After a short-lived rally above $28,000 this week following Grayscale’s historic victory in the U.S. Securities and Exchange Commission (SEC) lawsuit over GBTC’s conversion to a spot ETF, the price of BTC has once again fallen around $26,000. This comes after the SEC’s decision yesterday to delay all Bitcoin spot ETF decisions for 45 days.

Noted crypto analyst Rekt Capital has taken a closer look at the situation with a series of tweets providing insight into Bitcoin’s potential trajectory for the coming month. As the analyst points out, Bitcoin has closed a bearish monthly candle for the month of August as a result of yesterday’s price drop.

Bitcoin price prediction for September 2023

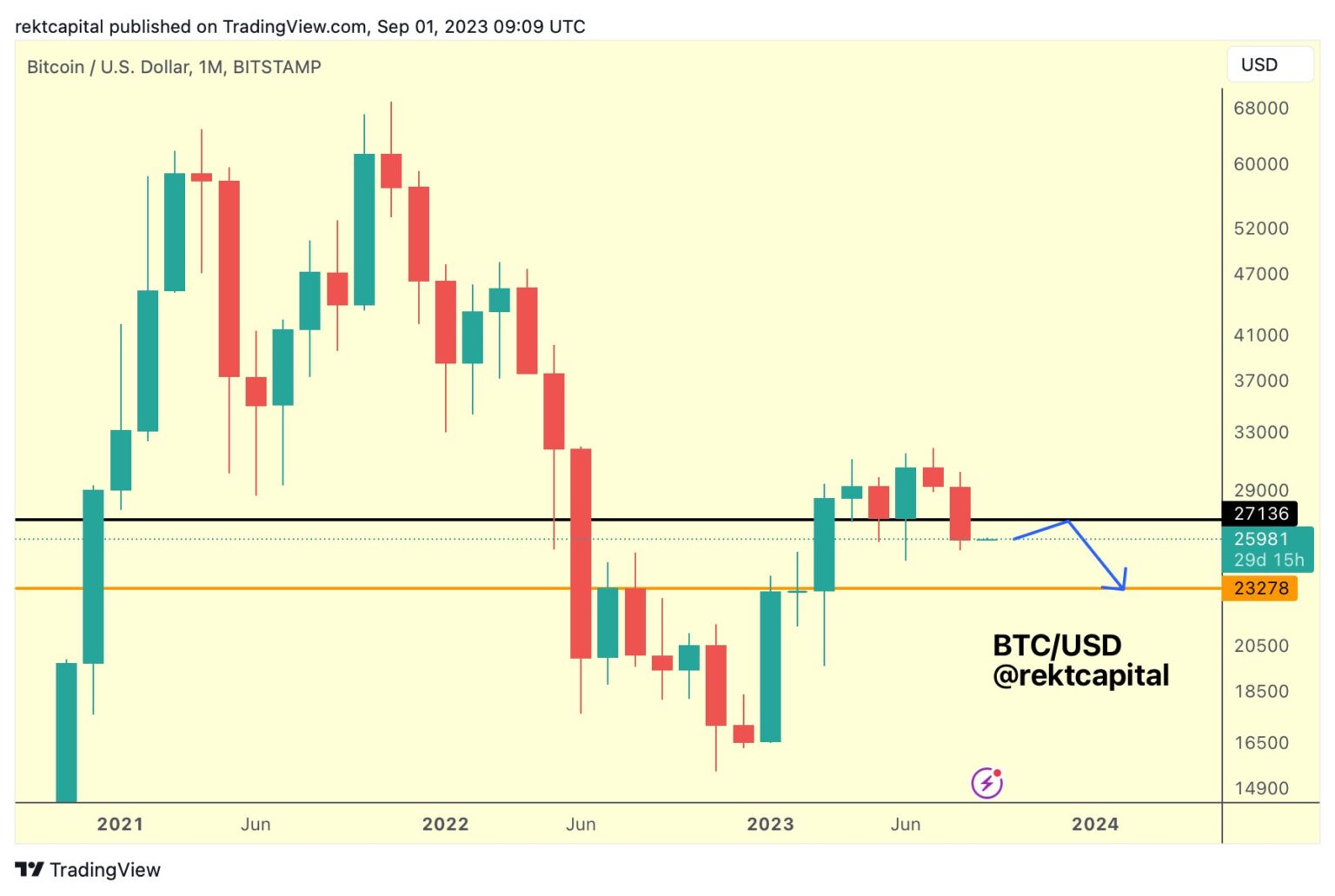

In a series of tweetsRekt Capital explained: “BTC closed below ~$27,150, confirming it is a losing support. It is possible that BTC could rise again to ~$27,150 in September, maybe even up. But that would likely be a relief rally that would confirm ~$27,150 as new resistance before falling into the $23,000 region.

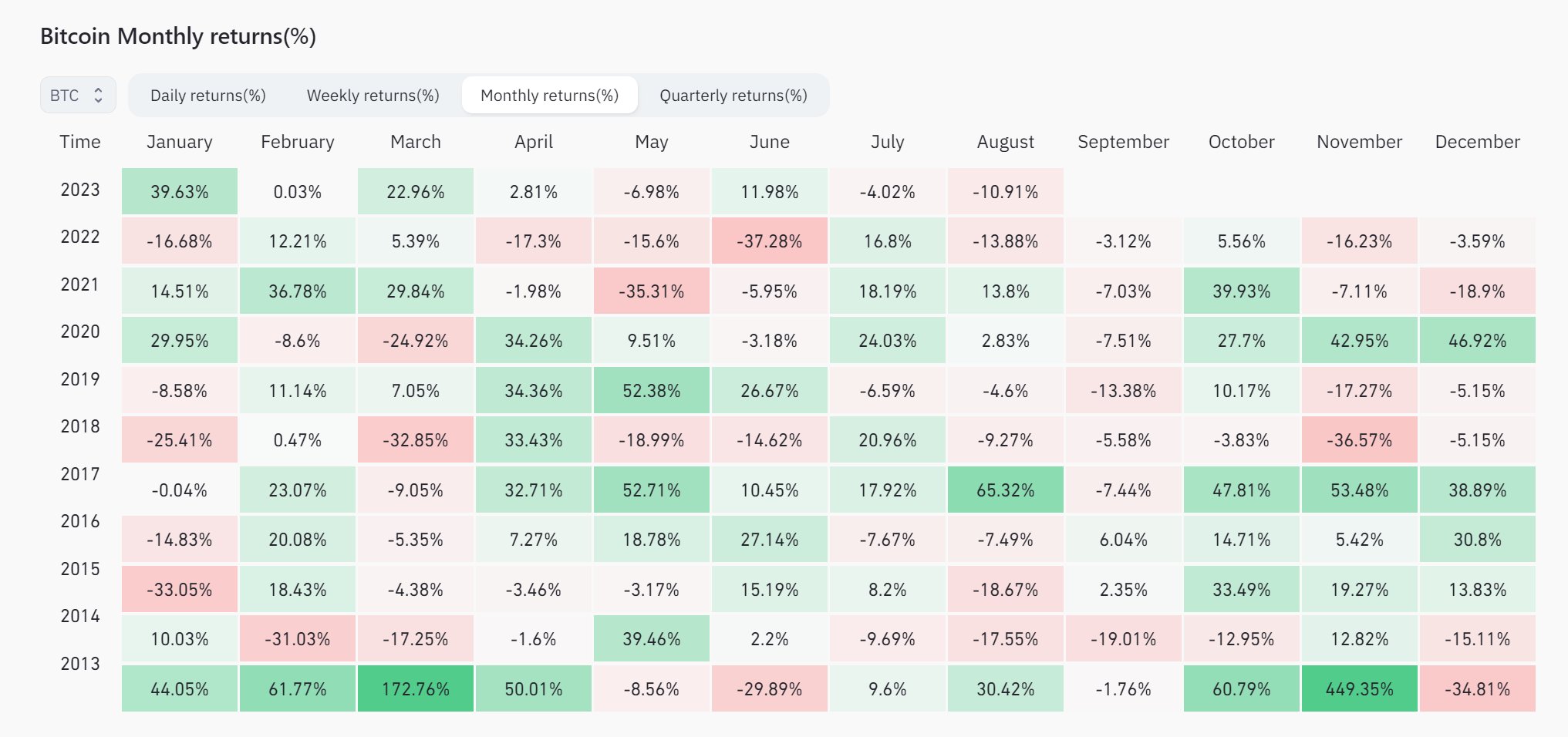

Historically, September has not been particularly kind to Bitcoin, with the month recording the fewest positive-yielding months (just two), and currently having negative returns for six years.

Rekt Capital elaborates on this trend, stating: “A frequently recurring BTC downside in the month of September is -7%. If BTC fell -7% from its current price level this month, the price would rebound to ~$24,000.”

However, according to the analyst’s analysis, the next major monthly level is at ~$23,400. This suggests that the price may not stop at -7% if BTC cannot gain new momentum. Instead, BTC could potentially fall -10% overall to reach that next big monthly level.

The analyst elaborated further on Bitcoin’s historical performance in September, noting, “September – positive or negative month? Usually we see a negative month for BTC in September. For the most part, however, BTC sees a single digit drop in September. 8 out of 10 of the past September months have experienced negative consequences. In just two months, there were small single-digit gains in the month of September (+2% in 2015 and +6% in 2016).

In the worst case

Rekt Capital drew parallels with previous years, highlighting that the most recurring September decline was a -7% decline, as observed in 2017, 2020 and 2021. However, he also pointed out that Bitcoin experienced only a double-digit retracement in 2019 . (-13%) and in 2014 (-19%). The latter, being a bear market year, may not be the best comparison for 2023, which looks set to hit a low, similar to 2019 or 2015.

Addressing the looming question of another potential crash in September, the analyst opined: “In 2019, BTC saw a -13% pullback, but we should also bear in mind that BTC just saw one of its worst-ever falls in August : -16%. Bitcoin is unlikely to experience a severe back-to-back drawdown in August as well as now September.”

Concluding his analysis, Rekt Capital shared his personal forecast: “I think there could reasonably be a fall of about -7% to -10% in September from current levels. This would result in a price drop to ~$24,000 – $23,000.”

Remarkably, a Bitcoin spot ETF decision is unlikely to come in September, which may be the biggest catalyst for the market right now. The next deadlines for submissions by Bitwise, BlackRock, Fidelity and the others are October 16 and 17. Only an SEC action after the lost Grayscale lawsuit could bring about a surprise event. However, there are currently no deadlines or statements from the SEC on whether or when they will implement the ruling.

At the time of writing, BTC was trading at $26,104.

Featured image from Finextra Research, chart from TradingView.com