While some gains are still being made, the Bitcoin price is showing signs of exhaustion, at least in the short term. Zooming out, recent data shows the massive rally that cryptocurrencies have experienced in recent months and the sector’s potential for additional gains.

At the time of writing, Bitcoin price is trading at $34,800, with sideways price action over the past 24 hours. This past week, BTC posted a 2% gain, while altcoin market trends were much higher and retained more gains.

Bitcoin’s 110% Jump Year to Date Heralds a New Era in BTC?

According to a report from Bitfinex: This year has been a major milestone for cryptocurrencies as Bitcoin (BTC) and Ether (ETH) have shown remarkable growth, leaving traditional assets like gold behind. Bitcoin is up 93% and Ethereum is up 3%, indicating a solid performance correlation that has remained consistently tight.

BTC in particular has been in the spotlight thanks to its first mover advantage, earning it the nickname “digital gold” and gaining wide institutional support.

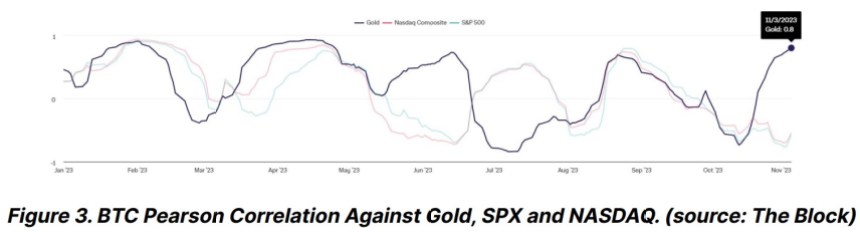

As these digital assets reach new heights, traditional stock indices like the S&P 500 and NASDAQ are navigating a correction phase. This contrast signals a changing investment landscape, with cryptocurrencies emerging as a dominant force capable of outperforming established markets, the report said.

As seen in the chart below, the data indicates that Bitcoin price is outperforming other assets and Gold is catching up with a correlation of 0.8 with the cryptocurrency.

Bitcoin’s price increase of more than 110 percent since the beginning of the year signals a “transition” for holders from unrealized losses to gains.

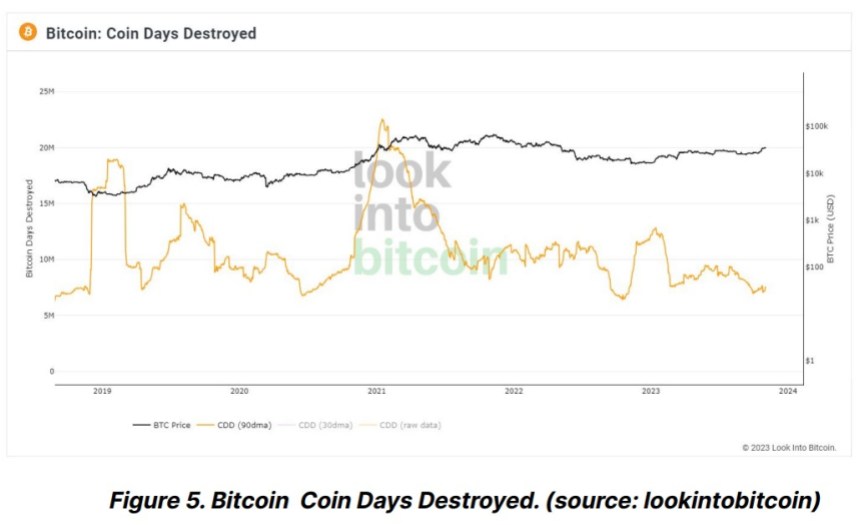

Typically, such increases lead to market consolidation or sharp pullbacks. Still, the current trend of declining Coin Days Destroyed, a metric used to measure market activity and sentiment, suggests that long-term investors remain steadfast, as shown in the chart below.

The lack of movement in portfolios containing significant Bitcoin sums further points to a bullish outlook or a defensive strategy against economic uncertainties.

Amid this crypto resilience, the Federal Reserve’s latest decision to maintain interest rates between 5.25 and 5.50 percent reflects a cautious but non-restrictive economic approach, the report said.

Crypto holds firm amid economic uncertainty

Despite the Fed’s updated, confident view of the US economy, the manufacturing sector saw a decline in October, mainly due to strikes in the auto industry. This indicates a significant impact of labor disputes on the sector.

The broader US economy is feeling the impact, with a slowdown in job creation and the slowest wage growth since mid-2021, signaling a shift in labor market conditions. This data supports a continuation of the current bullish trend.

However, as mentioned, traders should be on the lookout for spikes in volatility, which can pose obstacles, especially for speculators taking leveraged positions.

Cover image from Unsplash, chart from Tradingview