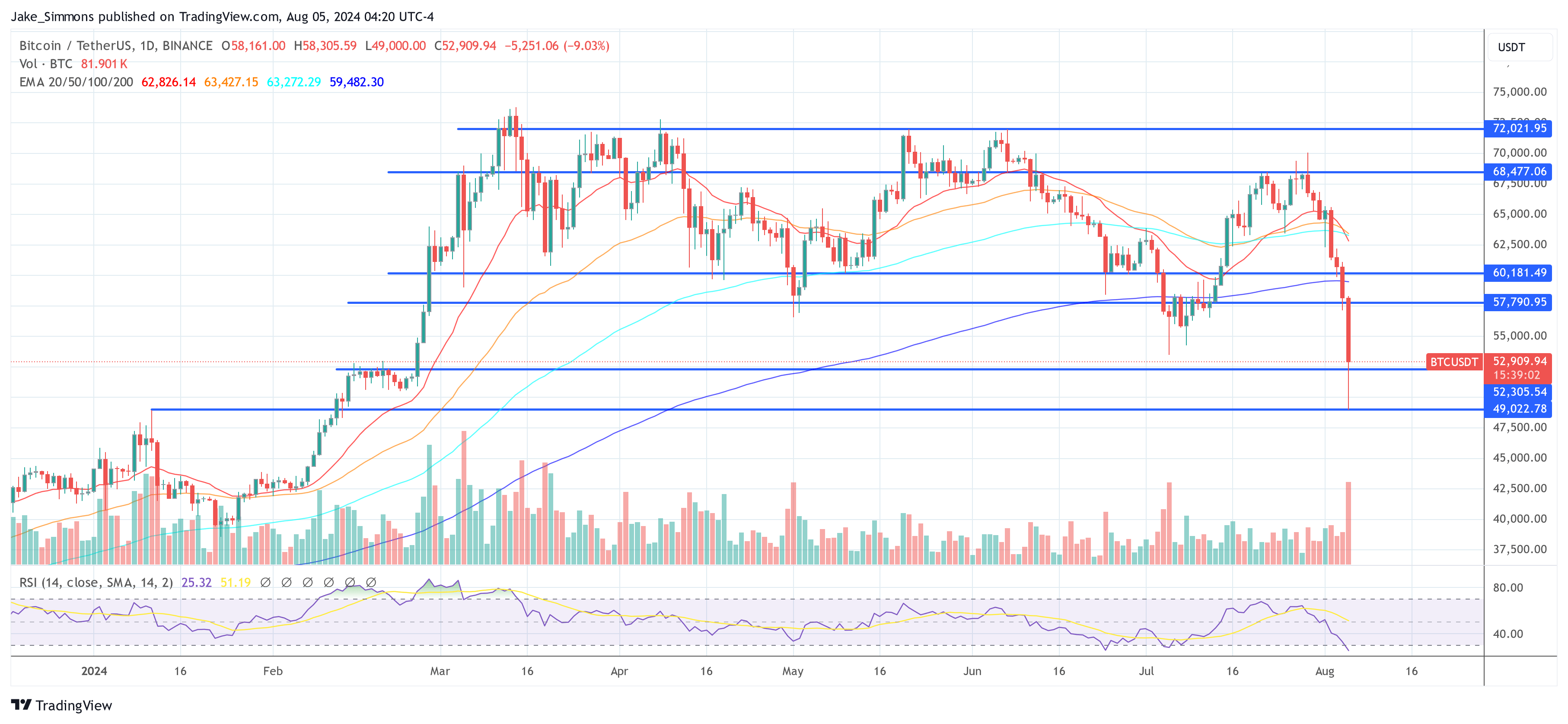

Over the past 24 hours, the crypto market has witnessed a severe downturn, with the price of Bitcoin falling 15% to a low of $49,000 on Binance (BTC/USDT), marking a significant departure from last week’s high of $70,000: a 26% crash. . Similarly, Ethereum (ETH) fell 39% from $3,400 to $2,100. This downward trend was not isolated, but echoed across the entire altcoin spectrum, which saw even steeper declines.

#1 Recession Fear Causes Bitcoin Crash

The initial spark for the current market volatility appears to come from growing fears of a US recession, driven by unexpectedly weak US labor market data on Friday. The July report showed a gain of just 114,000 jobs – significantly less than the Wall Street forecast of 175,000. This was the weakest job growth since December of the previous year and almost the lowest since the start of the COVID-19 pandemic in March 2020.

Charles Edwards of Capriole Investments noticed via X: “Any time the unemployment rate gets as high as it is now, we have a recession. Just as the Fed was too slow to tighten in 2021, it appears they were too slow to ease in 2024.”

Adding to market nervousness was the revelation that Warren Buffett’s Berkshire Hathaway sold about 50% of its shares in Apple. This sell-off by one of the world’s most watched investors was interpreted as a move to hedge against potential market downturns, as Berkshire Hathaway announced in its Q2 report that it was holding a record $277 billion in cash.

Related reading

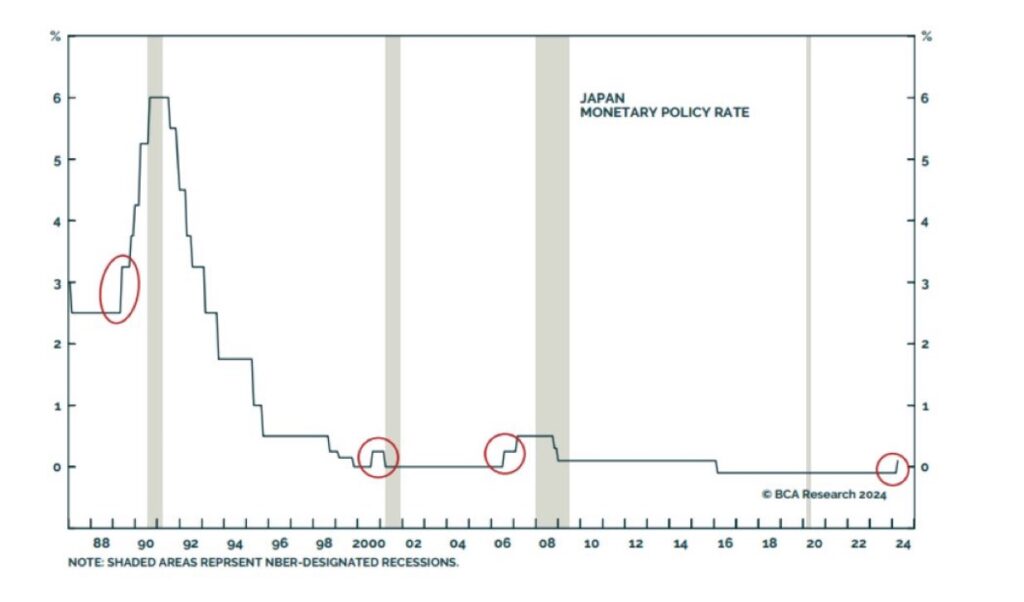

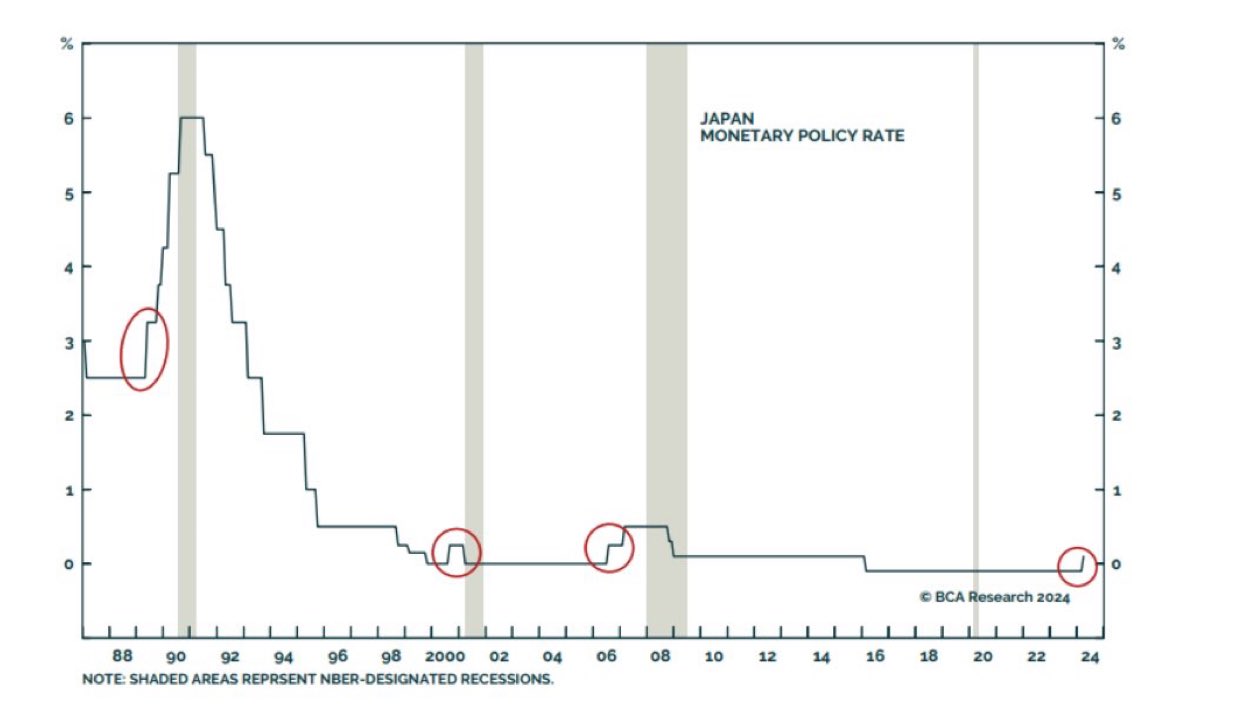

In addition, the Bank of Japan’s decision to raise its key interest rate from zero to around 0.1% to around 0.25% has had significant consequences. This interest rate increase, the second since 2007, sent shock waves through the financial sectors worldwide. Historically, interest rate hikes by the Japanese central bank have heralded global recessions. Following the announcement, the Nikkei experienced the biggest two-day decline in history, even surpassing the declines of Black Monday in 1987.

Nick Timiraos, often called the “Fed mouthpiece” and reporter for the Wall Street Journal, revealed“Goldman Sachs says there are good reasons to think the rising unemployment rate in July’s weak wages report is less scary than normal across the board… But raises the chance of a recession from 15% to 25%.”

Goldman Sachs also adjusted its expectations for the Federal Reserve’s policy response, anticipating rate cuts at each upcoming meeting, with the possibility of a more aggressive 50 basis point cut if the August employment report mirrors July’s weakness.

#2 Yen Carry Trade Relax

The market decline was further exacerbated by significant movement in the currency markets, especially with the Japanese yen. After the Bank of Japan raised its key interest rate, the yen strengthened significantly against the US dollar. The move put pressure on traders engaged in the “yen carry trade,” where they borrowed yen at low interest rates to buy higher-yielding U.S. assets.

Related reading

Adam Khoo noted“The sharp rise in the JPY/USD is causing a massive decline in carry trading positions in the yen and contributing to the sharp decline in US stocks.” The reversal of these trades has likely not only affected the forex and stock markets, but also had a cascading effect on Bitcoin and crypto as assets are liquidated to cover losses and repay yen-denominated debt.

BitMEX founder Arthur Hayes responded via X: “My TradFi birdies tell me someone has smoked big and is dumping all the #crypto. I have no idea if this is true, I’m not going to mention any names, but let the fam know if you hear the same thing????”

#3 Jump trading and big sellers

Unusual sell orders were recorded on major exchanges such as Kraken, Gemini and Coinbase, mainly on Sundays, which is typically a quieter trading day. This points to orchestrated actions by major players, which may involve unwinding of positions by companies like Jump Trading.

Jump Trading has reportedly been involved in a substantial unloading of Ethereum worth approximately $500 million in the past two weeks. Market rumors suggest the company’s sell-off could be a strategic exit from its crypto market-making ventures or an urgent need for liquidity. Ran Neuner responded via X: “I am looking at this sale by Jump Trading […] They are the smartest traders in the world. Why are they selling so quickly on a Sunday with low liquidity? I can imagine that they are being liquidated or have an urgent obligation.”

Dr. Julian Hosp, CEO of the Cake Group, suggested on The sell-off is brutal.”

Also Mike Alfred marked the possibility of market turmoil, indicating the possible collapse of a major Japanese fund that holds significant amounts of Bitcoin and Ethereum. “A major Japanese fund exploded. Unfortunately, it held some Bitcoin and Ethereum. Jump and other market makers sensed the need and exacerbated the movement. That is it. Game is over. On to the next one,” Alfred said.

#4 Liquidation Cascade Exacerbates Bitcoin Price Crash

The market witnessed a dramatic increase in liquidations, with CoinGlass reporting that 277,937 traders had been liquidated in the last 24 hours, leading to a total crypto liquidation of approximately $1.06 billion. The largest single liquidation order, worth $27 million, occurred on Huobi for a BTC-USD position.

A total of $302.07 worth of Bitcoin longs were liquidated in the past 24 hours, according to CoinGlass facts. These forced liquidations, driven by margin calls and stop-loss orders, have amplified downward pressure on cryptocurrency prices, pushing them further into the red.

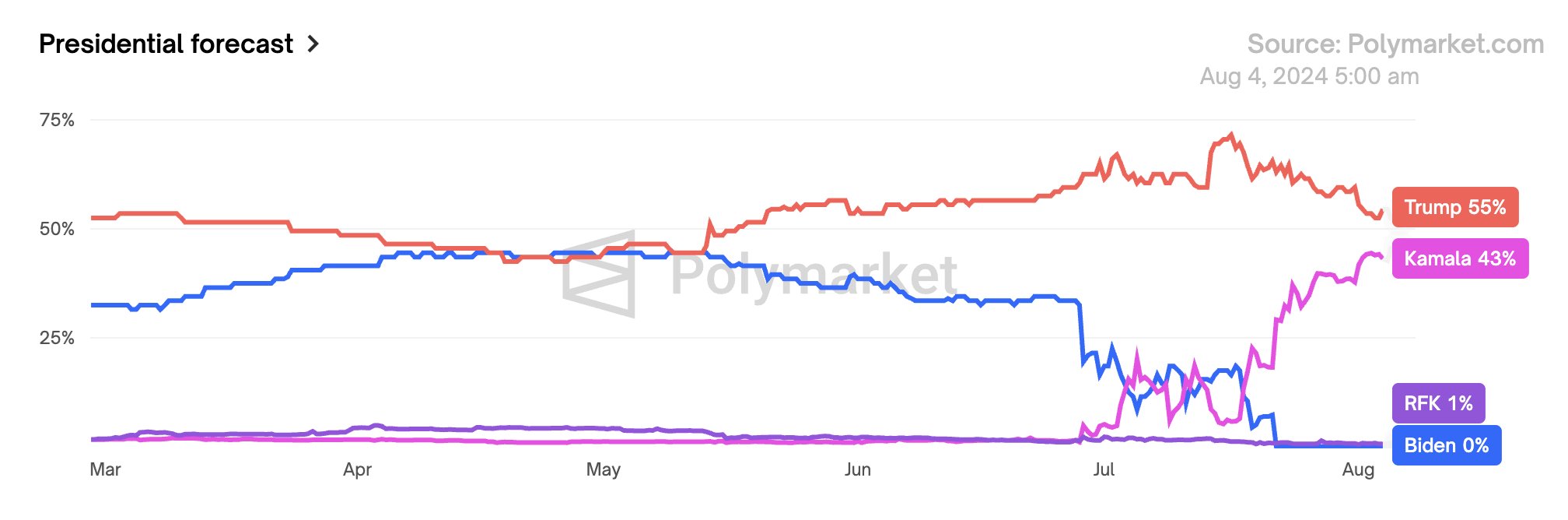

#5 Trump momentum fades

Another, less important factor may have to do with the changing political landscape, as Kamala Harris is gaining over Donald Trump according to Polymarkets (Harris 43% vs. Trump 55%). This shift is perceived negatively by the Bitcoin and crypto market. The entire market is in favor of a Trump victory. He wants to build a “strategic Bitcoin stockpile” and said last weekend that BTC could be used to pay off America’s $35 trillion debt.

#6 Mount Gox distributions still impact market liquidity

Finally, the continued distribution of Bitcoins from the defunct Mount Gox exchange continues to influence the market. As former users of the exchange receive and potentially sell their returned Bitcoins, this has increased selling pressure on the market, causing prices to fall further.

At the time of writing, BTC bounced off support and recovered to $52,909.

Featured image created with DALL.E, chart from TradingView.com