- Bitcoin saw additional selling pressure on Friday as economic data undermined market sentiment

- BTC could regain some momentum if the price drops into a potential buy zone

Bitcoin bears dominated on Friday, sending the market crashing by almost 6%. The leading cryptocurrency has been in a downward trend for some time now, with multiple economic reports impacting its performance in recent weeks.

Bitcoin’s bearish outburst on Friday was in response to weak unemployment data. The figures came in higher than expected, with the overall unemployment rate in the United States rising to 4.3%. Consequently, the news sparked fears of a recession, leading to bearish investor sentiment for BTC and the rest of the market.

Is Bitcoin Ready to Go Up Again?

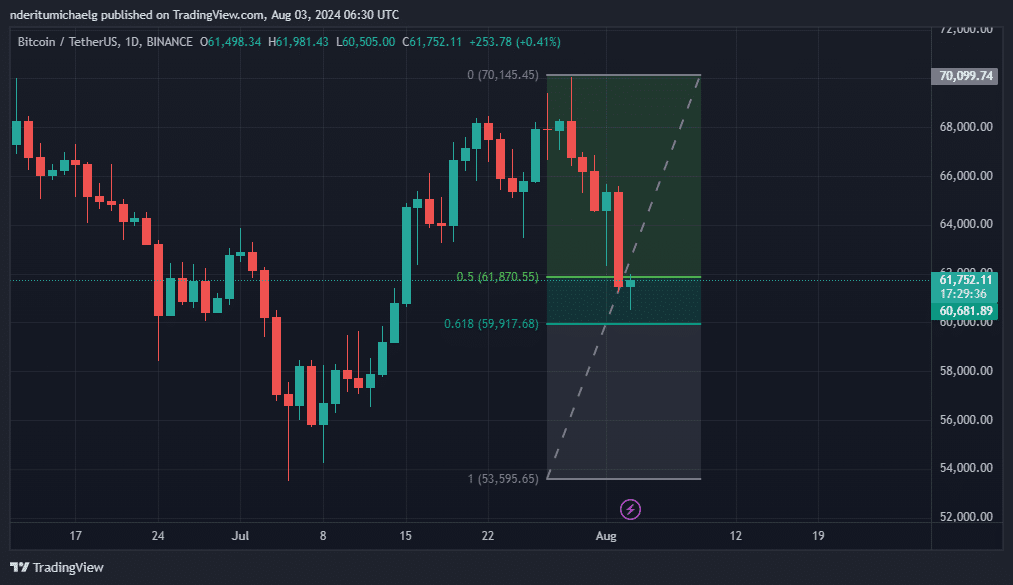

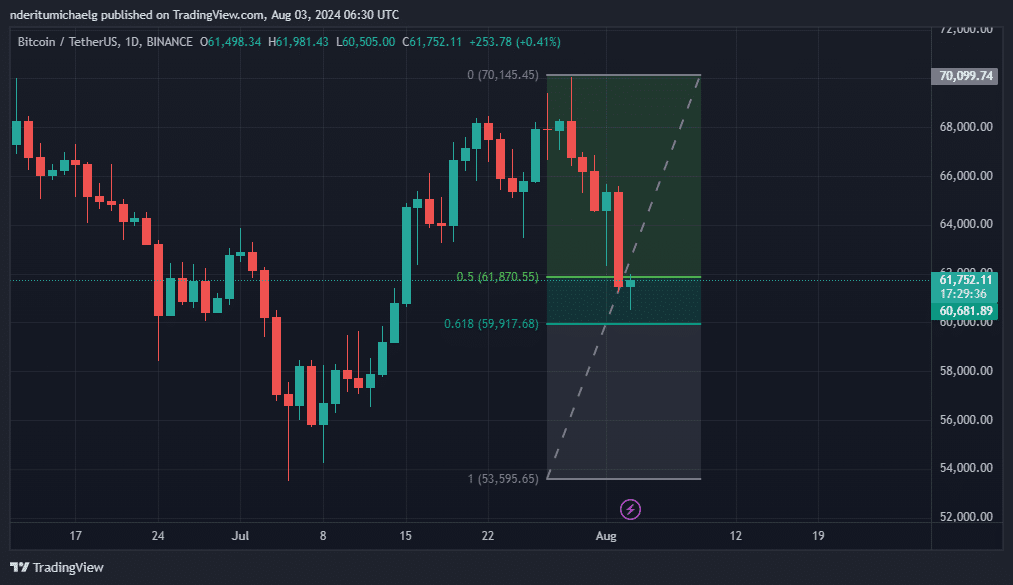

Bitcoin is down about 13% year to date from Monday’s high price, thanks to this recent bearish extension. As a result, it entered a major potential buying zone, one we highlighted earlier.

Our analysis placed the next potential buy zone between $61,870 and $59,917. This was based on Fibonacci retracement from the July low to the highest recent level.

Source: TradingView

At the time of writing, BTC was valued at $61,727, indicating a surge in buying pressure at recently depressed levels. This was also within the aforementioned Fibonacci retracement zone.

This can also be interpreted as a signal that selling pressure has decreased. Hence the question: will this be enough to maintain a significant uptrend now?

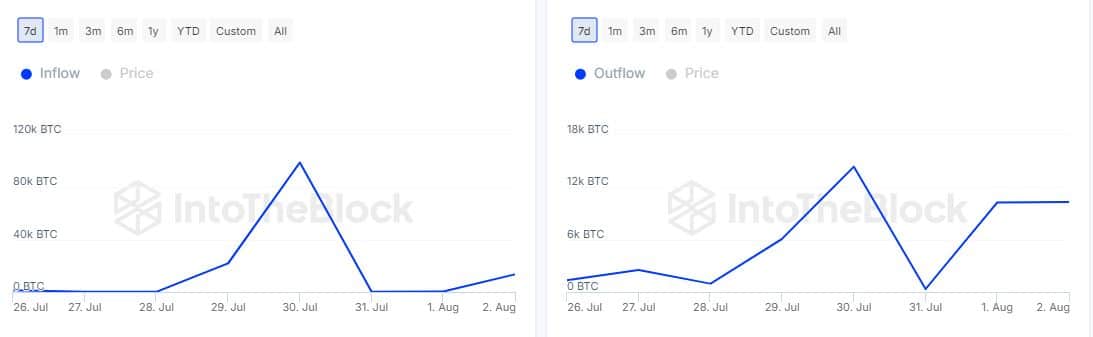

Bitcoin whales on the move

BTC ownership statistics show that whales have been actively moving money in and out of their wallets. The whale influx peaked at 99,000 BTC on July 30. Inflows also showed positive growth, from 391.8 BTC on August 1 to 13,490 BTC during yesterday’s session.

This could be a sign that whales have accumulated a significant amount of Bitcoin across the board.

Source: IntoTheBlock

On the contrary, the whale outflow peaked at 14,370 BTC on July 30, only to drop to 340 BTC the next day. The outflow recently peaked at 10,330 BTC on August 2. The total amount of inflows into whale addresses were higher than outflows – indicating that the number of whales has accumulated.

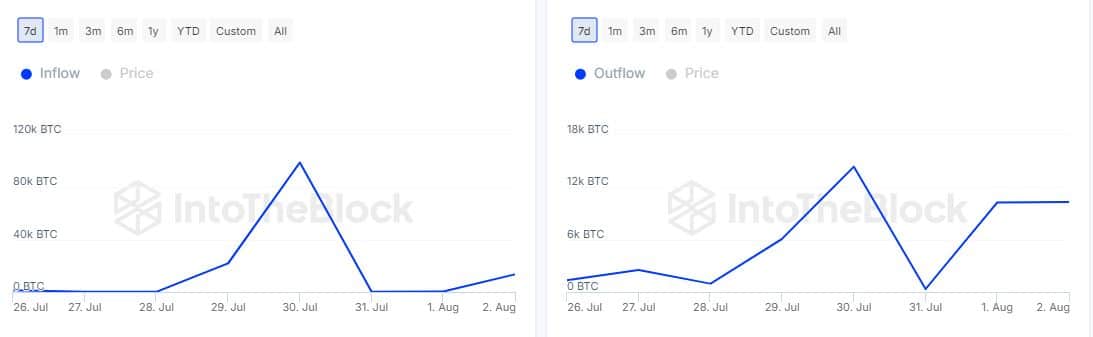

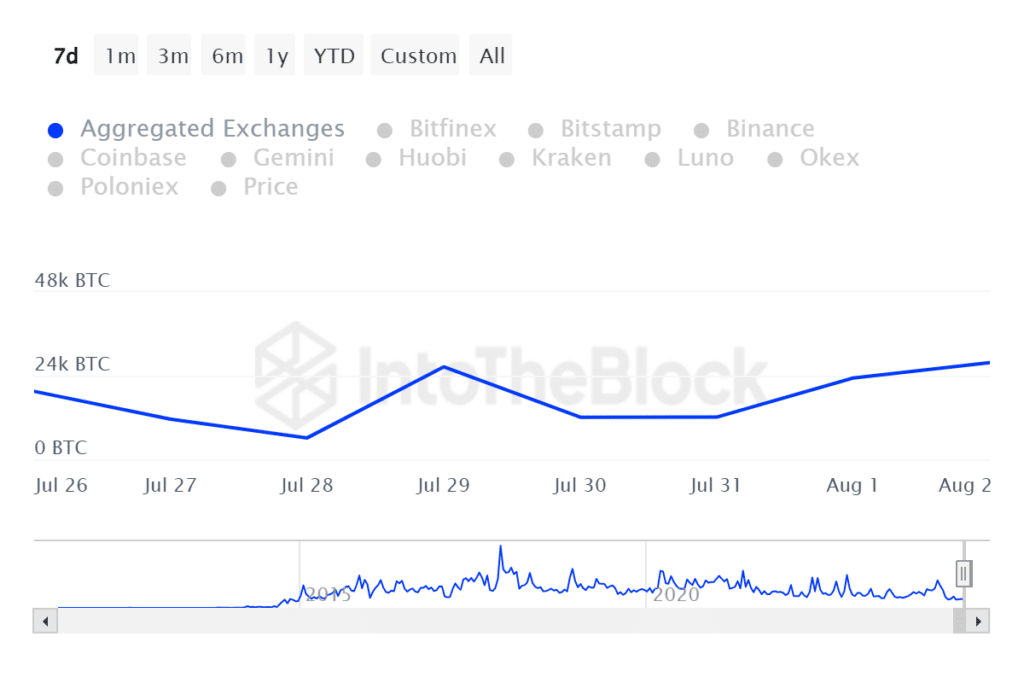

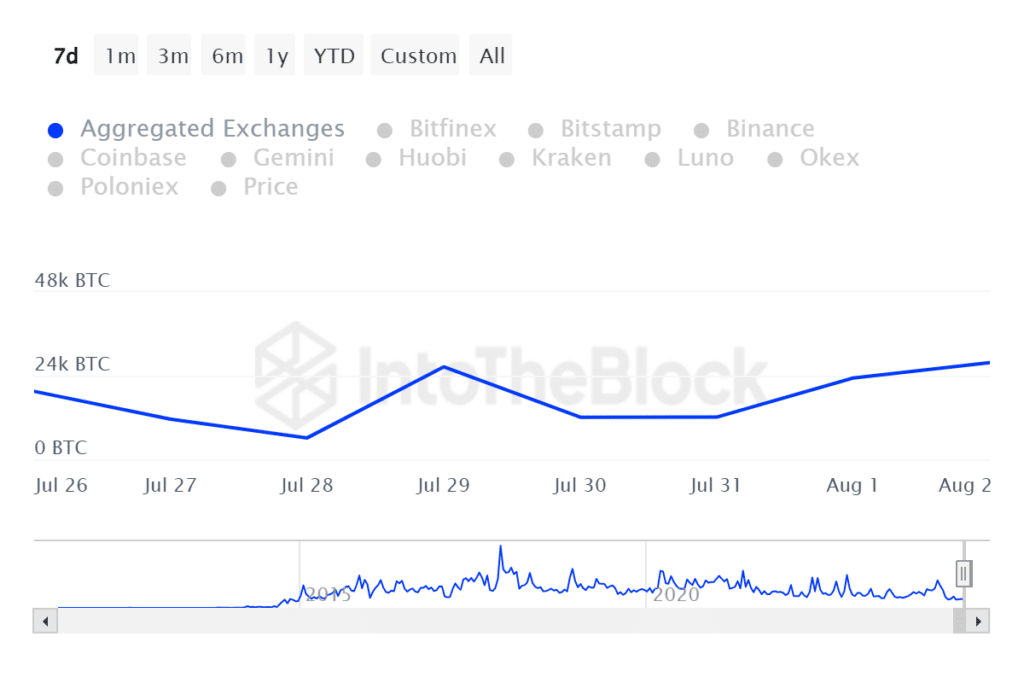

We also examined the amount of Bitcoin flowing in and out of exchanges to determine the level of buying or selling pressure.

The data showed that Bitcoin’s total outflows peaked at 27,730 BTC during yesterday’s trading session.

Source: IntoTheBlock

In comparison, Bitcoin had an outflow of 16,850 BTC during the same trading session. This means that there was a net outflow of 10,880 BTC. This amounts to over $671 million in buying pressure.

Ergo, the amount of BTC that flowed out of exchanges during Friday’s trading session seemed to confirm that traders, including whales, have gathered. This could set the pace for any recovery in the new week unless selling pressure increases.