Bitcoin price fell over 4% and traded below the USD 36,500 support. BTC still has the key support zone at USD 35,650 and dips could attract buyers.

- Bitcoin started a new decline after reports of Binance’s settlement and CZ’s resignation.

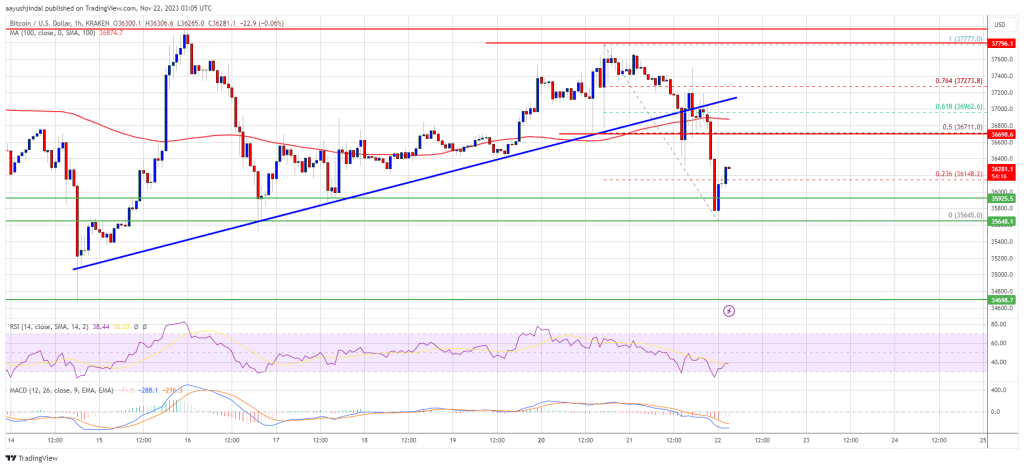

- The price is trading below $37,000 and the 100 hourly Simple Moving Average.

- There was a break below a key bullish trendline with support near $36,980 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could struggle in the short term, but dips could be attractive to the bulls.

Bitcoin price takes a hit

Bitcoin price failed to hold higher above the USD 37,800 resistance zone. BTC formed a short-term top and started a new decline after reports of Binance’s settlement and CZ’s resignation.

There was a sharp decline below the $37,000 level. There was a break below a key bullish trendline with support near $36,980 on the hourly chart of the BTC/USD pair. The pair even broke through the $36,500 support zone. Ultimately, it peaked below the $36,000 level.

A low is formed near USD 35,645 and the price is now consolidating losses. It recovered above the 23.6% Fib retracement level of the downward move from the $37,777 swing high to the $35,645 low.

Bitcoin is now trading below $37,000 and the 100 hourly Simple Moving Average. On the upside, immediate resistance is around the $36,500 level. Key resistance is now forming near the $36,700 level or the 50% Fib retracement level of the downward move from the $37,777 swing high to the $35,645 low.

Source: BTCUSD on TradingView.com

A close above the resistance at $36,700 could mean significant upside. The next major resistance could be near USD 37,000. A clear move above the USD 37,000 resistance could send the price further upwards towards the USD 37,500 level. In the said case, it could even test the USD 37,800 resistance.

Lose more in BTC?

If Bitcoin fails to rise above the USD 36,700 resistance zone, it could start a new decline. The immediate downside support is near the USD 36,000 level.

The next major support is $35,650. If there is a move below $35,650, there is a risk of more downside. In the mentioned case, the price could fall towards the support at $34,700 in the short term. The next major support or target could be $34,200.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major support levels – USD 36,000, followed by USD 35,650.

Major resistance levels – $36,500, $36,700 and $37,000.