This article is available in Spanish.

Crypto analyst Trader Tardigrade has drawn the community’s attention to the fact that Bitcoin price reflects 2023 movements. The analyst provided further insight into what this means for the flagship crypto.

Bitcoin price reflects 2023 movements

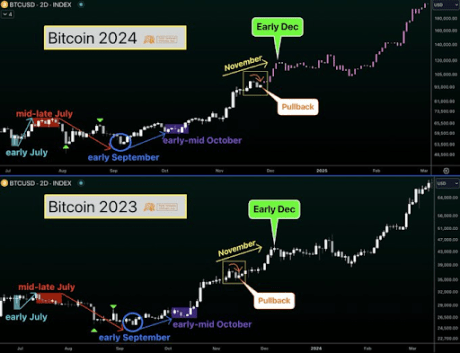

In an X post, trader Tardigrade said Bitcoin price remains on track with 2023 moves. He further noted that the flagship crypto just completed the withdrawal. With the pullback complete, the crypto analyst claimed that there will be a surge above 100,000, followed by a consolidation around that level.

Interestingly, trader Tardigrade also predicted that the Bitcoin price would reach $200,000 by early 2025. The analyst’s accompanying chart showed that this price increase to this target will occur in March 2025.

This parabolic rally to $200,000 is expected to mirror a similar rally that BTC enjoyed from early December that year when it rose to the previous. all-time high (ATH) from $73,000 in March earlier this year. Meanwhile, it is worth noting that trader Tardigrade is not the only one who has predicted that Bitcoin price could reach this level in this market cycle.

Bernstein Analysts also previously predicted that the BTC price would reach $200,000 by the end of 2025, although they claimed this was a ‘conservative’ target. Geoffrey Kendrick, head of research at Standard Chartered, also predicted that Bitcoin could reach this price target and gave a similar timeline to Bernstein analysts.

However, crypto analyst Tony Severino is skeptical that Bitcoin price could reach $200,000 in this bull cycle. Instead, he has made a more conservative prediction, stating that the flagship crypto will likely peak at some point in the future Range of $160,000. The analyst noted that this was a more attainable target, given that the golden ratio is within this range.

BTC is “far away” from a market top

In an X-post, crypto analyst Ali Martinez claimed that BTC price is still “far away” from a market top. He made this statement while highlighting the market value-to-realized value indicator (MVRV), which indicates whether the asset is overvalued or undervalued. The graph showed that Bitcoin has not yet reached its true value.

Related reading

Bitcoin price is currently facing a significant price correction and has been rising non-stop ever since Donald Trump’s victory. However, Martinez suggested this could be a good time to buy this dip. According to him, the TD Sequential presents a buy signal on the Bitcoin hourly chart while a bullish divergence is forming against the Relative Strength Index (RSI). He added that this could help Bitcoin recover to between $95,000 and $96,000.

At the time of writing, the Bitcoin price is trading around $93,400, down in the past 24 hours. facts from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com