- Bitcoin has recovered $60,000 amid a surge in OTC desk balances, indicating increased selling by miners.

- Analysts remain cautiously optimistic despite mixed signals from network activity and large-scale transactions.

Bitcoin [BTC] has recently shown signs of recovery after several weeks of consolidation below the $60,000 mark.

The leading cryptocurrency has managed to climb back above this physiological level, reaching a 24-hour high of $61,830 and currently trading at $60,798, marking a 2% increase from the past day.

This upward move has brought a sense of relief among traders who have been concerned about Bitcoin’s stagnant price action in recent weeks.

The rebound in Bitcoin’s price coincides with a significant development in one of its key metrics, which could have important implications for the market.

Rising OTC Desk: What This Means for BTC

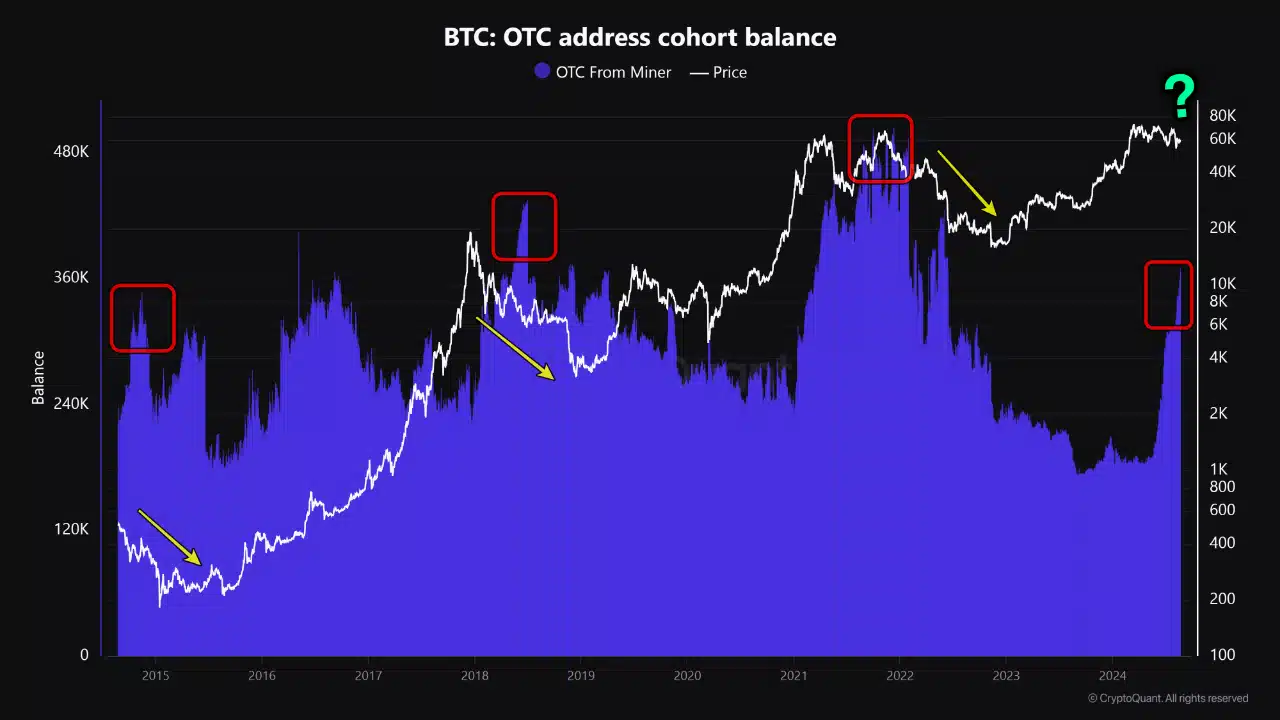

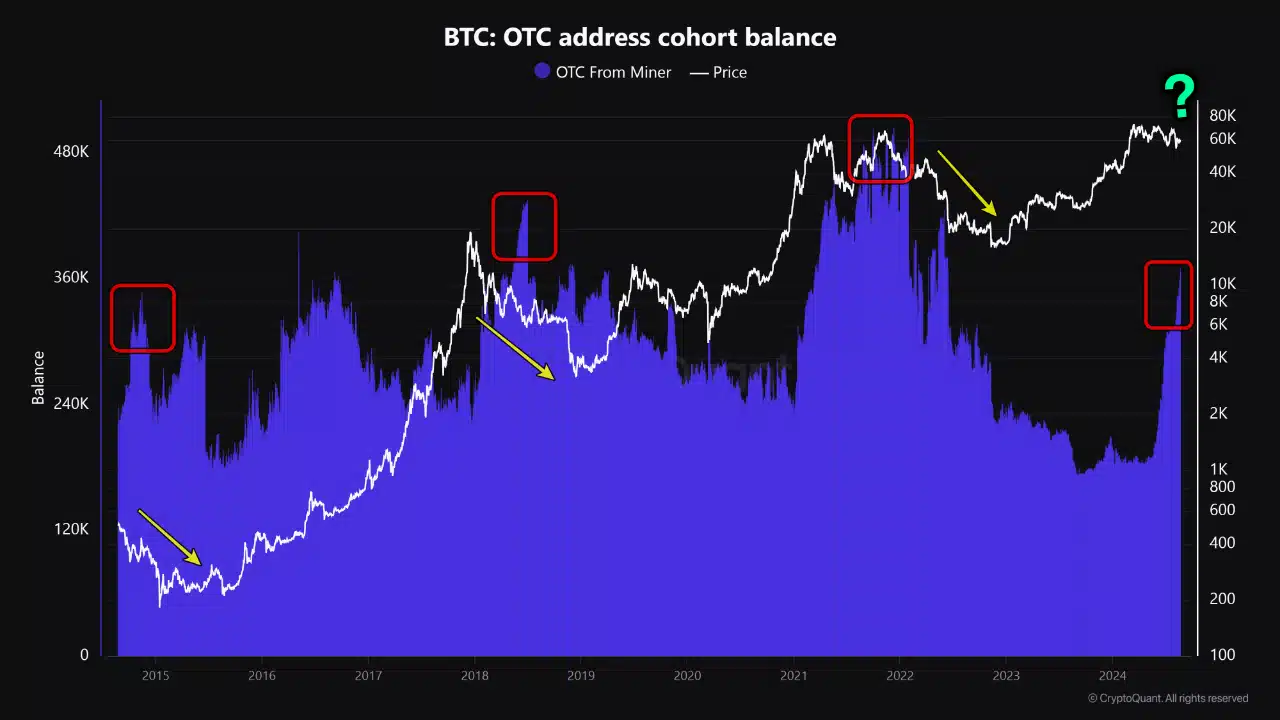

According to a recent report from CryptoQuant, Bitcoin balances in Over-the-Counter (OTC) desks have risen to a two-year high.

Analyst ‘Ego Hash’ reported that these balances, which represent the amount of Bitcoin that miners sell directly to buyers through OTC deals, have increased by more than 70% in the past three months.

Source: CryptoQuant

Specifically, OTC desk balances increased from 215,000 BTC in June to 368,000 BTC in August, an increase of 153,000 BTC.

This level of OTC activity has not been seen since June 2022. The rise in OTC desk balances is often associated with increased selling pressure from miners, which historically correlates with subsequent declines in Bitcoin’s price.

Despite the potential bearish implications of rising OTC desk balances, several cryptocurrency analysts and experts remain optimistic about Bitcoin’s prospects.

For example, a prominent crypto analyst known as Mags earlier today shared a bullish view on X, indicating that Bitcoin could be on the verge of a significant price increase.

Source: Mags on X

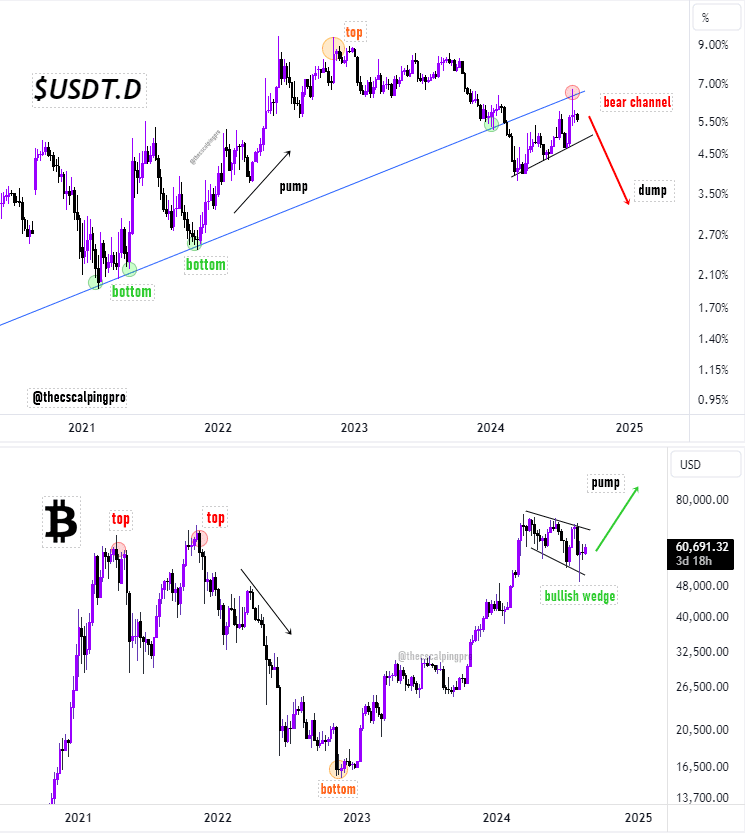

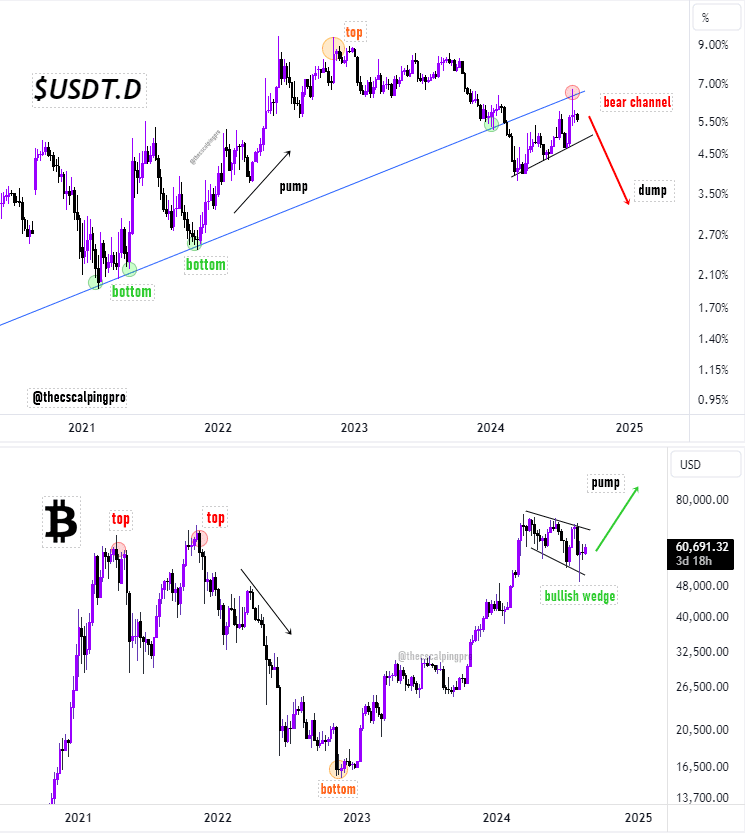

Mags pointed out the inverse correlation between the dominance of Tether (USDT.D) and Bitcoin (BTC), noting that a recent collapse in USDT.D’s trendline support could lead to a bullish continuation pattern for Bitcoin.

According to Mags, if this scenario plays out, Bitcoin could potentially rise to $72,000 or even higher in the near future.

Ready for the lift?

However, alongside these bullish predictions comes Bitcoin’s complex underlying fundamentals which, if assessed, can be used to gain a more comprehensive understanding of the current state of the market.

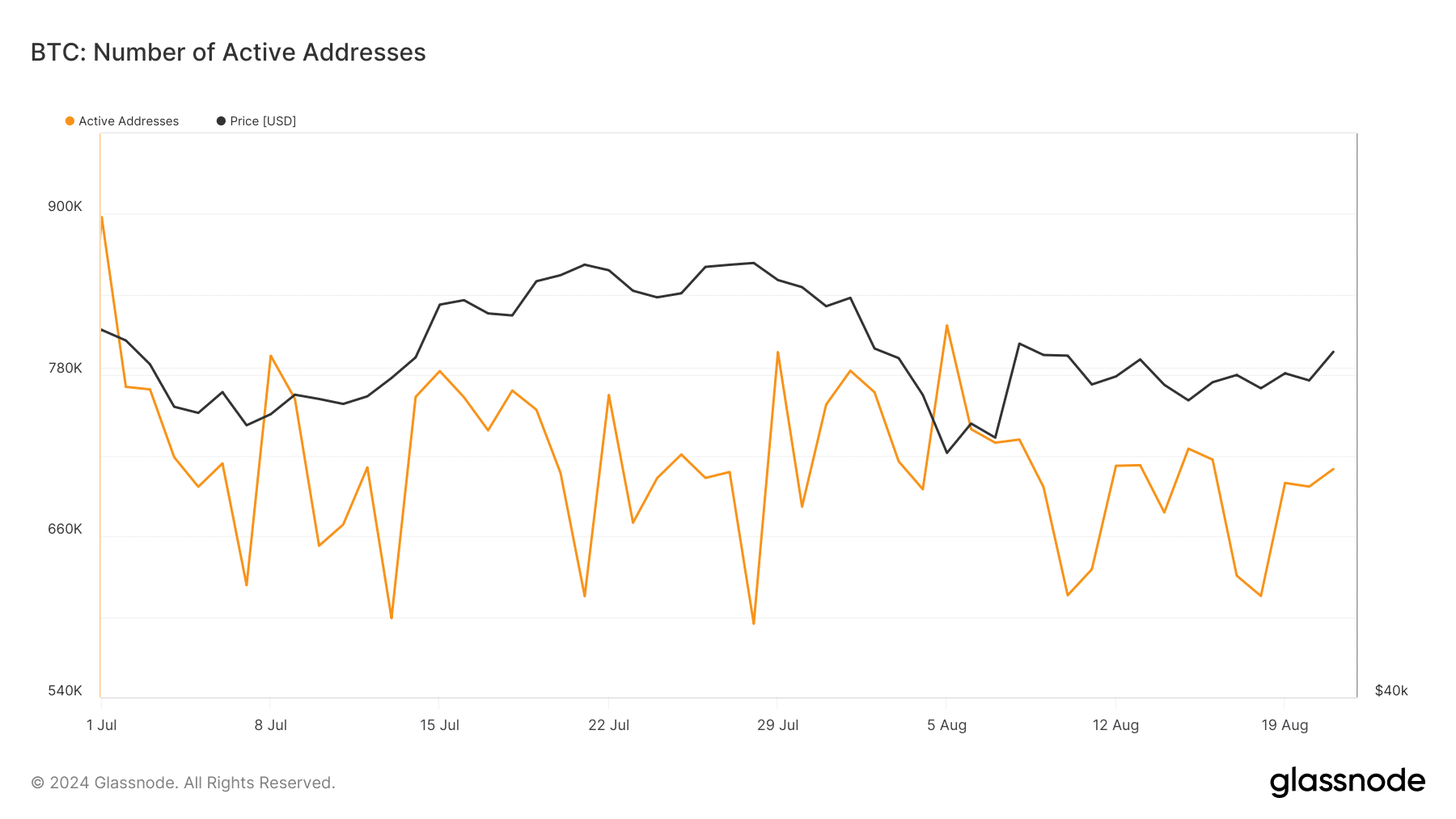

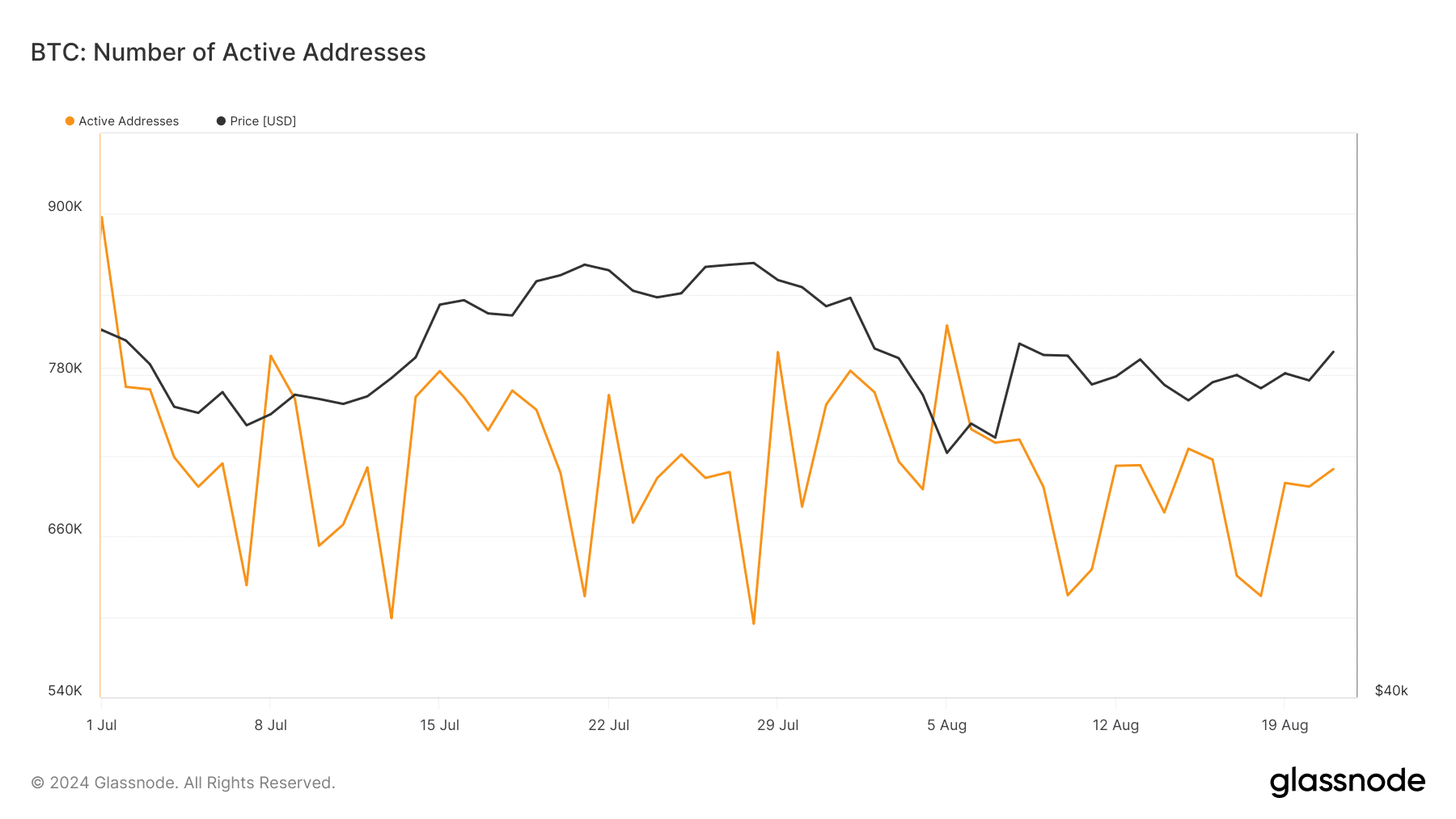

Facts from Glassnode reveals that the number of Bitcoin active addresses, a key indicator of network activity, has decreased significantly over the past month.

Source: Glassnode

The number of active addresses fell from almost 900,000 on July 1 to a low of 594,000 on July 24. Nevertheless, there has been a recent recovery, with the number of active addresses increasing to over 700,000 today.

This recovery in network activity suggests that user engagement with Bitcoin is starting to pick up again after a period of decline.

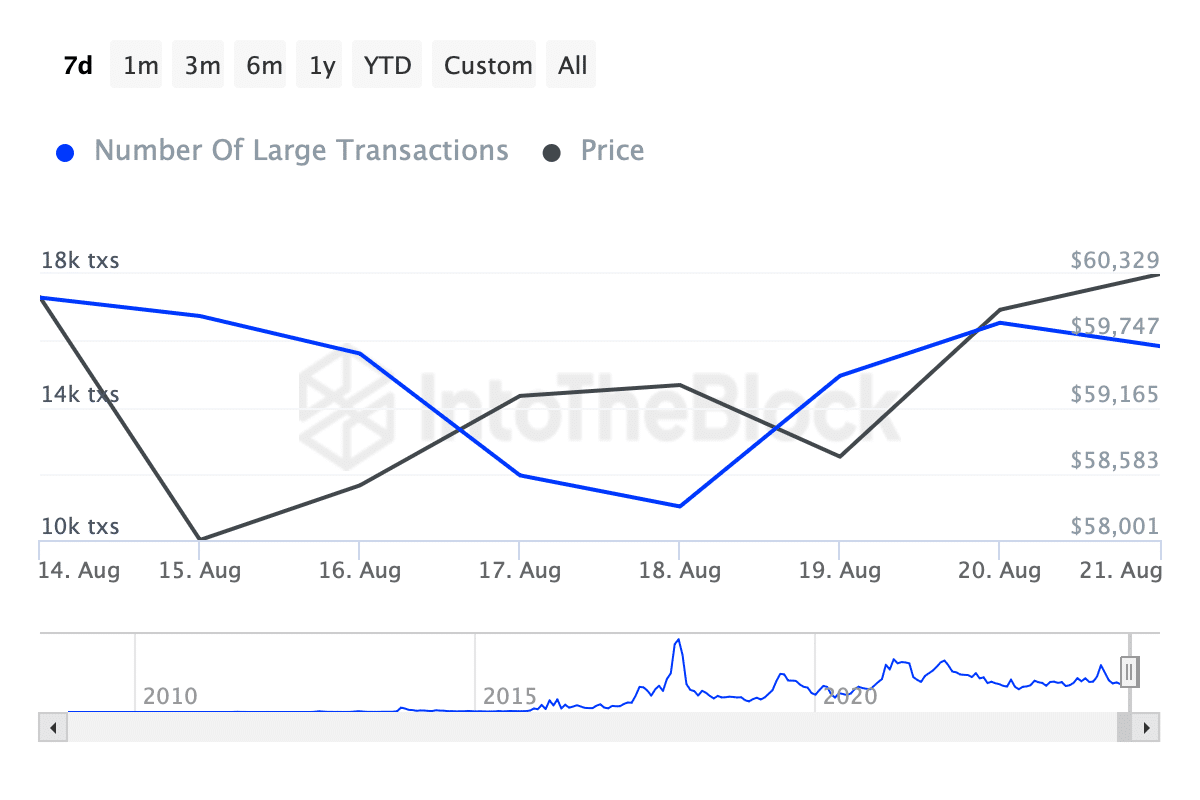

In addition to network activity, whale transactions (defined as Bitcoin transactions over $100,000) have also seen some fluctuations.

Read Bitcoin’s [BTC] Price forecast 2024-25

According to facts from IntoTheBlock, the number of these large transactions has fallen slightly over the past week, from more than 17,000 to just under 16,000.

Source: IntoTheBlock

While this decline may indicate some caution among major investors, it is not necessarily a cause for concern as overall market sentiment remains cautiously optimistic.