- With increased adoption, Bitcoin’s on-chain data confirmed a “local” bottom of $90,000.

- However, breaking through $99,000 amid the macro volatility requires a solid foundation.

Inflation in the US rose slightly in October, with a monthly increase of 0.2%, which spooked the stock markets. The S&P 500 snapped its seven-day winning streak as the “Trump dump” that followed the election began to fade.

Bitcoin, on the other hand [BTC] deviated from the US indexes and climbed more than 4% to close at $95,883. This recovery came after four consecutive days of losses following the record high of $99,317.

While Bitcoin’s Trump-related rally stalled just over a week ago, Bitcoin’s resilience amid rising economic uncertainties — particularly fears of rising consumption costs due to high tariffs — stands out.

This price action, just before Thanksgiving, has sparked speculation. US investors can keep up their trading appetite to take BTC back to $99,000.

However, this bullish hypothesis awaits confirmation from compelling on-chain data.

BTC on-chain data signals ground formation

Unlike the March cycle, when greed rose above 90, this time the index has remained below this threshold. However, the prevailing euphoria offers strategic investors an excellent opportunity to secure profits. Investors could walk away as millionaires or billionaires during this period.

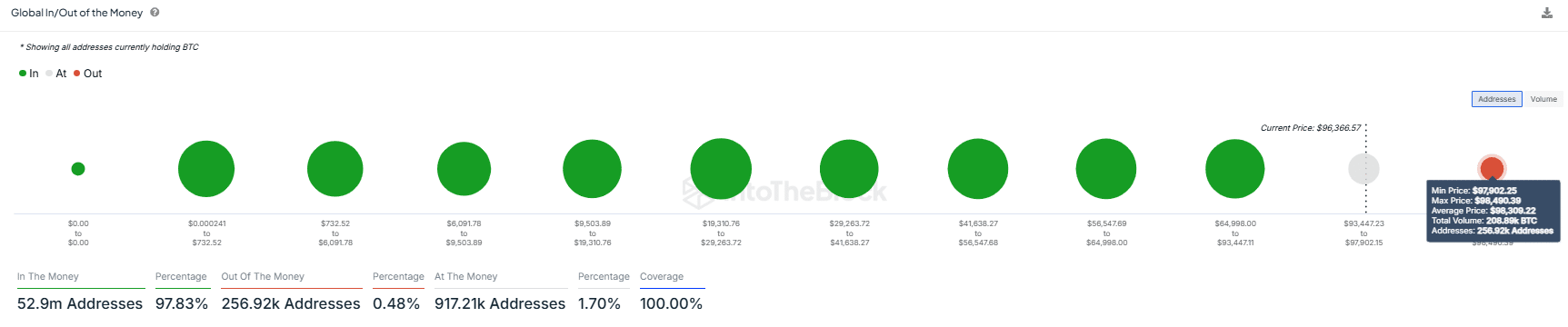

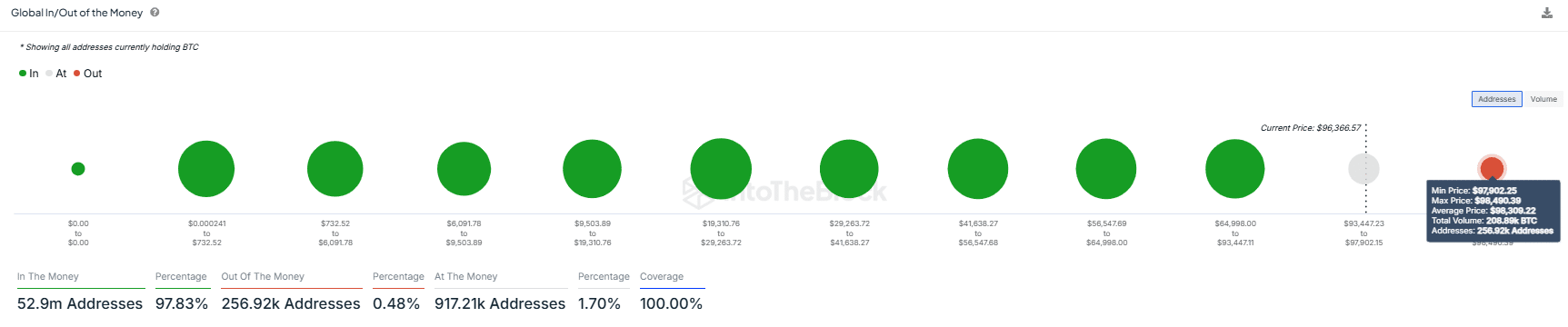

Furthermore, with the settlement of the “Trump trade”, approximately one million BTC was acquired at an average price of $93,447 against 917K pursesare counting on bullish on-chain data to validate their commitment to the $100K goal.

Bitcoin’s resilience amid inflationary pressures points to a potential bottom forming near $90,000, a level that was briefly tested as short-term holders discharged their positions.

This could create a strong foundation for new FOMO, potentially driving long-term commitment and paving the way for another rally, as illustrated in the chart below.

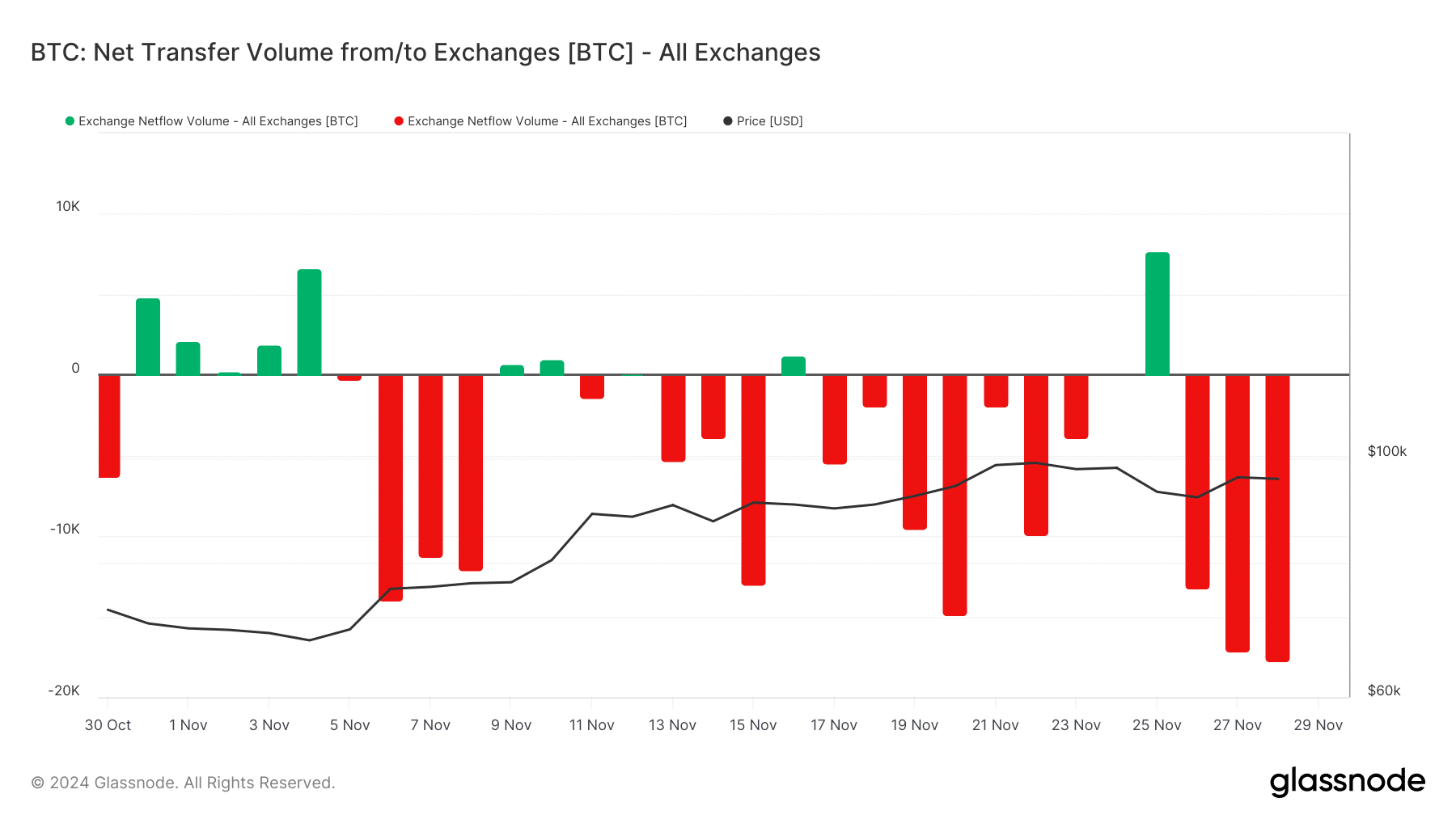

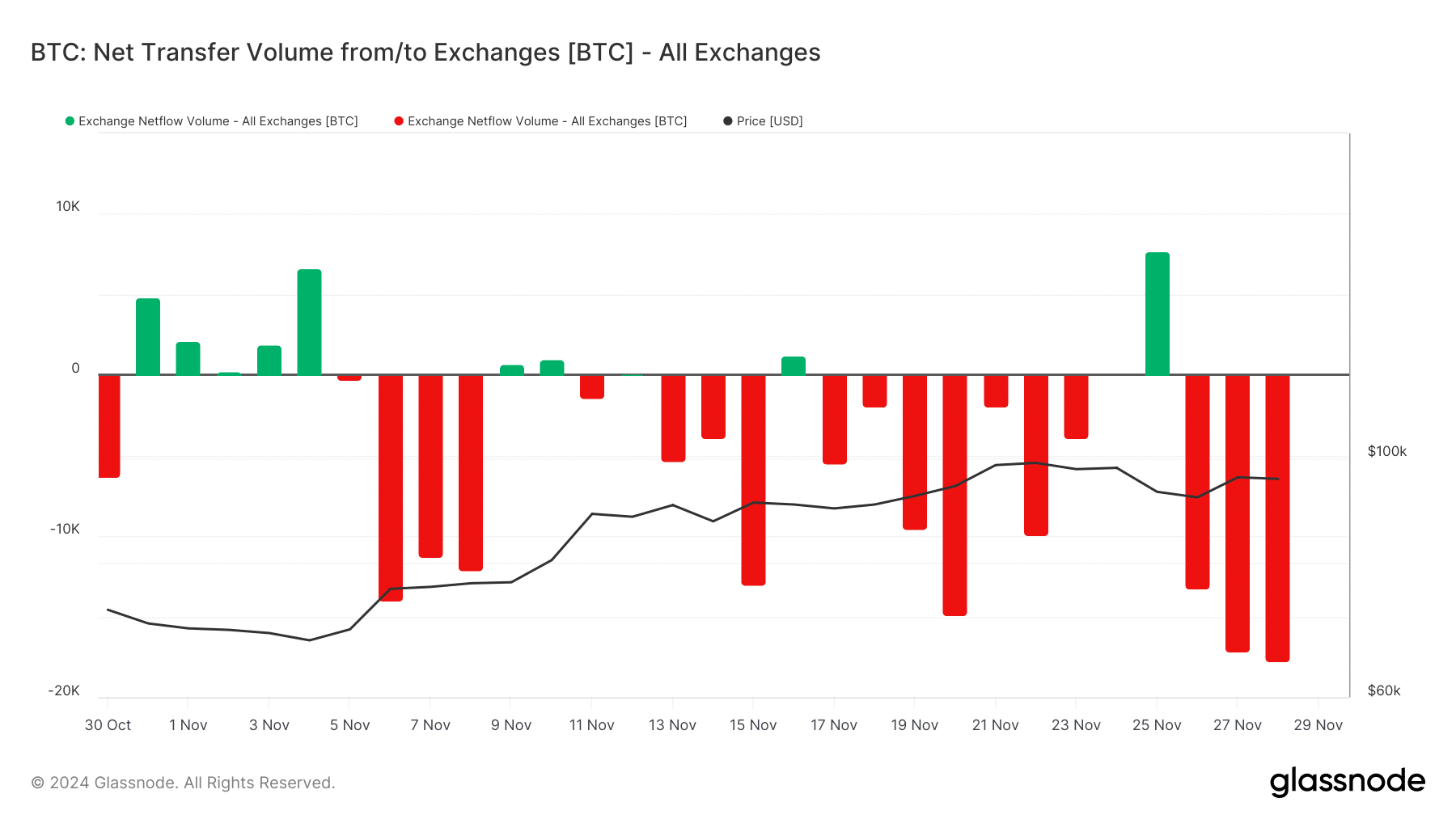

Source: Glassnode

Three days ago, a negative net flow triggered significant activity from retail investors, accumulating more than 13,000 BTC at an average price of $91,000.

This accumulation solidifies a crucial liquidity point, positioning the market for potential upside as investors take advantage of perceived bargain prices.

Additionally, major players appear to have expressed gratitude for the rally of the year this Thanksgiving, with over 20,000 BTC withdrawn. This has helped the price recover within the $96K band.

Together retail and institutional Investors have strategically targeted the recent “dip” to $90,000, which has driven a notable increase in adoption. This has helped counter downward pressure from short-term holders (STHs) and reinforced a strong bottom.

While a bottom may have formed, it is important to note that this could be a ‘local’ bottom rather than a true ‘market bottom’.

A reversal remains a possibility unless Bitcoin shows similar activity at price levels historically considered “high risk,” such as the $99K level, where strong resistance still exists.

99K resistance requires both micro and macro support

BTC’s on-chain data shows strong support at $90,000, with investor reactions likely to prevent further declines and create a local bottom for a potential recovery.

As a result, Bitcoin is back in the $96,000 range, restoring net gains after wiping out gains made during the final trading days of the election cycle.

In the coming days, monitoring these on-chain data sets will be critical to determine whether BTC can remain stable within the $95,000 to $97,000 range. This stability could pave the way for further upside potential towards $99,000, where significant activity is expected.

For starters, the 256,92,000 addresses holding approximately 208,000 BTC, acquired at an average price of $98,309, will be in the money. What they do next will play a crucial role in shaping Bitcoin’s price action.

Source: IntoTheBlock

Second, both ‘anticipation’ and ‘execution’ will play a crucial role. While few expect a breakout above $100,000 driven by social media hype, others are likely to execute their exit strategies as evidenced by recent market behavior.

So the responsibility for establishing $99,000 as a new bottom will fall on both the chain data and broader macroeconomic trends.

Read Bitcoin’s [BTC] Price forecast 2024-25

In a recent one questionnaireAt the December meeting, traders increased their bets that the Federal Reserve will cut rates by 25 basis points. The market now estimates a 64.7% chance of this happening, up from 55.7% a week ago.

This shift could provide a solid foundation for BTC to break the $100,000 barrier. This is especially true when combined with bullish on-chain data including whale activity, institutional inflows, and long-term holder commitment at a price of $99,000.