- More BTC has left the exchanges in recent days.

- BTC was still trading below the $60,000 price range.

Bitcoin [BTC] has seen a significant decline since the beginning of the month. Interestingly, despite this downturn, there has been a notable pullback from the stock markets. This is surprising considering the significant volume of Bitcoin reportedly sold recently.

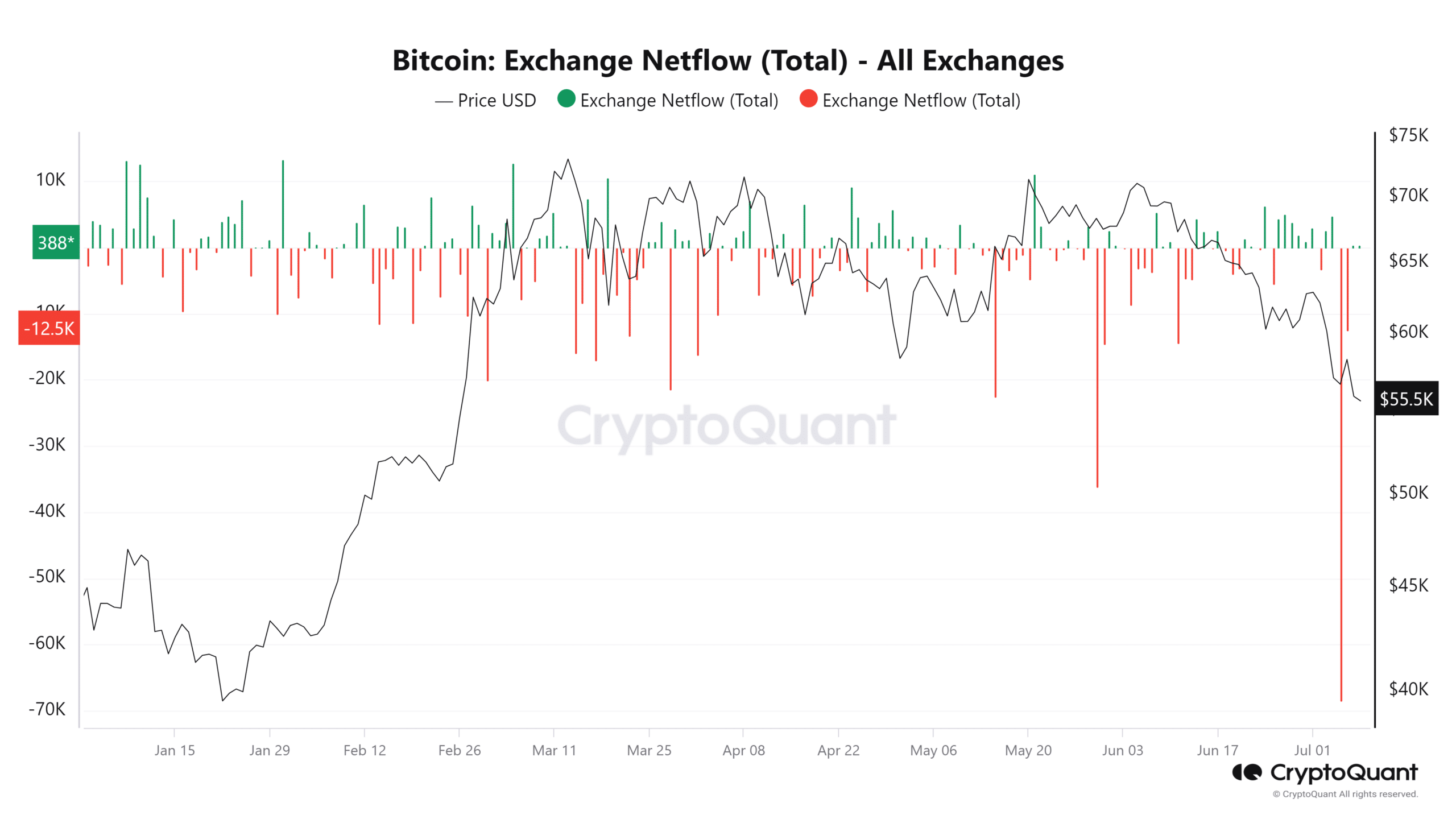

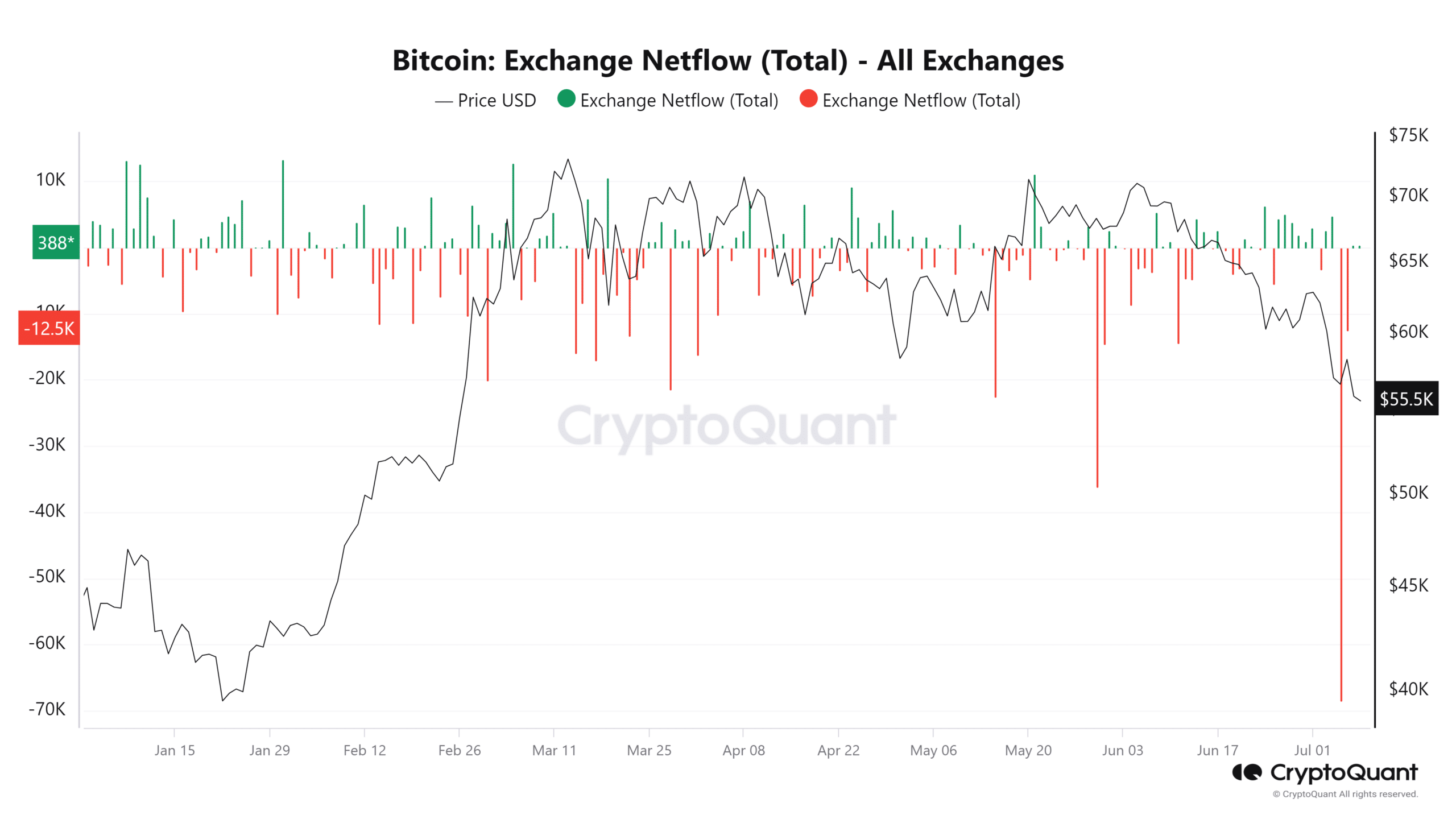

Bitcoin netflow shows massive drawdowns

Recently, Bitcoin has shown an intriguing pattern regarding its flow on exchanges.

Analysis of the flow data on CryptoQuant it turned out that there has been a greater outflow than inflow in recent days. The data shows that July 5 is a significant day, with a net outflow of over -68,500 BTC.

This was also the highest of the year, valued at approximately $3.8 billion based on the day’s exchange rate. The next day also recorded significant outflows, with more than -12,550 BTC leaving the exchanges, worth approximately $730.9 million.

Source: CryptoQuant

This trend of Bitcoin being delisted from exchanges, especially amid a price slump, is notable.

Such moves can usually be interpreted as a bullish signal, indicating that holders are choosing to hold on to their assets rather than sell even if Bitcoin breaks through support levels.

This behavior often reflects a collective expectation among investors that prices can recover, prompting them to withdraw their holdings from their wallets.

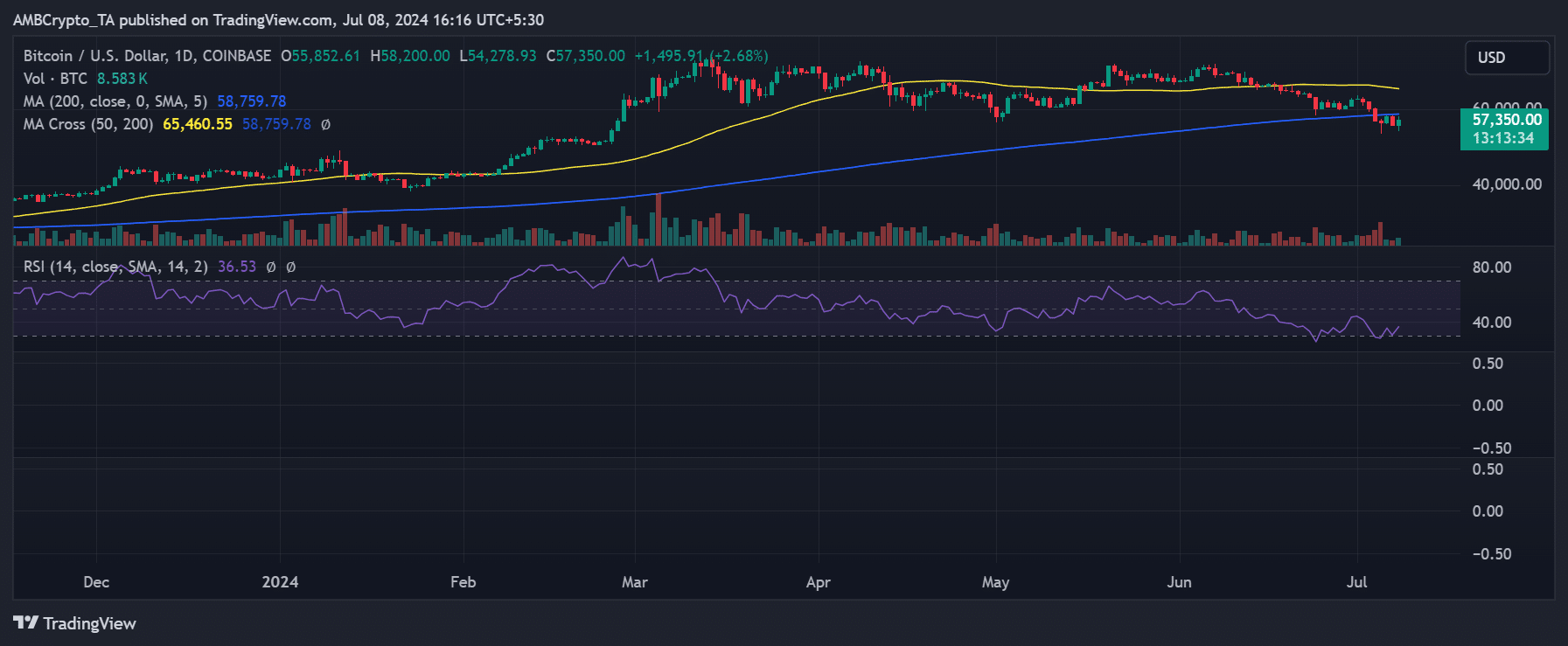

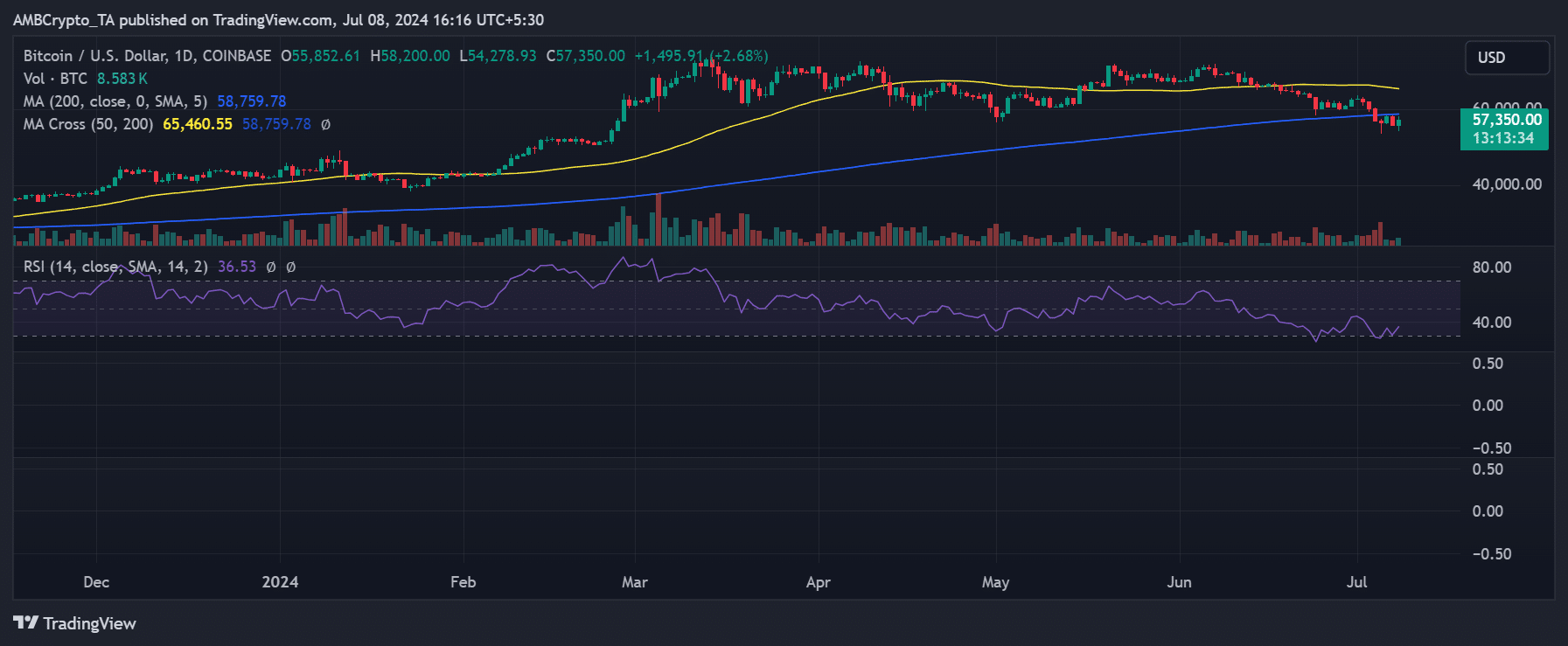

Bitcoin sees a slight improvement

AMBCrypto’s analysis of Bitcoin on a daily timeframe chart highlighted that the long moving average, represented by a blue line, is currently acting as an immediate resistance level. This resistance is around $58,900 to $59,000.

At the time of writing, BTC was trading at around $57,200, marking an increase of over 2%. This increase followed a notable 4.10% decline during the previous trading session, which had taken the price down to around $55,850.

Source: TradingView

Moreover, the Relative Strength Index (RSI) was below 37, indicating that the asset remained in a strong bearish trend. An RSI below this level usually means the asset is oversold, indicating that selling pressure has been prevalent.

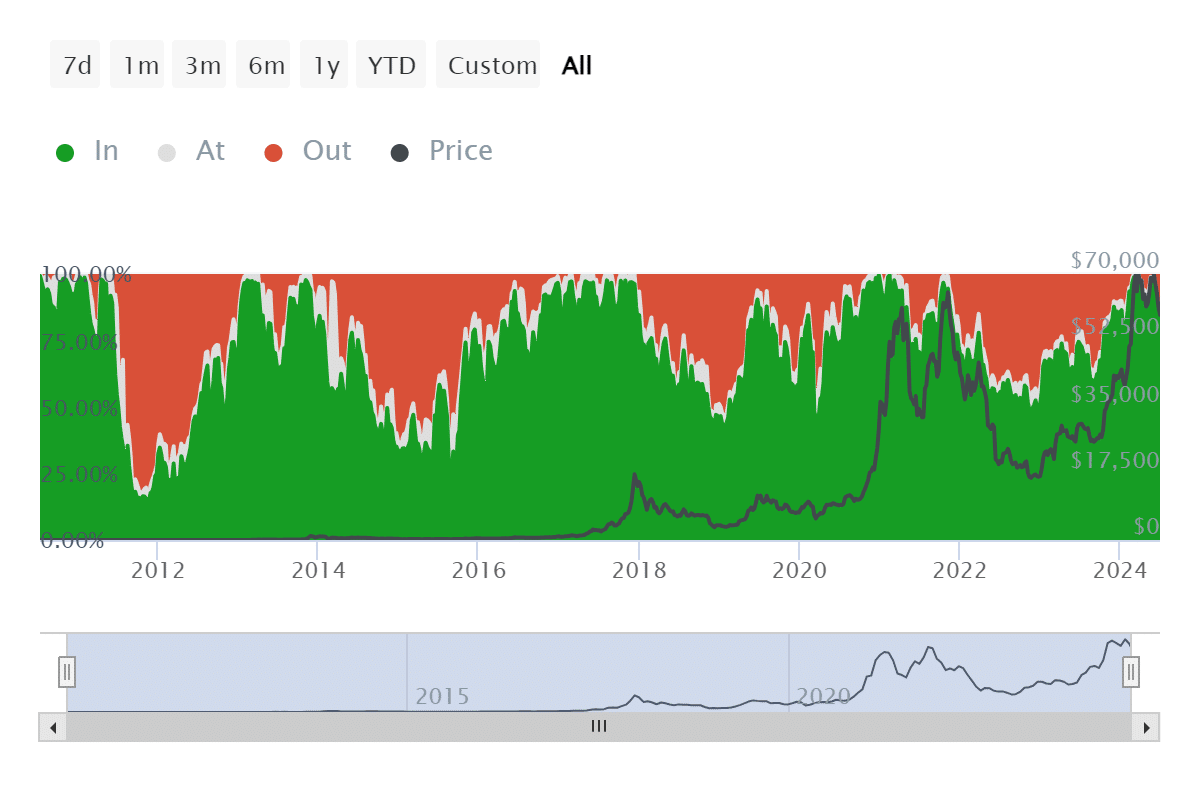

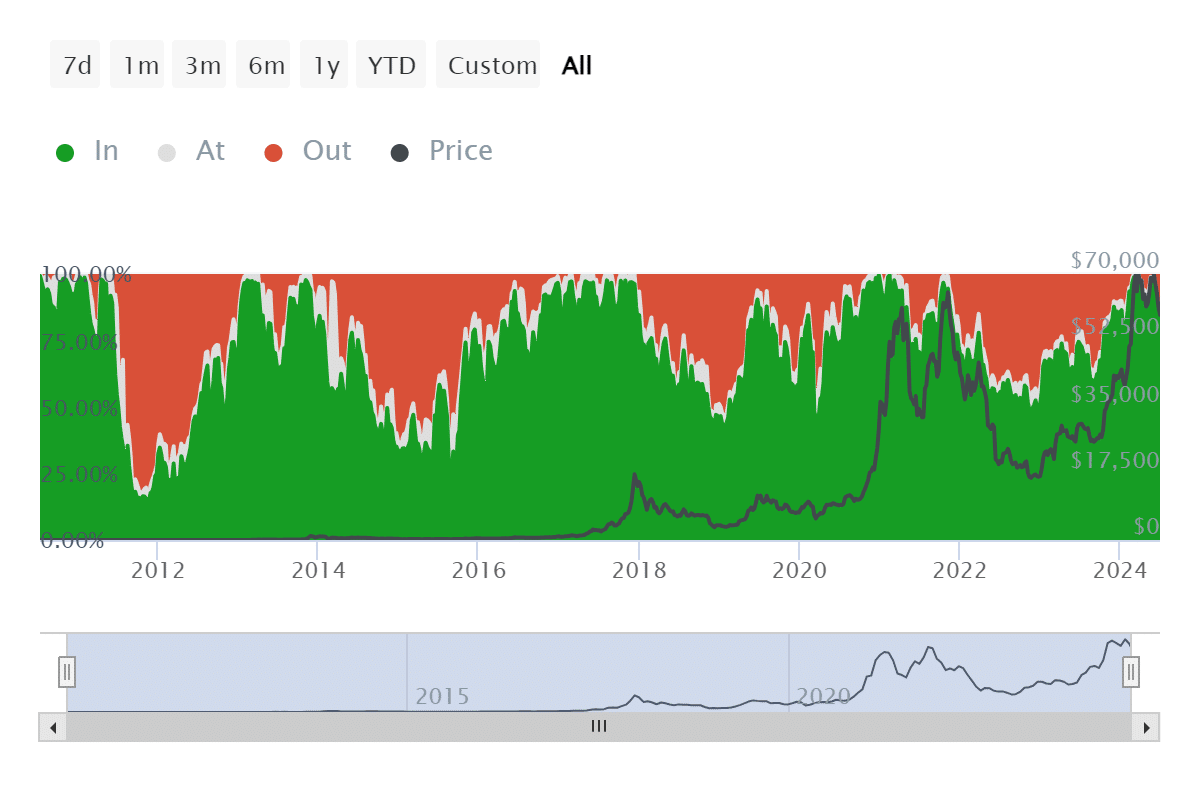

More holders continue to suffer losses

Analysis of InTheBlok The focus on Bitcoin holders’ profitability indicates that many are currently experiencing losses.

Source: IntoTheBlock

Read Bitcoin (BTC) price prediction 2024-25

The Global In/Out of Money index shows that approximately 5.43 million addresses, accounting for almost 64% of all holders, are holding Bitcoin at a loss.

Conversely, approximately 2.87 million addresses, representing almost 34% of holders, are profitable.