- Bitcoin transactions are down.

- Miners are currently underpaid as Runes transactions have dropped.

After the halving, Bitcoin [BTC] Compensation saw an unexpected spike, leading to a corresponding increase in miner compensation.

Runes had emerged as a major contributor to the network’s post-halving transactions. However, this spike has since subsided, resulting in falling transaction costs and falling miner revenues.

Runes continue to contribute to Bitcoin transactions

According to data from Glass junction, Runes has contributed approximately $117 million in transaction fees to date. Notably, more than half of these fees were generated on the day of Bitcoin’s halving.

These transactions and associated fees led to a spike in network activity, providing miners with significant compensation.

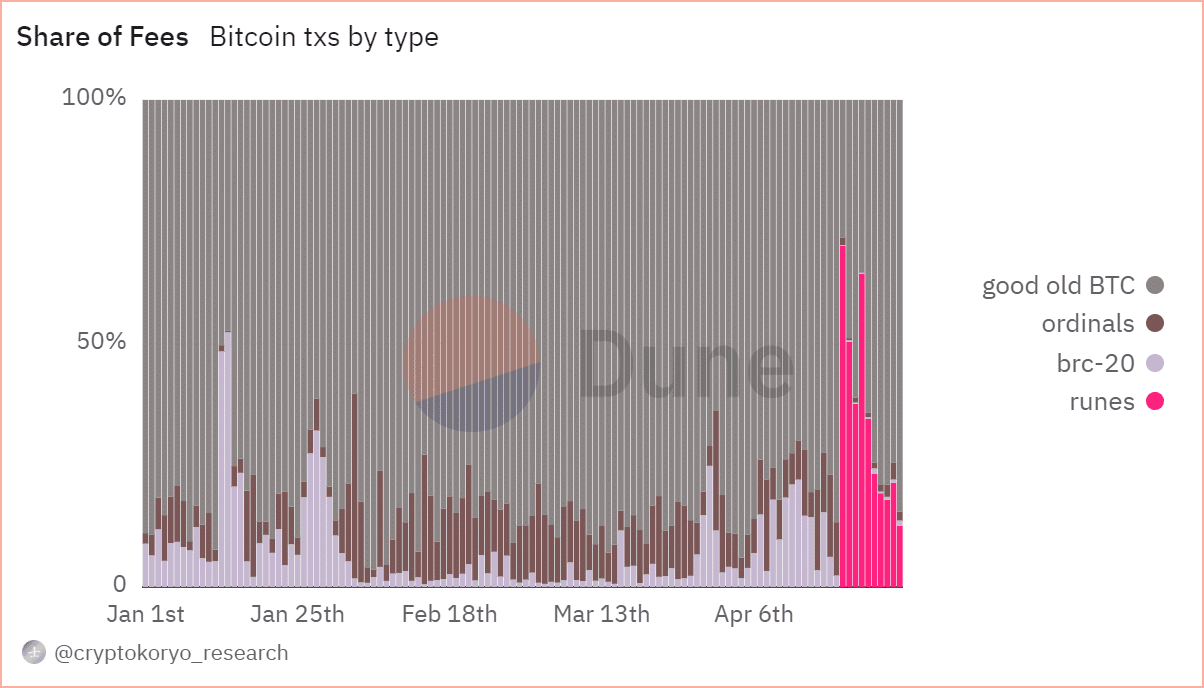

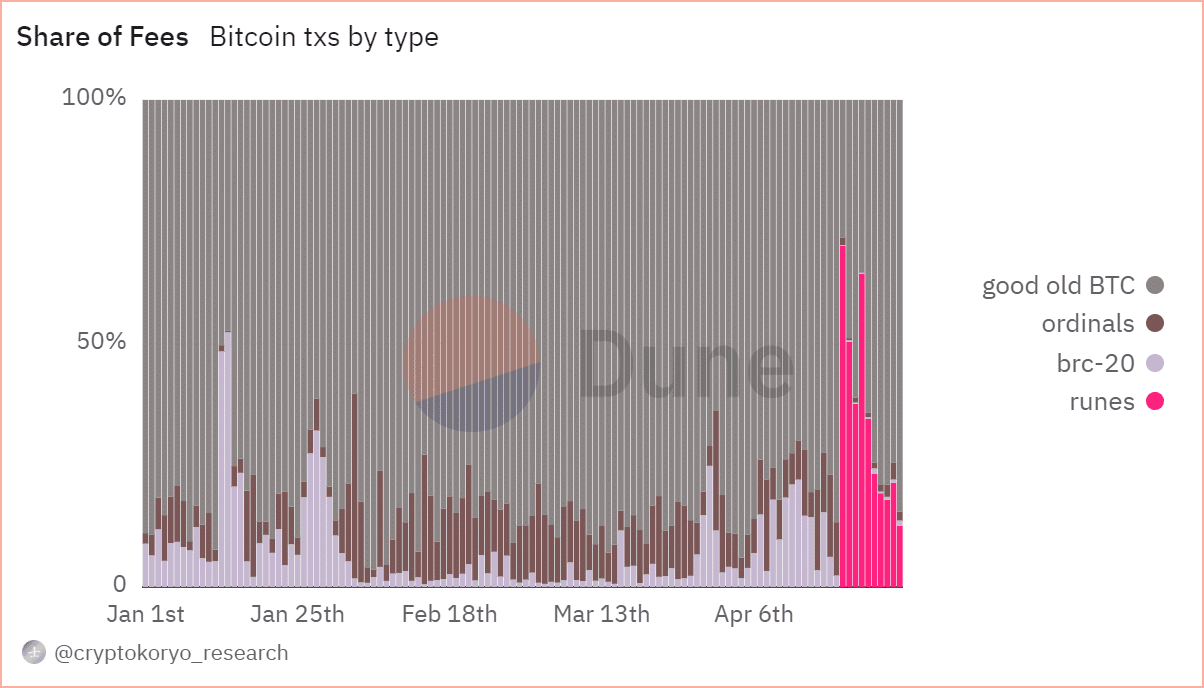

Further analysis conducted on Dune revealed that Runes ranked second in terms of transactions on the network.

Up to the time of writing, Runes accounted for over 19% of total transactions, and that was true the second highest contributor to network fees, although its contribution has declined significantly.

At the time of writing, Runes contributed more than 12% of the total network costs.

Source: Dune Analytics

Runic effect fade on Bitcoin miners

AMBCrypto’s analysis of Bitcoin miner compensation found that they were going through a period of underpayment.

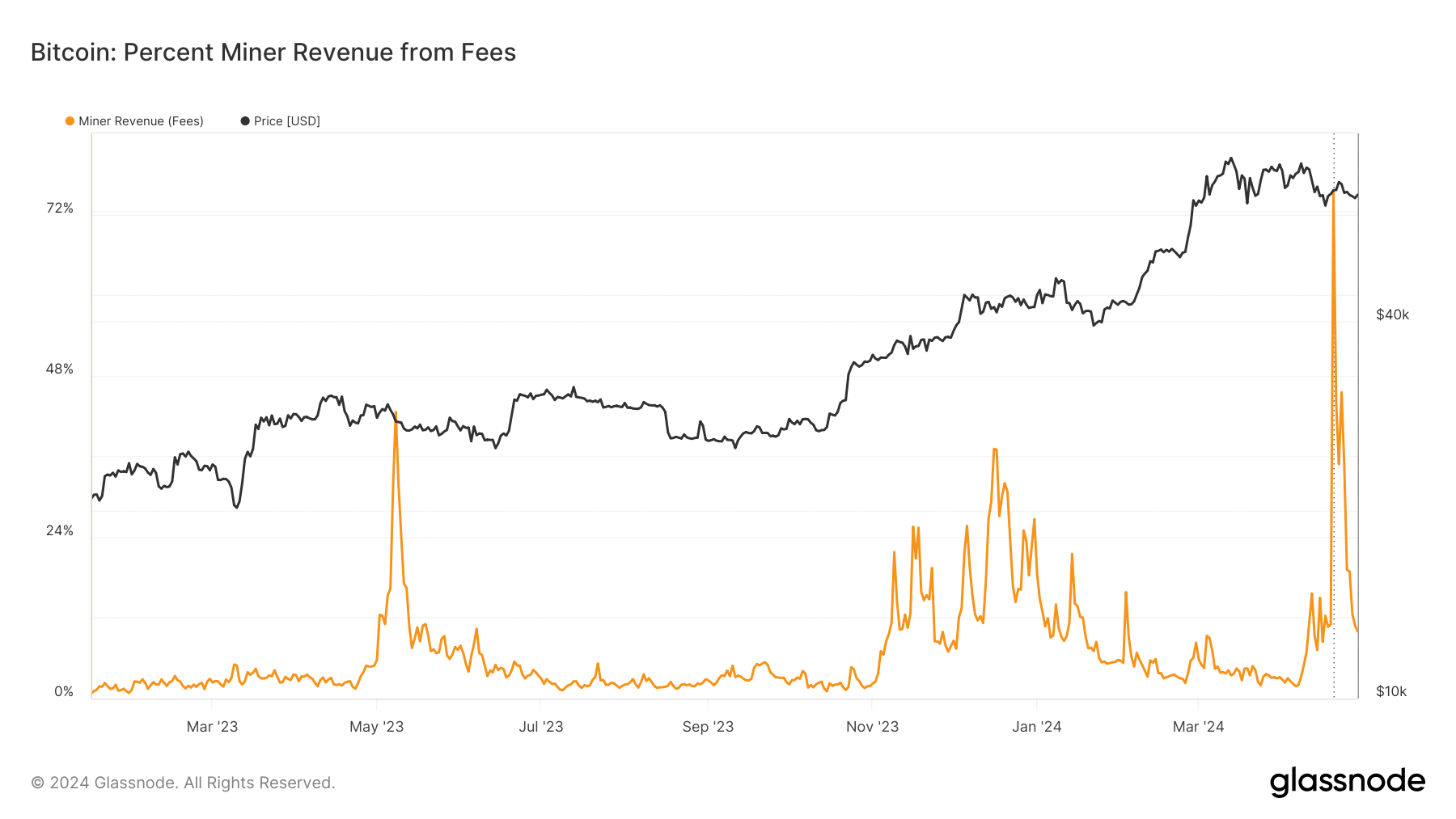

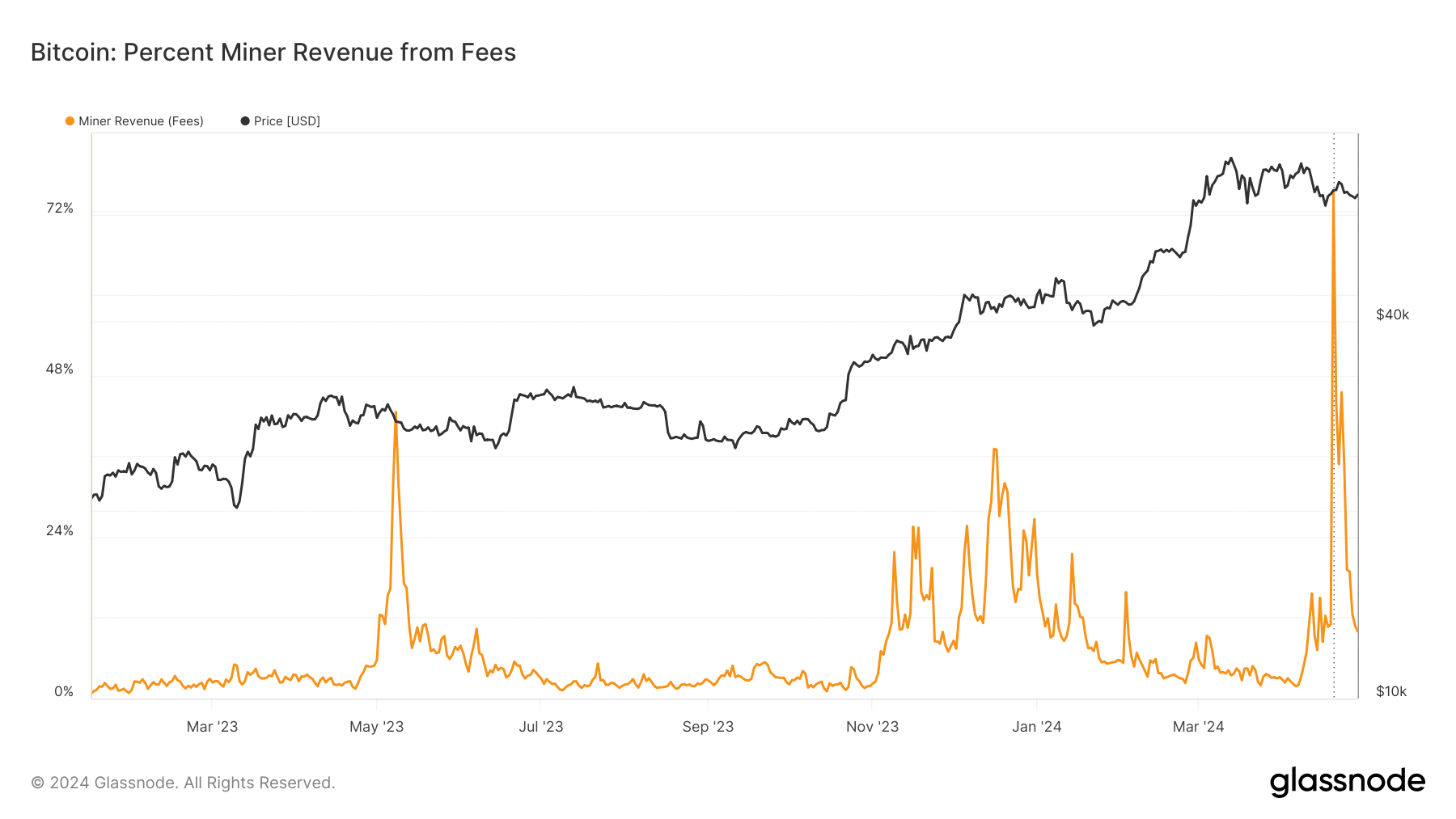

As shown in a Glassnode chart, miners’ earnings have fallen into negative territory, indicating that the difficulty of mining exceeded the reward earned.

Additionally, the fee metric on Glassnode showed a significant drop, hovering around 45 BTC at the time of writing.

Source: Glassnode

The percentage of miner revenues has also seen a notable decline, standing at around 10% at the time of writing. Before this drop, miners’ earnings and fees were over 40% and 1,200 BTC respectively.

This increase in statistics was mainly caused by the spike in transactions caused by Rune. However, with a decrease in Rune transactions, the costs and associated stats have also decreased.

Overall, transaction volume remains low as traders wait for a more positive trend in Bitcoin’s price.

BTC wipes away initial gains

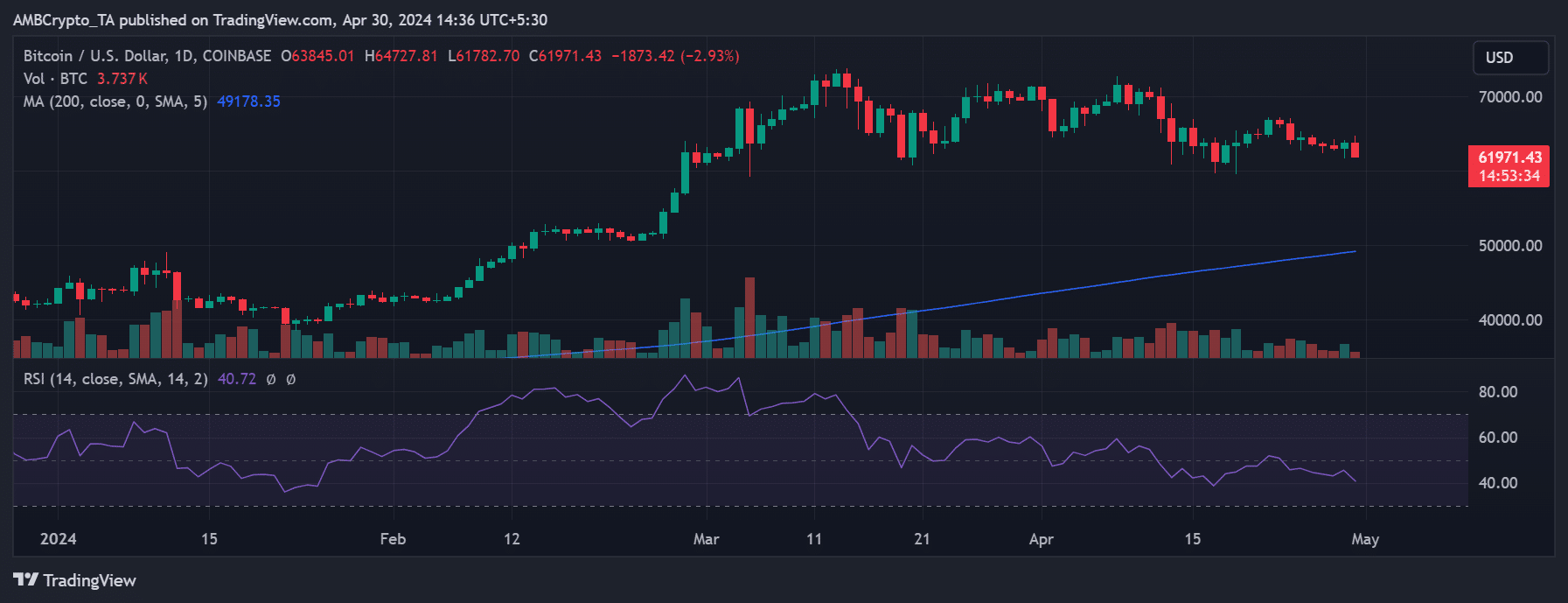

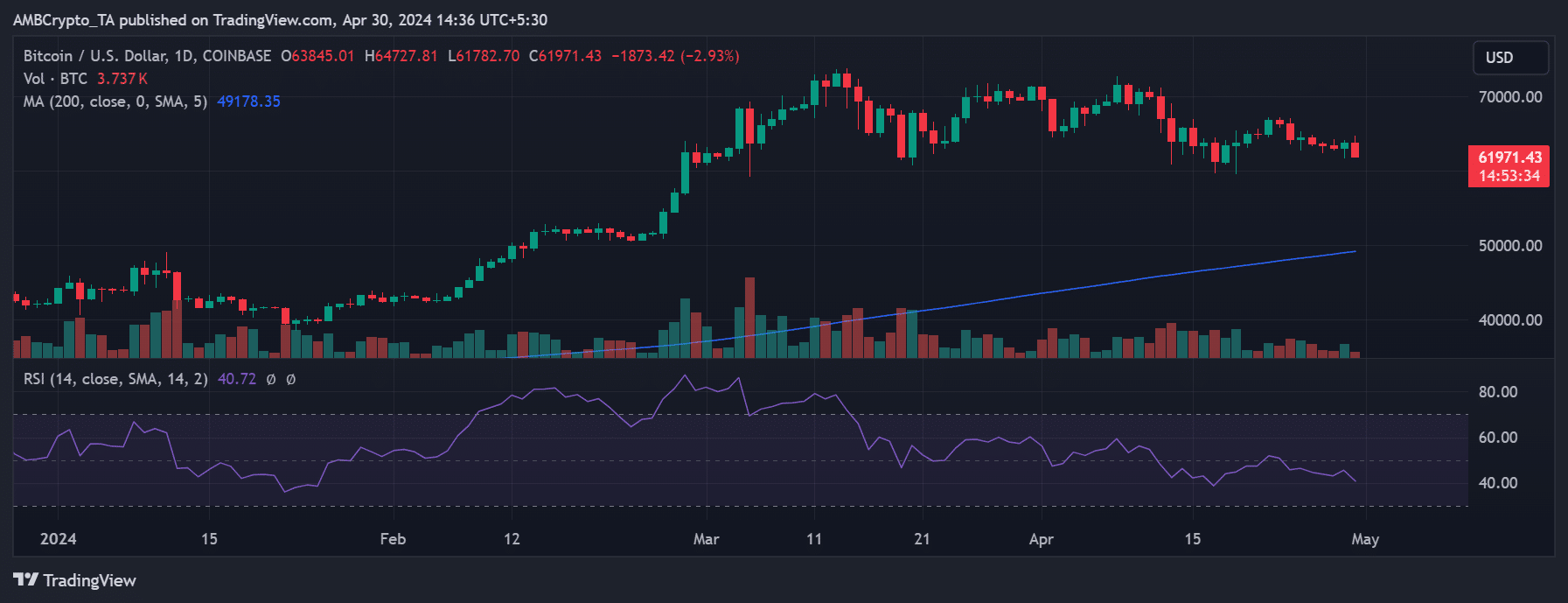

According to AMBCrypto’s daily price trend chart analysis, Bitcoin experienced a negative trend. At the time of writing, BTC was trading at around $61,900, reflecting a decline of almost 3%.

Read Bitcoin’s [BTC] Price forecast 2024-25

This marked a reversal from the positive trend observed during the previous trading session, which saw BTC gain more than 1%.

Source: TradingView

Furthermore, the Relative Strength Index (RSI) indicated that the bearish trend was getting stronger as it moved further away from the neutral line.