A closely watched crypto strategist believes the overextended Bitcoin (BTC) bears are about to be wiped out.

The anonymous host of the YouTube channel InvestAnswers says he sees a short squeeze coming for BTC.

A short squeeze occurs when traders who borrow assets at a certain price in the hope of selling them at a lower price to pocket the difference are forced to buy back the borrowed assets when momentum turns against them. triggering further rallies.

According to the analyst, Bitcoin bears are heavily shorting BTC, fueling the market for potential rallies.

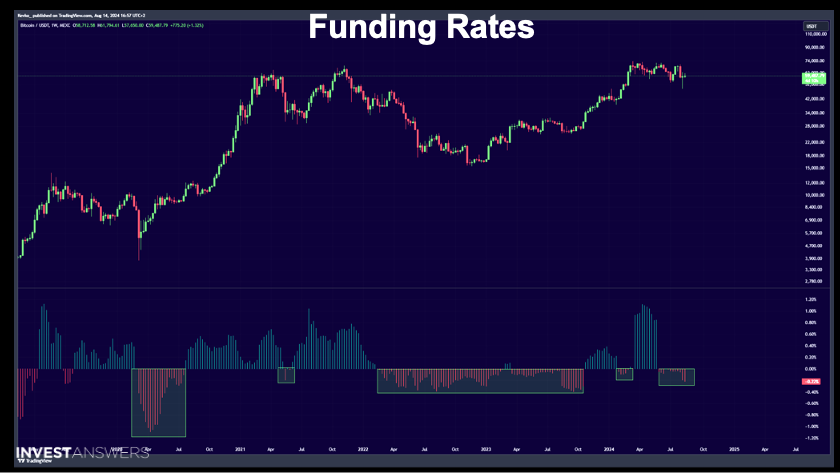

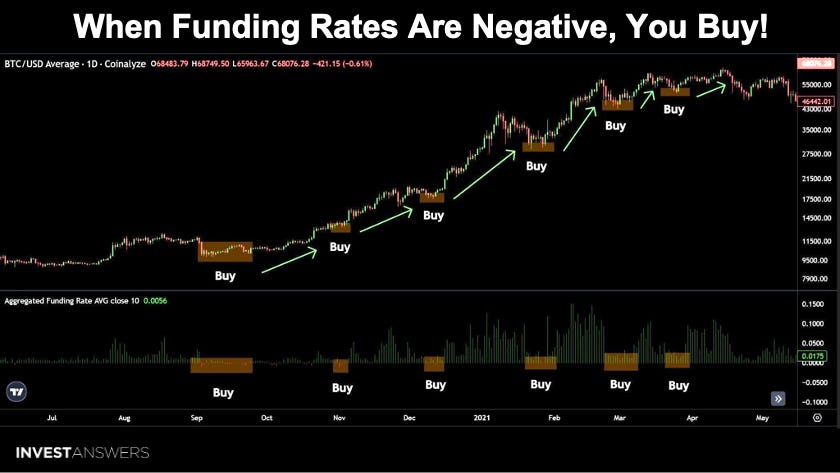

“The big story here is perpetual swap funding rates, which have averaged negative levels over the past week, while open rates have risen sharply. This indicates aggressive shorting, which structurally sets the stage for a ripe short squeeze.

These are the funding rates and I encourage you to keep your eyes on the bottom with the red dips.”

The analyst notes that historically, it has been a good time to accumulate Bitcoin when funding rates are low and negative.

The analyst adds that sentiment in the crypto market is currently hovering at fear levels, giving him yet another reason to be bullish on BTC.

“The Fear and Greed Index is at 26 and one point away from my kill mark at 25.”

At the time of writing, Bitcoin is trading at $63,990, down fractionally on the day.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney