- Bitcoin could undergo a long period of stagnation as the deathcross occurs at 30DMA and 365 DMA.

- BTC has recovered moderately on the daily charts by 2.58%.

In the last 24 hours, Bitcoin [BTC] has seen a strong rebound and has regained the $100k level.

However, there has been a setback in recent hours. At the time of writing, Bitcoin was trading as high as $99,417, after rising 2.58% on the daily charts.

This slight pullback reflects BTC’s overall struggle to keep up with its upward momentum. As such, this stagnation has led analysts to predict a bearish outlook for the Crypto.

To that extent, CryptoQuant analyst Yansei Dent has suggested a potential price stagnation in the medium to long term, citing the emergence of a dead cross.

Death Cross appears on Bitcoin’s active addresses

In his analysis, Dent noted that Bitcoin has entered a stagnation phase, with active addresses signaling weakening momentum.

Source: Cryptoquant

According to him, a deathcross has developed at the 30-Day Moving Average (DMA) and 365 DMA. This death cross indicates a decline in short-term activity among investors.

Historically, similar patterns in active addresses have coincided with bearish market conditions, acting as negative indicators.

Furthermore, the analysis shows that the number of transactions has decreased since the fourth quarter of 2024. This further increases the likelihood of market stagnation in the medium to long term.

Therefore, with these conditions still prevailing, BTC could struggle to maintain an uptrend until the overall market signals improvement.

What does this mean for BTC charts?

In particular, a drop in activity and the emergence of a death cross indicate weakening market fundamentals, which could see BTC struggling to maintain an uptrend.

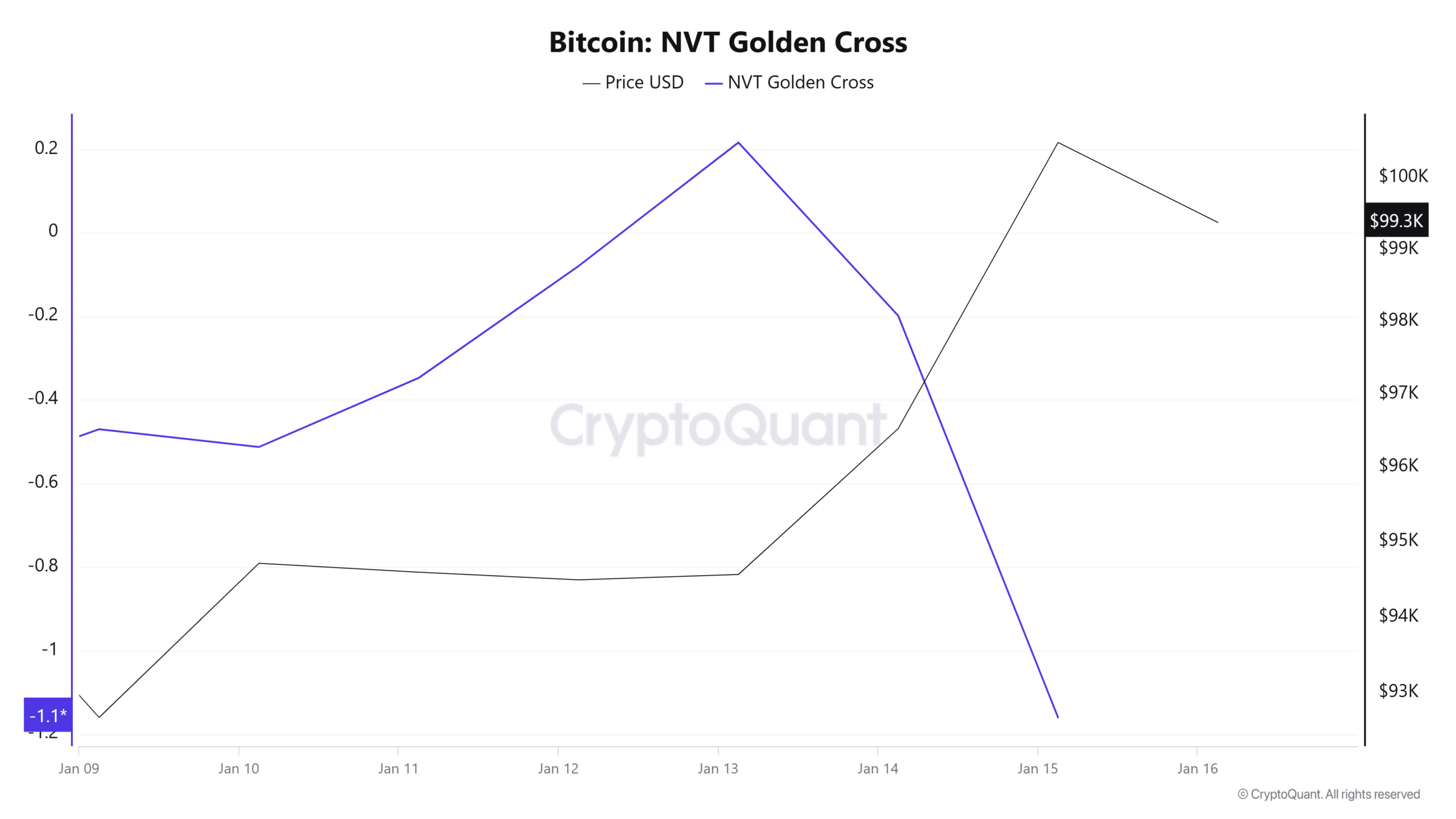

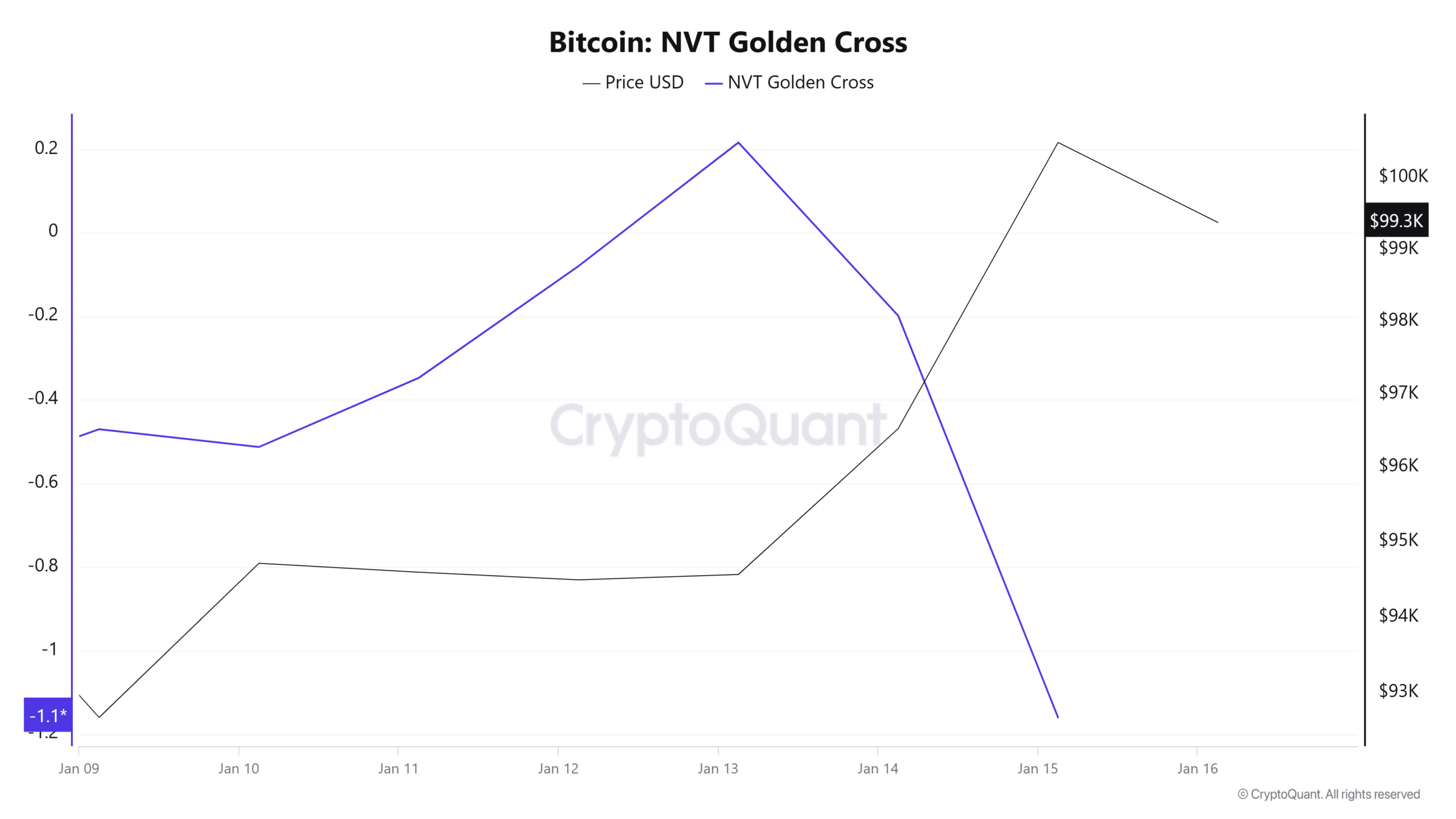

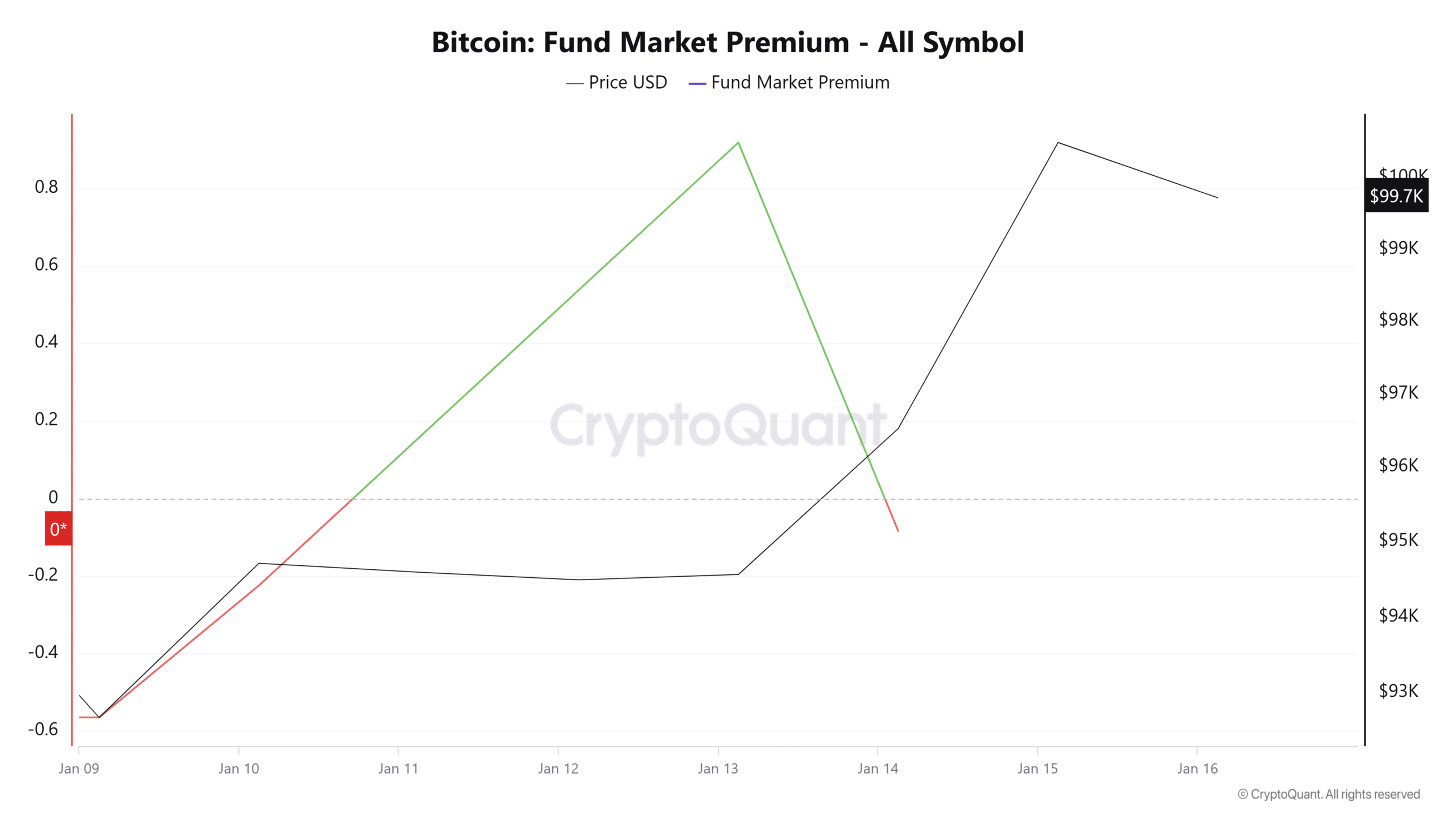

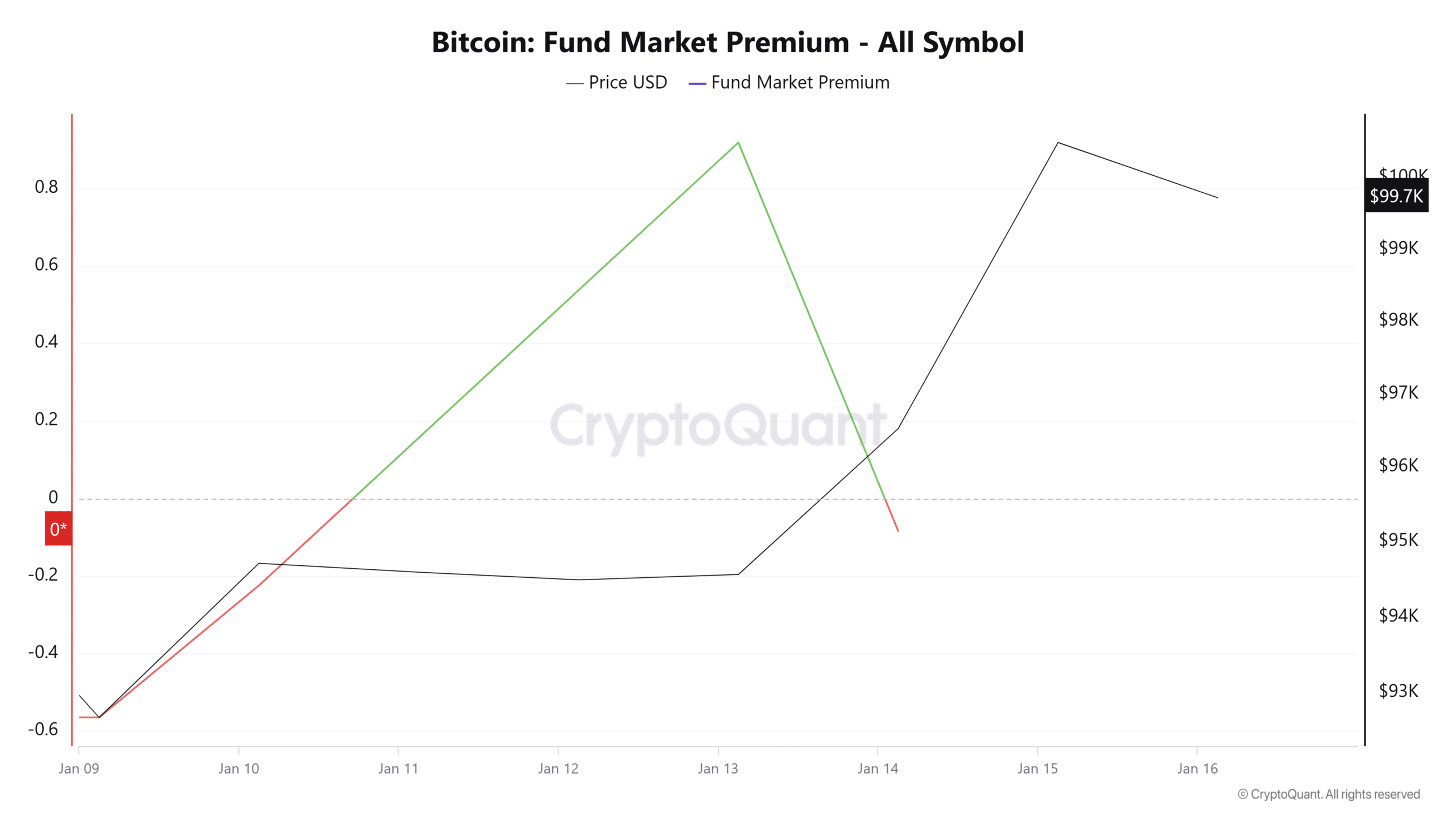

Source: CryptoQuant

For starters, we can see this bearish short term in the declining NVT Golden Cross. This has fallen and has reached the negative zone of -1.1 at the time of writing.

When the NVT gold cross turns negative, it indicates that Bitcoin’s market value is decreasing in proportion to transaction activity.

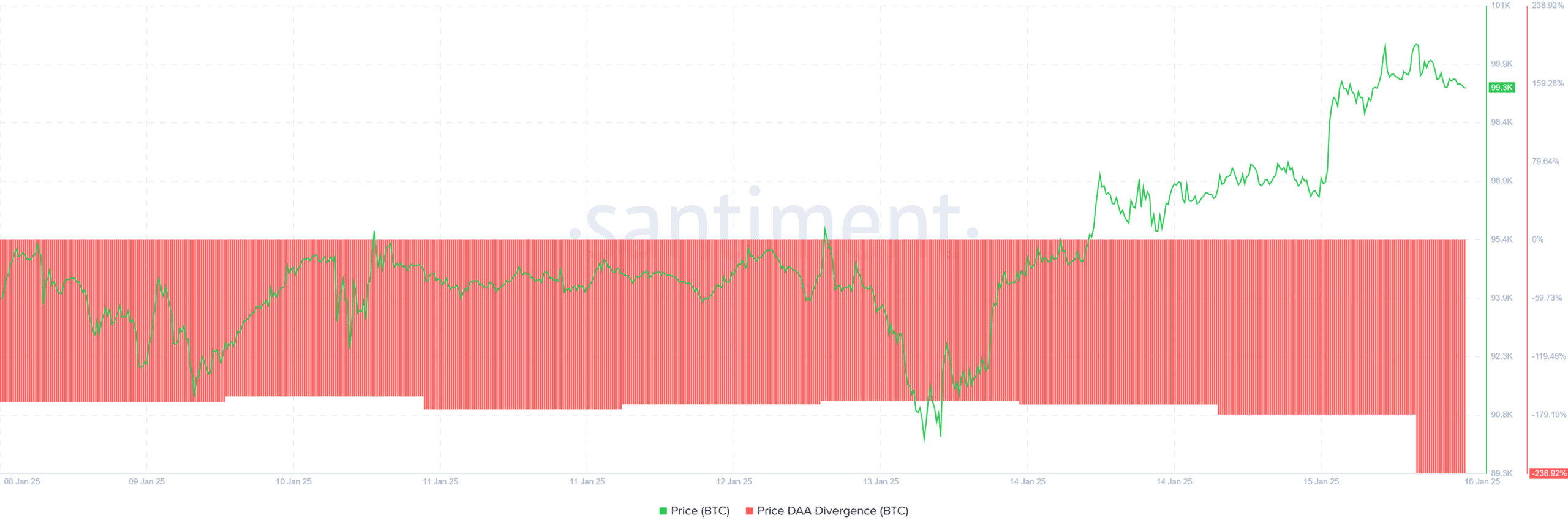

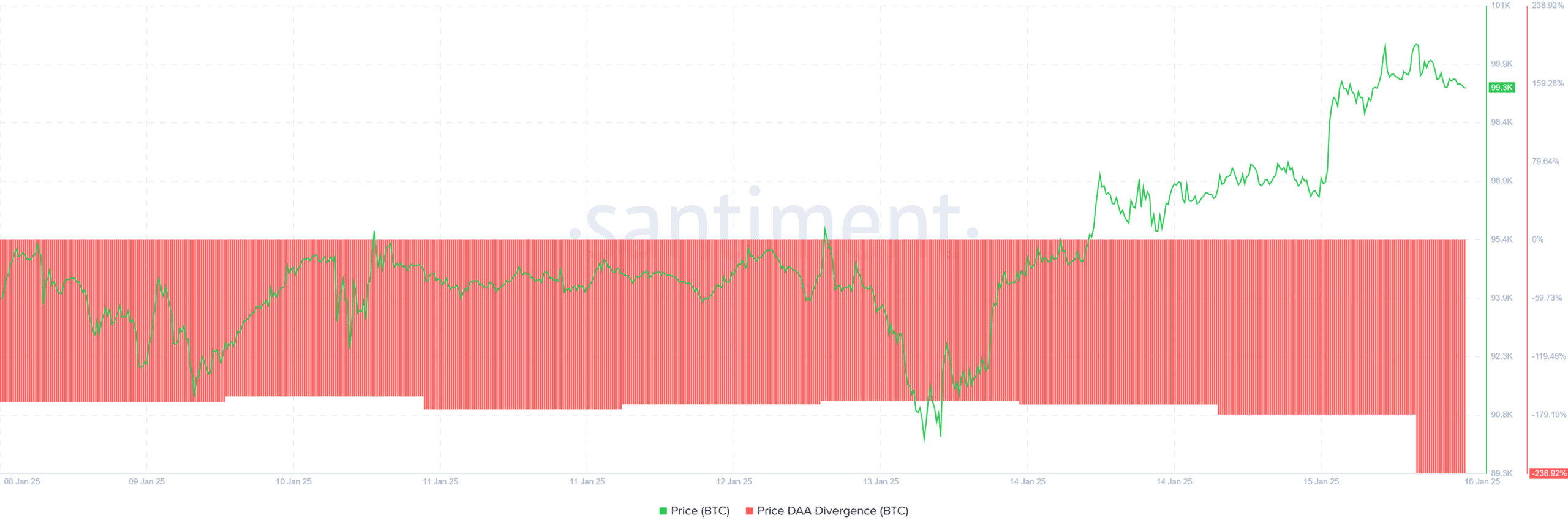

Source: Santiment

This reduced network activity is further confirmed by a negative DAA divergence price. This shows that market fundamentals are weakening and the current BTC value may be unsustainable.

Source: CryptoQuant

Bitcoin’s fund market premium has fallen to -0.08. When the premium in the fund market reaches this level, it indicates that futures prices are trading below spot prices. This indicates a high demand for short positions.

– Read Bitcoin (BTC) price prediction 2025-26

Although Bitcoin has reclaimed $100,000 in the past day, the markets are not healthy enough for a sustained uptrend.

The current gains are driven by speculative activity, especially following the release of US inflation figures.

Therefore, with weakening fundamentals, BTC will continue to consolidate within a range of $94,000 to $100,000.