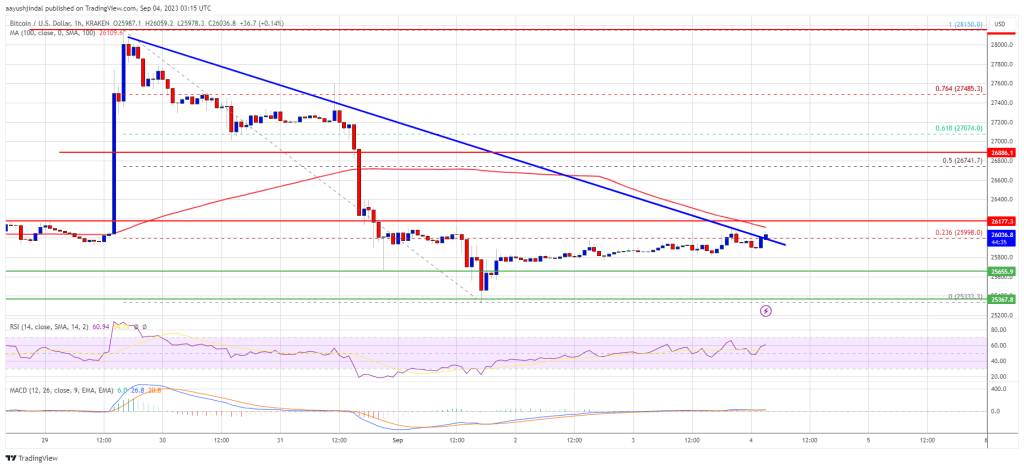

Bitcoin price tested the USD 25,350 zone and it is currently recovering. BTC needs to overcome the USD 26,200 resistance to stage a decent increase in the near term.

- Bitcoin is attempting a recovery wave from the $25,350 zone.

- The price is trading below $26,200 and the 100 hourly Simple Moving Average.

- There was a break above a major bearish trendline with resistance around $26,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start some decent gains if it hits $26,200 and the 100 hourly SMA.

Bitcoin price is facing hurdles

Bitcoin price remained in a bearish zone below the USD 27,000 resistance zone. BTC extended its decline and it traded below the USD 26,000 level. There was also a spike below USD 25,500 and the price tested USD 25,350.

A low was formed near USD 25,333 and the price is now trying to make a recovery wave. There was a small increase above the USD 25,800 resistance. The price climbed above the 23.6% Fib retracement level of the downward move from the $28,150 swing high to the $25,333 low.

In addition, there was a break above a major bearish trendline with resistance around $26,000 on the hourly chart of the BTC/USD pair. However, Bitcoin is still trading below $26,200 and the 100 Hourly Simple Moving Average.

Immediate resistance on the upside is near the USD 26,200 level and the 100-hour SMA. The first major resistance is near the $26,750 level or the 50% Fib retracement level of the downward move from the $28,150 swing high to the $25,333 low.

Source: BTCUSD at TradingView.com

The main resistance is now forming around the USD 27,000 level. A clear move above the USD 27,000 level could push the price towards USD 27,500. The next major resistance is around USD 28,000, above which there could be some decent upward movement. In the case mentioned, the price could test the USD 28,800 level.

Another drop in BTC?

If Bitcoin fails to clear the USD 26,200 resistance, it could spark another decline. The immediate downside support is near the USD 25,650 level.

The next major support is near the USD 25,350 level. A downside break below the USD 25,350 level could push the price further down. In the said case, the price could fall towards USD 24,800.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Key Support Levels – $25,650, followed by $25,350.

Key resistance levels – $26,200, $26,750 and $27,000.