- After a euphoric rise last week, Bitcoin has fallen, influenced by negative news.

- Bitcoin longs started to be liquidated, which could be another worrying sign for the king coin.

Bitcoin last week [BTC] The excitement rose to almost euphoric levels. Admittedly, there was a lot of hype around it, especially because of the Bitcoin 2024 conference.

In contrast, the market has adopted a slower pace this week, which is also evident in BTC’s price action.

Just as Bitcoin’s rally was driven by generally positive news, the cryptocurrency’s performance this week was impacted by negative news.

This contributed to Bitcoin’s bipolar mood, as evidenced by its price action, which fell nearly 6% to the press-time level of $66,042.

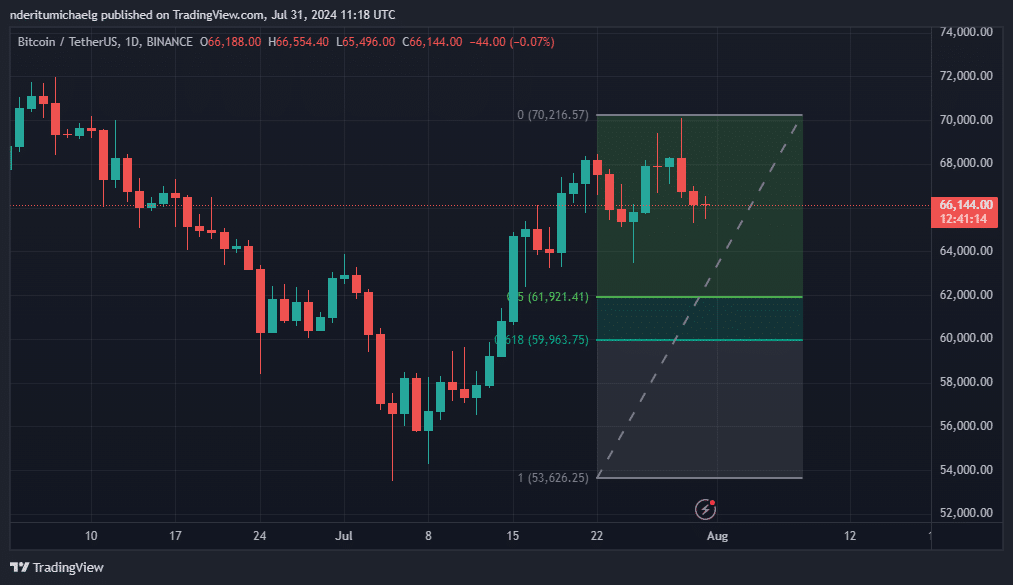

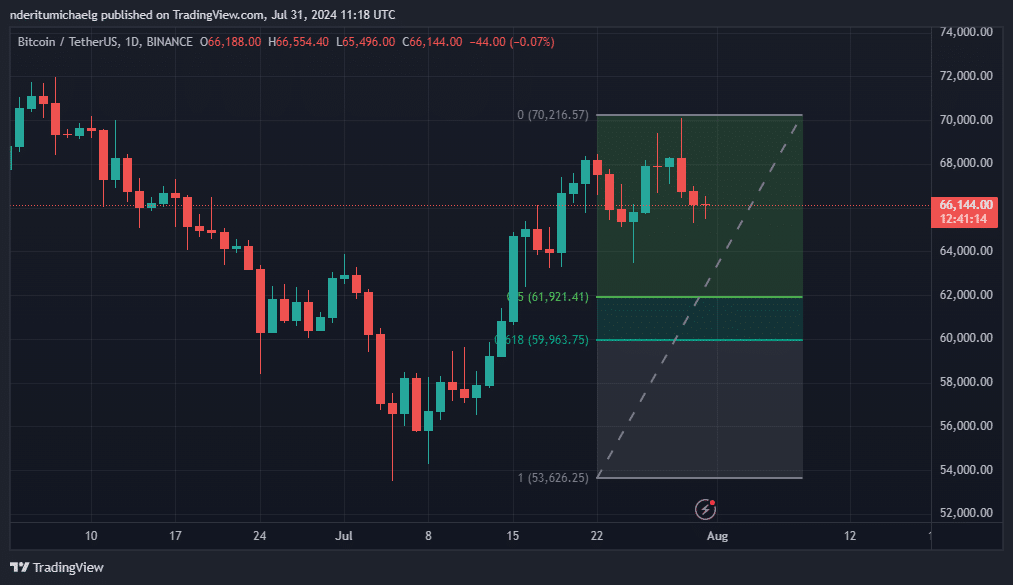

Source: TradingView

BTC recovered about 30% from its July low. Thus, short-term traders who bought on the dip may have an incentive to sell, contributing to the ongoing retracement.

But how long can this trend last?

AMBcrypto’s analysis using the Fibonacci retracement showed that the next pivot could be between $61,921 and $59,693. That is, if the selling pressure continues.

Bitcoin is going on a hype recession

There was a lot of politically charged speculation last week, but now the hype has died down. Instead, the market seemed to take a cautious stance this week, following the FOMC data and the upcoming FED meeting.

Uncertainty surrounding economic announcements tends to influence investment decisions. Therefore, many traders tend to exit their position and wait for clearer skies before making the next move.

This could explain the profit taking.

The subsequent selling pressure due to a cautious stance may have been reinforced by new Mt. Gox data. According to Look at chainBitcoin transferred 47,229 BTC to anonymous wallets in the last 24 hours.

This development further raised concerns about selling pressure in the market. If the relocated BTC were to be dumped onto the market, it would cause approximately $3.8 billion in selling pressure.

Liquidated by?

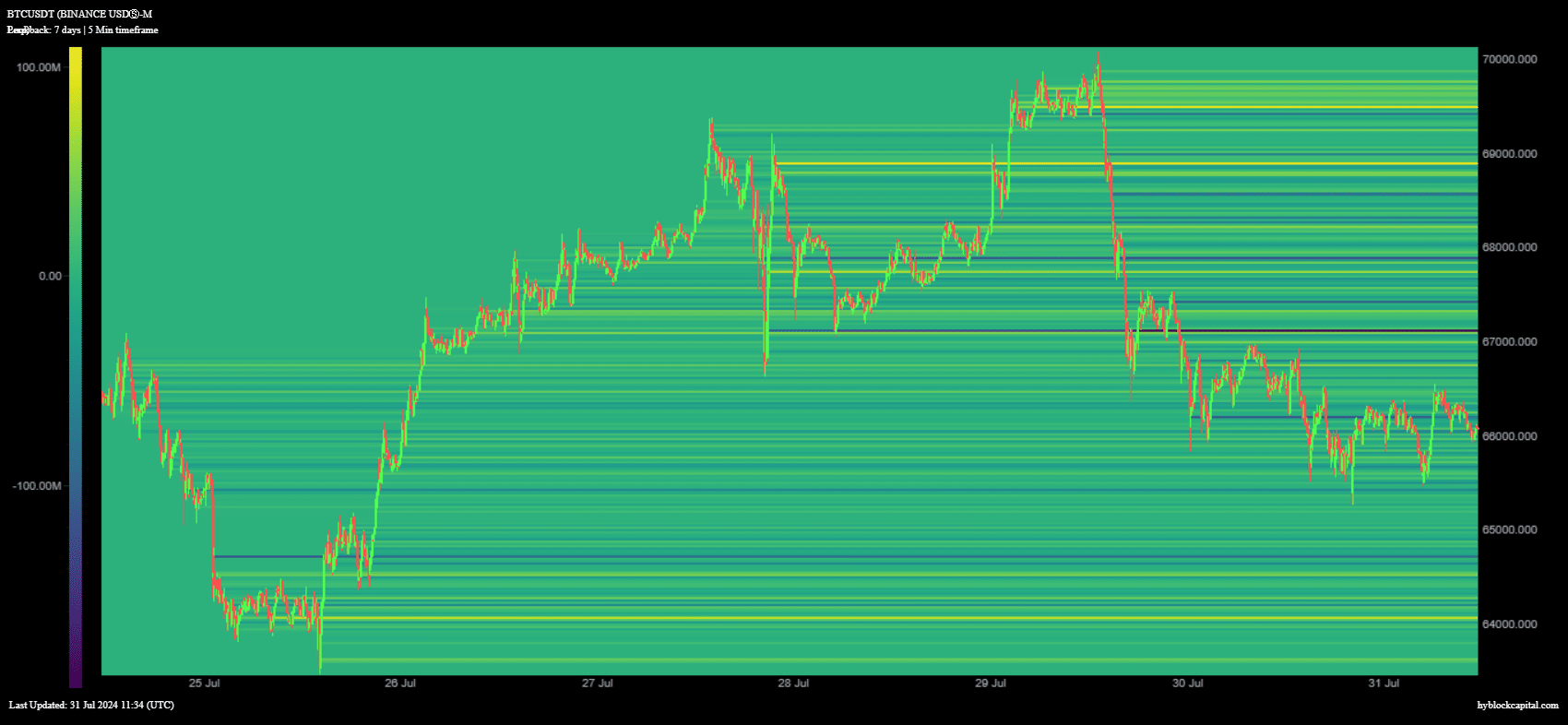

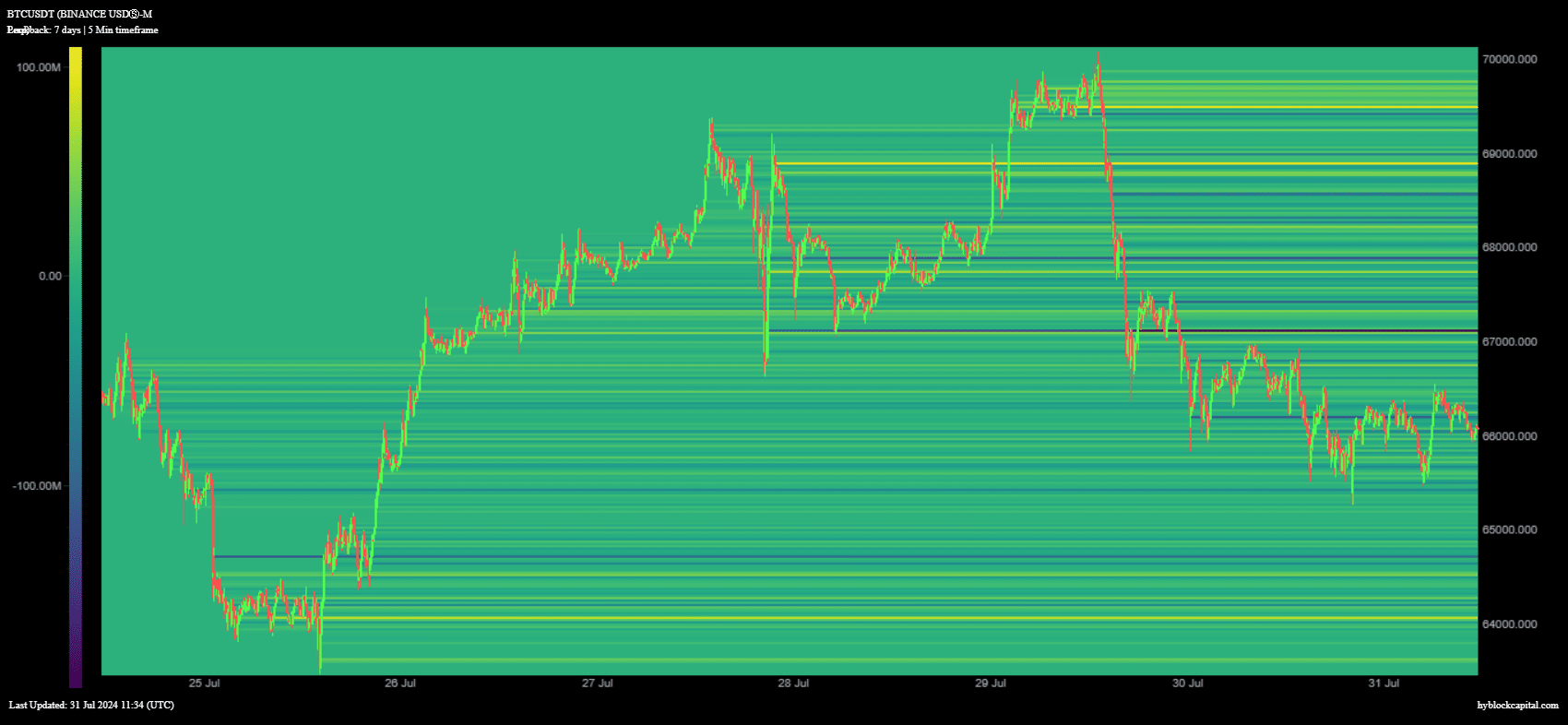

Long positions in Bitcoin may have contributed to the rapid pullback this week. AMBCrypto’s long heatmap review revealed that there were two major zones.

The first was at the $68,875 and $68,901 price levels, with BTC’s long position rising to $101.8 million. The second major zone was between $69,472 and $69,500.

Source: Hyblock Capital

BTC quickly fell below the two leveraged long positions, which may have provided more downside liquidity for short sellers.

Read Bitcoin’s [BTC] Price forecast 2024-25

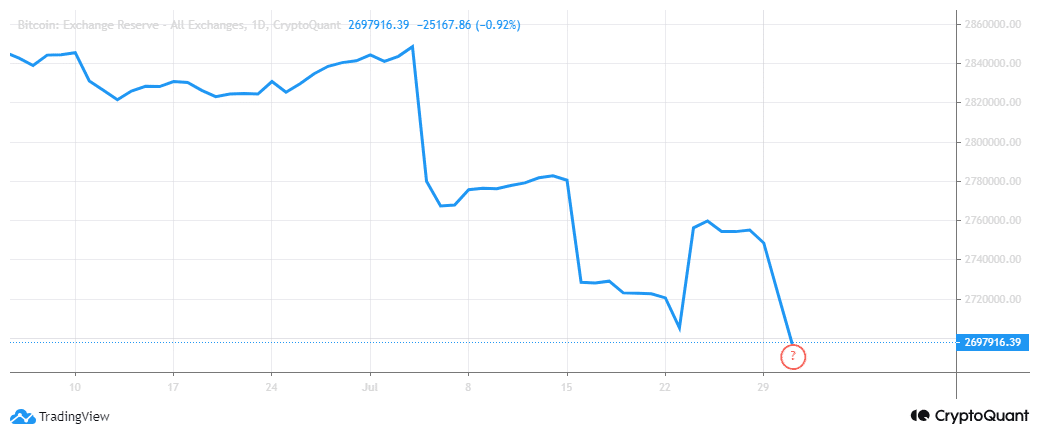

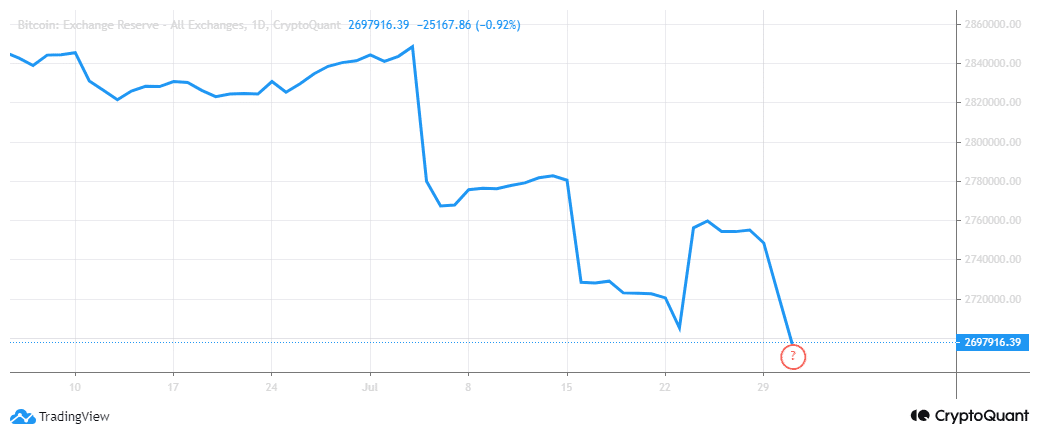

Will Bitcoin Fall Much Lower? This remains to be seen, especially since market dynamics can change at any time. Nevertheless, Bitcoin reserves just last July remained at their lowest level since 2018.

Source: CryptoQuant

The exchange rate reserve metric confirmed that there were approximately 2.6 million BTC remaining on the exchanges at the time of writing.