- Despite the recent decline, more Bitcoin holders have continued to make profits.

- BTC was trading above $66,000 at the time of writing.

Bitcoins [BTC] Recent price movements have impacted several classes of holders, with some making notable gains.

A study of when BTC was held, the purchase price versus the current price, and other factors revealed which class of holders had the most positive experience.

Bitcoin is trading for over $66,000

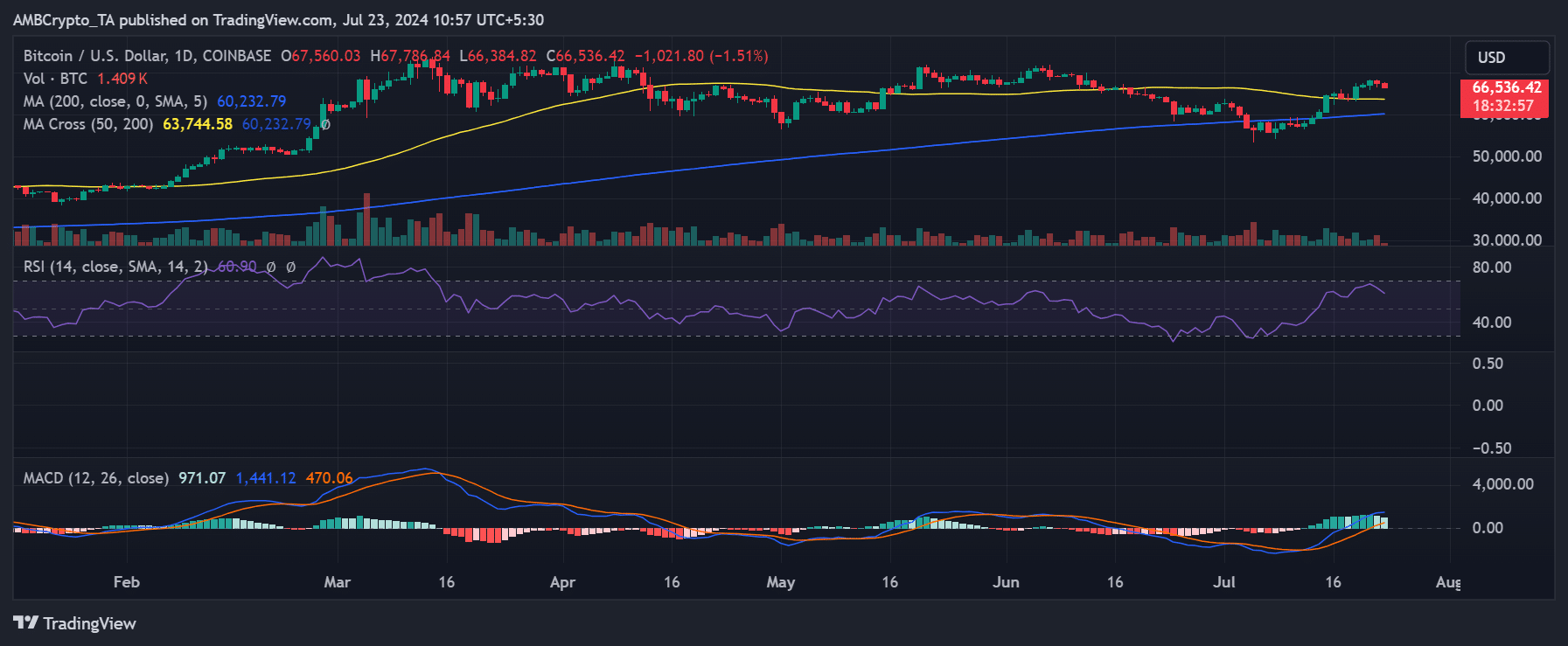

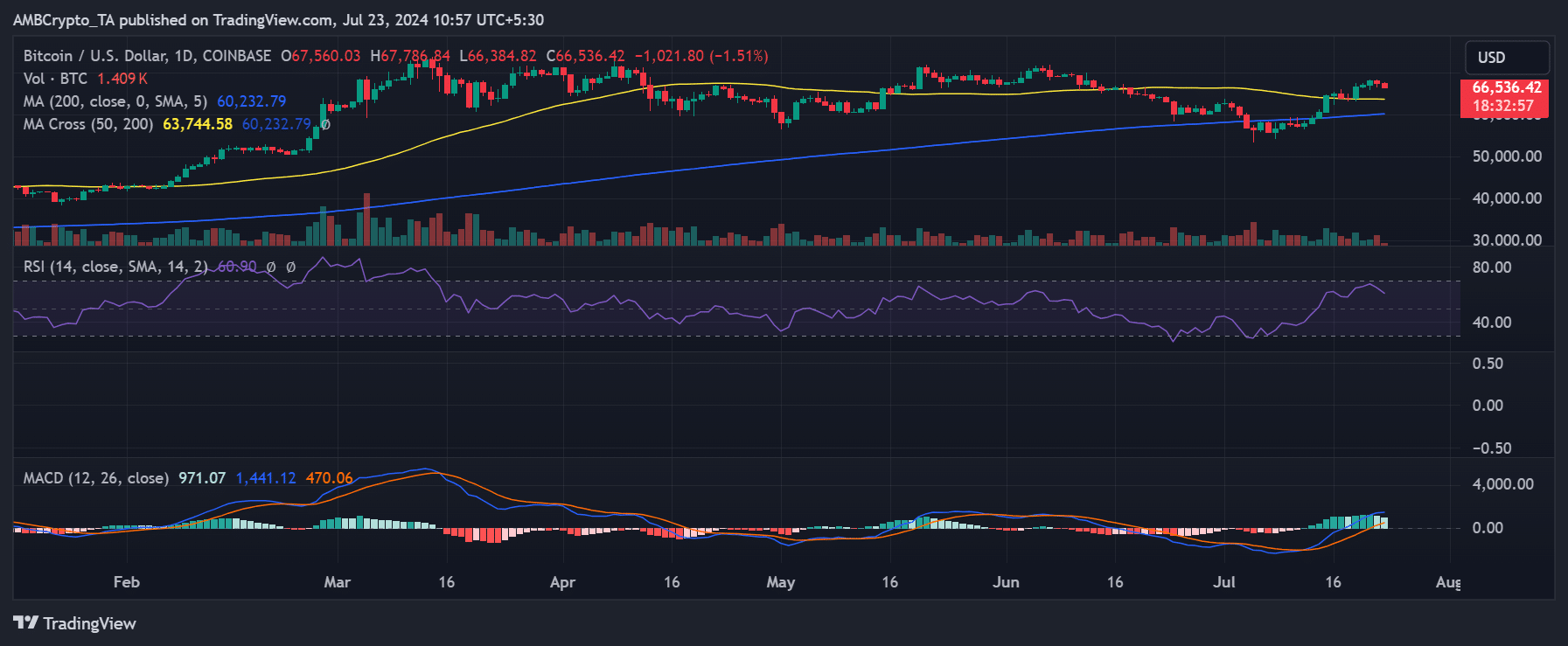

Bitcoin’s price trend analysis on a daily time frame highlighted a series of recent upward trends that have allowed it to regain a significant price level.

According to an analysis by AMBCrypto, the price of BTC rose to over $68,000 on July 21, marking an increase of more than 1%.

This increase peaked after several days of upward movement, an important recovery given the sharp decline at the beginning of the month.

Source: TradingView

Despite this positive momentum, some gains were subsequently lost, but the value remained above the $60,000 threshold. At the time of writing, the stock was trading around $66,500, down slightly by more than 1%.

How the increase affected holders

The analysis of the Global In/Out of Money Index on InHetBlok provided a compelling overview of the current state of Bitcoin.

Most holders are in a profitable position at the time of writing the BTC price. In concrete terms, almost 49 million addresses, representing more than 92% of all holders, were profitable.

This demonstrated the overall health of the market and the gains most participants have experienced during previous price increases.

Conversely, approximately 2.2 million addresses, representing approximately 4.14% of holders, suffered losses, indicating that these holders may have purchased their assets at a higher price point.

In addition, approximately 2 million addresses were at a break-even point, neither in profit nor loss, representing approximately 3.78% of all holders.

These statistics underlined a largely bullish sentiment in the Bitcoin market. The Relative Strength Index (RSI), around 60, further reinforced this sentiment.

An RSI reading above 50 generally indicated bullish momentum, indicating that the market could continue to see positive trends.

Long-term holders benefit from more profit

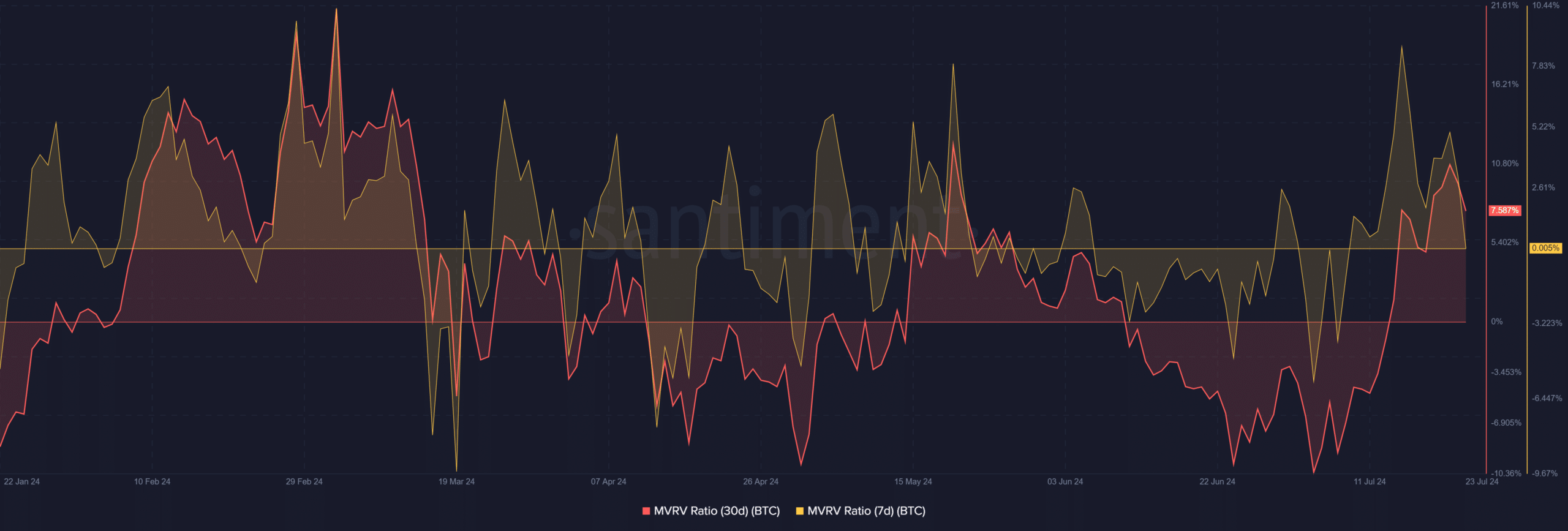

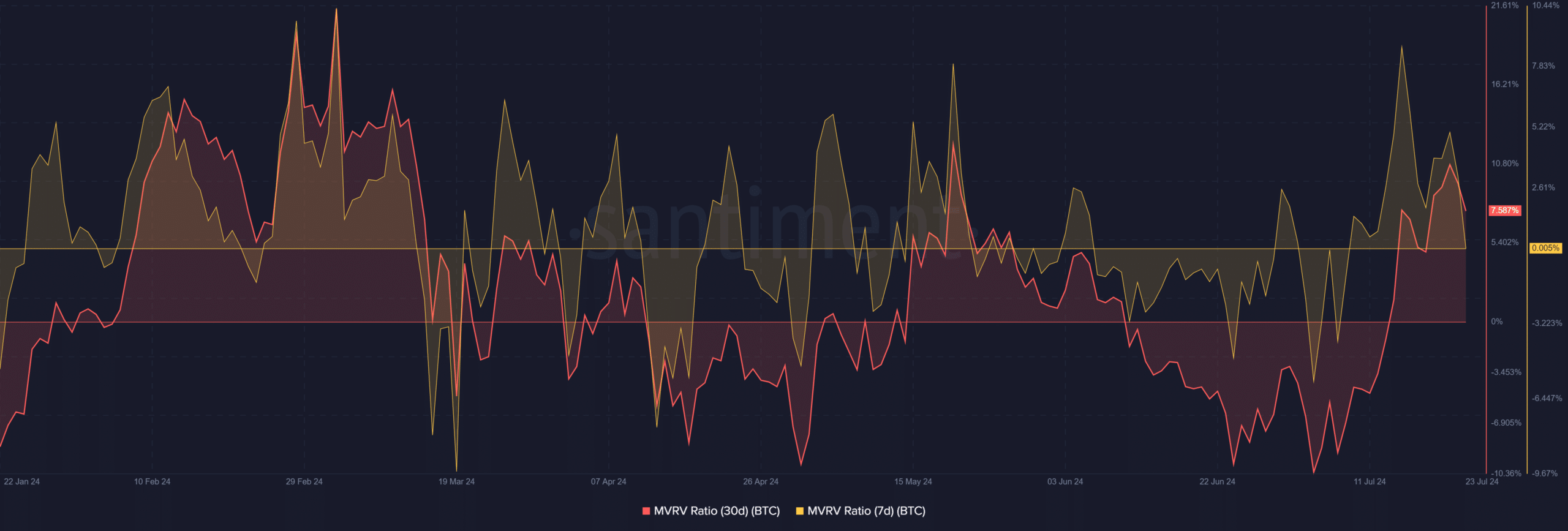

AMBCrypto’s look at Bitcoin’s market value to realized value (MVRV) ratios over different time frames provided valuable insights into the performance of different categories of holders.

Read Bitcoin’s [BTC] Price forecast 2024-25

The seven-day MVRV was around 0.6%, indicating a marginal gain for recent buyers. However, this value fell, indicating that short-term gains for these recent buyers were waning.

Source: Santiment

In contrast, the 30-day MVRV painted a more favorable picture for longer-term holders, at over 8%. So, those who bought Bitcoin a month ago have made significantly higher profits than more recent buyers.