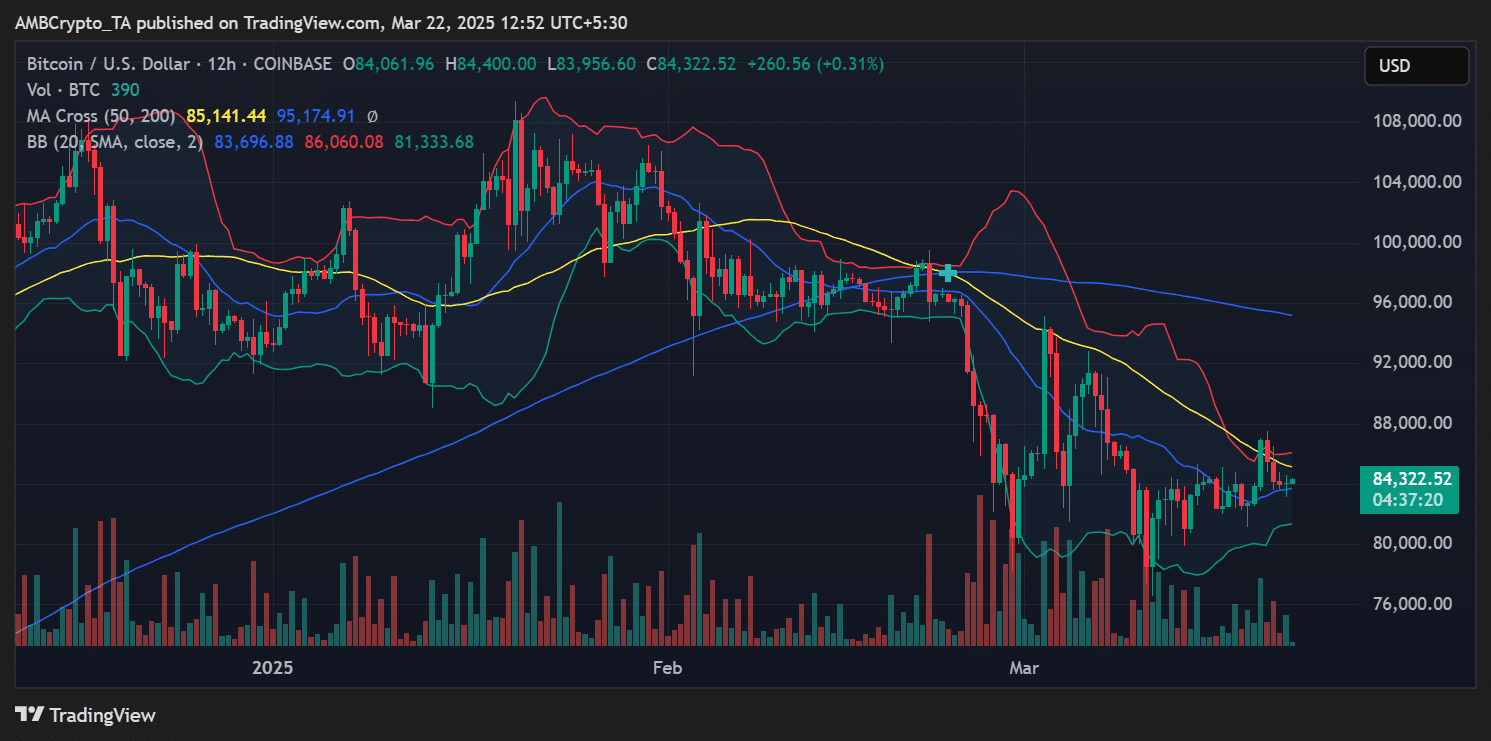

Bitcoin traded at $ 84.322 on the press, with the crypto just below the 50-day advancing average of $ 85.141 and well below the 200-day advancing average at $ 95.174.

These levels are important resistance zones and can continue to suppress the upward momentum. Especially if sentiment remains weak in the short term holders.

Source: TradingView

The Bollinger tires also emphasized a tightening range, so that a break -out of the bow showed.

With short -term holders under pressure, however, the bias can tilt bearish unless the new demand enters the market.

What this means for Bitcoin’s trend

The combination of rising non -realized and growing realized losses suggested an increased risk, especially for those who have taken over Bitcoin at recent highlights. However, the fact that these losses remain within historic bullmarkt patterns is a sign that a macroom barrier is not yet confirmed.

If BTC can reclaim the $ 85,000 level and convert them into support, this can renew the trust under STHS. Conversely, it cannot entail $ 83,000 lead to more sales while testing lower support nearly $ 80,000.

In general, pain in the short term is clear, but not yet extreme. As long as Bitcoin applies above the most important psychological levels and macrostrooms remain intact, this correction can serve more as a reset than as a reversal.