- New and old Bitcoin offerings revealed that the coin had no new investors

- Long-term owners are selling – sign of further price decline

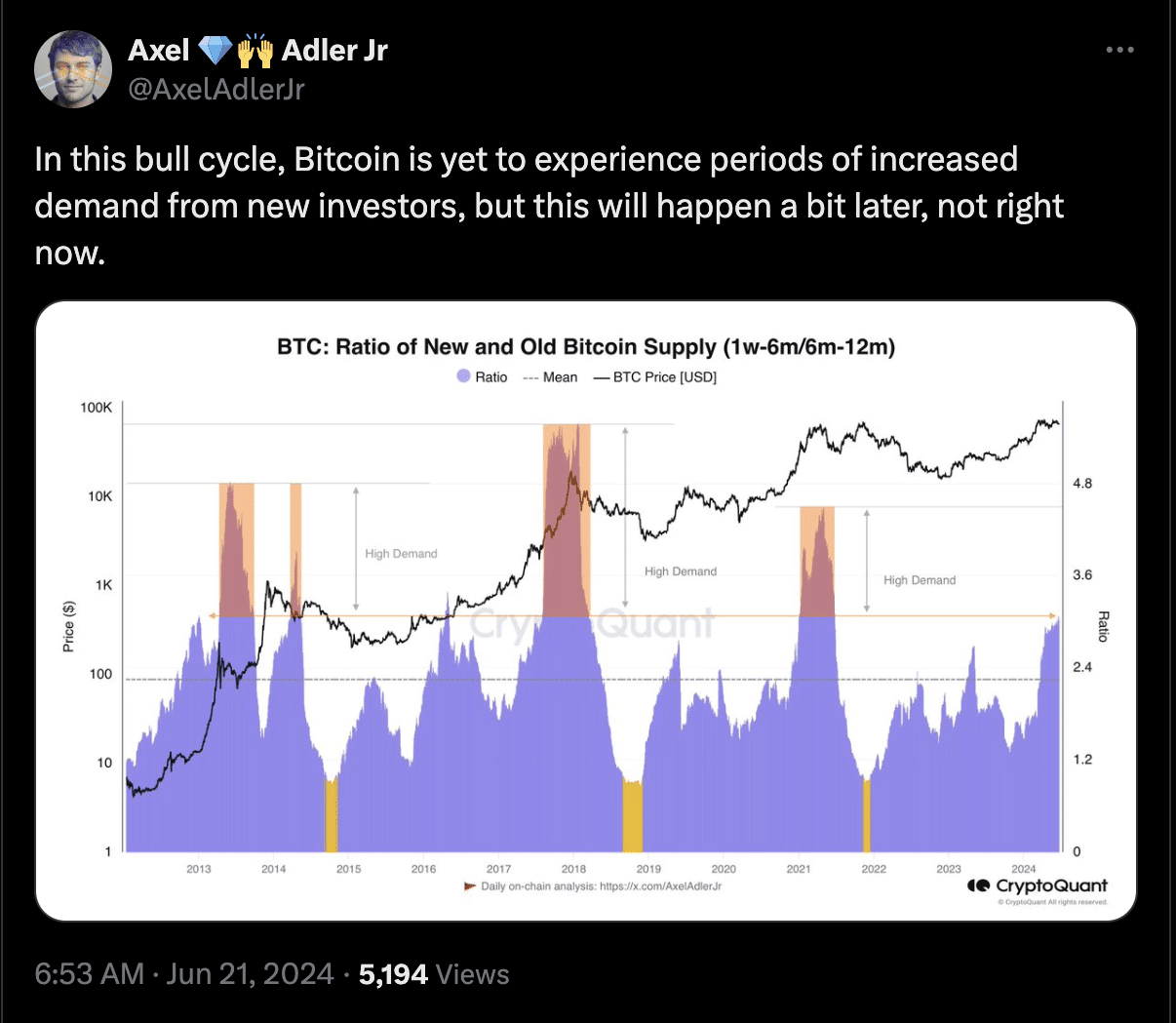

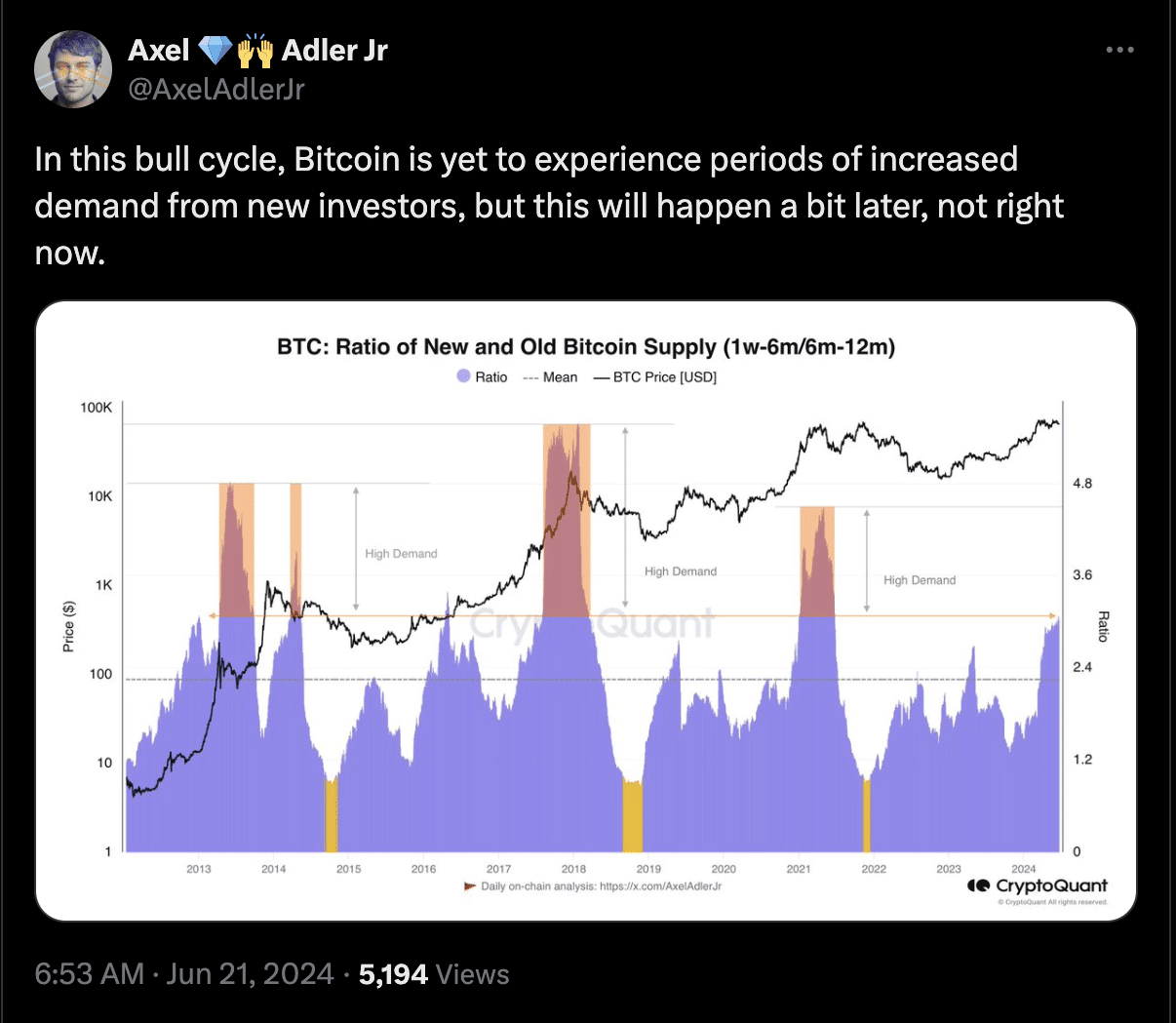

According to Axel Adler, an on-chain analyst, Bitcoin [BTC] has yet to reach peak levels of demand. He believes this may be the case because demand from new investors has been low compared to previous bull markets.

However, Alder also noted in his post on X that new investors would start purchasing BTC at a much later date. Evidence of this view can be seen in the ratio of old and new Bitcoin supply.

As can be seen in the chart below, Bitcoin is not yet near the areas of high demand. Therefore, the likelihood of a price increase in the medium to long term could be higher.

Source:

There are no new investors

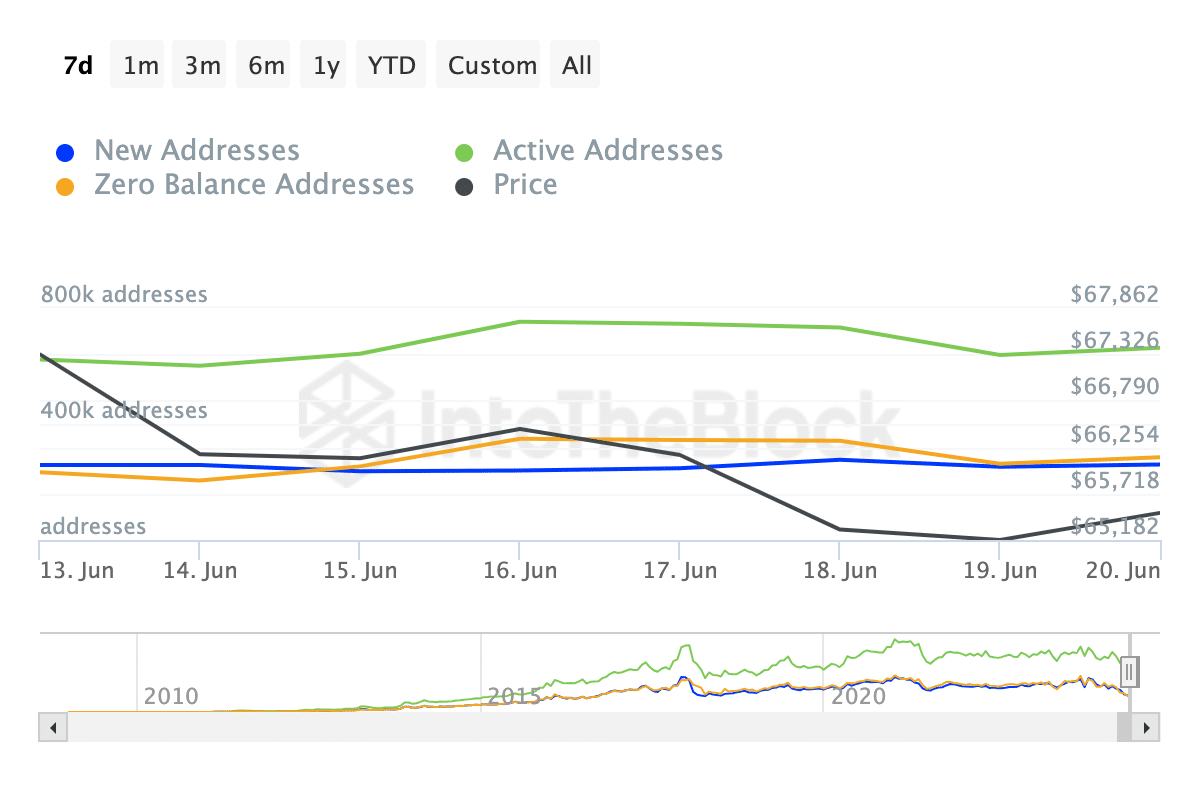

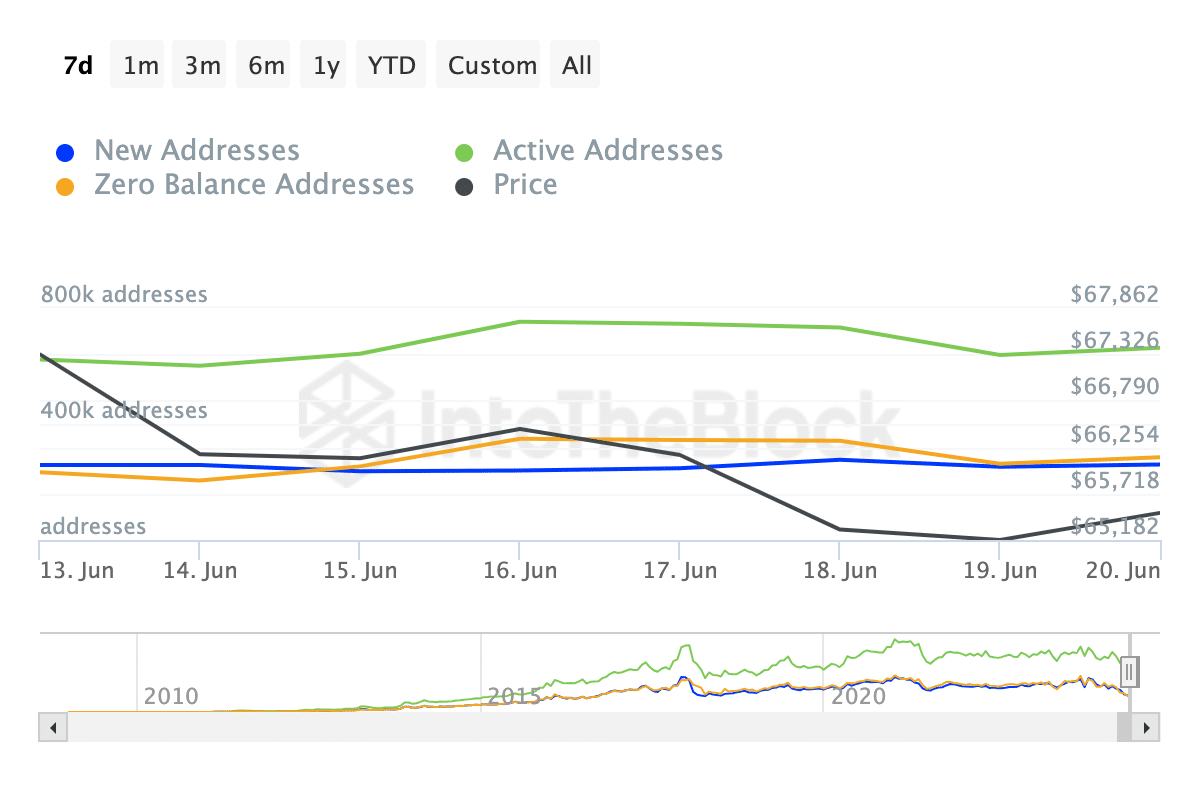

At the time of writing, Bitcoin’s price stood at $63,719, having fallen nearly 5% in the past seven days. To determine if Bitcoin’s price will rise, AMBCrypto looked at user engagement and growth on the network

In IntoTheBlock statistics we have the new addresses, active addresses and zero balance addresses. Active addresses measure the number of existing users transacting on the network.

New addresses, on the other hand, refer to the number of addresses that complete their first transaction. At the time of writing, active Bitcoin addresses were up 6.47% over the past seven days.

Zero-balance addresses increased by 22%, while the number of new addresses remained virtually the same. The stagnation in new addresses is a reflection of Adler’s view above. This could cause a new decline in the price.

Recently, AMBCrypto reported how an analyst predicted that the coin could fall to $54,000. While this may not happen in the short term, BTC could drop on the charts towards $61,000.

Source: IntoTheBlock

Holders keep selling

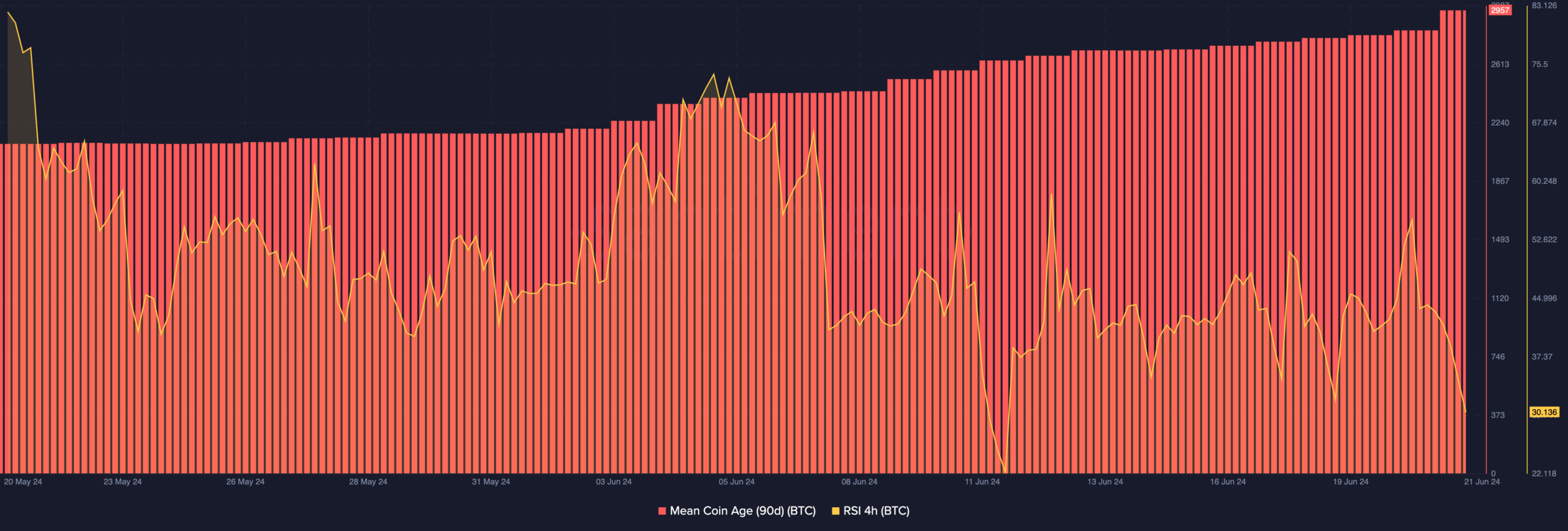

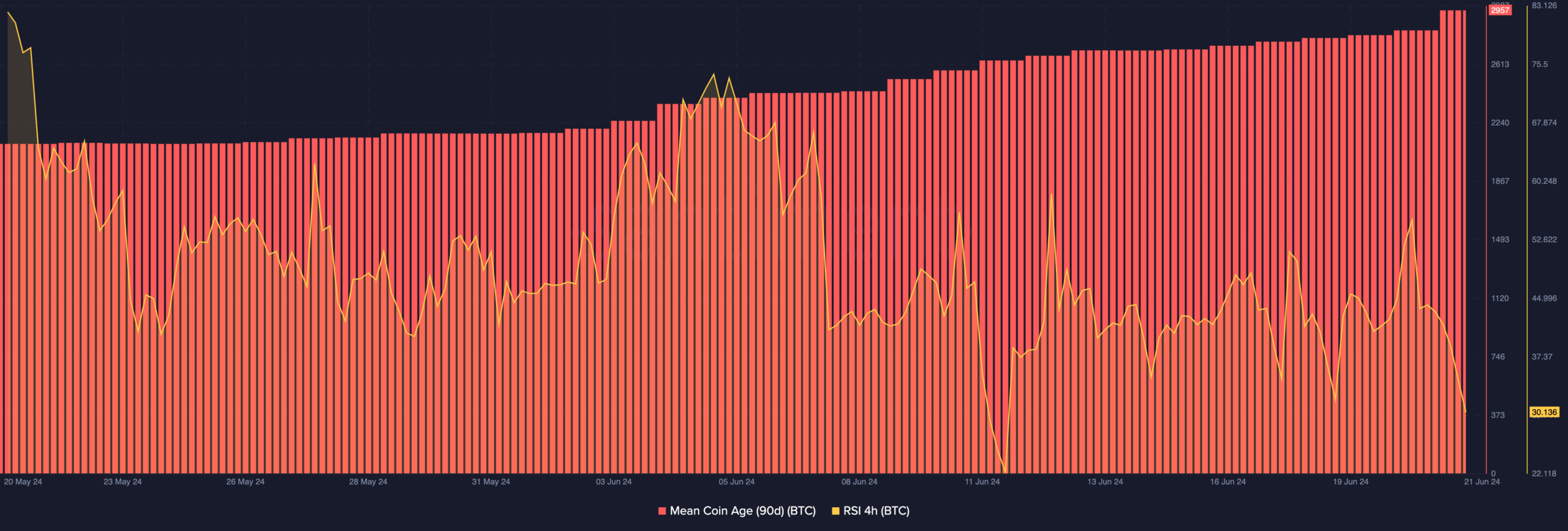

We also analyzed the Mean Coin Age (MCA). The MCA shows the average age of all coins based on the weighted purchase price. When the stat increases, it means that old coins are being moved from their previous storage.

In most cases, this means long-term holders are selling. However, when the MCA falls, it means holders of the coin do not want to sell. Instead, market participants collect new coins and put them in a cold wallet.

At the time of writing, Bitcoin’s 90-day MCA was still in the uptrend as of June 1. Should this continue, the price of the coin could fall, and the $61,000 prediction could do so too become reality.

In addition, the Relative Strength Index (RSI) on the 4-hour chart fell. The RSI is a technical oscillator that tracks the momentum of an asset.

It also tells us when a cryptocurrency is overbought or oversold. Values of 70 or higher mean overbought, while values below 30 mean oversold. At the time of writing, Bitcoin’s RSI was close to oversold territory.

Source: Santiment

Is your portfolio green? Check the Bitcoin Profit Calculator

This indicates that momentum has been bearish. A further price drop could therefore be possible.

However, if buying pressure increases, the price may pick up again. As for demand, it could remain low in the coming weeks.