- Bitcoin does not have enough demand in the short term to sustain a rally above $60,000.

- Traders can prepare for a bearish reversal on Monday, but should watch out for volatility.

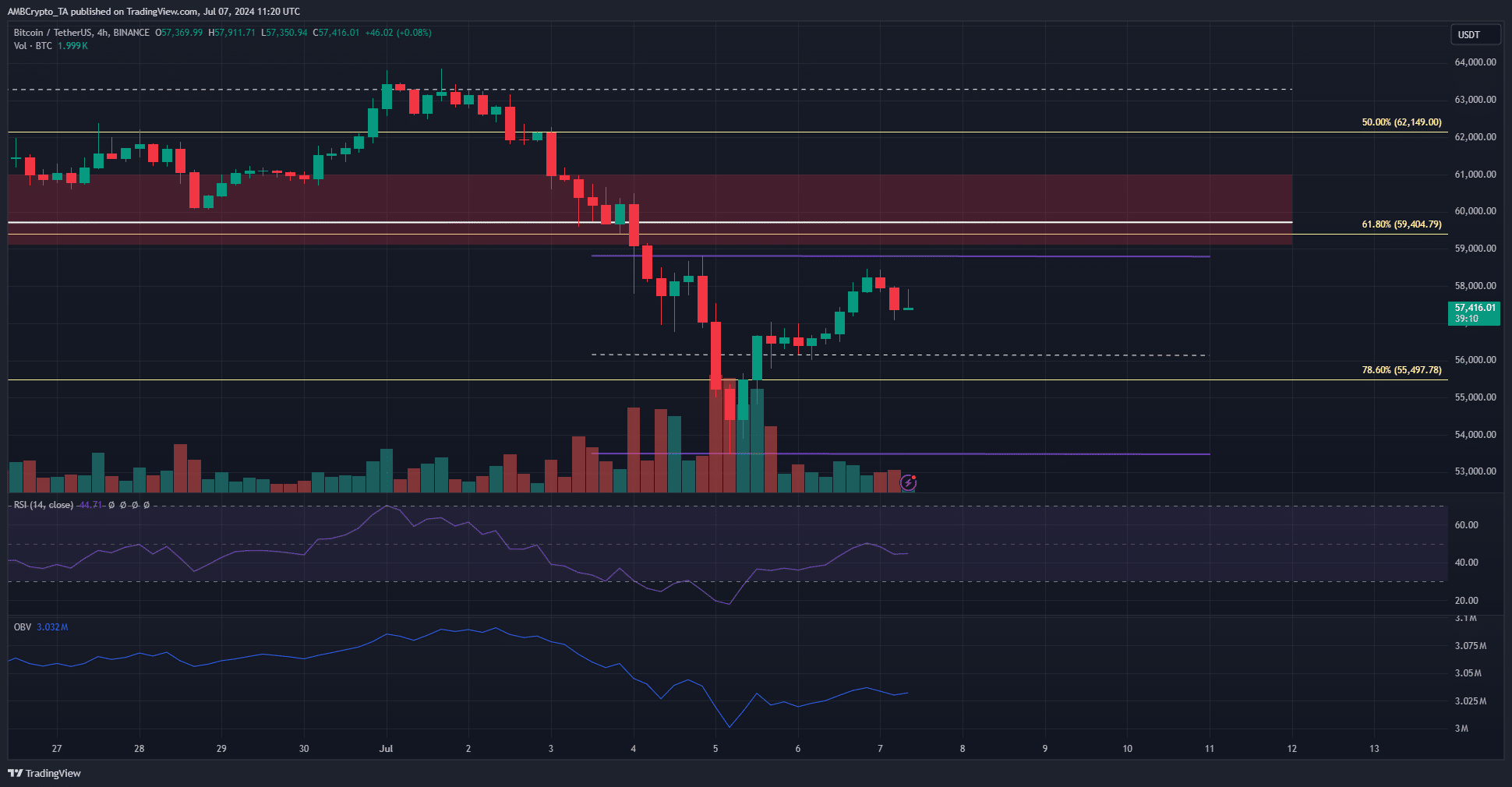

Bitcoin [BTC] fell by 16.2% between Monday, July 1 and Friday, July 5. After hitting a low of $53.5k, BTC rose 9.33% over the next day and a half. The sharp downward price movement could lead to a range formation in the short term.

AMBCrypto analyzed the liquidation charts and price action to understand where prices might move in the coming week. Whales were accumulating BTC, but sentiment was weak and currency movement to exchanges was a concern.

Plotting Bitcoin’s price path for the coming week

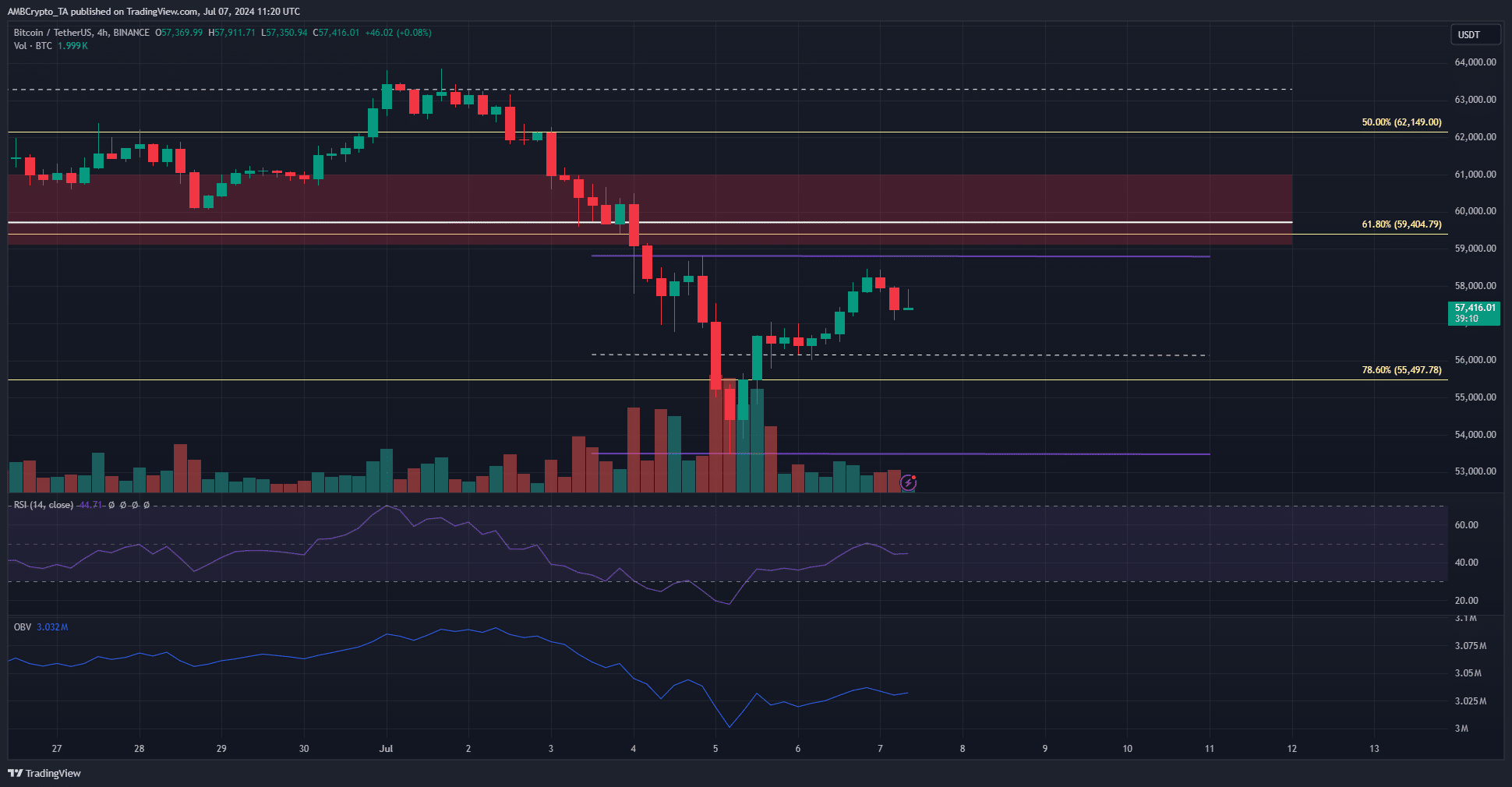

Source: BTC/USDT on TradingView

The 4-hour chart showed a potential range formation between $58.8k and $53.5k. The mid-level of $56.2k had acted as support on July 5 as prices tried to bounce higher.

The fourth-half RSI stood at 44 and was rejected at neutral 50. However, the RSI is likely to move higher in the next two days as the highs in the range invite BTC prices.

The OBV, on the other hand, remained in a downtrend and warned bulls not to take the bait on offer.

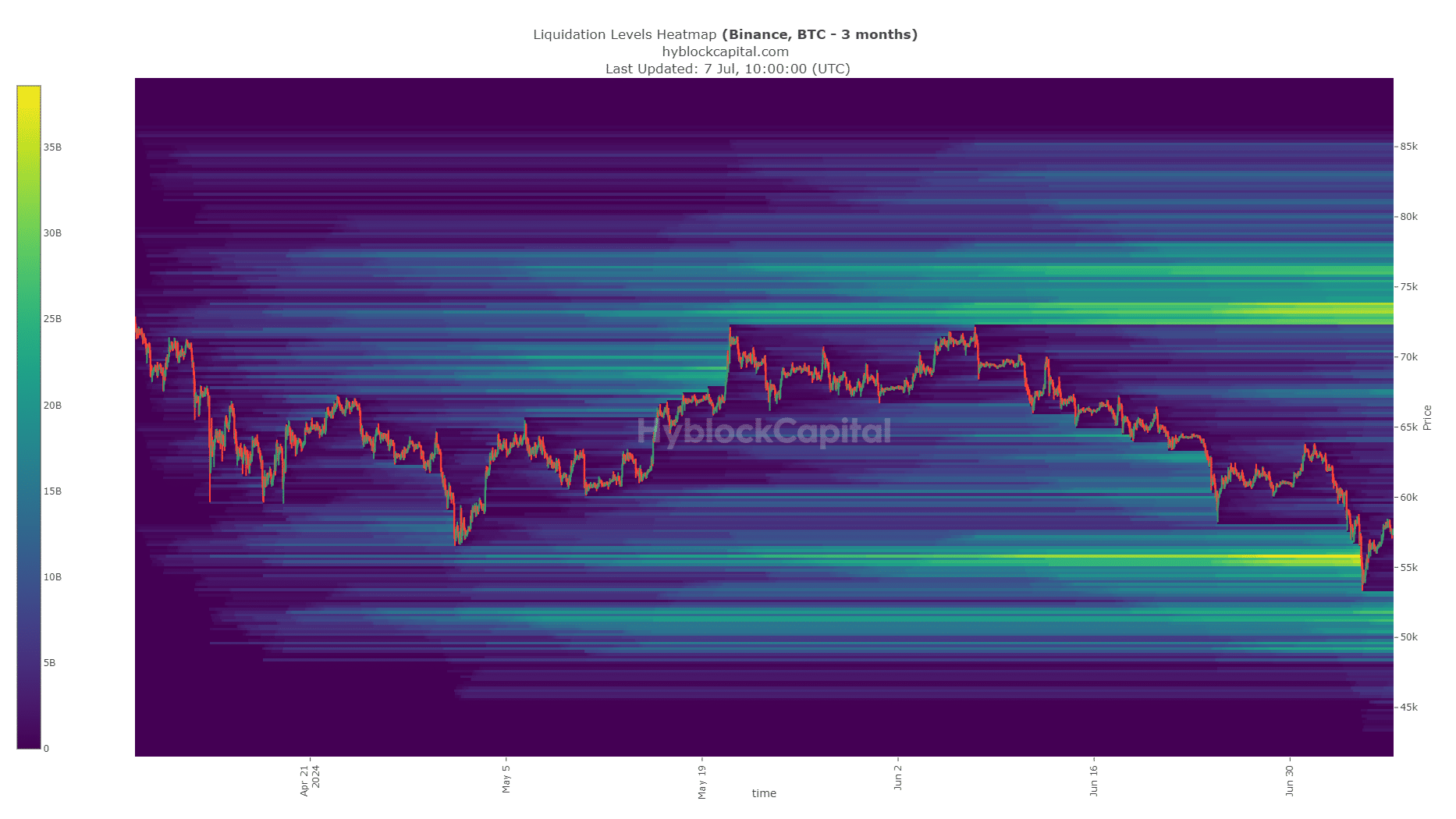

The liquidation heatmap for the past three months showed that the $55.5k region had a high concentration of liquidation levels. This liquidity pool was swept up and in the coming weeks, BTC could attempt to direct it north to the $73,000 liquidity zone.

However, in the short term, an immediate turnaround is unlikely. The bulls need time to regain their strength before moving higher. The spread formation previously outlined is expected to continue into the coming week.

An overview of the major Bitcoin price levels

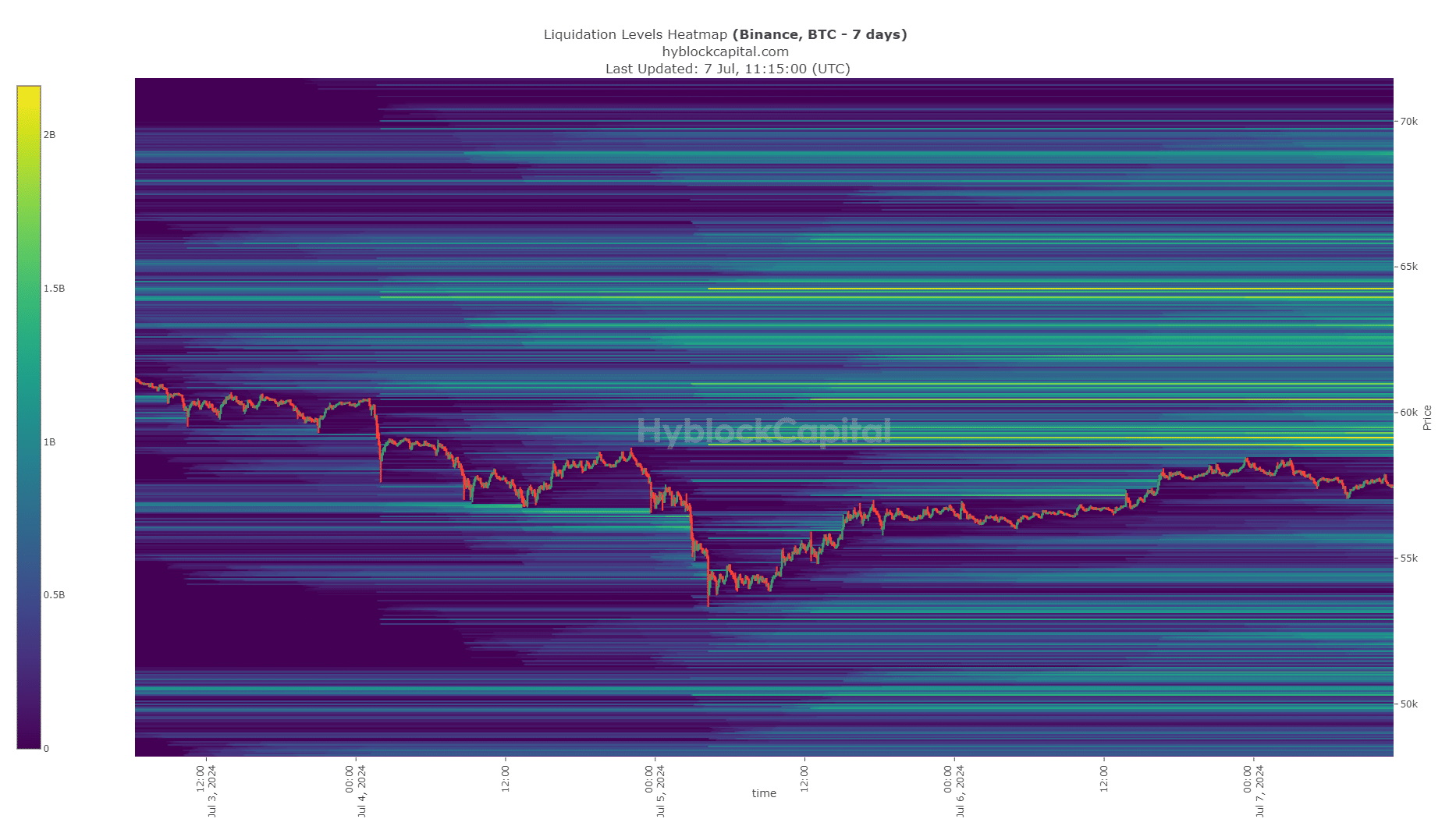

The seven-day liquidation heatmap showed that the $59k-$59.3k zone has increased liquidation levels. This aligned well with the $58.8k range highs.

The magnetic zone below $60,000 is likely to pull Bitcoin prices towards it.

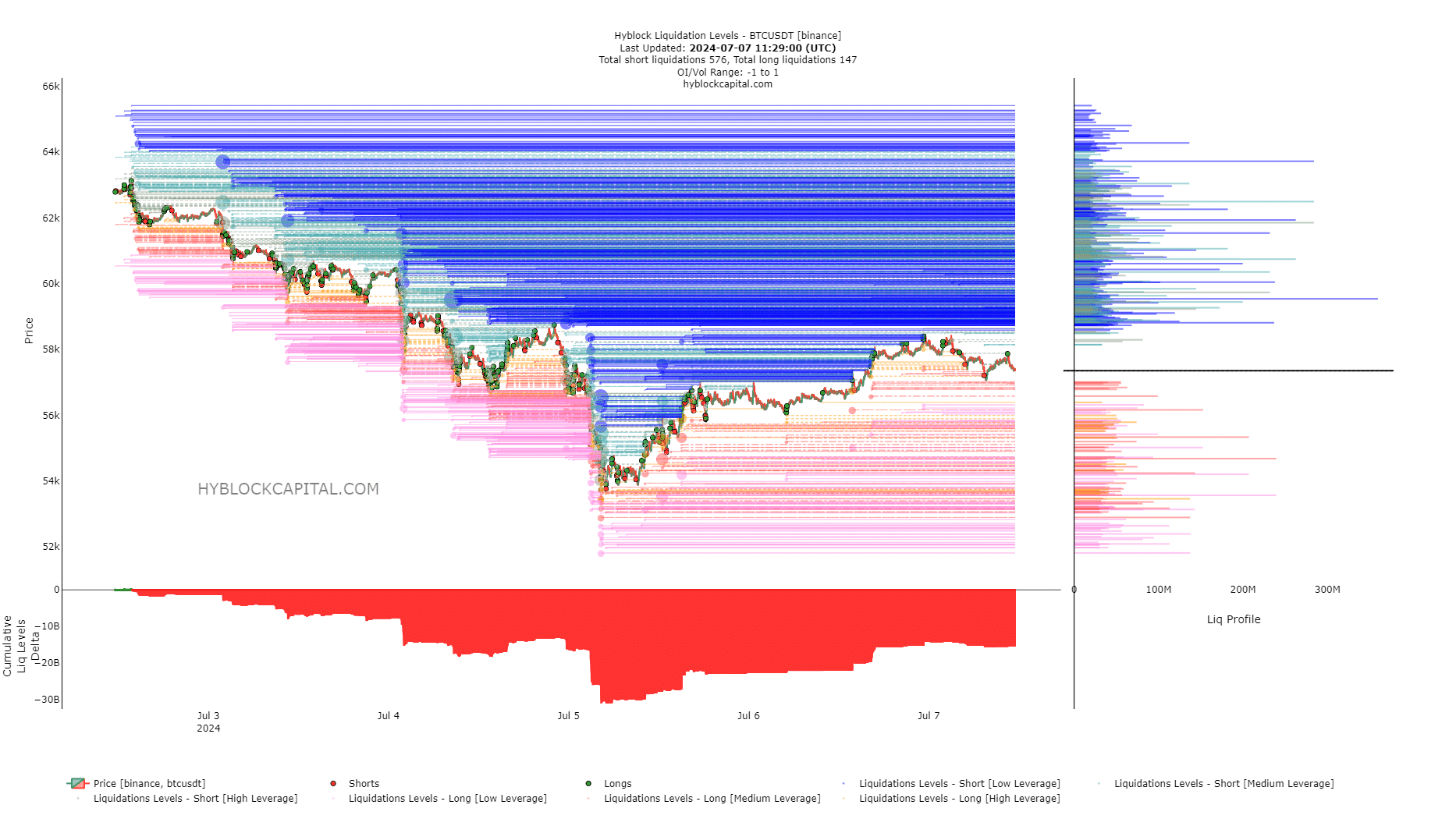

AMBCrypto also analyzed liquidation levels. They revealed that the cumulative delta of LIQ levels was still largely negative, but has retreated somewhat since the July 5 maximum.

Therefore, a move to the upside could begin on Monday, July 8, to prey on the over-indebted short sellers.

Read Bitcoin’s [BTC] Price forecast 2024-25

While the king of cryptocurrencies doesn’t have enough bullish sentiment or demand to fuel a quick rally, traders shouldn’t ignore the potential of a breakout above $60,000.

As things stand now, a bearish reversal from the $59.2k area is expected, with volatility around the New York Open at 1:00 PM UTC on Monday being something to watch out for.