- Interest in the Bitcoin NFT sector declined significantly.

- Despite this, the price of BTC increased and activity on the network remained stable.

Despite the halving, Bitcoin remains[BTC] Miners have continued to generate large amounts of fees in recent days, indicating continued profitability in the mining sector.

The increase in miner revenue was mainly attributed to the rise of Bitcoin runes, a protocol that facilitates the creation of fungible tokens on the Bitcoin blockchain.

The introduction of runes has increased the profitability of mining by opening avenues for the creation of new cryptocurrencies and tokens within the Bitcoin ecosystem.

Problems in sight

However, recent data indicates a decline in interest in Bitcoin runes, among other Ordinal NFTs.

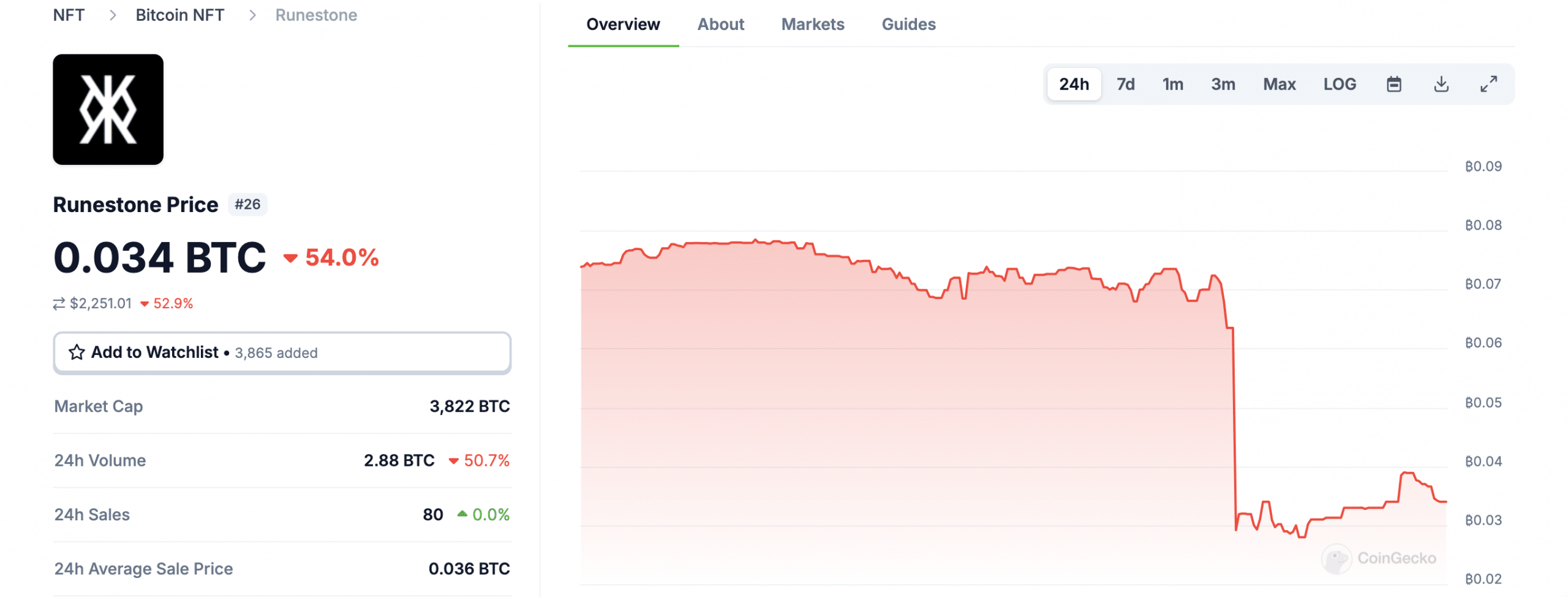

After the completion of the DOG Runes snapshot at 840,269, the floor price of the Pre-Runes concept Ordinals NFT Runestone fell by more than 60% within 24 hours.

Conversely, the rock bottom prices of Bitcoin Puppets and NodeMonkes have also fallen during this period.

Source: Coingecko

This downward trend in interest rates could potentially impact the fees generated by Bitcoin miners.

As enthusiasm for runes and associated NFTs wanes, miners may face increased selling pressure as profitability declines, potentially leading to a decline in overall mining revenue.

Furthermore, the consequences of reduced miner revenues could extend to the broader Bitcoin ecosystem, which could impact the cryptocurrency’s price. A decline in mining profitability could lead to selling among miners, contributing to downward pressure on BTC’s price trajectory.

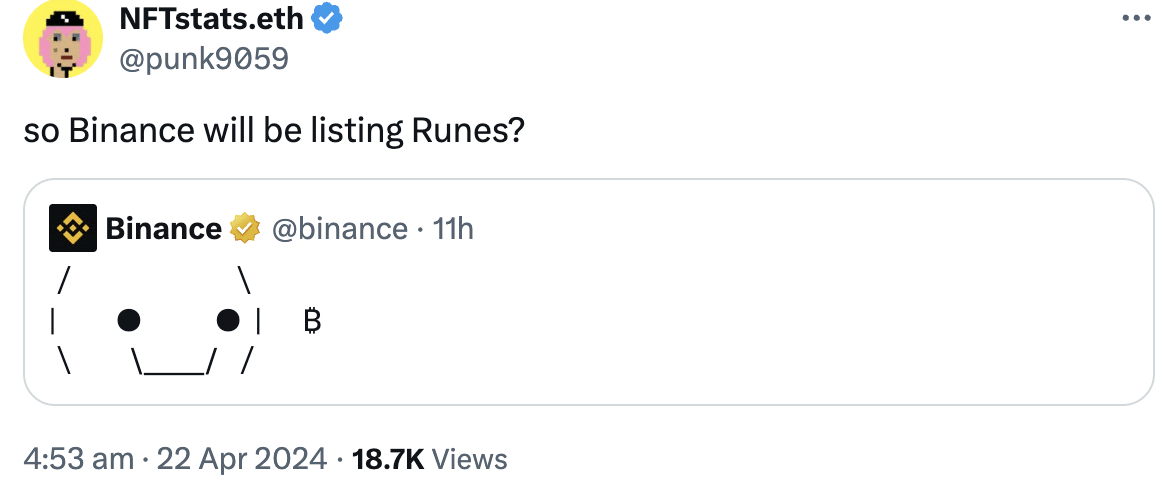

However, there may be a silver lining on the horizon for Bitcoin runes. Binance’s recent announcement about a possible listing of runes on its network signals a possible resurgence of interest.

Such a move by Binance could revive the rune market, reignite investor enthusiasm, and help BTC’s case within the NFT space.

Source:

Read Bitcoin’s [BTC] Price forecast 2024-25

How is BTC doing?

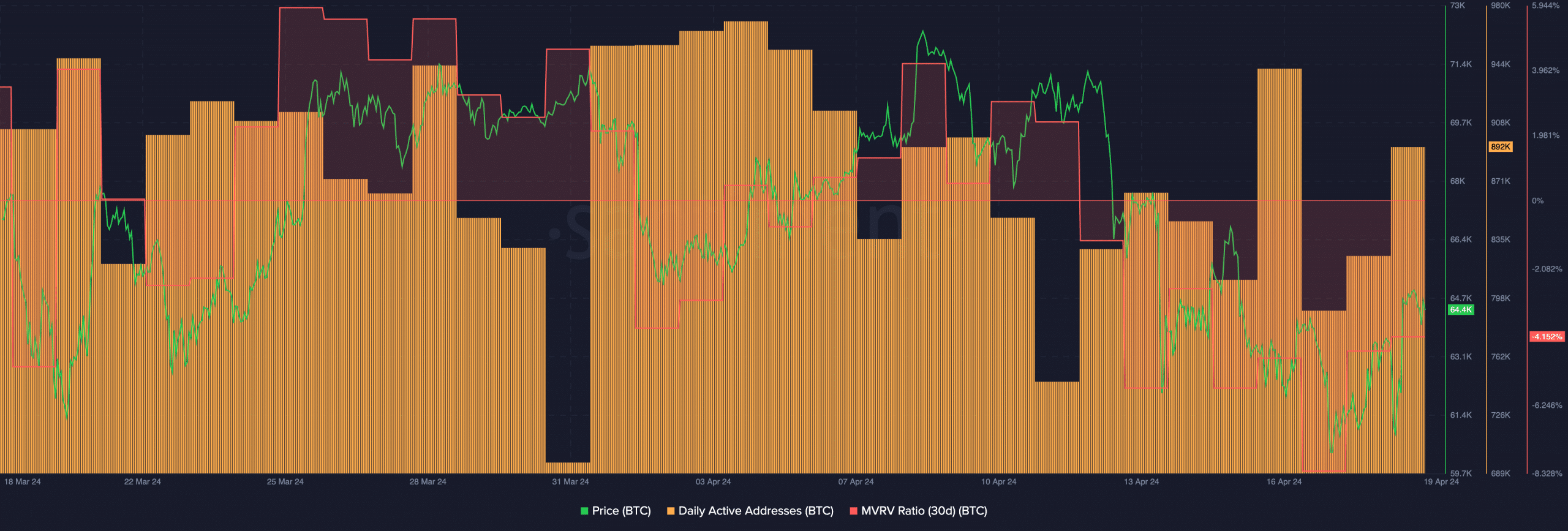

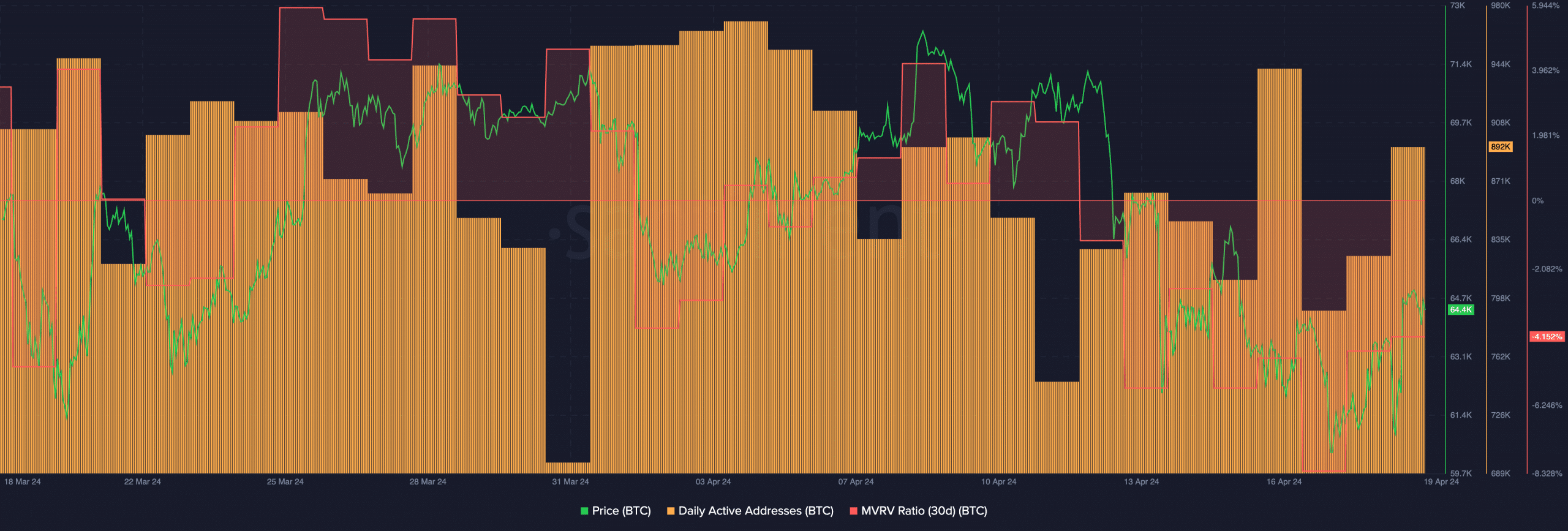

At the time of reporting, BTC was trading at $66,367.49, up a modest 2.11% in the past 24 hours. Despite this price increase, current activity on the Bitcoin network appears relatively stable, with daily active addresses maintaining consistent levels.

Although the price of BTC had soared, the MVRV ratio for BTC had fallen, indicating that most addresses were not profitable at the time of writing. This suggests that the price of BTC could rise further before significant profit-taking occurs.

Source: Santiment