- Bitcoin rose almost 15% in the past two weeks after recovering from the $55.8k support

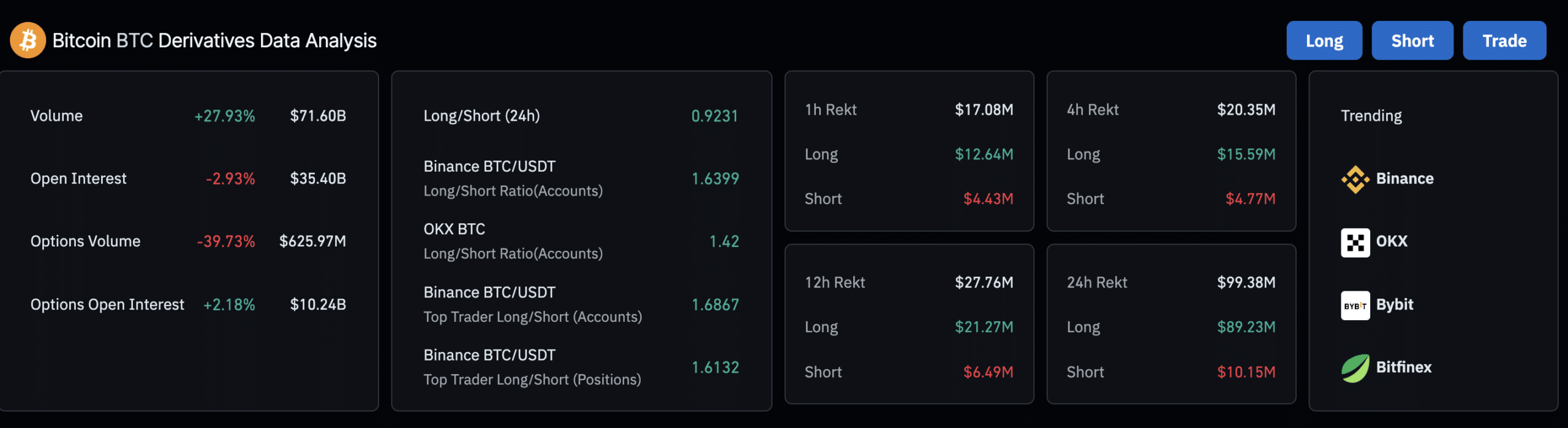

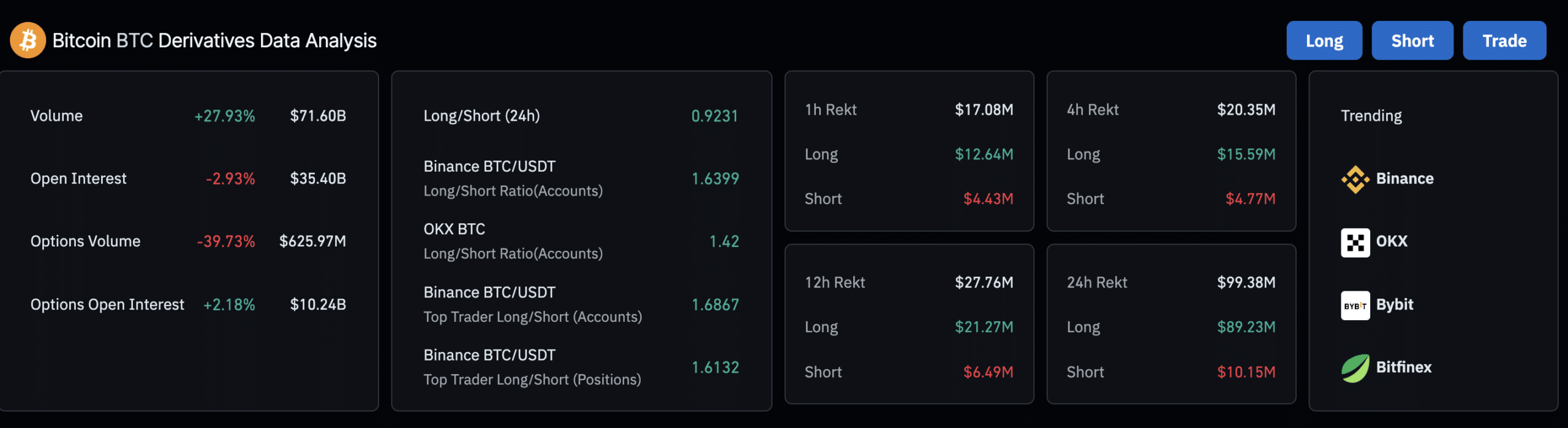

- BTC derivatives data showed a slight bullish edge over the long term

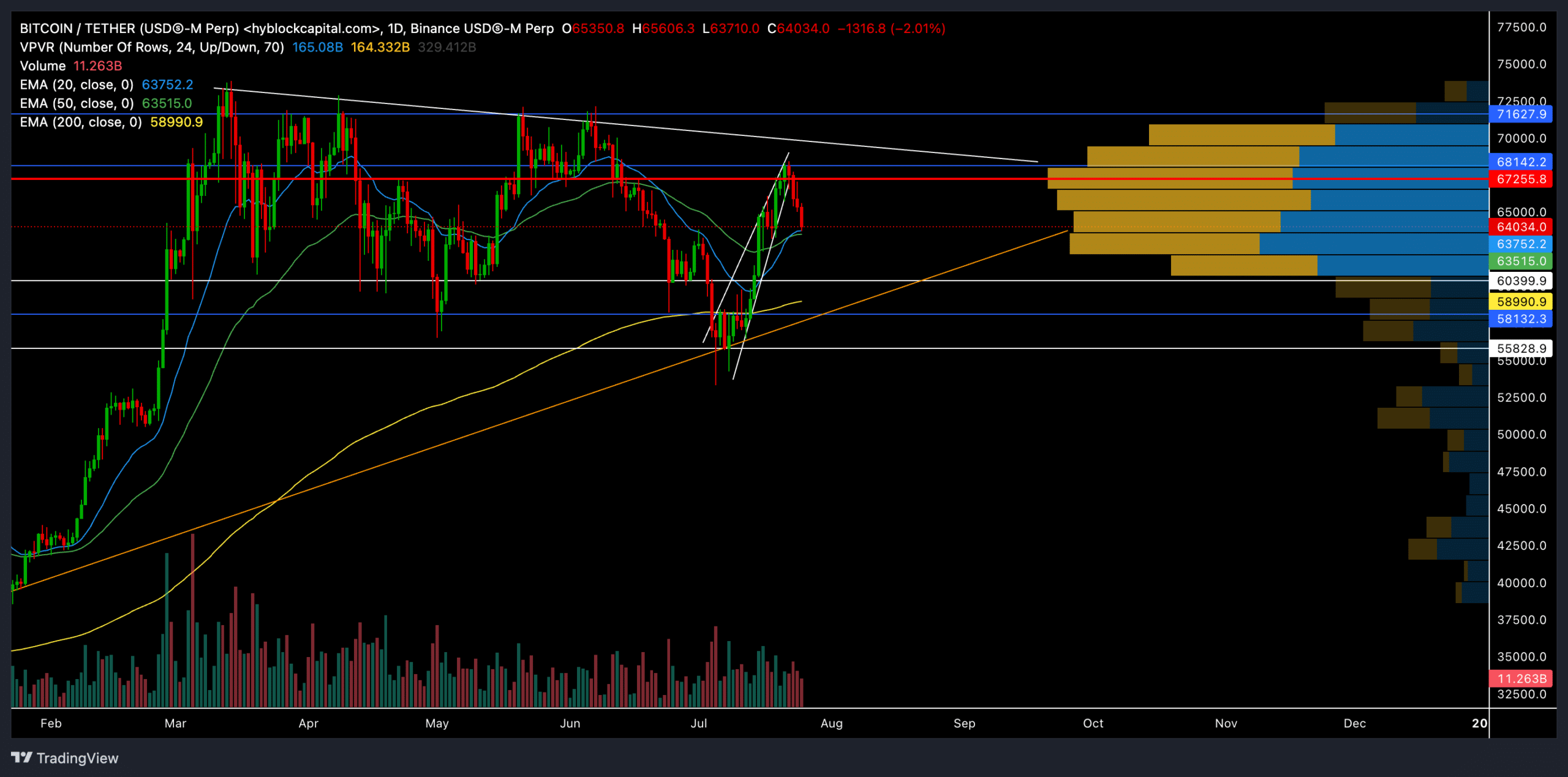

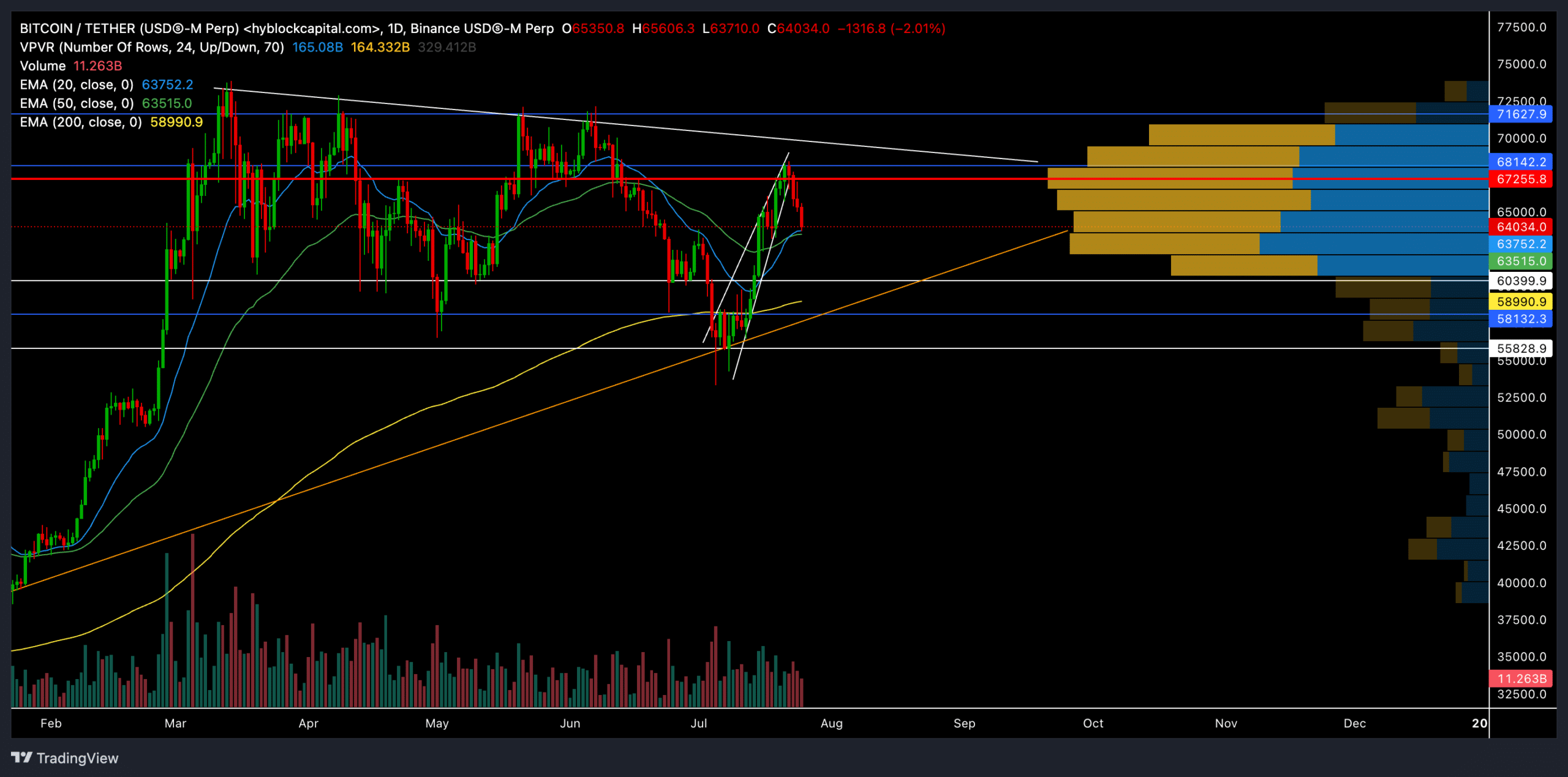

Bitcoin entered a relatively high liquidity zone after its recent rally, allowing the coin to regain a spot above the 200-day EMA.

Although the bulls had an advantage at the time of the price squeeze, any decline below the 20- and 50-day EMAs could delay the immediate near-term recovery prospects.

The King Coin recently broke out of a bullish chart pattern after reaching the ‘Point of Control (POC)’ – a level typically characterized by the highest trading levels at specific price points. At the time of writing, the crypto was trading at $64,304, down almost 3% in the past 24 hours.

An ascending wedge fracture

Source: TradingView, BTC/USDT

BTC has found an oscillating range between $55.8K and $71.6K for over four months now. The currency’s latest rebound from the upper end of this range saw a monthly decline of almost 21% through July 6.

Meanwhile, BTC closed below the 200-day EMA after more than nine months, indicating a strong bearish edge. However, the bulls re-entered the market and sparked a rebound from the $55.8k support level.

Consequently, Bitcoin drew a classic rising wedge on its daily chart. Such a pattern often causes a trend reversal in the short term. Thus, BTC saw an expected collapse after the pattern approached the POC level (red horizontal line).

The coin would likely see less volatility in the short term as it currently trades in a relatively high liquidity zone.

Here it is worth noting that the price action managed to stay above the 20, 50 and 200 day EMAs at the time of writing. While this indicated a slight bullish edge, any decline below the 20- and 50-day EMAs could trigger a downtrend towards the $60.3K support level.

BTC would likely recover from this support level, especially given the confluence of the support levels.

The RSI also saw a steep downtrend, but had yet to close below 50. Any closing price below this level will confirm a decrease in buying pressure. Likewise, buyers should look for a potential bearish cross on the MACD lines to gauge near-term sentiment.

Derivatives say…

The increase in open interest on options, despite a decline in volume, indicated that new positions were being opened due to longer-term volatility expectations.

The dominance of long positions in light of the recent price declines could indicate that market sentiment, at least among smaller traders, remains somewhat bullish or hopeful of a recovery.