Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

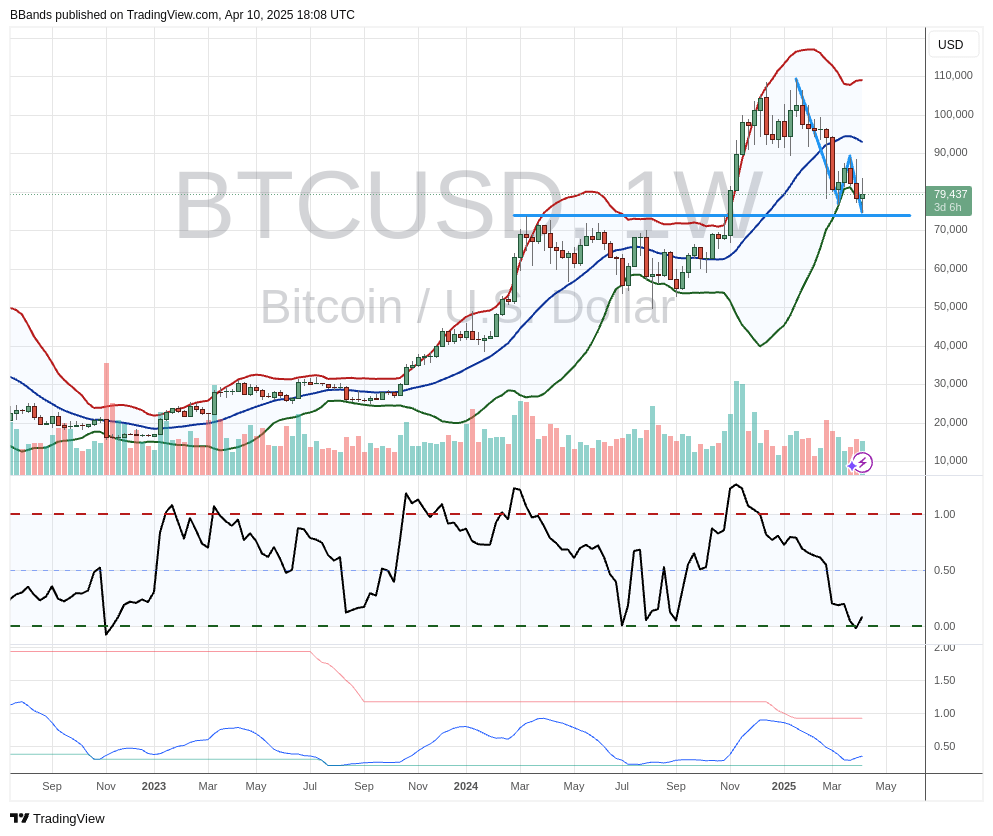

Legendary technical analyst John Bollinger has emphasized what he calls a “Classic Bollinger band W Bottom” that may form on the Bitcoin pair BTC/USD. According to him, BTC seems to have found support in the $ 74,000 area, so that the characteristic double lows are set up that define a W-shaped reversing pattern. Especially Bollinger stressed That the setup still has to be confirmed: “Classic Bollinger band w Bottom Setup in BTCUSD. Still needs confirmation”.

Is the Bitcoin below?

The graph shows Bitcoin who navigates a decline of his high from the middle of January near $ 110,000, with recent price promotion clustered around the lower tire of the Bollinger bands. The upper band is $ 108,837, while the lower band is $ 77.138, which suggests a relatively wide range of volatility every week. The middle line of the Bollinger is almost $ 93,000.

Related lecture

The indication of Bollinger of a W-Bottom is based on the formation of two different troughs quickly, as can be seen in both the price data and the Oscillator measurements under the graph. The first trough was released when BTCUSD fell from the then high of around $ 90,000 to the middle of $ 76,000, and then collected before he returned to a similar support area around $ 74,500. The repeated dip in this horizontal support level has so far been held, which Bollinger identifies as a potential basis for a bullish reversal – although he warns that a definitive movement above the intervening swing would help to validate this classic card pattern high near $ 90,000.

Other market instructions include slightly lower trading volumes, which suggests that the intense sale that Bitcoin reduced to his recent peak has been relaxed. The momentumoscillator of the graph, which follows overbough and over -selling circumstances, supports this dissertation and forms a soil near the lower edge. Although this coordination with price action suggests a possible soil, many technical analysts are looking for the oscillator to rise convincingly above his center to confirm that the momentum has indeed shifted in favor of buyers.

Related lecture

Bollinger tires itself, invented by John Bollinger, measures the volatility by placing envelopes above and below a progressive average. When these tires broaden, the market usually experiences great price fluctuations; When they beg, the volatility decreases. In the case of Bitcoin, they have remained relatively broad, which reflects the dramatic range of the cryptocurrency from less than $ 20,000 to six digits in the past two years.

Although it is led to optimism in bullish traders about a W-Bottom, the memory of Bollinger emphasizes that it “still needs to be confirmed” the importance of solid follow-up to price action. If Bitcoin can break above $ 90,000 on a robust volume, the long -awaited confirmation of this pattern would be within reach. Until then, the W-Bottom is only a possibility.

At the time of the press, BTC traded at $ 81,366.

Featured image made with dall.e, graph of tradingview.com