- The Bitcoin Rainbow Chart showed that investors should “BUY!” more BTC.

- Sentiment has been bearish over the past two weeks and further price declines are possible.

Bitcoin [BTC] traded near the $60k support zone again. Nearly two months ago, the same $60,000 support zone was retested as support after a sharp price drop to $56,000.

At the time, sentiment was fearful and investors were cautious. Once again a similar sentiment prevailed.

While the price action was bearish in the short term, the price movement in the higher time frame was strongly bullish. Over the past six months, Bitcoin is up almost 55% from its late January low of $38.5k.

It has set a higher low at $56.5k, marking this as the critical support level that buyers will need to defend in the coming weeks.

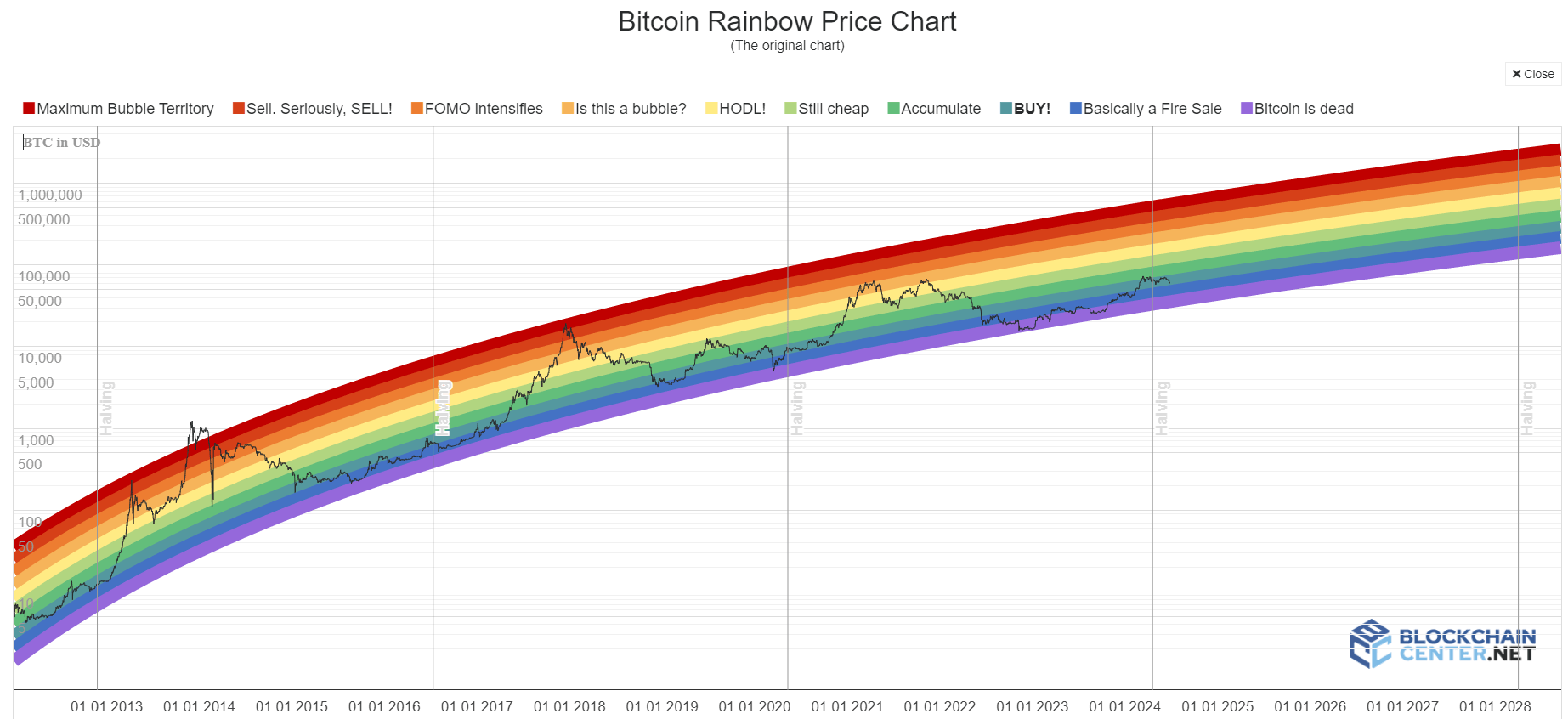

The Bitcoin rainbow chart showed that it is still a good time to buy Bitcoin. This chart represents Bitcoin’s price movement on a logarithmic scale and can be useful for investors to predict potential cycle tops.

Measuring the cycle top from the Bitcoin Rainbow Chart

The multicolored chart highlights different zones, from ‘Bitcoin is dead’ to ‘Maximum bubble area’. At the time of writing, BTC was in a rather aggressive “BUY!” marked zone.

At the time of writing, the chart was convinced that there is still a long way to go before this cycle’s price trend will extend.

AMBCrypto noted that the past two cycle maximums occurred 17-18 months after the halving. If we extrapolate that to the current cycle, a maximum could be reached in September or October 2025.

In 2021, BTC couldn’t get past “Is this a bubble?” area. AMBCrypto chose to be more conservative this time and assumed that Bitcoin might not cross the ‘HODL’ area this time.

Even this conservative bet places Bitcoin at a value of $260,000, with $373,000 being the estimate if Bitcoin is in the “Is this a bubble?” ends up? area.

So there you have it, something to mark your calendar: Sell Bitcoin above $250,000 in September 2025.

This is obviously not an accurate prediction and is based solely on the Bitcoin Rainbow Chart and the halvings and top timings of the previous cycle.

Investor caution and closer examination of price action and on-chain metrics would be needed to more sharply gauge the cycle top.

The weakness of the buyers was emphasized

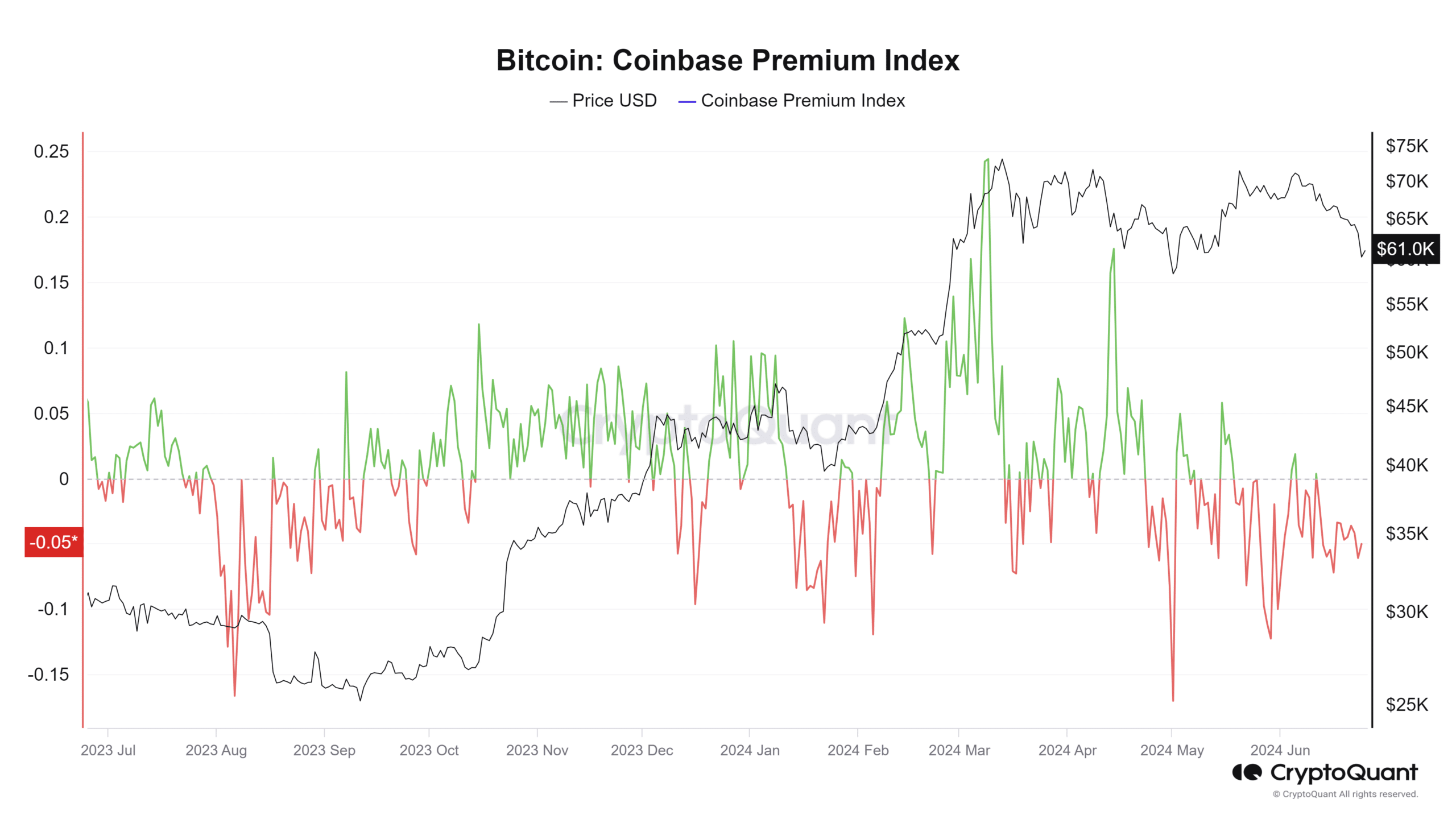

The Coinbase Premium Index has been negative over the past month. It indicated that the price on the Coinbase market was just under 0.1% lower than the Binance USDT Bitcoin pair.

This implied that US investor interest in Bitcoin has declined significantly over the past six weeks. In March and April 2024 the Index was mostly positive, but sentiment has changed significantly since then.

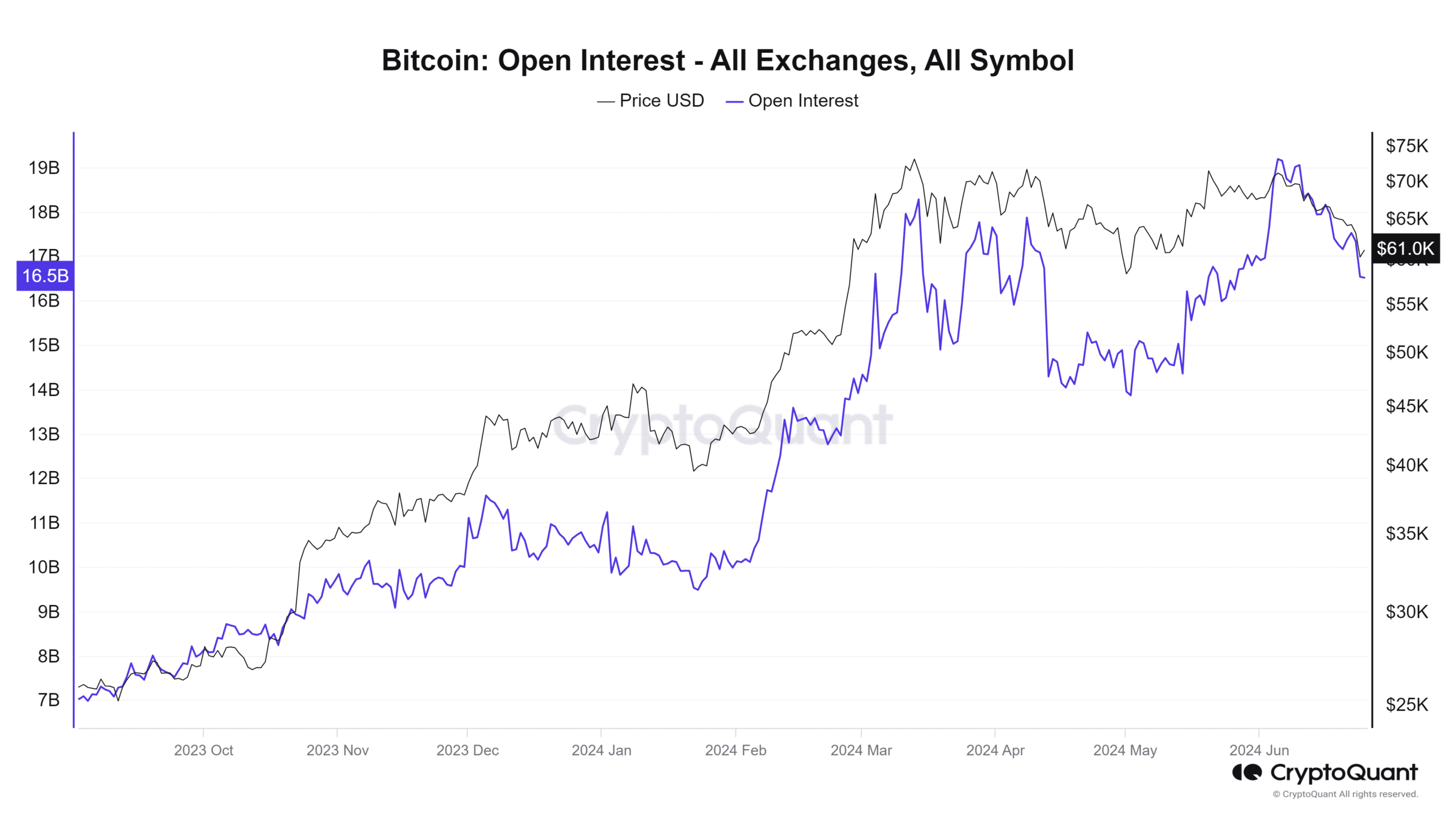

Another sign of bearish market sentiment was the sharp decline in Open Interest. As of June 6, OI was $19.1 billion. At the time of writing, with prices down 14.6%, OI was $16.5 billion.

It indicated that futures market participants preferred to remain on the sidelines and were unwilling to long BTC due to the continued decline in recent weeks.

This can be a good thing in the long run, as it wipes out over-indebted bulls, sending price movement toward a more stable, spot-driven path.

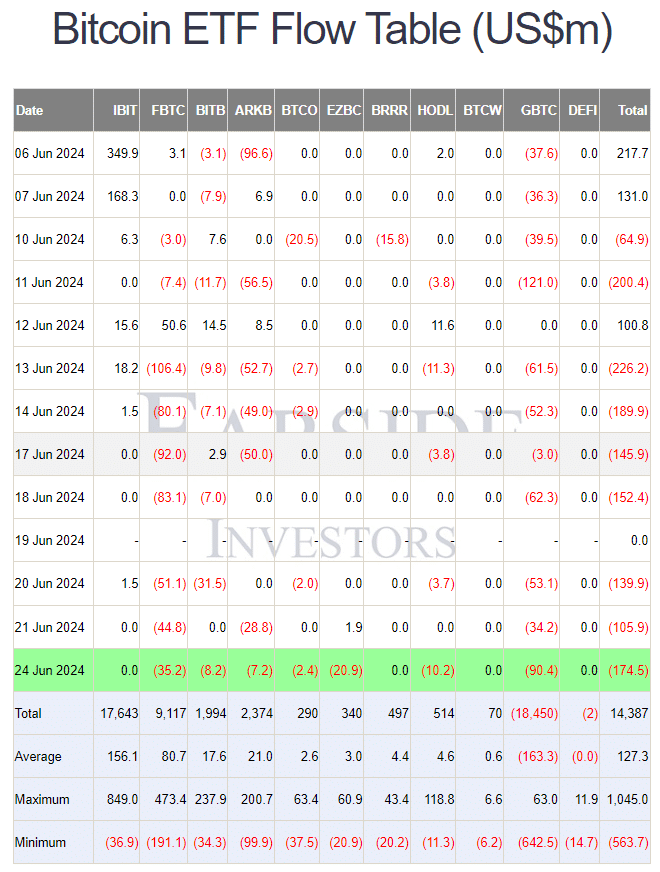

AMBCrypto also noted that Farside Investors data on Bitcoin ETF inflows was negative over the past week. This was very different from the first week of June and again reflected the shift in sentiment.

Read Bitcoin’s [BTC] Price forecast 2024-25

In a recent report, AMBCrypto highlighted that the current price decline could go deeper south.

The news of Mount Gox and refunds to customers whose assets were stolen a decade ago meant that there are a number of reasons why sentiment in the crypto market is in a tough spot.