- Bitcoin whales amassed huge sums of BTC as the crypto’s price soared

- On the other hand, overall activity in the Bitcoin ecosystem declined

After Bitcoin [BTC] fell below the $60,000 level, panic was the norm in the market, with FUD also making an appearance. However, as expected, cryptocurrency whales saw this dip as an opportunity to buy BTC at a discount. And they did.

Whales are getting hungry for BTC

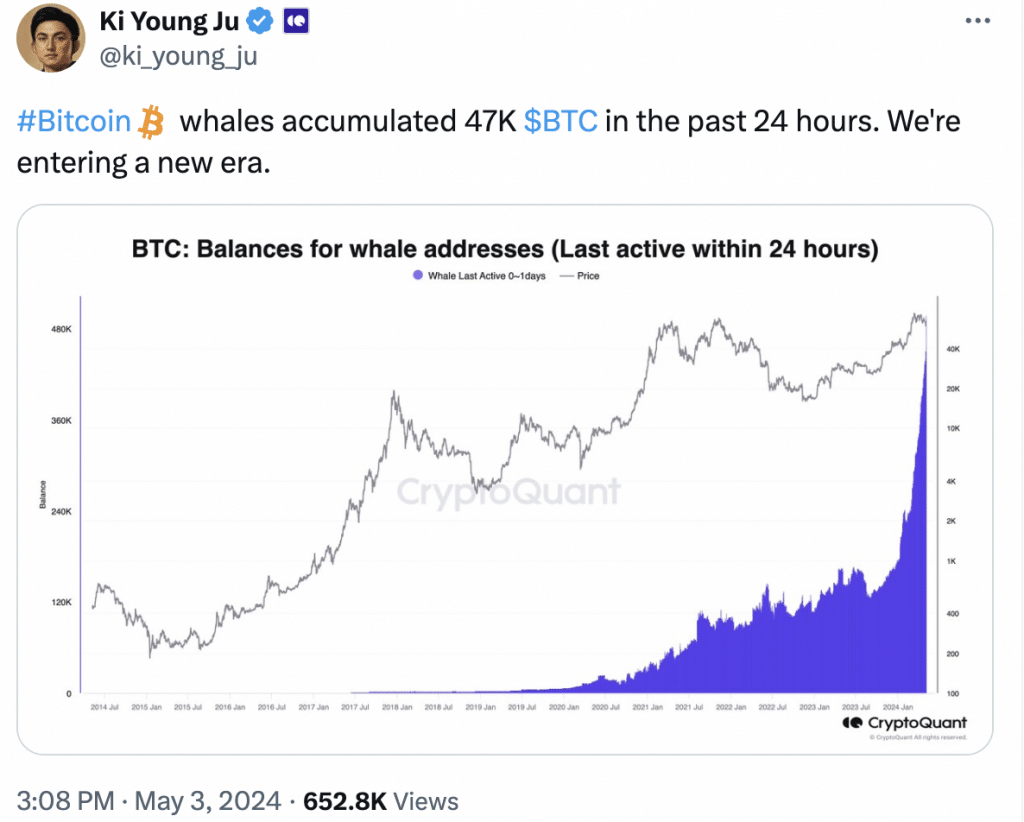

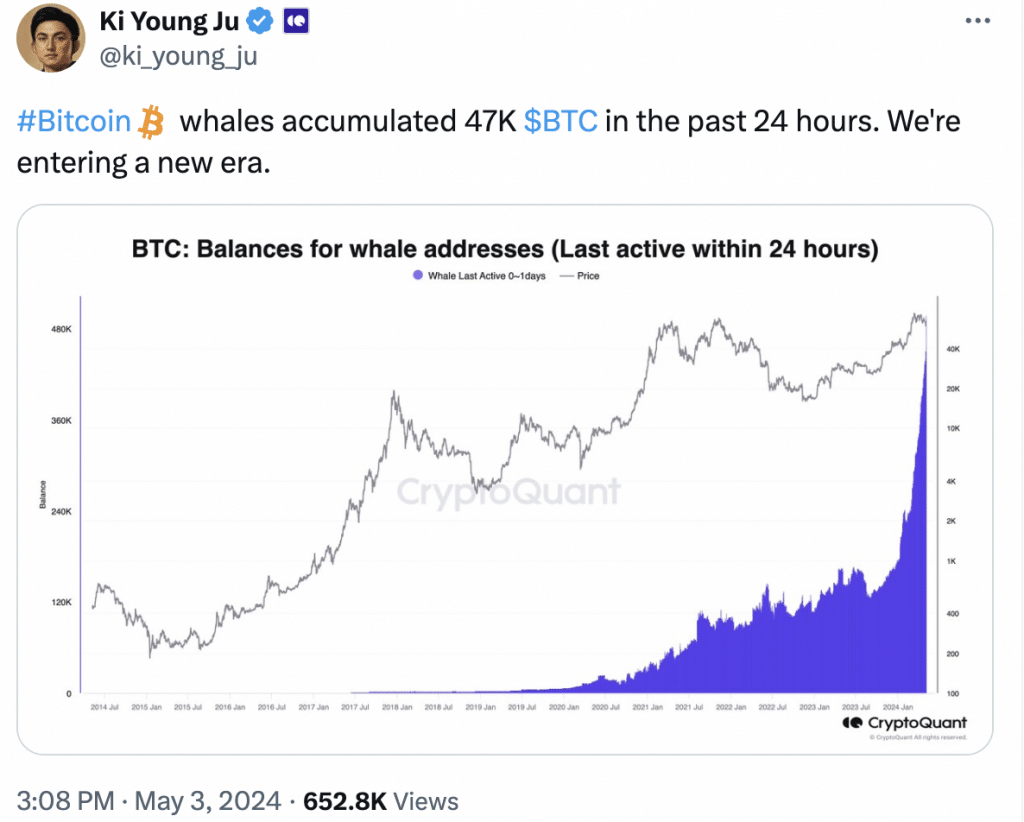

According to recent data, Bitcoin whales collected 47,000 BTCs in just 24 hours. The accumulation of whales on a large scale usually has positive effects on the price of any cryptocurrency.

Bitcoin was no different: the crypto rose 6.36% during the aforementioned period. At the time of writing, it was trading near $64,200 on the charts.

Source:

While interest in whales can help move prices north, there are also some downsides to interest in whales. High interest from whales could result in most of the BTC being controlled by a few. These wallets can then manipulate cryptocurrency prices, negatively impacting vulnerable retail investors.

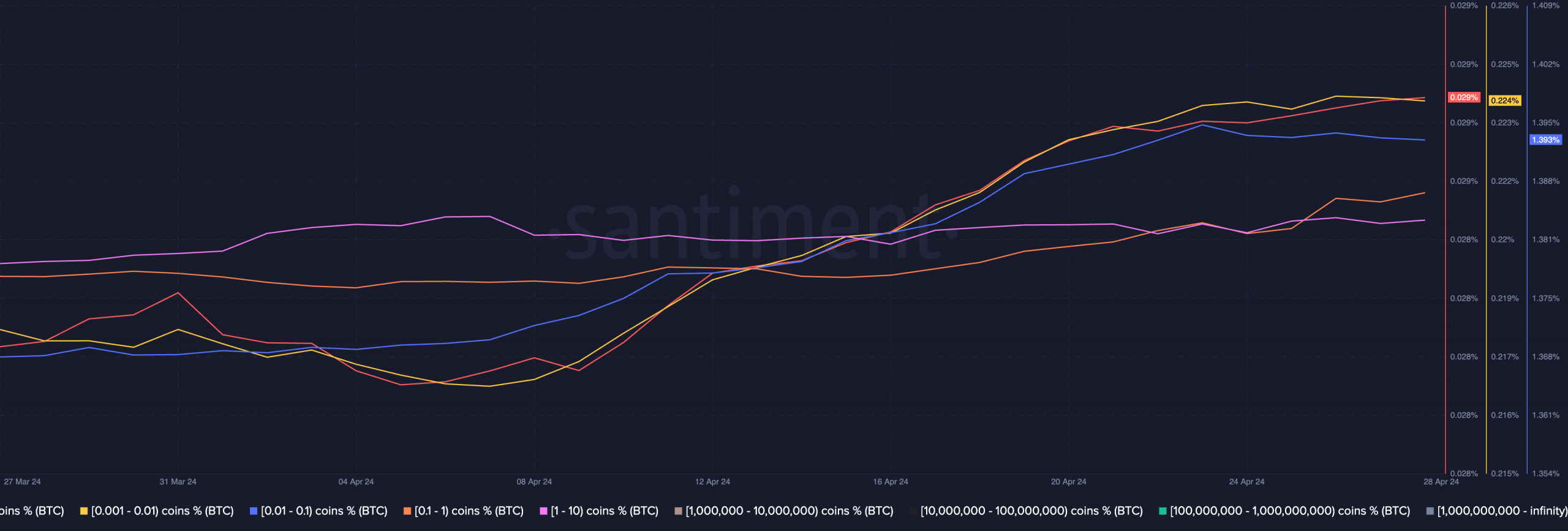

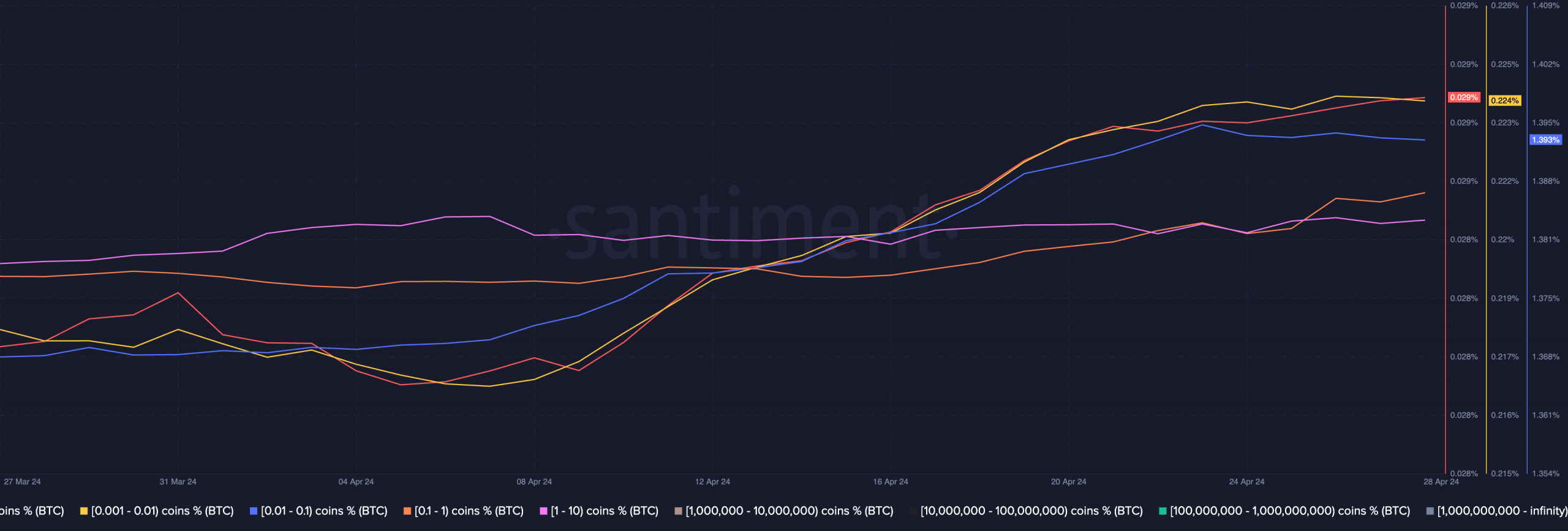

Interestingly, it was seen that it was not just whales that collected BTC. Instead, addresses with anywhere between 0.001 and 1 BTC also started showing interest in buying the king coin.

Source: Santiment

Looking at the data

If sentiment around BTC remains positive for both retail and whale investors, Bitcoin’s price could rise even further. By doing this, it could rise back up to $65,000.

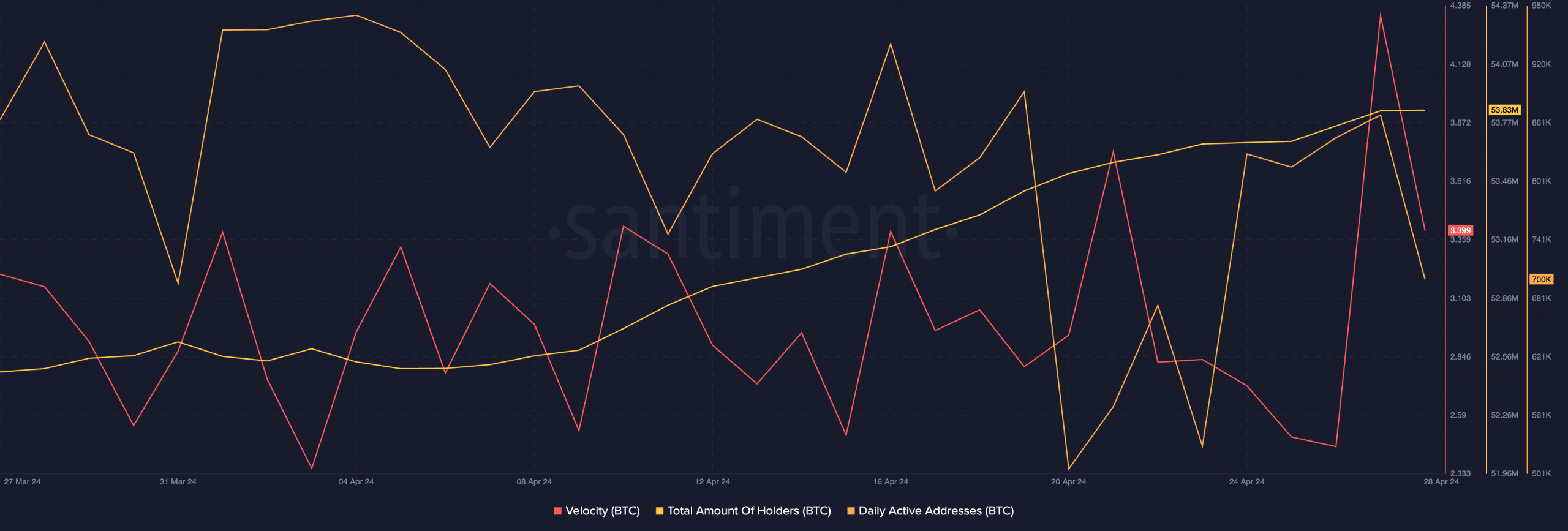

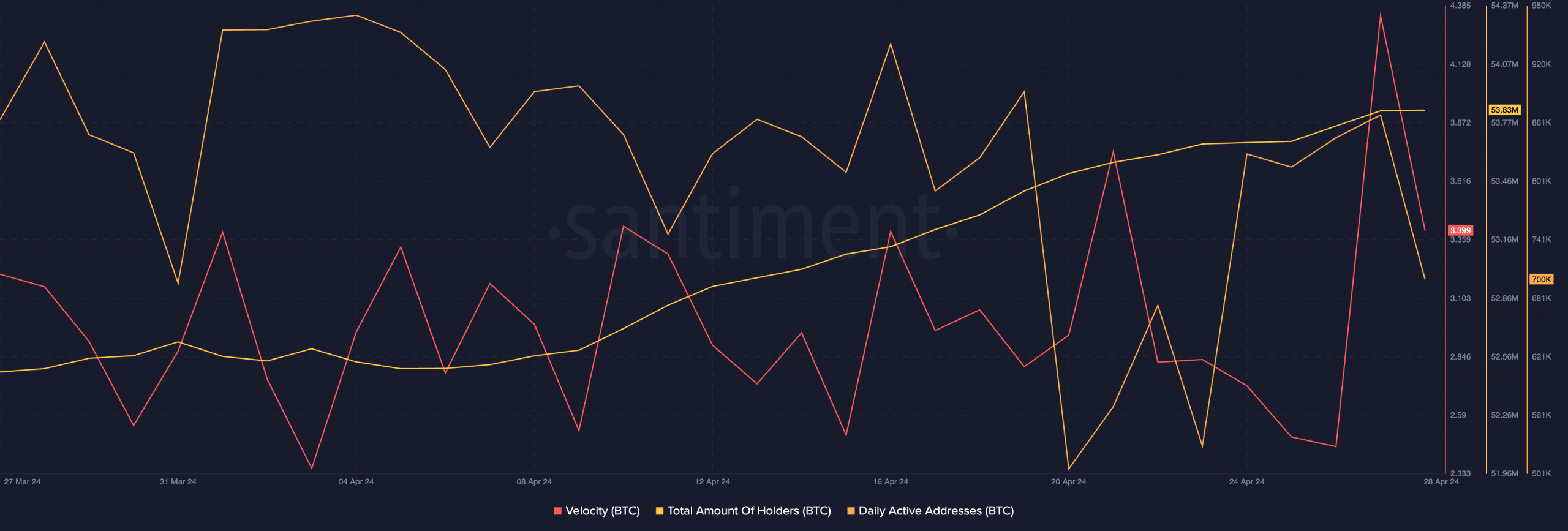

Moreover, the velocity around BTC has also increased significantly in recent days. This indicated that the frequency with which BTC was traded had increased significantly in recent days. Moreover, the total number of addresses with BTC also grew.

A combination of these factors could prove beneficial for BTC’s price trajectory in the long term.

Another factor that could play a role is the state of the Bitcoin network. In recent days, the number of daily active addresses on the network has decreased significantly. If activity on the network continues to decline, it could impact the revenue generated by miners, increasing selling pressure on the charts.

Source: Santiment

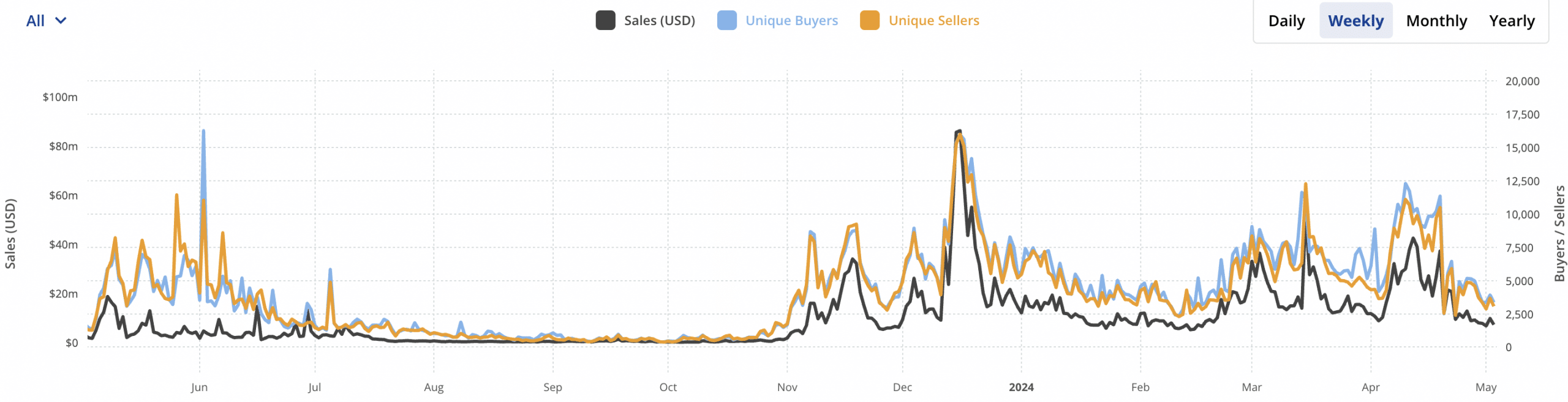

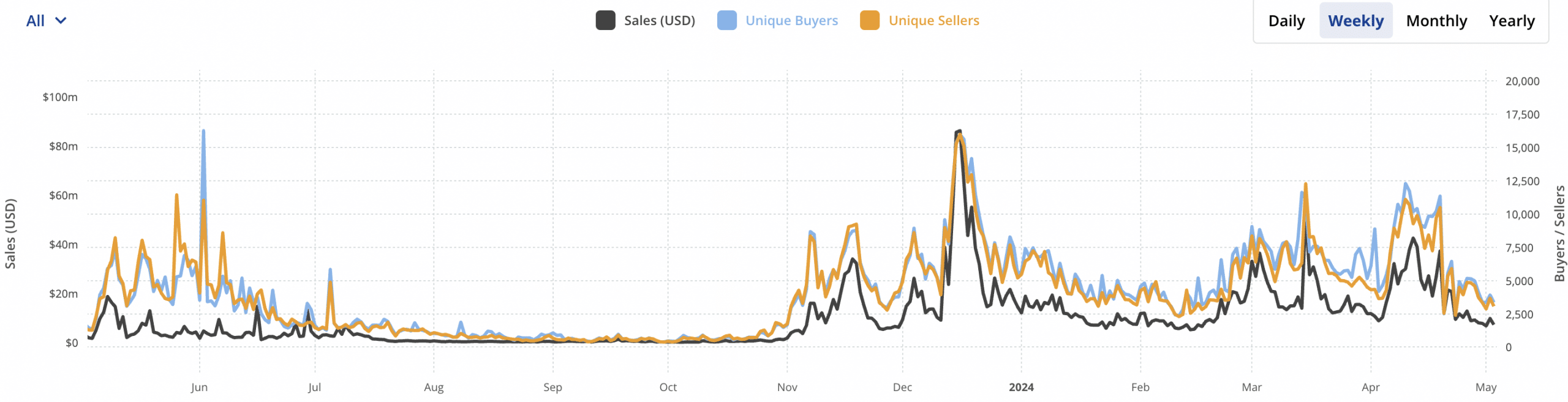

Even in the NFT sector, there seemed to be signs of waning interest. In fact, the number of NFTs sold on the Bitcoin network has dropped significantly.

Is your portfolio green? Check out the BTC profit calculator

Source: Santiment