Bitcoin increased on Thursday beyond $ 98,000, which means that an intense debate among traders will be fueled as to whether the milestone of $ 100k is again within reach or whether the current rally is vulnerable for a rapid correction. Behind the scenes, market observers point to rising open interest (OI) and increased leverage, so that the possibility of a lever -driven push is brought to the attention.

Bitcoin rally or fall?

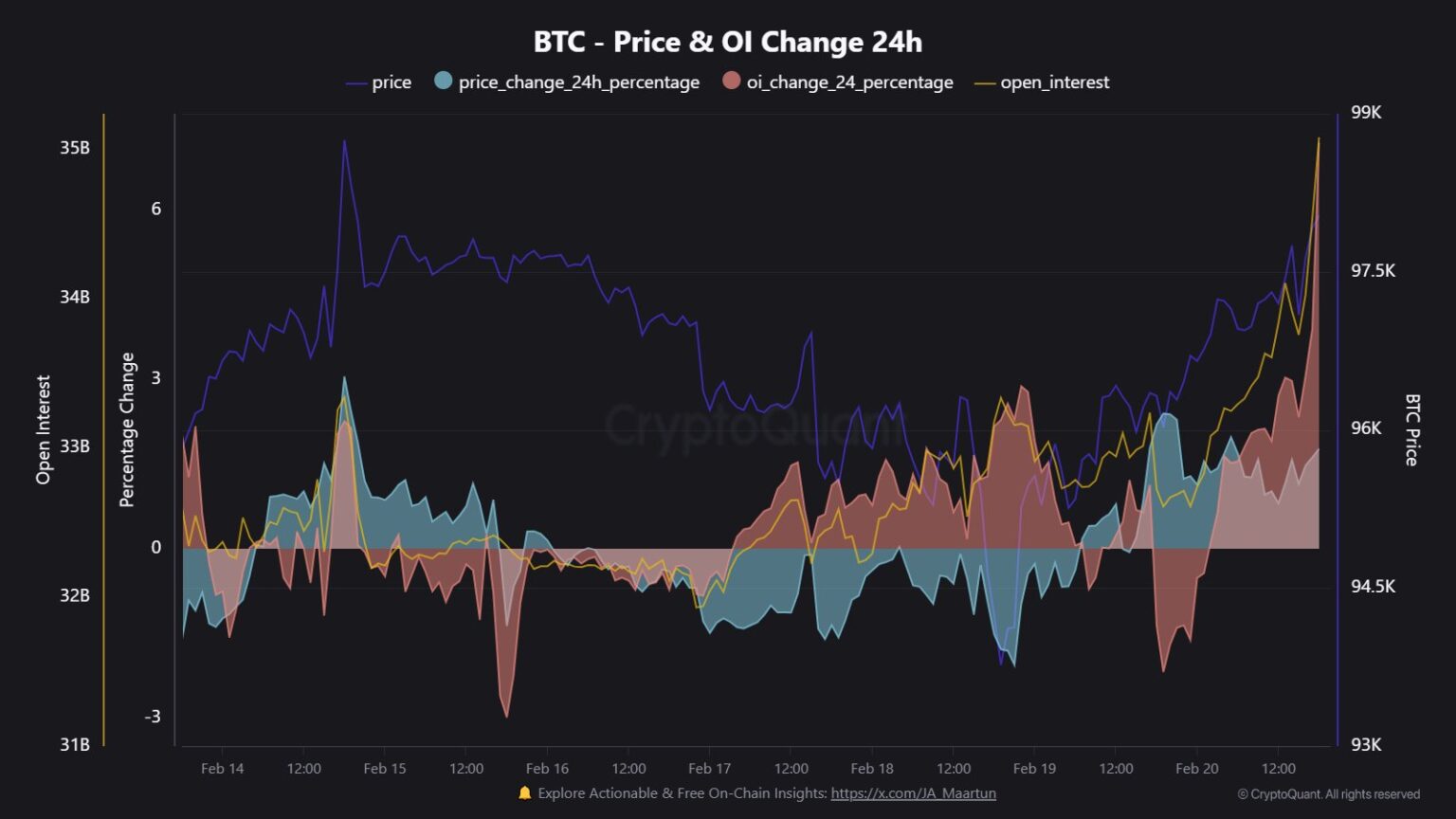

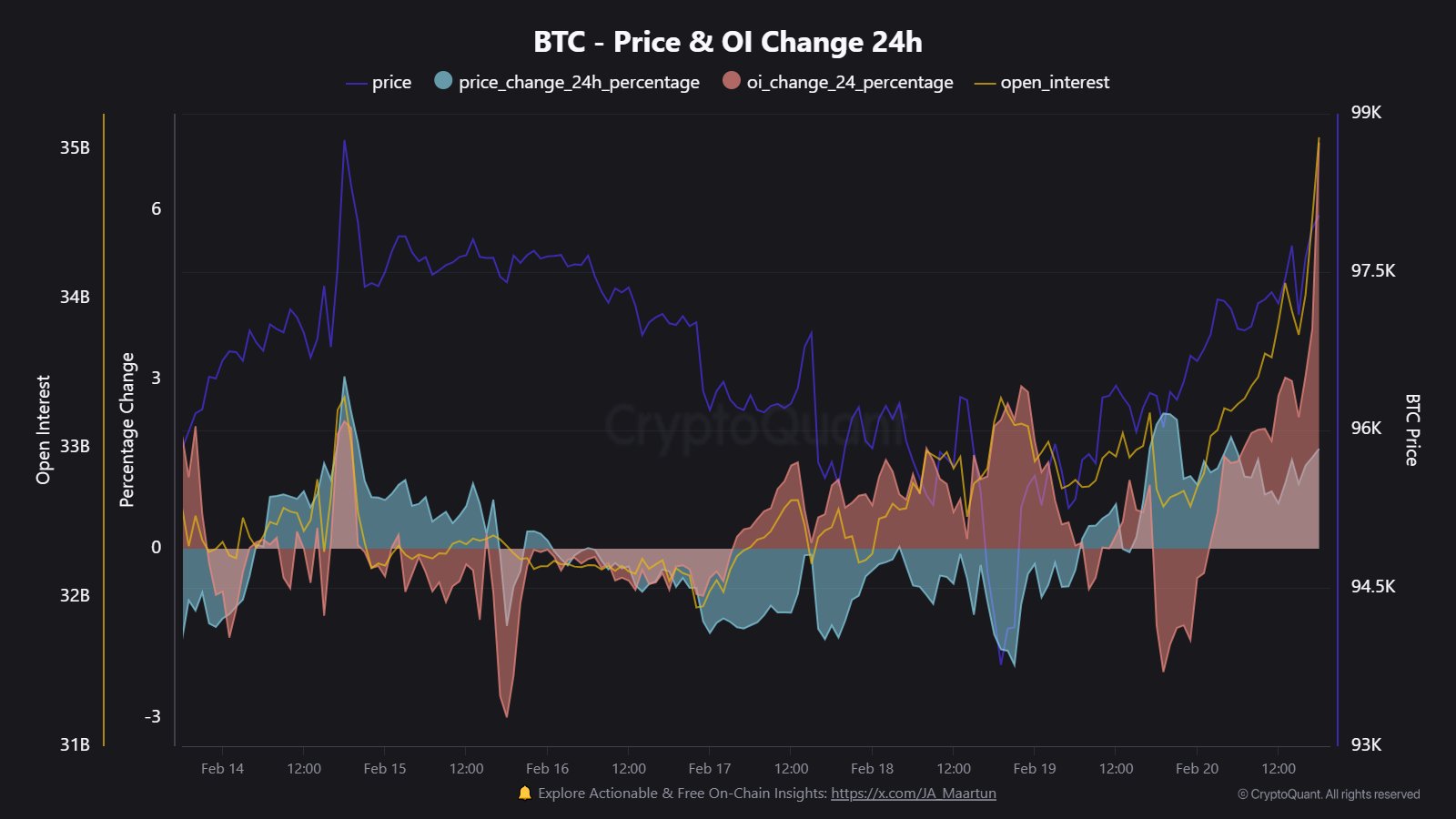

Cryptoquant Community Analyst Marchunn (@ja_Maartun) warned of a ‘lever -driven pump’, and noticed a $ 2.4 billion jump in Bitcoin’s OI within 24 hours. Via X he wrote: “Leverage driven pump: $ 2.4 billion (7.2%) increase in open interest in Bitcoin in the last 24 hours.”

Confirm these observations, well-known crypto-commentator Byzantine General (@ByzGeneral) marked The important role of new long positions in the higher continuation of the prices: “Many fresh lungs come here on BTC that shifts the price higher. Quite funny that the entire market is now being canceled from the back of this Degen Longs. “

Alpha Dojo analysts (@alphadojo_net) reflect Sentiments of caution, the underline of a remarkable gap between futures-based open interest and spot-driven purchases: “BTC continues to grind, while the OI is rising steadily, but there is little purchase. BTC is now approaching the top of the range again. It seems that some market participants have tried to give Saylor’s planned bid. “

Although the prospect of a large purchase could continue the market, they warn that without new catalysts such as a “short -term story or positive news, it is currently as if BTC will have difficulty pumping sustainably above $ 100k.”

Renowned crypto analyst Bob Loukas as long as A cyclical framework for interpreting Bitcoin’s price movements, and notes that the market is approaching the end of one more weeks of cycle and the beginning of another: “We are about to complete a weekly cycle of Bitcoin , because I last shared 6 weeks. For the context there have only been 5 weekly cycles since the lows of the Bears market of 2022 (average events of 6 months). 4 of these cycles had 90-105% movements. They could not do much (June-September 23). “

When asked whether this signals an imminent market top, Loukas clarified: “I say we are about to start a new one. Cycli always start at the lows. “His comments suggest that although a cycle transition is imminent, it is not necessarily the same as a market peak – instead, it could mark the start of a new upward trend.

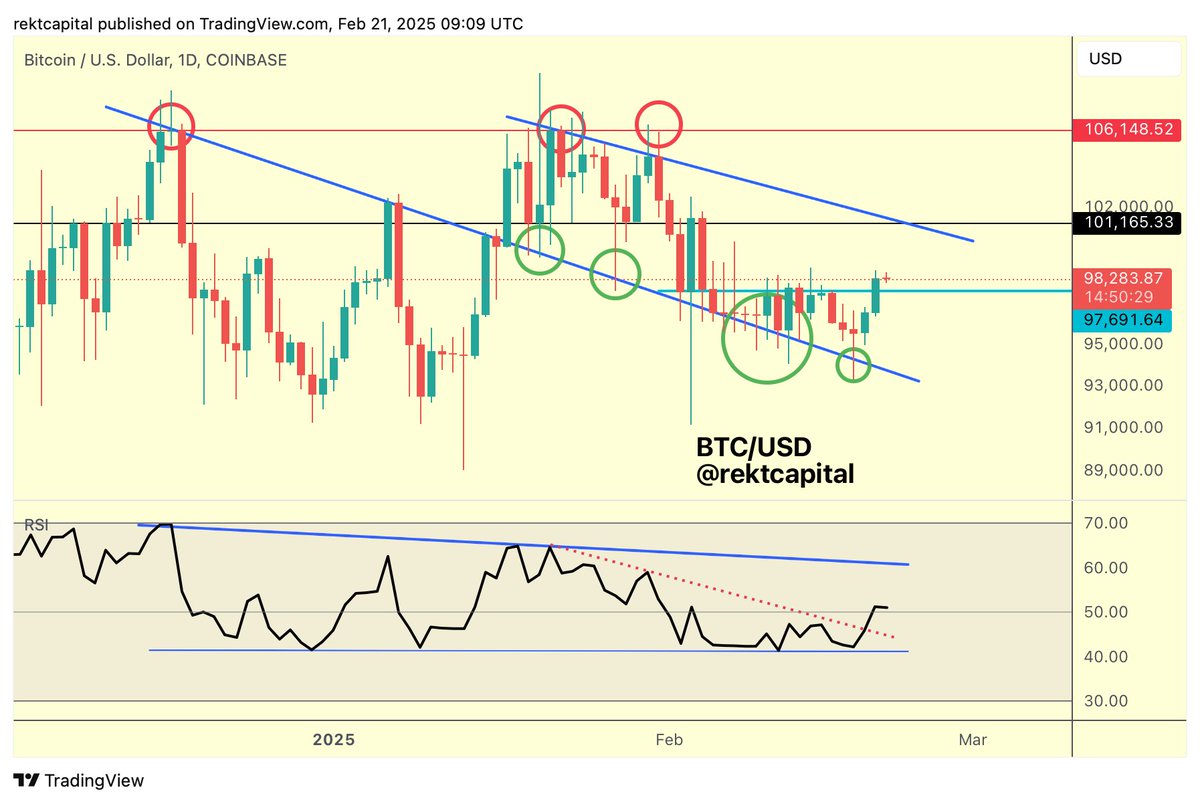

Technical analyst stretches Capital (@Rektcapital) emphasized The meaning of Bitcoin’s daily close to the threshold of $ 97,700, suggesting that a successful retest of this zone could pave the way for a movement that goes beyond $ 100,000: “The early stage momentum generated by the Bullish divergence has translated into this recent breakout movement. And with the recent daily closure above ~ $ 97700, Bitcoin will now try to re -test the level as support to make the continuation of the trend possible. “

He further worked out on Bitcoin’s Relative Strength Index (RSI) channel, which implies that the break above a series of lower highlights can indicate the next leg: “The price of Bitcoin de Blue Trendline continued to test as support. And the RSI kept holding its channel floor. Recently, the RSI broke its series of lower highlights, indicating that the RSI may be ready to peer at the Calaat Top. “

Looking ahead, a clear retest of $ 97,700, because support could confirm the Bullish prospects of Rekt Capital: “Daily close to $ 97700 has been successful (light blue). All dips in $ 97700 would form a retest attempt. A retest after the outbreak of $ 97700 in new support would fully confirm the outbreak to position BTC for a rally up to $ 101k resistance. “

At the time of the press, BTC traded at $ 98,645.