- Why Bitcoin could be showing signs of a volatility resurgence and a possible breakout.

- BTC whale activity is increasing as currency flows are expected to rise in the coming days.

Bitcoin [BTC] has been trading within a narrow range over the past fifteen days, supported by low volatility.

It has shown resistance near the $61,000 level during that time, resulting in a pullback every time it moves near or above that zone.

The king coin has once again managed to rise above the $61,000 price level in the past 24 hours. This time, however, there are some notable observations that could indicate growing bullish momentum.

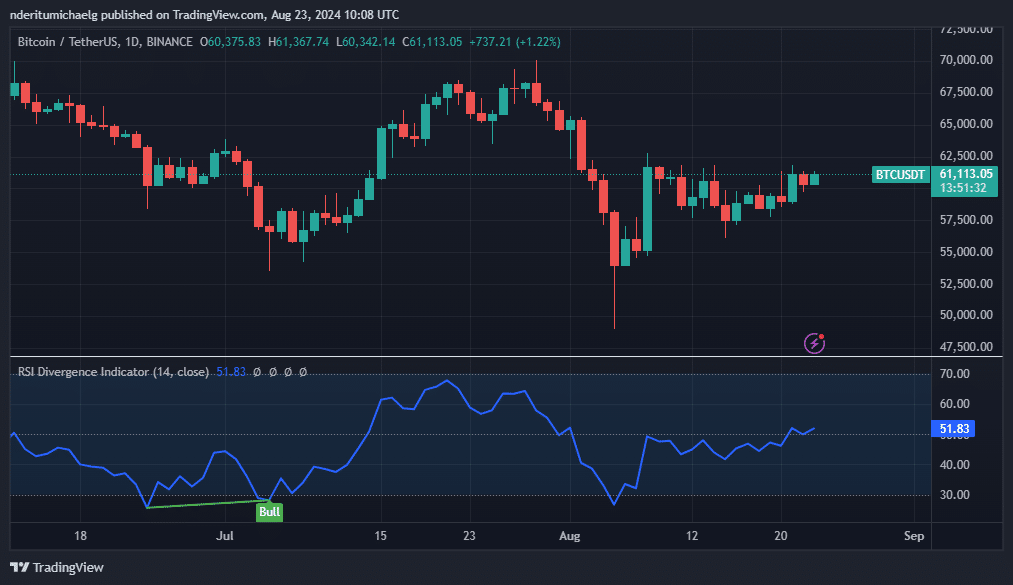

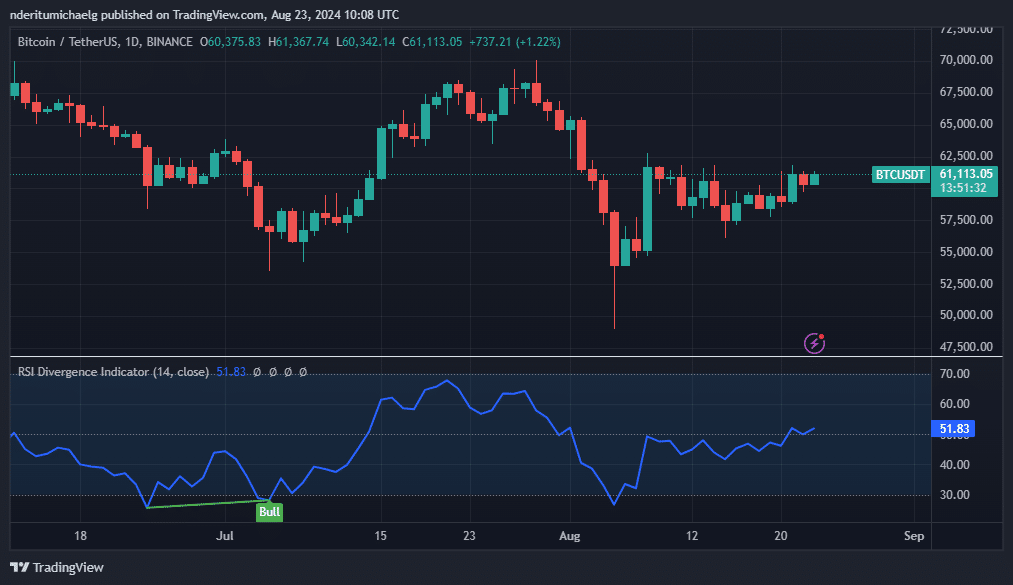

For starters, BTC’s RSI has struggled to break above the 50% level since the crash that occurred earlier this month.

However, the recent mid-week bullish push pushed the index above the mid-level of the RSI, and the rise over the past 24 hours has shown resilience above that level.

Source: TradingView

The behavior of the RSI indicates that Bitcoin is experiencing a gradual resurgence of bullish momentum, which could support the price action in the short term.

This could spill over into the weekend, potentially pushing BTC out of the sideways range.

Bitcoin signs at a crucial moment

Bitcoin could benefit from an influx of liquidity to establish robust upside potential. Coincidentally, the NASDAQ just formed a bearish divergence pattern, meaning a resurgence in selling pressure could cause liquidity to flow from stocks to Bitcoin.

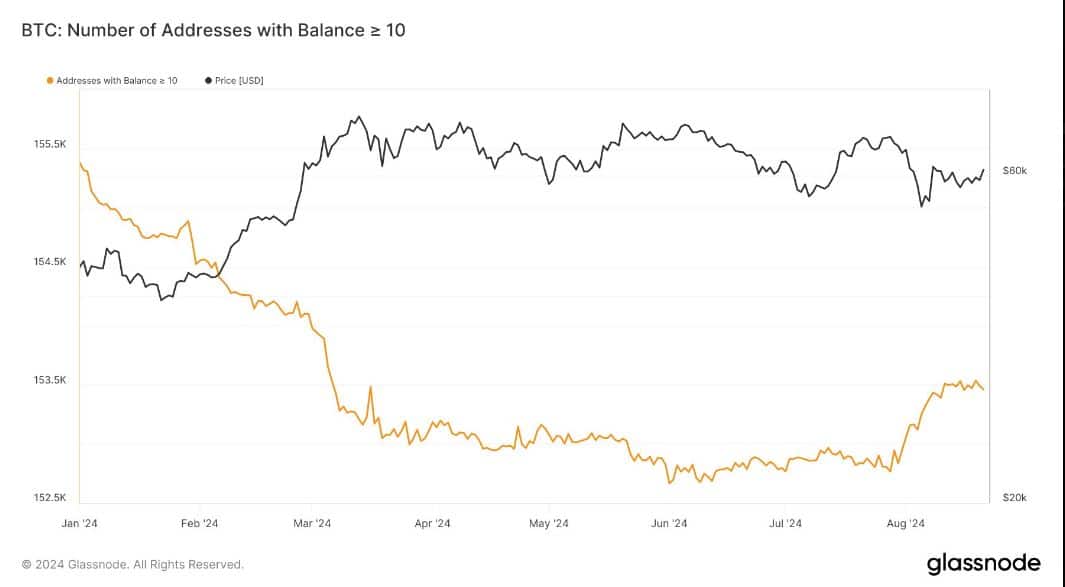

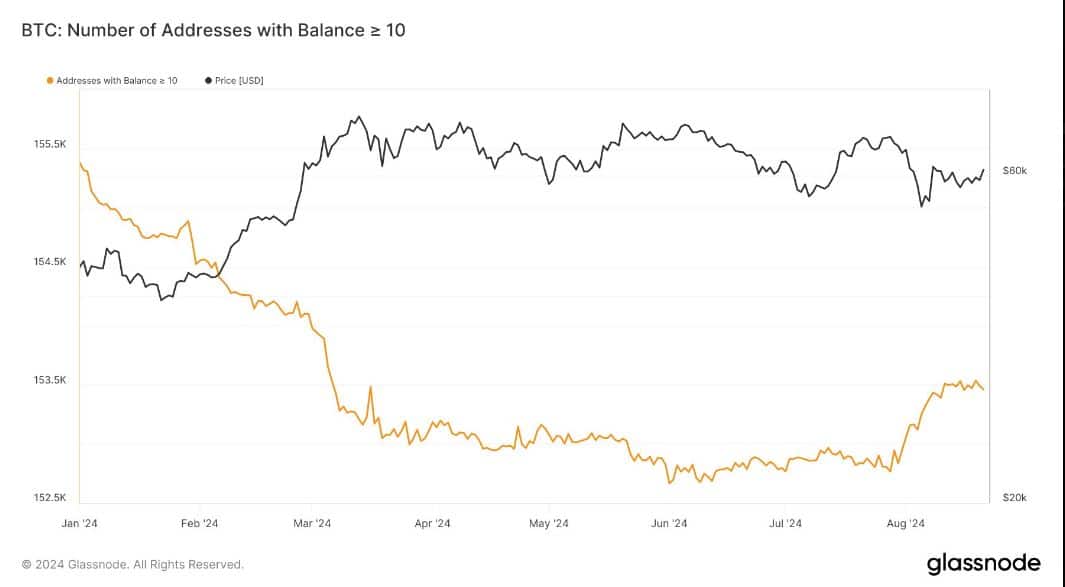

Meanwhile, Bitcoin whale activity has increased. The number of addresses with at least 10 BTC has increased in recent days.

Source: Glassnode

The growing whale activity suggested that Bitcoin was moving closer to exiting the current low volatility range. Bitcoin exchange flows also brought to light another important observation worth mentioning.

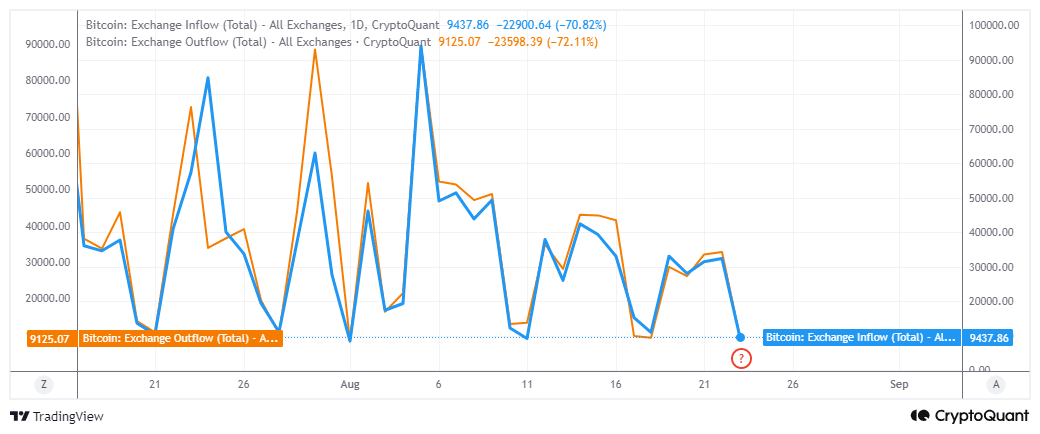

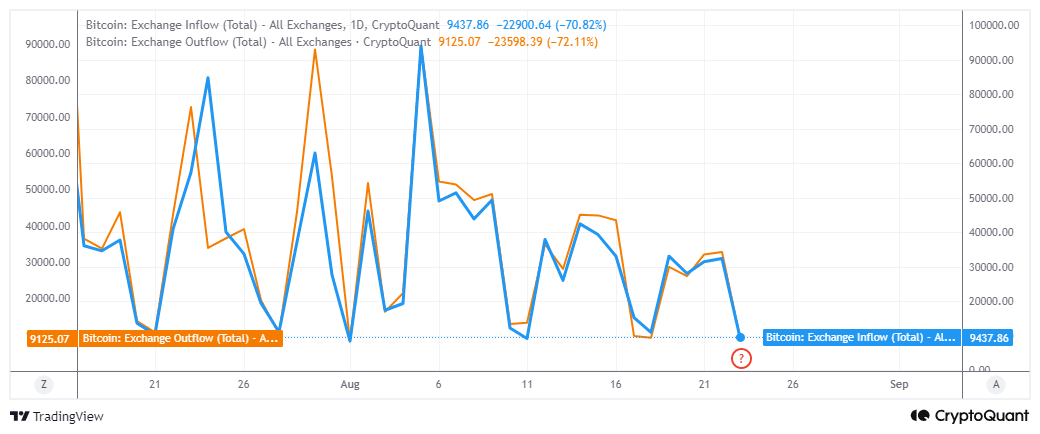

Currency flows have been quite cyclical in recent months, with peaks and troughs.

Although the peaks in the exchange currents were different for the most part, the lower range was relatively consistent. Exchange flows fell to the same low range over the past 24 hours.

Note that foreign exchange outflows were slightly higher than inflows at the time of writing.

Source: CryptoQuant

The chart above indicates that currency flows are about to reverse upwards. This means that the market will experience higher exchange rate flows in the coming days.

As a result, Bitcoin price volatility could be in favor of an upswing in the coming days.

Read Bitcoin’s [BTC] Price forecast 2024-25

The observation that whale activity is making a comeback could indicate a greater chance of Bitcoin bulls taking control in the coming week.

A stronger move can be expected if the US Federal Reserve announces interest rate cuts.