Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

The Bitcoin price last week has one of its strongest versions last week in one of the $ 88,000 level at the start of the $ 88,000 level. The Prime Minister Cryptocurrency, however, had a steep correction on Friday 28 March, after the last February inflation data.

With the price of BTC that is now floating under $ 84,000, panic seems to be growing on the market, because investors are afraid of further correction for the world’s largest cryptocurrency. Interestingly, the latest data on the chain show the critical support levels for the Bitcoin prize.

Is BTC running the risk of a fall up to $ 71,000?

In a recent message on the X platform, blockchain Analytics firm Glassnode explained The recent behavior of investors and how this can influence the Bitcoin price campaign in the coming days. This evaluation is based on the cost -based distribution data of investors around the Bitcoin price.

Related lecture

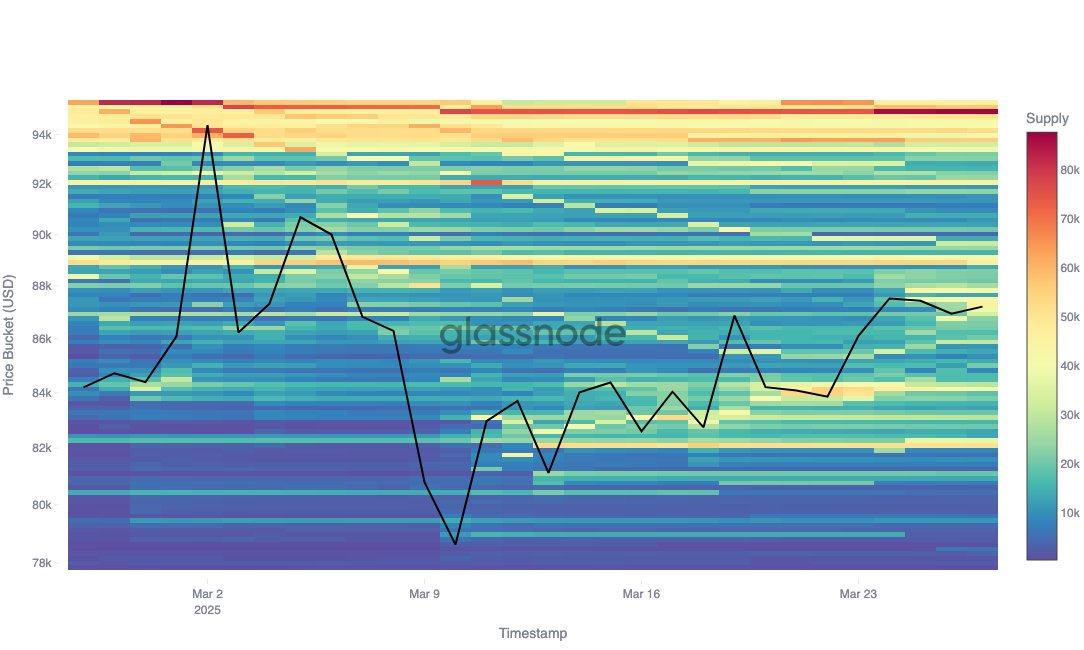

According to Glassnode, the cost -based distribution data reflects the total Bitcoin delivery that is held by addresses with an average cost basis within specific price m aways. As observed in the graph below, the heat card (color intensity) represents the size of BTC offer in a price zone.

Source: @glassnode on XGlassnode -Data shows that a considerable percentage of traders on 10 March bought around 15,000 BTC at the level of $ 78,000 before they sell at the recent local top of $ 87,000. After this last redistribution round, the BTC range at the level of $ 78,000 is now thin, which weakens the support cushion.

However, it is worth noting that the following crucial support levels are around $ 84,100, $ 82,090 and $ 80,920, where investors have bought 40,000 BTC, 50,000 BTC and 20,000 BTC respectively. However, the Bitcoin price can run the risk of a deep correction if it loses these levels.

In the case of a deeper correction, $ 78,000 may not offer strong enough kisses for the flagship cryptocurrency after the recent sale of investors who previously kept at the level. Glassnode -Data shows that the Bitcoin price could fall to $ 74,000, the next important support level after $ 80,000.

The On-Chain Analytics platform emphasized $ 74,000 (where investors bought 49,000 BTC) and $ 71,000 (where investors bought 41,000 BTC) because the following support levels should fall the Bitcoin price below $ 80,000. “These levels reflect conviction-driven accumulation zones that can absorb extra downward pressure,” Glassnode added.

Bitcoin -price at a glance

From this letter, the price of Bitcoin is around $ 83,800, which reflects a decrease of almost 4% in the last 24 hours.

Related lecture

Featured image of Istock, graph of TradingView