- Bitcoin’s profitability warrants an assessment of the likelihood of selling pressure.

- BTC’s recent data shows a resurgence of confidence in its potential to get back above $70,000.

Bitcoin [BTC] Bulls have been dominating for almost three weeks now, pushing the price above $64,000. This comes against a backdrop of renewed optimism, but should you consider taking profits at this level?

Although Bitcoin bulls have performed commendably, the price is now in a zone that previously generated selling pressure.

There was clearly some resistance building above the $64,000 price level over the past three days. Moreover, an overwhelming majority of Bitcoin holders, 84% above $63,000, are profit now.

This suggests that BTC could be susceptible to significant downside in the event of another bearish event. On the other hand, a series of events has raised expectations and hopes that Bitcoin can rise to $80,000 this time.

Many are now wondering which choice would be easier; Continue HODLing BTC or Take Profits?

Are long-term owners still optimistic?

A recent one CryptoQuant Analysis suggests that many long-term Bitcoin holders may choose not to move their coins. This suggests that they are not yet taking profits, and this could protect BTC from selling pressure.

It could also allow it to extend its recent upside potential in the coming days or weeks if there is demand to push the price higher.

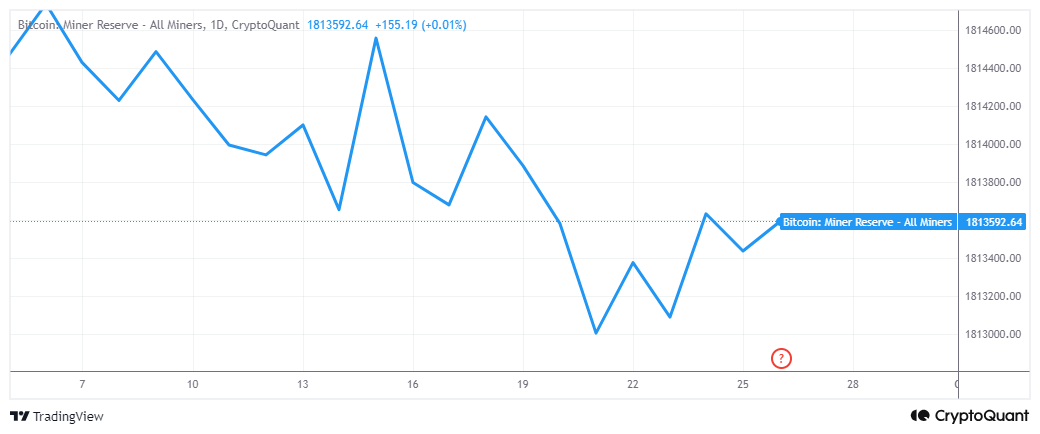

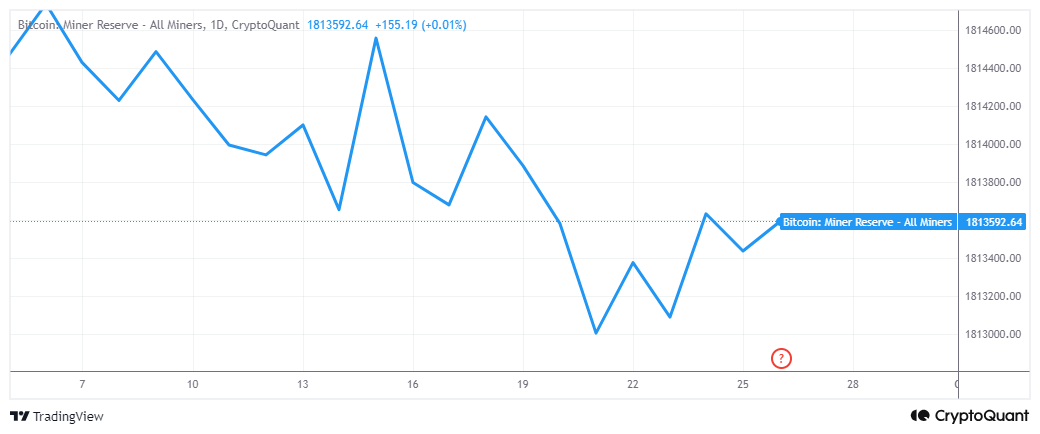

The CryptoQuant analysis also suggests that the capitulation of miners would be a reason for long-term Bitcoin holders to sell. However, on-chain data showed that miners’ reserves were on a general upward trend over the past five days.

Source: CryptoQuant

The rise in miner reserves suggests that miners are also choosing to HODL their coins in anticipation of higher prices.

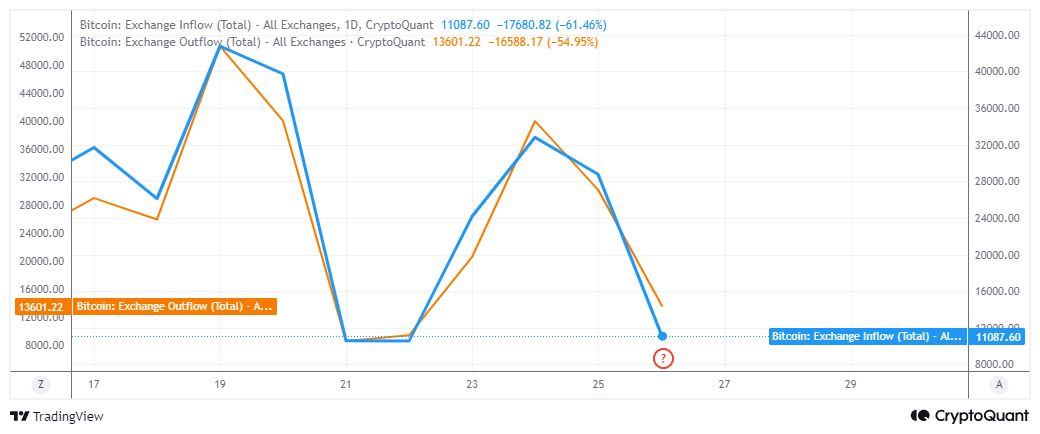

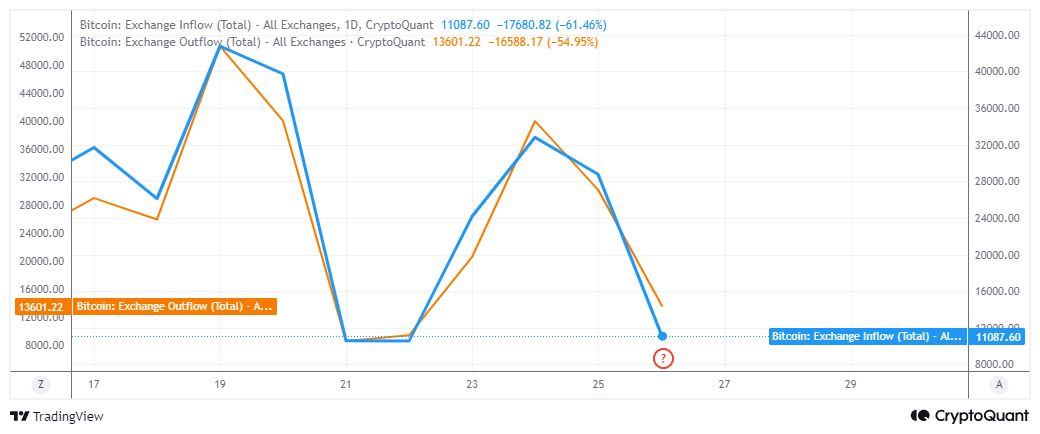

But what about the prospects for near-term selling pressure? Although the current price level provided some resistance, exchange rate data showed that demand still outweighed selling pressure.

Outflows from Bitcoin exchanges were higher over the past 24 hours at 13,601 BTC, compared to 11,087 BTC flowing out of exchanges.

Source: CryptoQuant

However, it is worth noting that currency flows have declined over the past three days. Additionally, they had slowed to levels where they were previously running, suggesting a shift could occur in the coming days.

Read Bitcoin’s [BTC] Price forecast 2024–2025

In conclusion, Bitcoin price action previously demonstrated robust selling pressure above $60,000. That doesn’t seem to be the case with the last step above the same level.

This signals growing confidence, boosted by recent prospects of liquidity flowing into the market.