Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Distitible and Español.

Bitcoin has recovered the $ 90,000 digit, so that the renewed optimism is fueled on the cryptomarkt. With the shifting of sentiment and returning bullish calls, many investors look again at a movement for six digits. However, not everything is as it seems below the surface. Despite the impressive price increase, risks continue to exist, especially because worldwide tensions between the United States and China escalate. The ongoing trade war and geopolitical friction inject volatility into markets, creating a fragile background for risk assets such as Bitcoin.

Related lecture

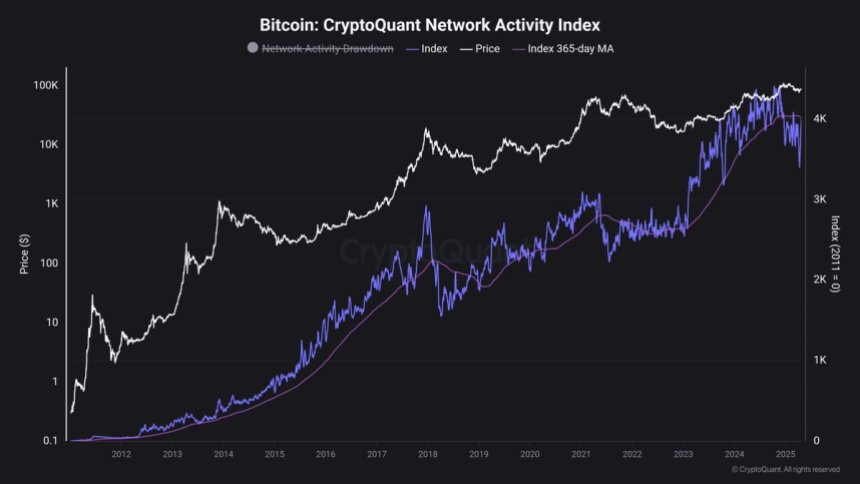

Top Analyst Marchunn shared a grim image of the current status of the Bitcoin network, in which on-chain statistics are revealed that paint a different picture. According to his analysis, the newest step higher is mainly driven by leverage and derivatives instead of strong organic demand. He noted that the Bitcoin network in his words is ‘a ghost city’, with very little new activity or visible inflow of real users.

This decoupling between price and Fundamentals on the chain suggests that the current rally may not have any sustainability. As such, investors must approach the next phase of the Bitcoin price action with caution, especially if macro -economic conditions worsen or start relaxing derivative positions.

Bitcoin is confronted with resistance: activity on the chains lags behind

Bitcoin is now confronted with critical resistance while Bulls try to reclaim the level of $ 95,000, a zone that could define the momentum in the short term. The recent outbreak above the resistance of $ 88,600 marked an important shift in market sentiment, in which bulls names and price action pushed into a new range. However, the continuing question will be essential to maintain this momentum. Analysts warn that a healthy retracement can occur before the next leg, especially given the current market conditions.

Volatility and uncertainty continue to dominate the landscape, with fear that is still hanging despite the recent rally. Much of this caution stems from constant global tensions and the unstable macro environment that has shifted since the re-election of US President Donald Trump in November 2024. With rates that rise and trade negotiations with China that are always tense, investors remain hesitant to fully commit themselves to risk reproaches.

Top Analyst Marchunn shared a sobering chain analysis On X emphasizes a decoupling between the price action of Bitcoin and network activity. According to his findings, the recent increase is largely powered by ETF flows and rising open interest in the market for derivatives – factors that often precede a reversal instead of a sustainable rally. Marchunn describes the current status of the Bitcoin network as a ‘ghost city’, in which a lack of new visible demand on chains is noticed.

This divergence between price and network fundamentals raises questions about the sustainability of the current step. For Bitcoin to push $ 95k convincingly and set up a run to $ 100k, a stronger location and an increase in real user activity will probably be needed. Until that time, traders must remain careful and look closely at important support levels.

Related lecture

Price promotion Details: $ 95k in sight

After a few days of bullish price action, Bitcoin acts at $ 93,600, so that the important resistance levels found. The price has now entered a consolidation phase on the $ 93k level, while Bulls is preparing for a potential outbreak to $ 95k. A persistent movement above that mark would open the door for a push in the direction of the long -awaited milestone of $ 100k, which indicates the renewed strength over the cryptomarkt.

However, the path ahead remains uncertain. Although the short -term sentiment appears to be optimistic, Bitcoin has to retain above the support level of $ 90K to maintain the bullish structure. A failure to do this could activate a fall back to the 200-day advancing average near $ 88k-one level that has served as an important pivot for market structure in recent months.

Related lecture

This zone is closely monitored by both traders and holders in the long term, because a breakdown under $ 90k would probably undermine the current recovery momentum. As the consolidation continues, the following few sessions will be crucial to determine whether BTC has sufficient strength to break higher or whether a short -term correction is in store. For now, all eyes are at $ 95k as the next obstacle in Bitcoin’s push to recover the dominance of the market.

Featured image of Dall-E, graph of TradingView