The story wasn’t much different for Bitcoin, with the price still stuck in a consolidation range over the past week. The sluggishness of the major cryptocurrency – and the overall market – has continued despite the completion of the halving event over a week ago.

The halving event, which saw mining rewards significantly reduced, was expected to herald a new round of bullishness for the Bitcoin price. On the contrary, investors seem to be growing frustrated with the market’s sluggish activity, with many calling for the dumping of BTC.

Bitcoin Sell Calls at a Higher Rate: Blockchain Company

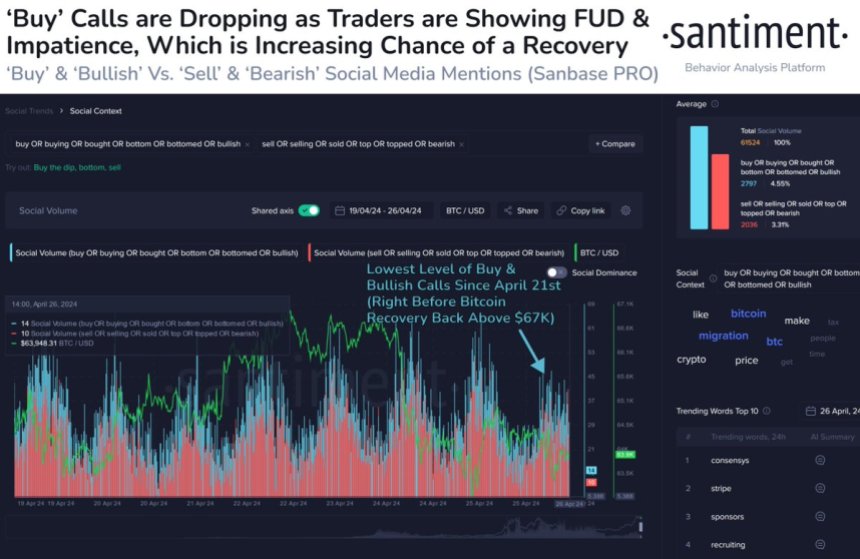

According to a recent report by on-chain analytics firm Santiment, investors are increasingly calling for Bitcoin to sell on social media, following its latest drop to $63,000. The relevant metric here is the ‘social volume’ indicator, which tracks the number of unique posts and posts across social platforms that mention a specific topic.

Santiment collected data on ‘buy or bullish’, ‘sell or bearish’ or related entries for the major cryptocurrency over the past week. The on-chain analytics then highlighted a shift in the trend, with the bearish calls trying to drown out the bullish noise on social media.

According to Santiment, Bitcoin’s recent drop to $63,000 resulted in the lowest level of buy and bullish calls since April 21 (just before BTC rebounded above $67,000). As shown in the chart above, social volume for terms related to “sales” skyrocketed after the price drop.

Typically, Bitcoin’s increased bearish mentions indicate rising levels of FUD (fear, uncertainty and doubt) among investors. However, when traders appear to become frustrated and impatient, the chances of a market recovery are usually greater.

Nearly 90% of circulating BTC in profit – impact on price

According to recent data about the chainapproximately 90% of the supply of Bitcoin is profit. At first glance, this basically implies that most current holders of the major cryptocurrency purchased at a lower price compared to the current price.

However, this level of profitability could also be an overbought signal, especially after bullish periods such as the one between October 2023 and March 2024. Ultimately, this suggests that investors could see Bitcoin lose more of its price gains in the coming weeks.

At the time of writing, Bitcoin is valued at $63,077, reflecting a 2% price drop in the last 24 hours.