- Bitcoin’s bull run was driven by Spot Bitcoin ETFs and rising confidence among US investors.

- MicroStrategy’s continued Bitcoin purchases and Trump’s crypto stance added fuel to the rally.

Bitcoin [BTC] has once again reached the $100,000 mark – a dramatic recovery that has reignited interest in the coin. As BTC embarks on a bull run, one factor stands out; the increasing role of American investors.

This surge in buying activity has been driven in part by the adoption of Spot Bitcoin ETFs, which have not only legitimized Bitcoin in the eyes of institutional players but also reinforced bullish sentiment among retail investors.

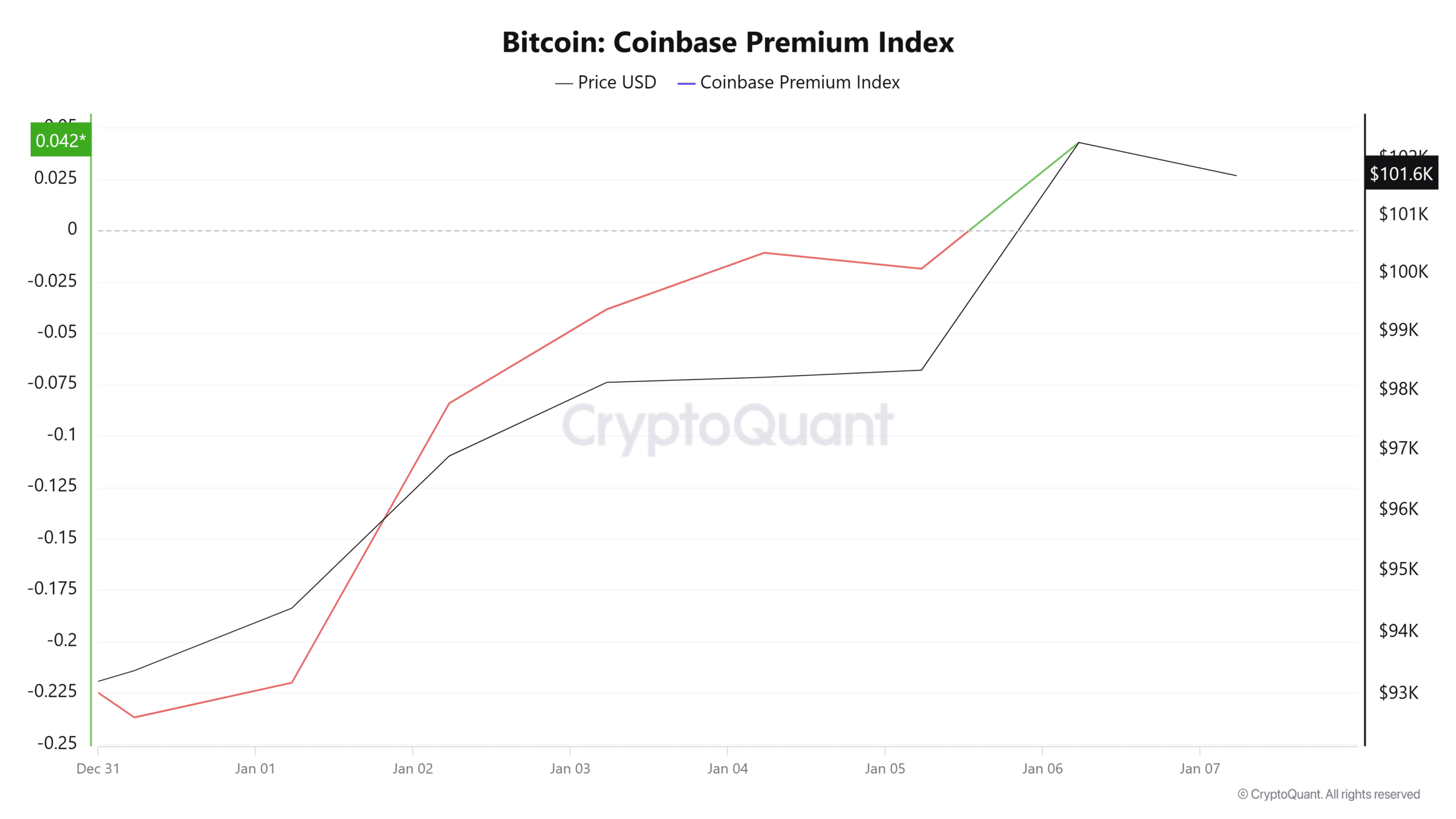

In addition to these developments, key indicators such as the Coinbase Premium Index and the large outflow of Bitcoin from the exchanges indicate a growing dominance of US market participants.

Bitcoin: a comeback to $100,000

MicroStrategy has been a key player in Bitcoin’s recent surge, buying more BTC for the ninth week in a row. The company now owns a whopping 447,470 Bitcoins, worth $27.97 billion.

This strategic purchase undoubtedly contributed to Bitcoin’s rise above the $100,000 mark.

Furthermore, with Donald Trump set to be inaugurated as US President on January 20, optimism is growing about a favorable crypto environment under his leadership.

Trump himself has floated the possibility of a Bitcoin fund for the US, further fueling enthusiasm.

This combination of institutional support and political developments has helped Bitcoin break significant price barriers, indicating a positive outlook.

US Investors and the Positive Coinbase Premium Index

The Coinbase Premium Index, which recently turned positive, highlights the crucial role of US investors in driving Bitcoin’s upward momentum.

A positive CPI reflects increased demand for Bitcoin on US exchanges such as Coinbase compared to their global counterparts, indicating stronger buying pressure from US market participants.

Source: Cryptoquant

This shift follows the launch of spot Bitcoin ETFs, which has increased the enthusiasm of both institutional and retail investors.

As Bitcoin passed the $100,000 mark, US investors appear to be leading the rally, capitalizing on renewed confidence in the asset’s long-term potential.

4,012 BTC outflow from Coinbase

A single block outflow of 4,012 Bitcoin from Coinbase sent ripples through the market, demonstrating robust accumulation activity.

Such substantial outflows are often associated with large institutional players or wealthy investors safeguarding their assets in cold storage.

This is consistent with the $100,000 Bitcoin bull run as strategic whale moves reinforce the narrative of continued bullish momentum.

Notably, these outflows coincide with the increasing dominance of US investors and the positive turn in the CPI. As the supply of Bitcoin on the exchanges decreases, the scarcity effect is amplified, pushing prices further higher.

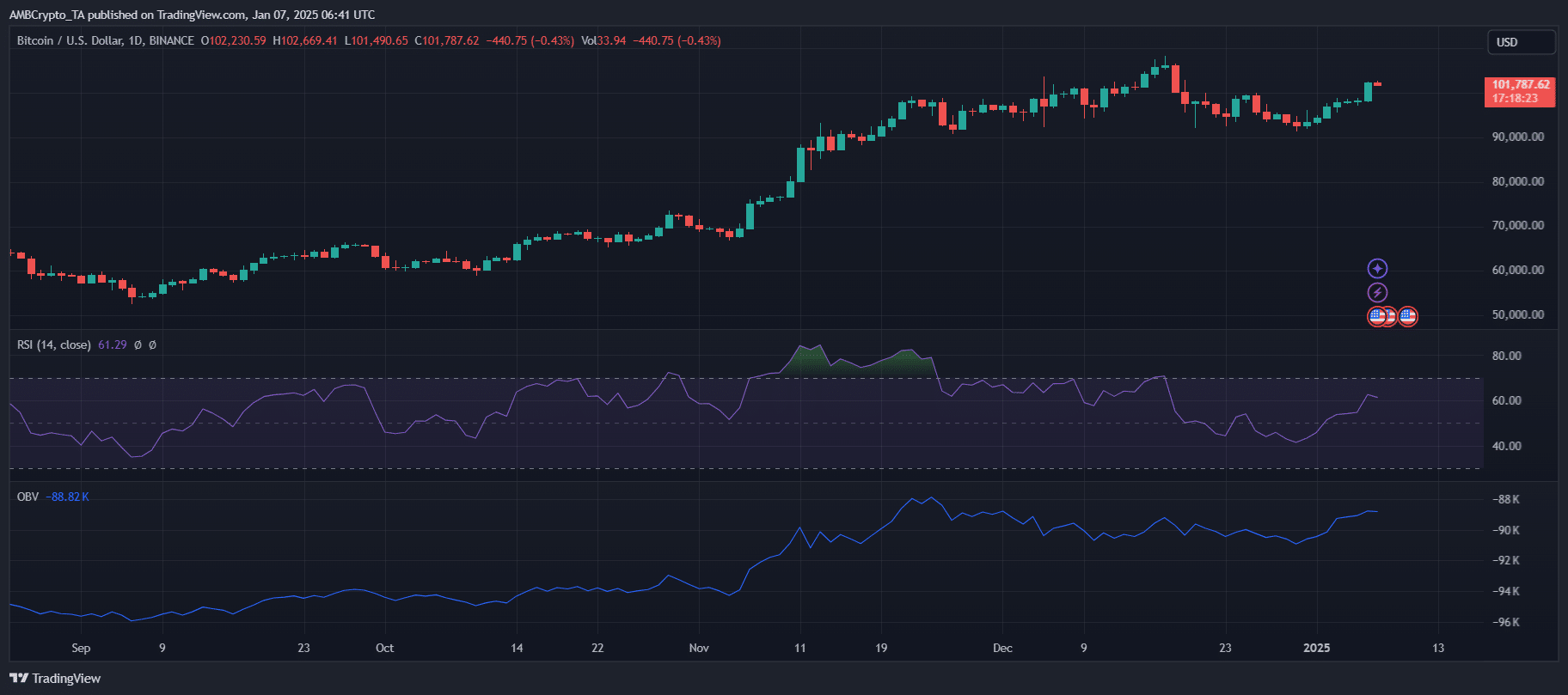

Break through resistance or retest key levels?

As Bitcoin consolidates above $100,000, the next move depends on breaking the critical resistance around $105,000.

The RSI at the time of writing indicated moderate bullish momentum with room for further upside before entering overbought territory.

Meanwhile, the OBV suggested that accumulation was underway, driven by institutional interest and dwindling foreign exchange reserves.

Source: TradingView

Read Bitcoin’s [BTC] Price forecast 2025-26

A decisive breakout above $105,000 could target $120,000, supported by psychological buying triggers. However, failure to maintain current levels could result in a retest of $95,000, a key support area.

With volatility likely, investors should keep a close eye on whale activity and macroeconomic signals for direction clarity.