- Bitcoin’s value has increased by more than 100% since the beginning of the year.

- Most investors kept profits at the time of writing.

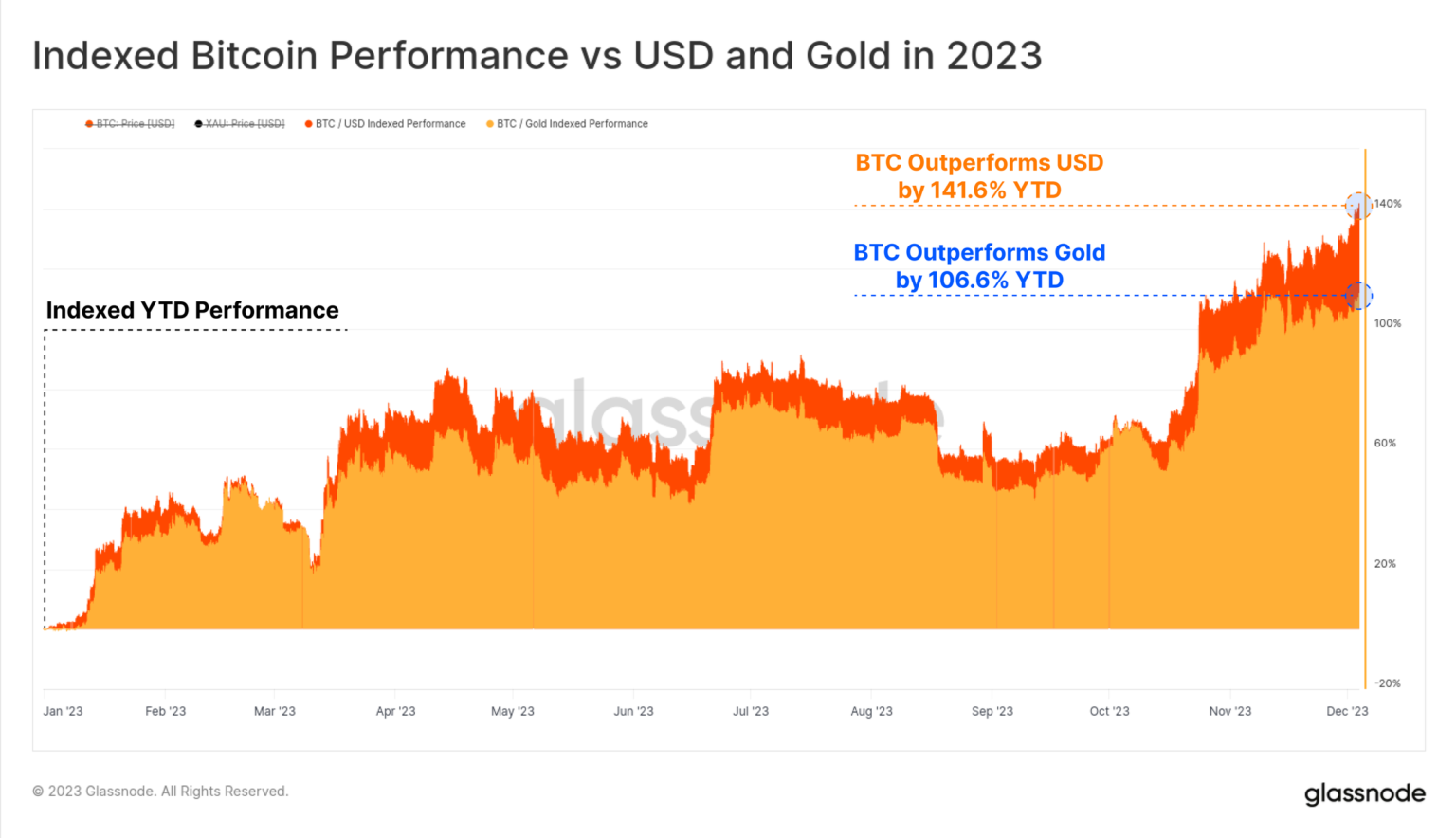

King coin Bitcoin [BTC] has retained its position as one of the best performing assets globally in 2023, surpassing traditional assets such as gold and equities, Glassnode found in a new report.

According to the on-chain data provider, a year-to-date review of BTC’s performance showed a 140% growth in the coin’s value. Compared to gold, the price of BTC has more than doubled since the beginning of the year.

Most BTC holders are now making a profit

When the coin exchanged hands at an 18-month high, Glassnode discovered that:

“The vast majority of Bitcoin holders are now making profits again, while a small portion of them are realizing these profits.”

At the time of writing, BTC was trading above the actual market average price of $31,000. Therefore, many coin holders have seen their investments recover from the losses they suffered during the 2022 bear market.

Assessing how profitable BTC investments have been, the coin’s price appreciation has significantly increased the share of coin holdings held in profit by long-term holders.

The research firm added:

“From the perspective of long-term holders, the YTD rally has increased their investments’ share of earnings from 56% to 84%. This is above the all-time average value of 81.6%.”

With a Spent Output Profit Ratio (SOPR) of 1.46%, investors in this category can expect a guaranteed average profit of 46% for each coin issued.

As for the short-term holders of the currency:

“The Short-Term Holder cohort is almost completely profitable, with more than 95% of their investments having a cost basis below the current spot price.”

Everyone wants a piece

Glassnode further found that there has been a strong increase in BTC trading volume momentum since the beginning of the year. It was noted that this

“Underlines a growing interest among investors to trade, accumulate, speculate and otherwise use exchanges for their services.”

Read Bitcoins [BTC] Price prediction 2023-24

Many expect favorable decisions on the Exchange-Traded Fund (ETF) applications pending before U.S. regulators; institutional investors have steadily increased their BTC holdings.

Glassnode commented:

“Deposits in foreign exchange markets are currently dominated by investors moving ever larger amounts of money. This may be a sign of growing institutional interest as key decision dates for ETFs approach in January 2024.”