- Short-term holders have sent more than 600,000 BTC tokens to exchanges since the rally started in mid-June.

- The total supply of STH has shown a steady upward trend over the past month.

Bitcoin [BTC] briefly touched $31,395 on July 6, the highest level in more than a year, as the rally, spurred by increased institutional interest in digital assets, continued to drive the market.

Read Bitcoin [BTC] Price Forecast 2023-24

Optimism has increased after a clear endorsement by BlackRock CEO Larry Fink at a recent event where he used words like “international asset” and “digitizing Gold” for Bitcoin. BlackRock had filed for a new Bitcoin spot ETF after the SEC found flaws in the initial filing, leaving the positive sentiment intact.

Short term holders rejoice

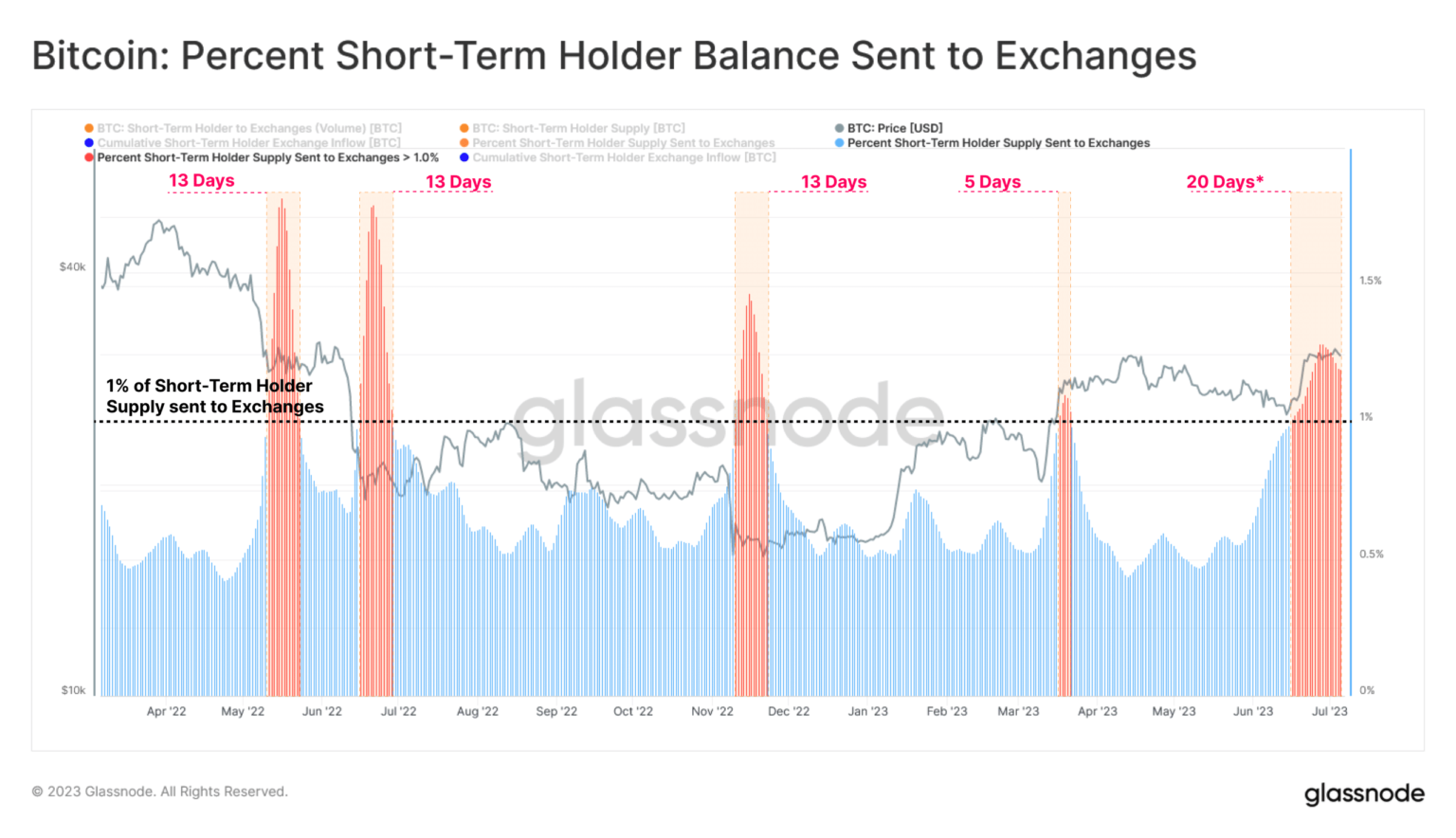

The prolonged bullishness continued to interest short-term holders (STH) of the king coin. This is reported by the blockchain analysis company Glasnodethis cohort of investors sent more than 600,000 BTC tokens to exchanges since the rally started in mid-June.

This was the longest period of exchange engagement by STH in the recent past, with the percentage of delivery shipped exceeding 1%.

Source: Glassnode

Short-term holders are those participants who, according to Glassnode, have held coins for less than 155 days and are more likely to give up positions due to market volatility.

As shown below, a sharp drop in supply between 1-3 months has been observed over the last 20 days. This was indicative of STH’s willingness to sell their holdings and lock in profits.

Source: Glassnode

Most short-term holders, or the “weak hands” as they are also known, have found it lucrative to sell their tokens.

According to blockchain research firm CryptoQuant, the Short-Term Holder SOPR has been more than 1 since the bullish rally began, indicating that most of these investors sold their BTC holdings at a profit.

Source: Glassnode

Emergence of a new trend

Interestingly, despite the increased levels of exchange interaction, the total supply of STH has been on a steady upward trend over the past month.

Is your wallet green? Check out the Bitcoin Profit Calculator

Bitcoin’s growing status as a safe haven may have prompted these investors to view BTC as a long-term investment option rather than just a speculative asset to trade.

Source: Glassnode

At the time of publication, Bitcoin was trading at $30,146.39 in hands CoinMarketCap. According to the latest reading of the Bitcoin Fear and Greed Indexthe sentiment changed to “Greed”, indicating that the market was rising.