- The price of Bitcoin rebound above $ 97,000 and rises 2.3% after falling to $ 94,000.

- A shift in the MVRV ratio and sleeping coin movement may indicate that holders influence market trends in the long term.

Bitcoin [BTC] has experienced a remarkable shift in Momentum after a steady decrease last week brought its price as low as $ 94,000.

In the early hours of 10 February, BTC began to recover, with its price that climbed $ 97,000 – an increase of 2.3% compared to the previous day.

Although this upward movement is a positive development, a deeper analysis of the underlying statistics of the network lights light on the potential future direction for the leading cryptocurrency.

A recent analysis of cryptoquant emphasized an important movement on the Bitcoin network. On February 10, around 14,000 bitcoins, sleeping for seven to ten years, were suddenly moved.

It is important that these coins were not sent to exchanges, which suggests that they were not intended for immediate liquidation.

Source: Cryptuquant

The Cryptoquant analyst who reported this wrote in particular:

“It is important to note that the average acquisition price of these coins is quite low, which could influence the future decisions of the holders with regard to potential sales.”

Bitcoin -High MVRV Ratio and its implications

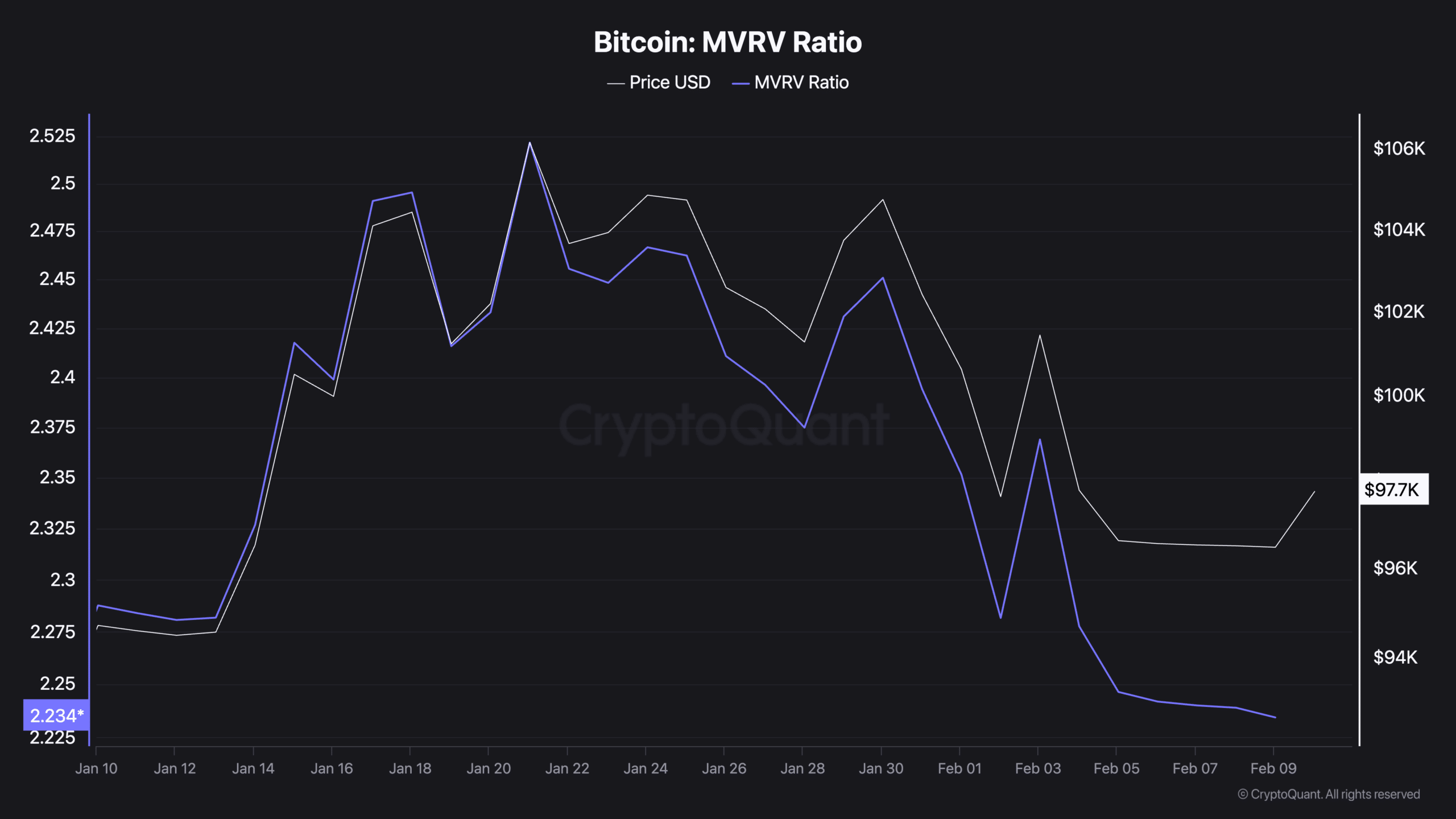

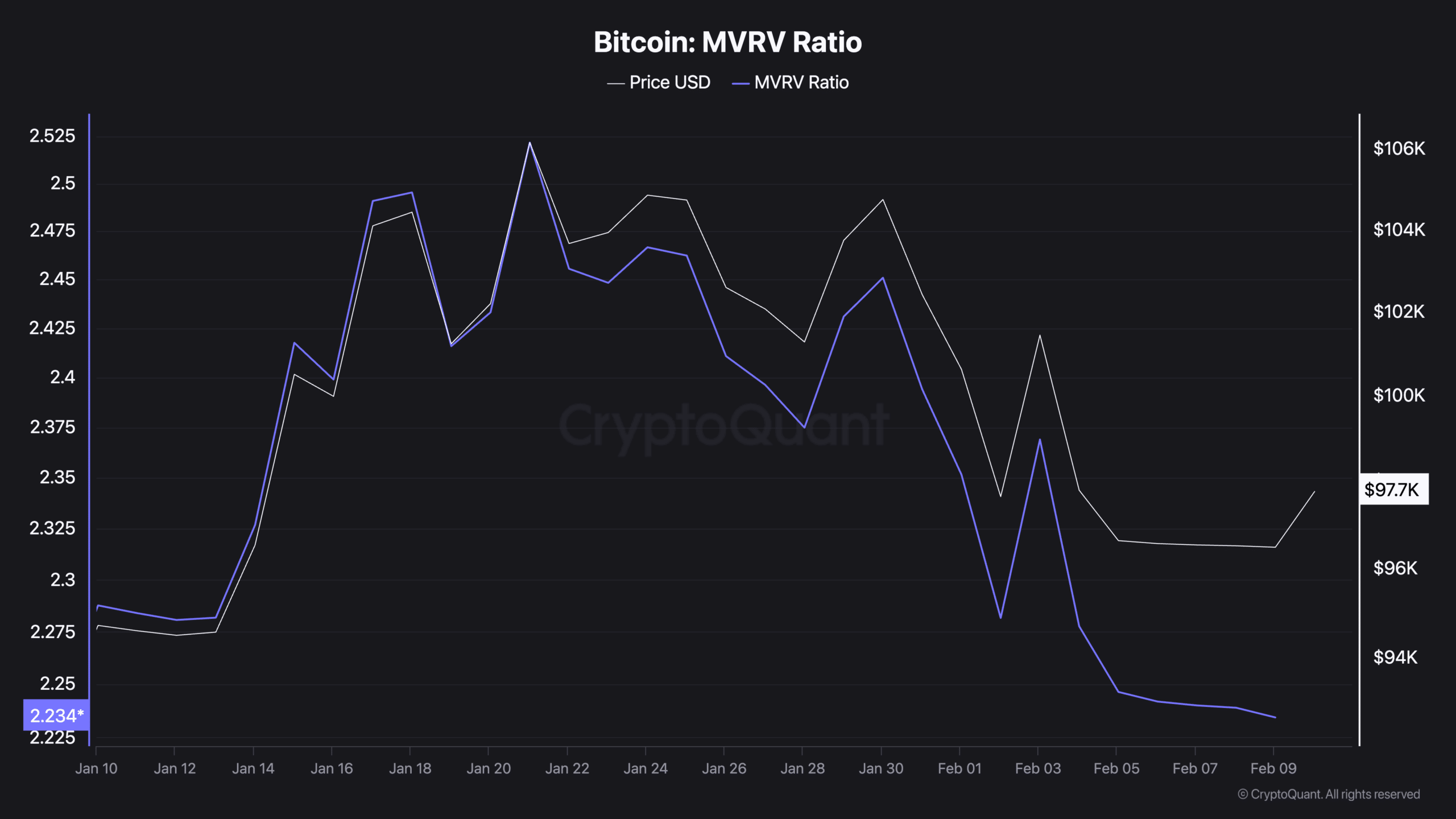

What is even more important, the MVRV ratio also gave valuable insights into the health of Bitcoin’s market.

The MVRV ratio (market value and realized value) measures the market capitalization of Bitcoin at the realized value – the total value of all the coins for the price they last moved on the blockchain.

This ratio can serve if an indicator or the active is overvalued or undervalued at the current price levels.

Recently facts Van Cryptoquant also revealed a downward trend in the MVRV ratio of Bitcoin, in accordance with the recent fall in price.

Read Bitcoin’s [BTC] Price forecast 2025–2026

The MVRV ratio was 2.52 on January 21. After the fall in the market price of BTC, however, it had fallen to 2.23 from 9 February.

Source: Cryptuquant

Historically, when the MVRV ratio drops, it has signaled potential access points for long-term investors. However, if the ratio continues to fall, this may indicate persistent market weakness or caution among investors.